Donaldson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donaldson Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Clear prioritization using a quadrant map that helps executives make key decisions.

What You’re Viewing Is Included

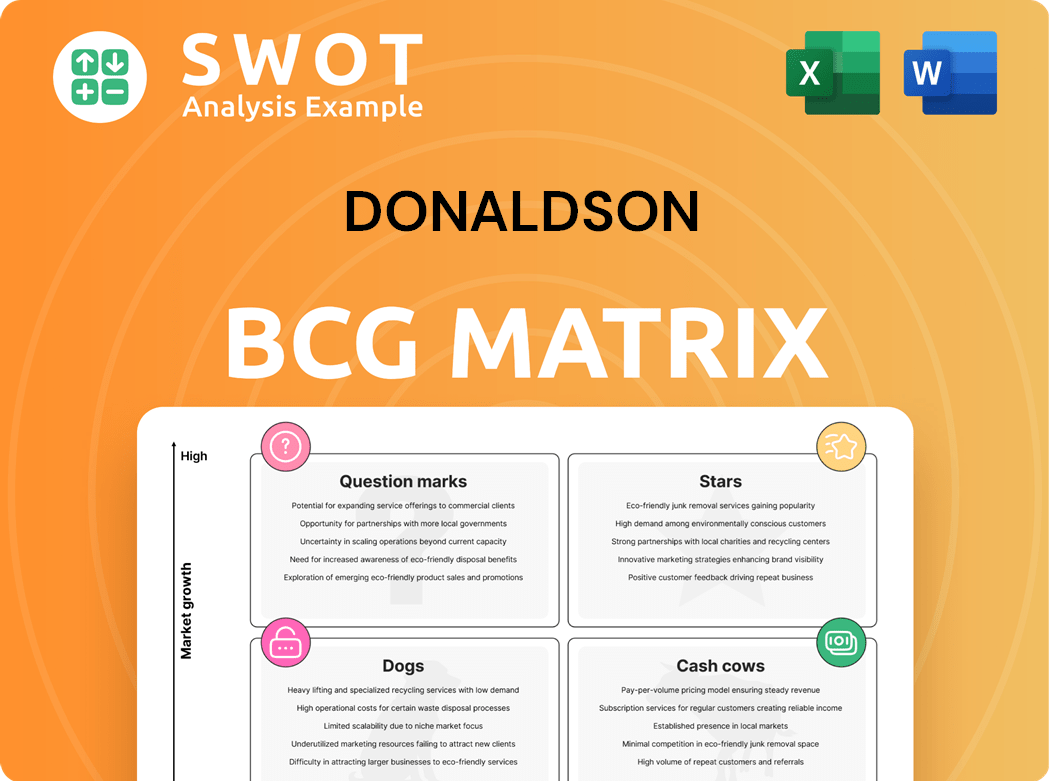

Donaldson BCG Matrix

The BCG Matrix preview showcases the identical document you'll receive post-purchase. This is the complete, fully functional report ready for immediate application. No hidden sections, just a comprehensive tool.

BCG Matrix Template

Ever wondered where a company’s products truly stand in the market? The BCG Matrix, a powerful tool, categorizes them into Stars, Cash Cows, Dogs, or Question Marks. This simplified view helps assess growth potential and resource allocation. It's a key framework for strategic product management and investment decisions.

This preview is just a glimpse. The complete BCG Matrix unveils detailed quadrant placements and strategic recommendations for immediate impact. Purchase now for a data-backed, actionable plan.

Stars

Aerospace and Defense filtration is a star in Donaldson's BCG Matrix. This sector benefits from strong market share and growth, fueled by rising defense budgets. Technological advancements also support this segment's leading position. Investing here should bring high returns, potentially making it a cash cow. In 2024, the global aerospace and defense market is estimated at $857 billion.

The Life Sciences segment, focusing on Disk Drive and Food & Beverage, shows high growth and expanding market share. Acquisitions like Univercells Technologies boosted bioprocessing capabilities. In fiscal year 2024, Donaldson's Life Sciences sales increased, reflecting strong demand. Continued innovation in this area could drive substantial leadership. The segment's strategic importance is underscored by its robust performance.

Donaldson's aftermarket filtration is a "Star" due to consistent demand, especially for replacement filters. This segment's robust market share and growth are fueled by high vehicle use. In 2024, aftermarket sales saw a rise, contributing significantly to Donaldson's revenue. Expanding product lines and distribution will boost this segment further.

Engine OEM Systems

Donaldson's Engine OEM Systems are a shining example of a "Star" in the BCG Matrix, capitalizing on strong OEM relationships. This segment is a major revenue driver, thanks to its solid market position and ongoing innovation in filtration. Investment in new tech and customer relations is essential for future growth.

