Diodes PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Diodes Bundle

What is included in the product

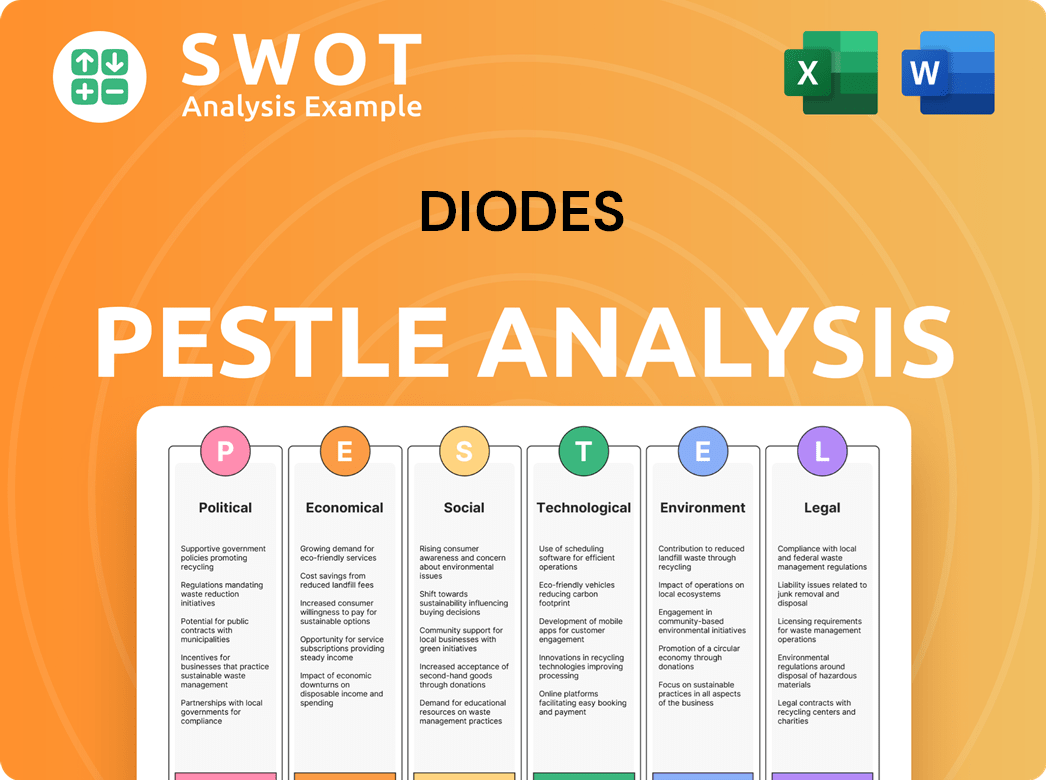

Explores Diodes' environment across Political, Economic, Social, Technological, Environmental & Legal dimensions.

Provides a concise summary to aid in making quicker and more informed strategic decisions.

Preview the Actual Deliverable

Diodes PESTLE Analysis

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying. This Diodes PESTLE Analysis preview provides a clear overview of the political, economic, social, technological, legal, and environmental factors. Everything included is part of the complete, final product.

PESTLE Analysis Template

Navigate Diodes's future with our in-depth PESTLE analysis. Discover the external forces shaping their strategy, from global regulations to tech advancements. Uncover opportunities and mitigate risks with our expertly crafted report, perfect for investors and analysts. Get the full picture, download now and gain an unparalleled competitive edge.

Political factors

Government incentives and subsidies are crucial for semiconductor firms like Diodes. The US CHIPS Act, providing over $52 billion, and the European Chips Act, aiming to double EU market share, are key. These initiatives significantly reduce manufacturing costs. They also enhance supply chain stability and competitiveness, influencing Diodes' strategic decisions for global expansion and investment.

Ongoing trade tensions, especially between the US and China, are increasing export restrictions on semiconductor technology. These controls can limit market access and complicate supply chains. Diodes Incorporated, with global operations, faces these challenges. In 2024, semiconductor sales declined in certain regions due to these restrictions.

