DXC Technology SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DXC Technology Bundle

What is included in the product

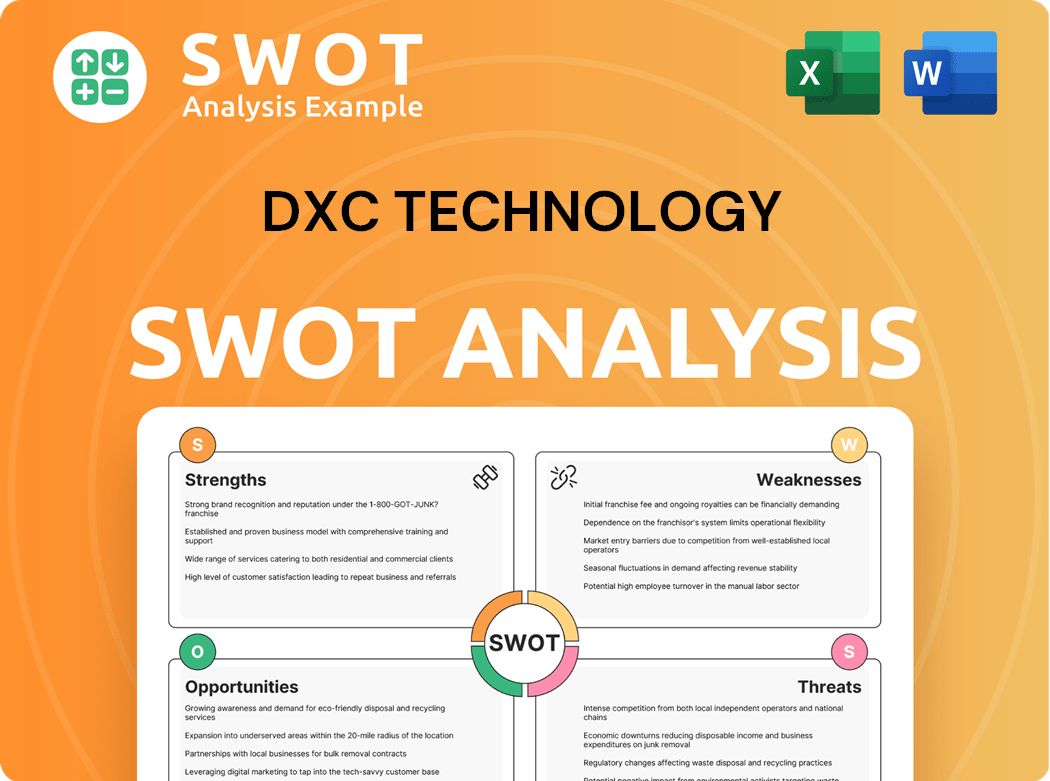

Offers a full breakdown of DXC Technology’s strategic business environment.

Streamlines SWOT communication with visual, clean formatting.

What You See Is What You Get

DXC Technology SWOT Analysis

The preview showcases the genuine DXC Technology SWOT analysis you'll receive. This is the complete document, not a snippet or sample. Upon purchase, you get immediate access to the full, in-depth report.

SWOT Analysis Template

DXC Technology faces a complex landscape. The company's strengths in IT services are undeniable, yet vulnerabilities exist. Key weaknesses and external threats require careful navigation, affecting DXC's overall performance. But opportunities for innovation and expansion abound. Uncover actionable insights and strategic takeaways with our comprehensive SWOT analysis, fully editable and designed for smart decision-making.

Strengths

DXC Technology's global presence spans over 70 countries, giving it a massive footprint. This reach lets DXC serve various clients and offer services worldwide. In 2024, DXC reported revenue from multiple regions. This broad presence helps DXC get market share and support multinational IT needs.

DXC Technology boasts a diverse service portfolio, encompassing cloud, security, analytics, and application services. This broad offering allows DXC to provide complete IT solutions, catering to various client needs. For example, in 2024, cloud services contributed significantly to DXC's revenue. This wide range aids in client acquisition and retention.

DXC Technology boasts a robust partner ecosystem, notably with tech giants like Microsoft and SAP. These alliances integrate advanced technologies into DXC's services. In 2024, DXC's partnerships helped secure $2.5B in new business. This approach fuels innovative solutions. The collaborations boost DXC's market competitiveness.

Focus on Digital Transformation

DXC Technology's focus on digital transformation is a major strength. With operations in over 70 countries, DXC has a substantial global footprint. This wide reach enables DXC to serve a diverse client base and offer services worldwide. A strong global presence improves DXC's ability to capture market share.

- Global Presence: DXC operates in over 70 countries.

- Client Base: Serves a diverse client base.

Emphasis on Security

DXC Technology's strength lies in its strong emphasis on security, a crucial aspect of its IT services. They provide a range of security services, including cloud and platform security, to protect clients' data. This focus helps build trust and attracts clients seeking robust IT solutions. In 2024, the cybersecurity market is projected to reach $228.8 billion.