- In fiscal year 2024, Engine OEM Systems generated $1.9 billion in revenue.

- Donaldson's strategic partnerships with major engine manufacturers ensure a steady stream of orders.

- The segment's operating margin was approximately 20% in 2024.

- Continuous R&D spending supports the development of cutting-edge filtration solutions.

Industrial Automation Filtration

Industrial automation filtration is a rising star for Donaldson, fueled by growing demand. Robotics and semiconductor manufacturing drive this need, creating a high-growth market. Donaldson's precision filtration expertise and tech focus are key advantages. Strategic investments are vital for continued success in this area.

- Market growth in industrial automation filtration is projected at 8-10% annually through 2024.

- Donaldson's revenue from industrial filtration solutions reached $1.8 billion in fiscal year 2023.

- The company increased R&D spending by 12% in 2024 to support innovation.

Donaldson's "Stars" show high growth and strong market share, ideal for investment. These segments, like Engine OEM, drive revenue and have high operating margins. Continuous innovation and strategic partnerships boost their potential.

| Segment | Key Features | 2024 Data |

|---|---|---|

| Engine OEM | Strong OEM relationships, innovation | $1.9B Revenue, 20% margin |

| Life Sciences | High growth, acquisitions | Sales increased, strong demand |

| Aftermarket | Consistent demand | Sales rise |

| Industrial Automation | Growing demand | $1.8B Revenue (2023), 8-10% growth |

Cash Cows

The Mobile Solutions segment, especially its aftermarket, is a Cash Cow. It consistently generates cash from replacement filters. In 2024, aftermarket sales contributed significantly. Strong distribution and customer retention are key for steady revenue.

Industrial Filtration Solutions (IFS), excluding Aerospace and Defense, is a cash cow for Donaldson. It has a strong market position with consistent revenue. Growth is steady, not explosive, offering financial stability. Focusing on efficiency and key areas like dust collection is key. In 2024, Donaldson's Industrial Solutions segment generated $2.1 billion in sales.

Donaldson's mining air filters are cash cows, particularly in Australia, due to strong market presence. Local manufacturing and sustainable practices give them an advantage. In 2024, Donaldson's sales in the Asia-Pacific region reached $1.2 billion. Maintaining local production and customer focus secures dominance.

Filtration for Existing Automotive

Filtration solutions for the existing automotive sector are cash cows due to the large installed base of passenger and commercial vehicles needing replacement filters. Despite the rise of electric vehicles, the demand for traditional filtration products remains strong. This sector benefits from consistent revenue streams and established market presence. Innovation and adapting to evolving needs are key to sustaining profitability.

- In 2024, the global automotive filter market was valued at approximately $18 billion.

- Replacement filters account for a significant portion of this market, driven by regular maintenance needs.

- Companies like Donaldson are focused on improving filtration efficiency and extending filter lifespans.

- The shift to EVs is gradually changing the filtration landscape, with new types of filters emerging.

Bulk Tank Filtration

Bulk tank filtration systems are a cash cow for Donaldson, generating consistent revenue across various industries. These systems are crucial for fluid purity and equipment protection, ensuring operational efficiency. Donaldson's focus on this area reflects its commitment to reliable, high-performance solutions. Expanding the product range and targeting specialized industry needs will fortify its market position.

- In 2024, the global filtration market was valued at approximately $80 billion.

- Donaldson reported $3.4 billion in sales in fiscal year 2023.

- Industrial filtration accounted for a significant portion of Donaldson's revenue.

- The demand for filtration systems is consistently growing.

Cash cows provide consistent revenue and high market share. Donaldson’s segments like aftermarket solutions generate steady cash flow. Key examples include industrial filtration and mining filters, ensuring profitability.

| Segment | Description | 2024 Sales (approx.) |

|---|---|---|

| Mobile Solutions (Aftermarket) | Replacement filters | Significant contribution |

| Industrial Filtration | Dust collection, etc. | $2.1B |

| Mining Air Filters | Strong market presence | Regional sales in APAC $1.2B |

Dogs

Donaldson's on-road sales of non-strategic products struggle due to tough market conditions. Sales are declining, and market share is shrinking. This makes it hard to justify new investments in these areas. A strategic move would be to divest or scale back these product lines. For example, in 2024, this segment saw a 7% decrease in sales.

The off-road sales segment faces headwinds, especially in agriculture, due to weak demand. Global equipment production declines, echoing this challenging climate. Donaldson's Q1 2024 results showed a 7% sales decrease in off-road, signaling continued pressure. Reassessing the product mix and shifting to growth areas is key.

Donaldson's on-road business faces headwinds due to decreased global truck production, impacted by industrial market softness. The off-road sector struggles with weak agricultural markets and dampened global demand. In Q2 FY2024, on-road and off-road sales dropped significantly; 24.4% and 12.8%, respectively, year-over-year. These segments are classified as "Dogs" within the BCG matrix due to their low market share and growth.