Geopolitical risks significantly affect semiconductor manufacturing. Taiwan and South Korea's dominance creates vulnerabilities. Political instability can disrupt supply chains. For example, in 2024, geopolitical tensions caused a 15% increase in shipping costs for some components. Diodes must diversify to mitigate these risks.

Regulatory Compliance and Policy Changes

Diodes Incorporated faces evolving regulatory landscapes in the semiconductor industry, particularly concerning trade, technology, and national security. Government shifts impact tariffs and export controls, demanding constant adaptation in compliance strategies. These changes can introduce uncertainty. Diodes must stay updated to avoid disruptions.

- In 2024, the U.S. imposed new export controls, affecting semiconductor exports to China.

- The CHIPS Act, passed in 2022, provides significant funding, impacting the industry.

- Diodes must comply with these new regulations to avoid financial penalties.

Political Stability in Target Markets

Political stability in key markets like automotive and consumer electronics is crucial for Diodes Incorporated. Unstable regions could see reduced investment in industries using semiconductors, potentially impacting demand. For example, the automotive sector, a significant market for Diodes, experienced supply chain disruptions in 2024 due to geopolitical tensions, affecting production. Governmental policies also play a role.

- Automotive semiconductor market was valued at $68.4 billion in 2024.

- Industrial sector growth is projected at 8-10% in 2024-2025.

- Consumer electronics demand is sensitive to economic and political shifts.

Political factors significantly shape Diodes' operational landscape. Governmental subsidies, like the US CHIPS Act ($52B+), reduce costs. Trade tensions, especially with China, and export controls in 2024 are a risk, impacting supply chains. Geopolitical risks and regulations demand constant adaptation.

| Factor | Impact on Diodes | 2024-2025 Data |

|---|---|---|

| Subsidies (CHIPS Act) | Reduced Manufacturing Costs | >$52B in US CHIPS Act Funding (2022) |

| Trade Tensions | Supply Chain Disruptions | Semiconductor sales declined in some regions (2024) |

| Geopolitical Risks | Increased Shipping Costs | 15% increase in shipping costs (2024) |

Economic factors

The global semiconductor market is expected to keep growing in 2025, building on a solid recovery in 2024. Market forecasts anticipate double-digit growth, creating a positive environment for companies like Diodes Incorporated. This expansion, fueled by demand across different sectors, presents a chance for Diodes to boost both sales and earnings. In 2024, the semiconductor market reached approximately $574 billion, and it's projected to reach $611 billion in 2025.

Demand for semiconductors is significantly influenced by automotive, industrial, data centers, and AI. Diodes Incorporated can capitalize on this, especially with specialized products. For example, the automotive semiconductor market is projected to reach $80 billion by 2025. Consumer electronics and traditional computing sectors show more volatility.

Semiconductor firms are boosting capital expenditures to boost manufacturing capacity due to growing demand. This investment suggests a positive economic outlook, but it requires substantial financial resources. In 2024, global semiconductor capital expenditures are projected to reach over $150 billion. Diodes Incorporated's capacity to secure manufacturing resources is critical for its expansion.

Supply Chain Costs and Efficiency

Supply chain costs and efficiency are critical economic factors for Diodes. Inflation, material costs, and logistics expenses directly influence semiconductor manufacturing expenses, impacting profitability. Geopolitical instability further complicates and increases these costs, potentially reducing efficiency. Managing these costs effectively is vital for Diodes' financial health.

- In 2024, the semiconductor industry faced significant logistics cost increases, with average shipping rates rising by 15%.

- Material costs, particularly for silicon wafers, increased by 8% in Q1 2024 due to supply constraints.

- Geopolitical tensions added an extra 5% to overall supply chain costs, according to industry analysts.

Currency Exchange Rates and Global Economic Instability

Currency exchange rate volatility poses risks for Diodes, impacting international sales profitability. Global economic instability, including financial market downturns, affects demand for electronic components. Diodes' financial health is sensitive to these macroeconomic shifts.