- Security services are a key growth area for DXC.

- Client trust is enhanced by a focus on security.

- The cybersecurity market is expanding rapidly.

- DXC offers end-to-end security solutions.

DXC Technology’s worldwide reach and diversified service offerings strengthen its position. Their global footprint in over 70 countries lets them serve various clients. In 2024, partnerships secured $2.5B in new business, with cybersecurity services becoming key.

| Strength | Description | 2024 Data |

|---|---|---|

| Global Presence | Operates in 70+ countries, offering widespread service. | Revenues from various global regions. |

| Diverse Services | Offers cloud, security, analytics, and application services. | Cloud services are a key revenue driver. |

| Strategic Partnerships | Collaborates with tech leaders such as Microsoft and SAP. | Partnerships secured $2.5B in new business. |

| Focus on Digital Transformation | Aids clients' digital shifts through IT solutions. | Focus on adapting to market demands. |

| Strong Security | Provides robust security services for client protection. | Cybersecurity market projected at $228.8B. |

Weaknesses

DXC Technology has consistently struggled with revenue declines. In fiscal year 2024, revenue fell by 6.7% to $14.1 billion. This downturn reflects challenges in a competitive IT services market, alongside broader economic pressures. Successfully reversing this trend is vital for DXC's future. It impacts its ability to meet financial targets and maintain investor trust.

DXC Technology faces margin pressures, driven by intense pricing competition and rising operational costs. These pressures can erode profitability, as seen in the fiscal year 2024, where operating margins were impacted. Addressing these challenges requires strategic cost management and optimized pricing, crucial for sustained financial health. In Q1 2024, DXC's adjusted EBIT margin was 9.3%, highlighting the need for margin improvement efforts.

DXC has faced challenges, sometimes missing revenue targets set by analysts, possibly due to sales or market strategy issues. This underperformance can hurt investor confidence, impacting stock value. In 2024, DXC's stock performance was volatile, reflecting these concerns. Better forecasting and sales tactics are crucial to meeting and exceeding expectations.

Complex Organizational Structure

DXC Technology's complex organizational structure presents challenges. The company has experienced revenue declines, signaling difficulties in maintaining growth. This could stem from fierce competition or adapting to changing market needs. Addressing this decline is vital for regaining investor trust and ensuring long-term success.

- Revenue decreased by 5.4% year-over-year in Q3 2024.

- DXC's market capitalization as of late 2024 is approximately $6 billion.

- IT services market is highly competitive, with major players like IBM and Accenture.

Talent Retention Issues

DXC Technology faces talent retention issues, which can lead to increased costs for recruitment and training. High turnover rates disrupt project continuity and erode institutional knowledge. This is a significant challenge for a company that relies heavily on skilled IT professionals. These issues can affect project delivery and client satisfaction. The company's ability to compete effectively in the market is therefore at risk.

- DXC Technology's voluntary attrition rate was 18.9% in fiscal year 2024.

- DXC's employee count decreased from 131,000 in 2020 to 130,000 in 2023.

- The company's spending on employee compensation and benefits was $6.5 billion in 2023.

- DXC has been actively investing in upskilling and reskilling its workforce.

DXC Technology's revenue has been decreasing, facing challenges from the competitive IT market; in 2024 revenue dropped by 6.7%. Intense competition puts pressure on profit margins; the adjusted EBIT margin in Q1 2024 was 9.3%. Talent retention issues drive up costs, with an 18.9% voluntary attrition rate in fiscal year 2024, and overall, employee count decreased.

| Aspect | Details | Impact |

|---|---|---|

| Revenue Decline | 6.7% drop in fiscal 2024 | Financial target challenges, trust. |

| Margin Pressures | Q1 2024 EBIT margin: 9.3% | Erosion of profitability. |

| Talent Retention | 18.9% attrition (FY24) | Increased costs & disrupted projects. |

Opportunities

The escalating need for digital transformation services is a prime opportunity for DXC Technology. Organizations are increasingly modernizing IT, creating demand for DXC's tailored solutions. In Q3 2024, DXC's Digital Advisory revenue grew, reflecting this trend. This focus drives revenue growth and market share expansion.

DXC Technology can capitalize on the rising use of AI and automation to boost its services and cut costs. Integrating AI into its offerings lets DXC give clients advanced features and boost productivity. In 2024, the AI market is projected to reach $200 billion, showing huge growth potential for DXC to expand its AI-driven solutions.

The cloud computing market's expansion offers DXC significant revenue growth opportunities. Cloud migration and management services are in high demand as more businesses adopt cloud solutions. DXC can leverage its expertise to capitalize on this trend, as the global cloud computing market is expected to reach $1.6 trillion by 2025. This strategic focus enables DXC to enhance its market position.

