Douglas Dynamics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Douglas Dynamics Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Quickly identify strategic areas for investment, divestment or focus with the quadrant.

Full Transparency, Always

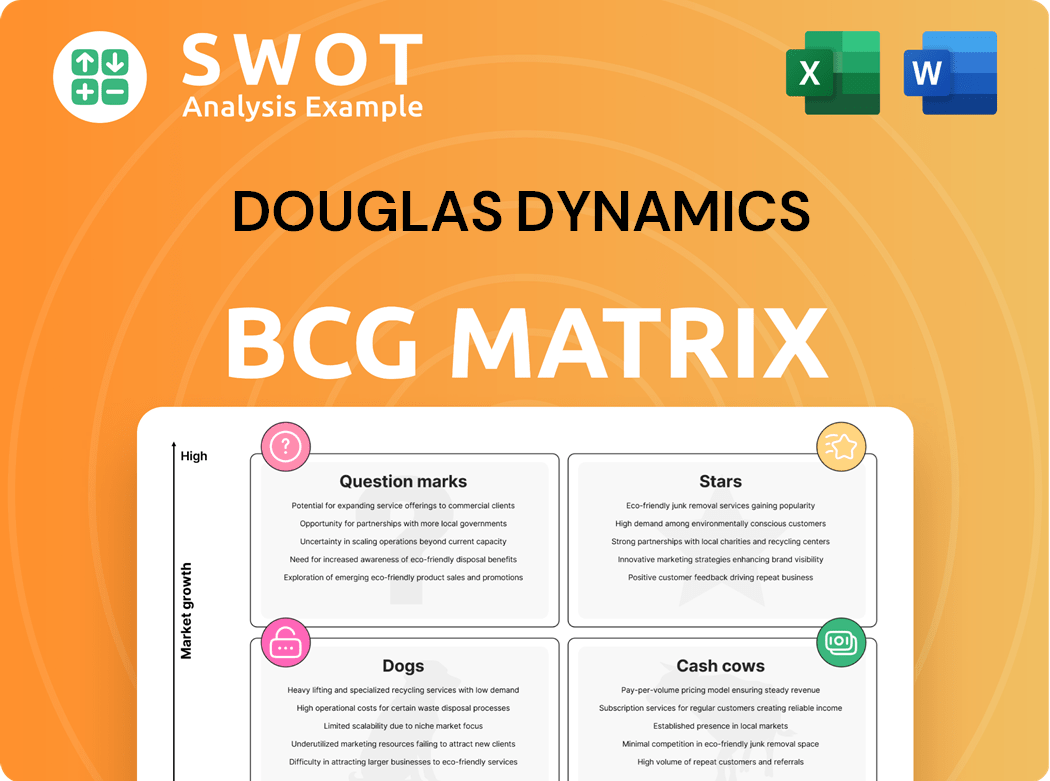

Douglas Dynamics BCG Matrix

The Douglas Dynamics BCG Matrix you're previewing is identical to what you'll receive upon purchase. This professional-grade report is ready for immediate use in your strategic planning and analysis. No hidden content, just the fully unlocked document for your needs. It's formatted for easy integration into presentations and reports.

BCG Matrix Template

Douglas Dynamics' BCG Matrix offers a snapshot of its product portfolio, classifying items as Stars, Cash Cows, Dogs, or Question Marks. This framework helps pinpoint growth opportunities and resource allocation needs. Identifying the strengths and weaknesses of each product category is crucial for strategic planning. Understand which segments require investment, which generate profit, and which might need to be divested. This analysis empowers smarter decision-making. Purchase the full version to unlock comprehensive insights and strategic guidance.

Stars

The Work Truck Solutions segment, a star in Douglas Dynamics' BCG matrix, reported record results in 2024. This segment's success is due to strong execution and favorable market conditions. With a near-record backlog, further investment is likely. In 2024, the segment's revenue increased, reflecting its strong market position.

Douglas Dynamics, a leader in snow and ice control, thrives on innovation. The company regularly launches new products, like the XRS™ plow. In 2024, R&D spending remained a priority, ensuring a competitive edge. This focus helps maintain market share, with 2023 revenue at $683 million.

Douglas Dynamics' 2024 Cost Savings Program was a major success, achieving over $10 million in savings. This initiative significantly boosted margins, especially in Work Truck Attachments. The program has been vital for maximizing profits amid weaker demand. Continued focus on operational efficiency remains key for future performance.