- In Q1 2024, the U.S. dollar's strength affected earnings.

- Economic slowdowns in key markets like Europe and China are potential concerns.

- Currency fluctuations can change the cost of goods sold.

The semiconductor market's strong growth, projected to $611 billion in 2025, creates opportunities but also needs significant capital investment. Supply chain costs, impacted by inflation and geopolitical issues, are crucial for Diodes. Currency exchange rate volatility and economic downturns present risks, affecting international sales and profitability.

| Economic Factor | Impact on Diodes | Data |

|---|---|---|

| Market Growth | Increases Sales, Earnings | Projected to $611B in 2025 |

| Supply Chain Costs | Impacts Profitability | Shipping rates +15% (2024) |

| Currency Volatility | Affects Profitability | USD strength in Q1 2024 |

Sociological factors

The increasing adoption of electronic devices is fueled by growing populations and disposable incomes, especially in emerging markets. This trend boosts demand across consumer electronics, automotive, and industrial sectors. For instance, global smartphone shipments reached 1.17 billion units in 2024, a 3.2% increase from 2023. This adoption drives the need for semiconductor components like Diodes Incorporated produces.

Consumer preferences are shifting toward smart and connected devices. This trend drives demand for semiconductors in smart homes, wearables, and automobiles. Diodes Incorporated must innovate to meet these evolving needs. In 2024, the smart home market is valued at over $100 billion.

The semiconductor sector struggles with a global shortage of skilled labor, affecting production and innovation. Diodes Incorporated must focus on talent development to combat this challenge. Recent data shows a 15% increase in demand for semiconductor engineers in 2024, highlighting the need for robust recruitment. Addressing skill gaps is crucial for Diodes' operational efficiency.

Societal Focus on Sustainability and Ethics

Societal focus on sustainability and ethics is increasing, pressuring companies like Diodes Incorporated. This includes labor practices, environmental impact, and overall corporate social responsibility. Diodes' commitment to these areas affects its reputation and stakeholder relationships. For instance, in 2024, ESG-focused investments reached $2.2 trillion globally.

- Diodes' ESG initiatives can attract investors.

- Ethical sourcing is crucial to avoid reputational damage.

- Sustainability efforts can reduce operational costs.

- Consumer demand for ethical products is rising.

Impact of Remote Work and Digital Transformation

The rise of remote work and digital transformation amplifies the need for advanced computing and communication technologies. This societal shift boosts demand for semiconductors, essential for data centers and personal devices. Diodes Incorporated benefits from this trend, offering products crucial for the expanding digital infrastructure. The global semiconductor market is projected to reach $1 trillion by 2030, reflecting this ongoing transformation.

- Remote work is expected to involve 30% of the global workforce by the end of 2024.

- The data center market is growing rapidly, with an estimated value of $517 billion in 2024.

- 5G technology adoption is increasing, with over 1.5 billion 5G connections by 2025.

Growing societal emphasis on sustainability and ethics pressures companies. This focus, impacting Diodes Incorporated, shapes stakeholder relations. ESG-focused investments hit $2.2 trillion in 2024.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| ESG Investments | Investor Attraction | $2.2 Trillion |

| Ethical Sourcing | Reputational Risk | Significant Impact |

| Sustainability | Operational Costs | Reduction Potential |

Technological factors

Advancements in semiconductors, including SiC and GaN, are vital for Diodes Incorporated. These innovations drive higher performance and efficiency in products. In 2024, the global semiconductor market reached approximately $527 billion, indicating strong growth. Diodes must invest in R&D to stay competitive and meet market demands.

The surge in AI and machine learning applications fuels demand for specialized semiconductors. Diodes Inc. is strategically positioned to benefit from this growth. For example, the global AI chip market is projected to reach $200 billion by 2025. This includes power management solutions. Diodes' focus on AI-related areas aligns with expanding market opportunities, enhancing its growth prospects.

