Dropbox Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dropbox Bundle

What is included in the product

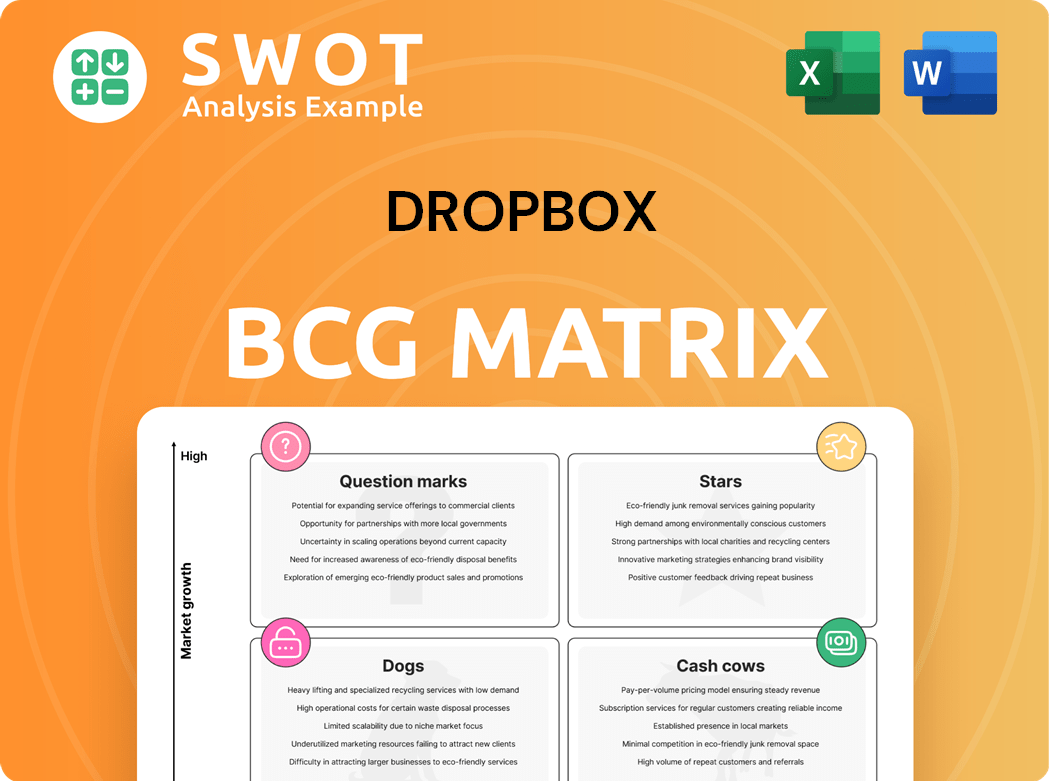

Dropbox's products are classified into the BCG Matrix, suggesting investment, holding, or divestment strategies.

Printable summary optimized for A4 and mobile PDFs to share findings with stakeholders.

What You’re Viewing Is Included

Dropbox BCG Matrix

This Dropbox BCG Matrix preview showcases the identical document you'll gain upon purchase. The fully editable, professionally formatted report is instantly downloadable, ready for strategic planning and presentations.

BCG Matrix Template

Dropbox's file storage reigns, but where do its other offerings stand in the market? This snapshot hints at the product portfolio's strategic landscape. See how features fare as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Dropbox is heavily investing in AI. They're rolling out features like Dash for Business. These AI tools aim to enhance content discovery and security. This strategic move could boost future growth. Early user feedback on Dash is positive, signaling strong market demand.

Dropbox's collaboration tools, like Dropbox Paper, boost teamwork and workflow. These tools are key for keeping business clients, especially with hybrid work. In 2024, Dropbox had over 700 million registered users. Continuous tool innovation is vital to stay ahead. Dropbox's revenue in Q3 2024 was $640.6 million.

Dropbox's enterprise solutions cater to larger organizations, offering advanced file management and collaboration tools. In 2024, Dropbox's revenue from enterprise customers grew, reflecting the strong demand for its business-focused services. Enhancing these offerings could boost revenue, with enterprise clients contributing significantly to overall financial performance. Dropbox's focus on enterprise solutions aligns with market trends.

Secure File Sharing

Dropbox shines as a "Star" in secure file sharing. They have a strong reputation built on features like end-to-end encryption and compliance with regulations. This focus is a key differentiator, attracting users who prioritize data privacy. Keeping up security is key to keeping user trust. Dropbox's revenue in 2023 was $2.5 billion, reflecting its strong market position.