Strong Free Cash Flow

Douglas Dynamics demonstrated robust financial health in 2024 with a substantial increase in free cash flow, a key metric for assessing a company's financial performance. This improvement, compared to 2023, stems from enhanced cash generation from operations and reduced capital spending. This solid financial position enables strategic investments and shareholder returns.

- Free cash flow increased in 2024, showcasing improved financial health.

- Enhanced cash from operating activities contributed to the positive trend.

- Lower capital expenditures supported the free cash flow growth.

- The company can now focus on growth and shareholder value.

Market Leadership in Snow and Ice Control

Douglas Dynamics shines as a "Star" in the BCG matrix, dominating the snow and ice control market in North America. The company's robust brand and loyal customer base are key advantages. They are expanding market share and innovating with new products. In 2024, Douglas Dynamics reported net sales of $738.5 million.

- Exceptional customer loyalty and brand equity.

- Extensive distributor network ensures market reach.

- Focus on new product introductions for growth.

- Strong financial performance, with $738.5M in net sales.

Douglas Dynamics' Work Truck Solutions segment is a "Star," achieving record results in 2024 with revenue growth. Innovation drives their success. The company focuses on R&D, with 2024 net sales hitting $738.5 million, marking strong market leadership.

| Metric | 2023 | 2024 |

|---|---|---|

| Net Sales (M) | $683 | $738.5 |

| R&D Spending | Priority | Ongoing |

| Cost Savings (M) | N/A | $10+ |

Cash Cows

Douglas Dynamics dominates the commercial snow and ice control equipment market. This sector sees steady demand, especially in areas with heavy snowfall. The company's strong brand and reliable products ensure consistent revenue. In 2024, Douglas Dynamics reported a revenue of $721.8 million, highlighting its market strength.

Douglas Dynamics' expansive distributor network, boasting over 2,200 points of sale, is a cornerstone of its "Cash Cow" status. This vast reach gives it a considerable edge against smaller competitors. For instance, in 2024, their network facilitated roughly $700 million in sales. Further optimization of this network could boost market penetration and customer satisfaction, potentially increasing revenue by 5-7% annually.

Douglas Dynamics, with brands like FISHER, SNOWEX, and WESTERN, benefits from strong brand equity. This is due to decades of innovation, productivity, and reliability. For example, in 2024, the company's market share in the snow and ice control market was over 40%, a testament to customer loyalty. Reinforcing these values helps maintain customer loyalty.

Operational Efficiency

Douglas Dynamics excels in operational efficiency, employing lean manufacturing and a flexible cost structure. This approach enables them to adapt production to match demand fluctuations while managing costs. Enhancing these efficiencies further boosts profitability and resilience. In 2024, the company reported a gross profit margin of 29.4%.

- Lean manufacturing principles streamline production.

- Variable cost structure allows for production adjustments.

- Efficiency improvements enhance profitability.

- Gross profit margin of 29.4% in 2024.

Stable Dividend Payouts

Douglas Dynamics showcases its "Cash Cow" status through dependable dividend payouts, reflecting a dedication to shareholder value. This consistency is a key factor in drawing and keeping investors. For 1Q25, a dividend of $0.295 per share was declared, signaling financial stability. Such payouts are critical in the current financial landscape.

- Consistent Dividends: Douglas Dynamics maintains a history of stable dividend payments.

- Investor Attraction: Stable dividends help in attracting and retaining investors.

- 1Q25 Dividend: A quarterly dividend of $0.295 per share was announced.

Douglas Dynamics, a "Cash Cow," generates consistent revenue and profits. It thrives in a stable market with a robust distribution network. This solid performance is underpinned by strong brand recognition and operational efficiency.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total sales | $721.8M |

| Market Share | Snow & ice control | Over 40% |

| Gross Profit Margin | Efficiency indicator | 29.4% |

Dogs

The used commercial BEV segment, categorized as a "Dog" in Douglas Dynamics' BCG matrix, shows concerning price declines. Data from 2024 reveals that average used commercial BEV prices experienced a significant year-over-year drop. This downward trend presents financial risks for Douglas Dynamics. Strategic adjustments are vital to offset potential losses in this market.

The Attachments segment of Douglas Dynamics faces headwinds from low snowfall, particularly in key markets. This directly reduces net sales, as snow removal equipment demand declines. The extended equipment replacement cycle further dampens sales figures. To combat this, diversifying revenue streams and minimizing weather dependencies are essential strategies. In 2024, the company reported a decrease in revenues in the first quarter attributed to these factors.