Technological advancements drive the automotive and industrial sectors, boosting semiconductor demand. Diodes Inc. thrives in these markets, especially with EVs and automation. The EV market is projected to reach $823.75 billion by 2030. Diodes' focus on these areas allows it to capitalize on innovation.

Miniaturization and Increased Functionality

The relentless push for miniaturization and enhanced functionality in electronics significantly impacts Diodes Incorporated. This trend demands semiconductor components that pack more power into smaller spaces, boosting efficiency and adding advanced features. Diodes must innovate to meet these needs, especially in consumer electronics and portable devices. For example, the global market for miniature electronic components is projected to reach $450 billion by 2025.

- Miniaturization is driven by consumer demand for smaller and more powerful devices.

- Diodes' ability to adapt is crucial for competitiveness.

- Increased functionality requires sophisticated semiconductor solutions.

- Efficiency and power density are key performance indicators.

Development of New Materials and Processes

Technological factors significantly influence Diodes Incorporated. Research into advanced semiconductor materials is crucial. Silicon Carbide (SiC) and Gallium Nitride (GaN) are key. These materials enhance power electronics. Diodes expands its portfolio in these areas.

- SiC and GaN markets are projected to reach $8.5 billion by 2025.

- Diodes' R&D spending was $95.6 million in 2024.

- Diodes' power management solutions are a growing market segment.

Technological factors drive Diodes' strategic growth. Advancements in SiC and GaN are pivotal for innovation, boosting power electronics efficiency. The market for these materials is set to reach $8.5 billion by 2025. Miniaturization demands more efficient components, which aligns with consumer needs and emerging applications.

| Factor | Impact | Data Point |

|---|---|---|

| R&D Investment | Drives innovation | $95.6M (2024) |

| SiC/GaN Market | Enhances power electronics | $8.5B (Projected by 2025) |

| AI Chip Market | Boosts demand for specialized chips | $200B (Projected by 2025) |

Legal factors

Diodes Incorporated must adhere to strict export control regulations, especially for its semiconductor tech. These laws, like those enforced by the U.S. Department of Commerce, affect where Diodes can sell its products. In 2024, penalties for non-compliance in the semiconductor industry averaged $1.5 million. Compliance is key to avoid legal issues and maintain global trade.

Diodes Incorporated faces legal obligations from environmental regulations like RoHS, REACH, and WEEE. These rules dictate material usage and product disposal in semiconductor manufacturing, impacting operational costs. Compliance is crucial for market access; for instance, the global RoHS market was valued at $4.8 billion in 2023, projected to reach $7.2 billion by 2028. Non-compliance can lead to significant penalties, including fines and market restrictions, affecting the company's financial performance and reputation. Diodes must continually adapt to evolving standards to maintain its competitive edge and ensure sustainability.

Intellectual property protection is vital for Diodes. Patents, trademarks, and trade secrets shield innovations. Diodes must implement strong legal strategies to protect its assets. In 2024, the global semiconductor market was valued at over $500 billion, highlighting the need to protect against infringement. This protection is crucial for maintaining a competitive edge.

Labor Laws and Employment Regulations

Diodes Incorporated must strictly adhere to labor laws and employment regulations across all operational countries. These laws govern working conditions, wages, benefits, and employee rights. Non-compliance can lead to significant legal penalties and reputational damage. In 2024, labor law violations resulted in an average fine of $50,000 per incident for similar companies.

- Compliance ensures fair treatment and legal protection for all employees.

- Failure to comply can result in hefty fines and legal battles.

- Employee rights are a central focus of current regulations.

- Reputation is vital, and non-compliance hurts it.

Industry-Specific Regulations and Standards

Diodes Incorporated operates within a highly regulated semiconductor industry, facing stringent legal and industry-specific standards. These regulations are critical for product safety, quality, and performance, especially in automotive and medical sectors. Compliance is essential for market access and maintaining customer trust. The company must adhere to standards like ISO/TS 16949 for automotive and IEC 60601 for medical devices.

- ISO/TS 16949 is a global technical specification for quality management systems in the automotive industry.