Cybersecurity Solutions Demand

The rising need for robust cybersecurity solutions is a prime opportunity for DXC Technology. With digital transformation accelerating, the demand for secure IT infrastructure is also increasing. DXC can leverage its expertise to offer cybersecurity services, fostering revenue growth. In 2024, the global cybersecurity market was valued at over $200 billion.

- Market growth: The cybersecurity market is projected to reach $345.7 billion by 2028.

- Service demand: Organizations are prioritizing cybersecurity as a core business function.

- DXC's advantage: DXC can integrate security into its digital transformation offerings.

Strategic Partnerships

Strategic partnerships present DXC Technology with avenues to leverage AI and automation, thereby enhancing service offerings and operational efficiency. The integration of AI into DXC's solutions allows for advanced capabilities and productivity gains for clients. Furthermore, these partnerships can drive down operational costs, improving overall service delivery and market competitiveness. In 2024, the global AI market is projected to reach $200 billion, indicating substantial growth potential for companies like DXC that strategically integrate AI.

- AI integration can increase service efficiency by up to 30%.

- Automation can reduce operational costs by 15-20%.

- Strategic partnerships can open new market segments.

DXC Technology can benefit from rising digital transformation needs, growing its market share as clients modernize IT. Leveraging AI and automation offers chances to cut costs, as the AI market is booming, projected at $200 billion in 2024.

Cloud computing's expansion provides significant growth opportunities, with the market expected to reach $1.6 trillion by 2025, offering more services.

DXC can tap into the robust demand for cybersecurity solutions, projected at $345.7 billion by 2028, by integrating security within its offerings, thus increasing its market position.

| Opportunity | Description | Data |

|---|---|---|

| Digital Transformation | Meet growing IT modernization demands. | DXC's Digital Advisory revenue grew in Q3 2024. |

| AI and Automation | Enhance services and cut operational costs. | AI market at $200B in 2024; efficiency gains up to 30%. |

| Cloud Computing | Capitalize on the expanding cloud services market. | Cloud market expected to reach $1.6T by 2025. |

| Cybersecurity | Offer cybersecurity services. | Cybersecurity market projected to $345.7B by 2028. |

| Strategic Partnerships | Leverage AI/automation and open market segments | Partnerships can cut costs by 15-20%. |

Threats

The IT services sector is fiercely competitive, hosting many global and local firms. This competition often leads to price and margin squeezes. In 2024, DXC Technology's operating margin faced pressures, dropping to 8.5% due to competitive pricing. To thrive, DXC must set its services apart and stay ahead of rivals, focusing on innovation and client satisfaction.

Economic downturns pose a significant threat to DXC. Reduced IT spending during economic slumps directly impacts DXC's revenue and profitability. Clients often delay or cancel IT projects amid economic uncertainty, affecting financial performance. For instance, in 2023, IT spending growth slowed to 4.3%. Diversifying the client base and emphasizing essential services are key mitigation strategies.

Rapid technological changes are a significant threat to DXC Technology. Failure to adapt swiftly to new technologies could disrupt its business models. Significant investment in training and infrastructure is crucial. DXC must continuously innovate to stay relevant, as seen in 2024 with cloud computing and AI. The IT services market is expected to grow, presenting both challenges and opportunities.

Cybersecurity Risks

Cybersecurity risks pose a significant threat to DXC Technology, given its reliance on digital infrastructure and data handling. Increased cyberattacks and data breaches could lead to financial losses and reputational damage. The cost of addressing cyber threats continues to rise, impacting profitability. Recent data shows a 20% increase in cyberattacks targeting IT services in 2024.

- Data breaches can lead to substantial financial penalties and legal liabilities.

- Cybersecurity incidents can disrupt operations and client services.

- Maintaining robust cybersecurity requires significant investment in technology and personnel.

Geopolitical Instability

Geopolitical instability poses significant threats to DXC Technology. Economic downturns, often triggered by global events, lead to reduced IT spending. Clients may delay or cancel projects, directly impacting DXC's financial performance. In 2024, IT spending growth slowed to 3.5% globally, a decrease from previous years. Diversifying its client base and offering essential services can help mitigate risks.

- Economic uncertainty often curtails IT investments.

- Project delays and cancellations directly affect revenue.

- Diversification and essential services are key strategies.

- IT spending slowed to 3.5% growth in 2024.

DXC faces intense competition, leading to potential margin pressures and the need for differentiation. Economic downturns and reduced IT spending can directly impact DXC's financial performance. Cybersecurity threats and geopolitical instability introduce additional risks, requiring robust mitigation strategies.

| Threat | Description | Impact |

|---|---|---|

| Intense Competition | Competitive market, price pressures. | Margin squeeze, reduced profitability. |

| Economic Downturns | Reduced IT spending. | Revenue and profit decline. |

| Cybersecurity Risks | Data breaches and attacks. | Financial loss, reputational damage. |

SWOT Analysis Data Sources

This SWOT analysis relies on financial reports, market analysis, and expert opinions to provide accurate and strategic insights.