Non-Core Industrial Filtration Applications

In Donaldson's BCG Matrix, non-core industrial filtration applications, characterized by small markets and fierce competition, are "Dogs." These areas might consume considerable resources without significant profit. For example, in 2024, niche filtration markets showed flat growth, with some segments experiencing a 2% to 3% decline due to oversupply. Prioritizing core competencies and shedding non-core assets can boost profitability. Donaldson's strategic shift in 2024 included divesting from low-margin product lines.

- Market stagnation in niche filtration segments.

- High competition leading to margin pressure.

- Resource drain without substantial returns.

- Strategic focus on core business.

Commoditized Filtration Products

Commoditized filtration products, categorized as "Dogs" in Donaldson's BCG matrix, grapple with intense price competition and limited differentiation, making profitability challenging. These products, often lacking unique features, face easy substitution, squeezing profit margins. To improve their market position, Donaldson must invest in innovation and differentiate its offerings. In 2024, the filtration market saw a 3% increase in demand, yet commoditized segments experienced stagnant growth.

- Low profit margins due to high competition.

- Stagnant growth in commoditized segments.

- Need for innovation to differentiate.

- Market demand increased by 3% in 2024.

In Donaldson's BCG Matrix, "Dogs" represent products with low market share in slow-growing markets. These segments often require resources without generating significant returns. The company's 2024 data shows declines in both on-road and off-road sales, classifying these as "Dogs." Strategic moves involve divestiture or focusing on core competencies.

| Segment | Market Share | Growth Rate (2024) |

|---|---|---|

| On-Road | Low | -7% |

| Off-Road | Low | -7% |

| Niche Filtration | Low | Flat |

Question Marks

Expansion into emerging markets, especially in Asia-Pacific and South America, presents Donaldson with chances and difficulties. These markets offer high growth potential, but Donaldson needs significant investment and adaptation. For example, in 2024, the Asia-Pacific region saw a GDP growth of roughly 4.5%. Careful market analysis and strategic partnerships are key to success.

The burgeoning EV sector demands specialized filtration for batteries and thermal systems. Although the EV market is expanding, Donaldson's current market share is uncertain. Investing in R&D for novel EV filtration could significantly boost its position. Globally, EV sales rose by 31% in 2024, signaling substantial growth potential.

Sustainable filtration solutions represent a question mark in Donaldson's BCG Matrix. The rising demand for eco-friendly products creates an opportunity. Although Donaldson has made efforts, more innovation and investment are vital. Developing sustainable materials and energy-efficient systems is beneficial. In 2024, the market for green filtration grew by 12%, indicating potential.

Industrial Gases Filtration

Industrial gases filtration is a question mark in Donaldson's BCG matrix, indicating potential for growth but requiring strategic investment. The market for filtration solutions in compressed air and gas purification is expanding, driven by the need for higher purity gases. Donaldson could boost its position by broadening its product range and market penetration. Targeted investments and collaborations are key to capitalizing on this opportunity.

- Global industrial gas filtration market size was valued at $6.8 billion in 2023 and is projected to reach $9.7 billion by 2028.

- The compressed air treatment market is expected to grow, with a CAGR of 5.8% from 2023 to 2030.

- Key players like Donaldson are focusing on innovation, such as advanced filtration media, to meet evolving industry demands.

Advanced Air Purification Systems

Advanced air purification systems are becoming increasingly important due to growing concerns about air quality and health. Donaldson has a presence in this market, but there's room to grow by expanding the product range and targeting specific applications. Focusing on technological advancements and offering customized solutions can boost market share.

- The global air purifier market was valued at USD 11.9 billion in 2023.

- It is projected to reach USD 19.7 billion by 2030, growing at a CAGR of 7.5% from 2024 to 2030.

- HEPA and ULPA filters are key technologies in air purification.

- Increasing awareness of indoor air quality is driving demand.

The "Question Marks" in Donaldson's BCG Matrix represent opportunities requiring strategic investment due to high market growth but uncertain market share. Sustainable filtration solutions, industrial gas filtration, and advanced air purification systems fall into this category. Success demands focused innovation, targeted investments, and market expansion strategies.

| Area | Market Growth (2024) | Donaldson's Position |

|---|---|---|

| Sustainable Filtration | 12% | Requires more investment |

| Industrial Gas Filtration | 5.8% CAGR (2023-2030) | Expand product range |

| Advanced Air Purification | 7.5% CAGR (2024-2030) | Expand product range |

BCG Matrix Data Sources

Our BCG Matrix leverages company financials, market share data, industry analyses, and economic forecasts for comprehensive, data-driven insights.