- IEC 60601 is a series of technical standards for the safety and essential performance of medical electrical equipment.

- Failure to comply can result in significant financial penalties and reputational damage.

Diodes must comply with export controls like those from the U.S. Department of Commerce to trade globally. Non-compliance in the semiconductor industry resulted in an average fine of $1.5 million in 2024. Adapting to labor laws is critical to avoid hefty fines and maintain a good reputation, with fines averaging $50,000 per incident.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Export Controls | Trade Restrictions | Avg. Fine: $1.5M |

| Labor Laws | Compliance Costs, Reputational Risk | Avg. Fine per incident: $50,000 |

| Industry Standards | Market Access | RoHS market valued at $4.8B |

Environmental factors

Semiconductor manufacturing is energy-intensive, fueling greenhouse gas emissions. Regulators, investors, and customers demand reduced environmental impact. Diodes Incorporated must boost energy efficiency, possibly using renewables. The semiconductor industry's carbon footprint is under scrutiny; in 2024, the sector faced increased pressure to decrease emissions by 15%.

Semiconductor manufacturing, like Diodes Incorporated's operations, demands substantial ultra-pure water. Efficient water use and wastewater treatment are vital for environmental compliance. Diodes likely invests in water-saving tech. In 2024, semiconductor firms faced rising water costs; these costs are projected to keep rising in 2025.

Semiconductor manufacturing uses chemicals. Proper handling and disposal are key for environmental protection. Diodes Incorporated focuses on environmental compliance. In 2023, the global semiconductor waste recycling market was valued at $3.2 billion. This is projected to reach $4.8 billion by 2029.

Supply Chain Environmental Practices

Diodes Incorporated's PESTLE analysis must consider the environmental impact of its supply chain, which includes suppliers and contractors. Sustainable practices and responsible material sourcing are vital. In 2024, the semiconductor industry faced scrutiny regarding its environmental footprint. For example, a report by the Semiconductor Industry Association (SIA) highlighted the need for supply chain transparency.

- In 2024, the SIA reported that 80% of semiconductor companies are working on supply chain sustainability.

- Diodes can adopt initiatives to ensure suppliers meet environmental standards.

- The company can also encourage suppliers to cut emissions.

E-waste and Product End-of-Life Management

The surge in electronic waste (e-waste) poses a notable environmental hurdle. Regulations like the Waste Electrical and Electronic Equipment (WEEE) directive mandate that manufacturers handle the collection and recycling of electronic products once they reach the end of their lifespan. Diodes Incorporated, as an electronics manufacturer, must consider these factors. This includes focusing on the recyclability of their products and actively participating in e-waste management initiatives. Globally, e-waste generation is estimated to reach 82.6 million metric tons by 2025.

- Global e-waste generation is projected to hit 82.6 million metric tons by 2025.

- WEEE directive is a key regulation.

- Diodes must consider product recyclability.

Diodes must address energy use and emissions to meet environmental standards, pressured by regulations and stakeholders. Water consumption and wastewater treatment are crucial due to rising costs and regulatory compliance. Chemical handling and waste management are vital; the global semiconductor waste recycling market is projected to grow to $4.8 billion by 2029. Supply chain sustainability and e-waste management, like complying with the WEEE directive and product recyclability, are critical.

| Environmental Factor | Impact | Data/Fact |

|---|---|---|

| Energy and Emissions | High energy use; emissions concerns. | Sector faced a 15% reduction demand in 2024. |

| Water Usage | Large water demand; compliance. | Water costs keep rising in 2025. |

| Waste & Chemicals | Chemicals; recycling market growth. | Waste recycling to reach $4.8B by 2029. |

| Supply Chain | Sustainability needed. | 80% of semiconductor cos work on it. |

| E-waste | Product end-of-life; recycling. | 82.6M metric tons by 2025. |

PESTLE Analysis Data Sources

Diodes PESTLE analysis integrates global market data, government policy, tech reports, and industry-specific studies. We ensure insights from various trusted sources.