- End-to-end encryption protects data.

- Compliance with regulations boosts trust.

- Security is a key market differentiator.

- 2023 revenue: $2.5 billion.

Cross-Platform Compatibility

Dropbox's cross-platform compatibility is a key strength, supporting Windows, macOS, Android, and iOS. This broad accessibility allows users to sync and share files seamlessly across devices. It enhances user experience by ensuring files are available anytime, anywhere. Dropbox's commitment to diverse platform support is vital for maintaining its wide user base.

- Dropbox reported 18.24 million paying users as of Q4 2023.

- The company's revenue for 2023 was $2.52 billion.

- Dropbox is available on various operating systems including Windows, macOS, Android, and iOS.

Dropbox excels as a "Star" in secure file sharing. Their strong security, with end-to-end encryption, attracts users. Dropbox's 2023 revenue was $2.5 billion, showcasing its market dominance. Continuous innovation and user trust are key for Dropbox.

| Feature | Impact | Data |

|---|---|---|

| End-to-end encryption | Protects data privacy | Crucial for user trust |

| Compliance | Meets regulatory standards | Enhances security |

| Revenue (2023) | Indicates market position | $2.5 billion |

Cash Cows

Dropbox's core file sync and share business is a cash cow, ensuring a steady revenue stream. Although growth has slowed, it still produces significant income. In 2024, Dropbox's revenue was approximately $2.5 billion. Enhancing this core service for efficiency and profitability is key for funding new projects.

Dropbox's massive user base, with millions of paying users, is a key strength. This large audience generates consistent, predictable revenue streams. In Q3 2023, Dropbox reported 18.06 million paying users. Keeping users happy is vital for revenue growth. In 2024, user retention rates directly influence financial performance.

Dropbox benefits from strong brand recognition, solidifying its position in file storage and collaboration. This brand trust attracts new users and retains existing ones, generating consistent revenue. In 2024, Dropbox reported over 700 million registered users. Leveraging its brand equity in marketing and product development is key to maintaining its cash cow status.

High Gross Margins

Dropbox, categorized as a "Cash Cow" in the BCG matrix, showcases high gross margins. These margins indicate operational efficiency and a scalable model. The company's profitability heavily relies on these high margins. Dropbox must focus on continuous operational improvements to sustain or enhance these margins.

- Gross margin for Dropbox was approximately 77% in 2024.

- Operating expenses as a percentage of revenue decreased in 2024.

- Dropbox is actively investing in AI-driven features to boost efficiency.

- The company's focus is on cost optimization.

Average Revenue Per User (ARPU) Growth

Dropbox has shown consistent ARPU growth, a sign of strong monetization. This improvement reflects the success of its premium feature upsells. Dropbox's ability to increase ARPU is crucial for long-term profitability. Continued innovation in premium features can drive further ARPU gains.

- In 2024, Dropbox's ARPU was approximately $13.50.

- Premium subscriptions are a key driver of ARPU growth.

- Upselling to business plans also boosts ARPU.

- Dropbox's focus on higher-value users is evident.

Dropbox's core file-sharing services are cash cows due to steady revenue. The company's strong gross margins and operational efficiency support profitability. In 2024, Dropbox's ARPU hit $13.50, highlighting monetization.

| Metric | 2023 | 2024 (Estimate) |

|---|---|---|

| Revenue (USD Billions) | 2.33 | 2.5 |

| Gross Margin (%) | 76 | 77 |

| Paying Users (Millions) | 18.06 | 18.5 |

Dogs

Dropbox's revenue growth has decelerated, a concern for investors. In 2023, Dropbox's revenue was $2.5 billion, with a growth rate of about 8% annually. This slowdown, compared to prior years, signals challenges. Dropbox must innovate to maintain market relevance and financial health.

Dropbox, despite its broad user base, has seen declines in paying users at times. This signals potential problems with keeping or gaining users. In 2024, Dropbox's paying user base was approximately 17 million, a figure that has fluctuated. To combat this, user retention and acquisition strategies are crucial.

Dropbox confronts hurdles in enterprise sales adoption. This limits securing large enterprise contracts. Tailoring solutions and improving sales strategies are vital. In 2024, enterprise revenue grew but slower than expected. Addressing these challenges unlocks growth potential.