Douglas Dynamics' performance is significantly tied to weather, especially snowfall, making results volatile. In 2024, a mild winter affected snow and ice control product sales. The cyclical nature of the industry requires strategies to offset weather impacts. Diversification and innovation are crucial for mitigating these risks.

Declining Used Truck Sales

The used truck market's decline signals challenges for Douglas Dynamics. Sales dipped in 2024, requiring strategic shifts. This segment may need adjustments to improve performance. Analyzing market trends is essential for managing inventory effectively.

- Used truck sales faced a downturn in 2024.

- Douglas Dynamics must adapt to mitigate losses.

- Inventory management strategies need review.

- Market analysis is crucial for this segment.

High Equipment Costs

High equipment costs pose a significant challenge in the snow removal industry, acting as a barrier to entry for new businesses and smaller operators. Advanced equipment, such as snowplows, demands substantial upfront investments, impacting profitability. In 2024, the average cost of a new commercial snowplow ranged from $5,000 to $15,000, significantly affecting startup capital. Exploring financing options and cost-effective equipment solutions can broaden the customer base.

- Initial Investment: New snowplows can cost $5,000-$15,000.

- Financing: Explore leasing to reduce upfront costs.

- Cost-Effective Solutions: Used equipment or smaller models can help.

- Impact: High costs can limit market access for new entrants.

The "Dog" segment, used commercial BEVs, saw price declines in 2024. This downward trend poses financial risks for Douglas Dynamics. Strategic pivots are vital.

| Category | 2024 Performance | Implication for Douglas Dynamics |

|---|---|---|

| Used Commercial BEV Prices | Significant YOY drop | Financial risk, need strategic adjustments |

| Sales Volume | Decreased | Inventory management and market analysis crucial |

| Market Analysis | Essential for managing inventory | Adapt to mitigate losses |

Question Marks

The electric and battery-operated snow removal equipment market is expanding, driven by sustainability efforts. Sales of electric snow blowers have risen, with a notable increase in 2024. Investing in these models could boost Douglas Dynamics' market position. In 2024, the electric snow blower market grew by about 15%.

Autonomous snow removal solutions represent a "Question Mark" for Douglas Dynamics. This area offers potential for growth, with the global autonomous snow removal market projected to reach $80 million by 2024. Investing in this technology could improve efficiency and reduce labor costs, a key concern in winter maintenance. Successful implementation could establish Douglas Dynamics as a leader in innovation.

The tree care industry is expanding, fueled by urban forestry and storm cleanup. This growth boosts demand for dependable equipment. Douglas Dynamics could generate new revenue by entering this segment. The urban forestry market was valued at $12.8 billion in 2023.

Commercial Vehicle Accessories Market

The commercial vehicle accessories market is a Question Mark for Douglas Dynamics within the BCG matrix, indicating high market growth but low market share. Rapid urbanization and infrastructure development fuel this growth, creating opportunities for Douglas Dynamics. Focusing on specialized accessories could boost its market position. In 2024, the global commercial vehicle accessories market was valued at approximately $40 billion, with projected annual growth of 6-8%.

- Market growth driven by infrastructure spending.

- Douglas Dynamics could gain market share with targeted accessories.

- Focus on urban transport needs.

- Market size: $40 billion in 2024.

New Product Development

Douglas Dynamics' strong in-house new product development program places it within the "Question Mark" quadrant of the BCG Matrix. This signifies high growth potential but uncertain market share. The company's focus on innovation aims to capture market share and boost profitability.

Expanding the product portfolio in commercial and municipal vehicle attachment markets is a key strategy. This approach is vital for Douglas Dynamics to maintain its leading market position. The goal is to transform "Question Marks" into "Stars".

- New product development is critical for Douglas Dynamics to stay competitive.

- Innovation helps the company grow and capture market share.

- Expanding the product line in key markets is a strategic move.

- The aim is to increase profitability through new products.

Question Marks represent high-growth, low-share markets for Douglas Dynamics. These segments, like commercial vehicle accessories, offer considerable potential for expansion. Strategic investments are needed to increase market share. By focusing on innovation and new products, Douglas Dynamics aims to transform these into profitable ventures. The commercial vehicle accessories market was $40B in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Growth | High potential, low current share. | Commercial vehicle accessories market: $40B |

| Strategic Focus | Innovation, new products to gain share. | Electric snow blower market grew by 15% |

| Goal | Transform Question Marks into Stars. | Autonomous snow removal market: $80M |

BCG Matrix Data Sources

The Douglas Dynamics BCG Matrix leverages market analysis, company financials, and industry forecasts for insightful strategy. Data sources encompass financial reports, sector trends, and expert opinions.