Dependence on Mature File Sync and Share Business

Dropbox's core file sync and share business faces challenges due to maturity and competition. This dependence makes Dropbox susceptible to market saturation and rivals. To ensure future growth, diversifying into new product areas is essential. Scaling newer products, such as Dash, is vital for this strategic shift.

- File sync and share market size in 2024: $3.5 billion.

- Dropbox's revenue in 2023: $2.5 billion.

- Competition: Google Drive, Microsoft OneDrive.

- Dash is a new product aimed at improving productivity.

Layoffs and Restructuring

Dropbox's recent layoffs and restructuring reflect struggles to sustain profitability and expansion. Such moves, though meant to boost efficiency, can hurt employee morale and innovation. Strategic investments and careful transition management are crucial to lessen adverse impacts.

- In 2023, Dropbox announced layoffs affecting approximately 16% of its workforce.

- Dropbox's Q3 2024 revenue grew by 5.3% year-over-year, a slower pace than previous quarters.

- Restructuring costs in 2024 are projected to be between $20 million and $30 million.

Dropbox faces "Dog" status, indicating low market share in a slow-growth market. Its core file-sharing market, valued at $3.5 billion in 2024, shows slow growth. Dropbox's 2023 revenue of $2.5 billion reveals limited dominance against rivals like Google Drive and Microsoft OneDrive.

| Characteristic | Dropbox | Market Context |

|---|---|---|

| Market Share | Low | Competitive, with strong rivals. |

| Growth Rate | Slowing | File sync market growth has decelerated. |

| Investment Strategy | Needs significant strategic shifts. | Focus on innovation and diversification. |

| Financial Performance | Facing challenges | Layoffs and restructuring costs in 2024. |

Question Marks

Dash for Business, Dropbox's AI search, is a question mark in its BCG Matrix. Its success hinges on adoption and solving customer issues. Dropbox invested $1.6 billion in R&D in 2024, crucial for Dash's growth.

Dropbox's foray into new product integrations, like file collaboration tools, holds promise, yet market acceptance is key. Successful integration hinges on user-friendly designs and responding to user needs. Recent data shows that companies with well-integrated products experienced 15% higher user engagement. Thorough market analysis is vital to navigate these integrations.

Dropbox's expansion into new markets, like Asia-Pacific, presents opportunities for growth. However, localization challenges and competition from local players are significant hurdles. In 2024, Dropbox's revenue reached approximately $2.5 billion, indicating potential for further gains in new regions. Strategic market analysis and tailored approaches are crucial for success. Targeting high-growth areas can boost revenue, mirroring the 15% annual growth seen in some emerging tech markets.

Partnerships and Acquisitions

Dropbox's strategic moves, including partnerships and acquisitions, aim to boost its market position. These actions can unlock new technologies and customer bases. However, they bring integration challenges. A successful outcome hinges on thorough research and smooth integration. Synergistic partnerships and acquisitions could drive growth and innovation.

- In 2024, Dropbox acquired FormSwift, enhancing its document workflow capabilities.

- Dropbox has partnered with Microsoft, improving its integration with Microsoft Office.

- These partnerships and acquisitions aim to increase user engagement.

- The deals are part of Dropbox's plan to expand its services.

Focus on Data Security and Privacy

Data security and privacy are pivotal for Dropbox. While Dropbox has a solid security reputation, data protection is increasingly critical. Continuous investment in security infrastructure and compliance is essential to navigate the evolving regulatory landscape. This will help meet user expectations and maintain trust.

- Dropbox's data breach detection systems include intrusion detection and prevention, with a focus on continuous monitoring.

- Dropbox's security spending was approximately $177 million in 2023.

- Dropbox offers features like two-factor authentication and encryption.

- User data privacy expectations are rising, with stricter regulations.

Dropbox's question marks face an uncertain future, demanding strategic decisions. Investments in R&D, like the $1.6B spent in 2024, are crucial. Market adoption and user satisfaction are key for success.

| Feature | Details | Impact |

|---|---|---|

| Dash for Business | AI-powered search | Dependent on user adoption |

| Product Integrations | File collaboration tools | Require user-friendly design |

| Market Expansion | Asia-Pacific | Localization challenges |

BCG Matrix Data Sources

The Dropbox BCG Matrix draws on company financial data, market share assessments, growth rate predictions, and competitor analysis for dependable insights.