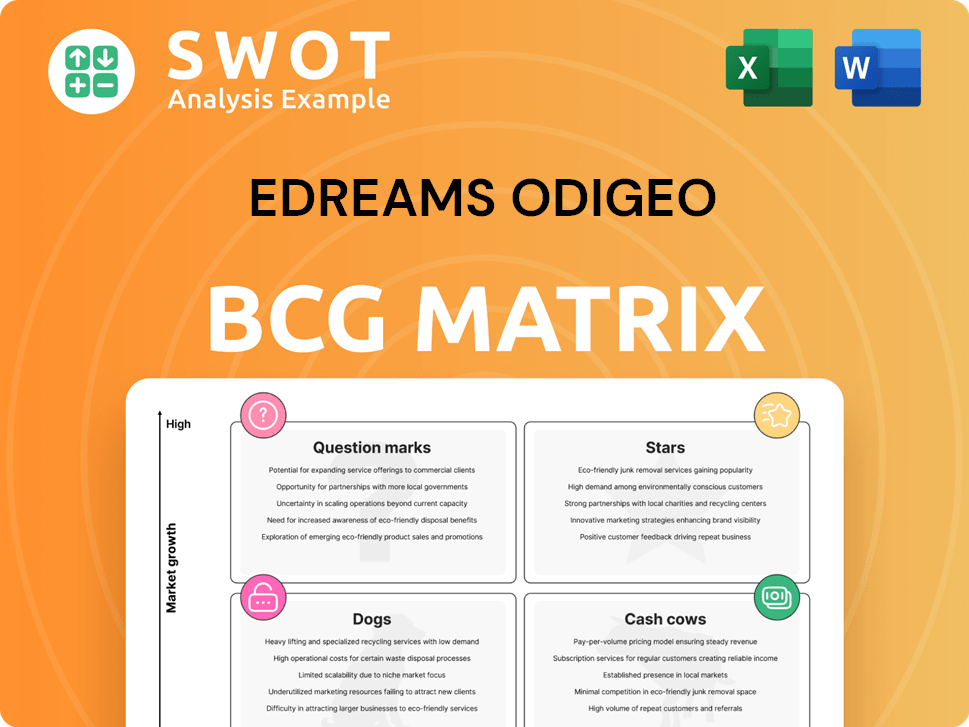

eDreams ODIGEO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

eDreams ODIGEO Bundle

What is included in the product

eDreams ODIGEO's BCG Matrix analysis across its portfolio, offering strategic recommendations.

A clear BCG Matrix layout eases strategic decisions by visualizing business unit performance.

Delivered as Shown

eDreams ODIGEO BCG Matrix

The BCG Matrix previewed is the complete document you'll receive upon purchase. It is fully formatted, ready for immediate use, analysis, and integration into your strategy presentations. No hidden extras or different versions; what you see is what you get. Download the final report without modifications needed and start your strategic planning.

BCG Matrix Template

eDreams ODIGEO's BCG Matrix reveals intriguing insights into its diverse travel offerings. This preview hints at how its brands perform in a competitive market. Understand which are the potential "Stars" and which might be "Dogs." Uncover the strategic implications of their quadrant placements. Delve deeper into the complete BCG Matrix to understand the company's potential. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

eDreams ODIGEO's Prime subscription model is a significant growth driver, attracting over 7 million members by February 2025. This model generates recurring revenue, boosting financial stability and supporting expansion. Prime membership grew to 6.8 million by December 2024, highlighting its sustained appeal and strong customer loyalty.

eDreams ODIGEO heavily invests in technology, using AI to boost its platform and improve customer engagement. This tech focus gives them an edge, enhancing user experiences. For example, in 2024, they continued to develop their NDC platform. The company is working to create the most advanced NDC platform, aiming to lead in online travel.

eDreams ODIGEO dominates as Europe's top online travel agency for flights, boasting a substantial market share. This leadership leverages the rising online travel demand. In 2024, the company's gross bookings hit €6.4 billion. eDreams ODIGEO's market presence drives innovation in e-commerce.

Strong Financial Performance

eDreams ODIGEO shines as a "Star" in the BCG Matrix due to robust financial health. They've shown consistent growth in revenue, profitability, and cash flow, fueling future investments. This financial strength provides a solid base for shareholder value. Cash EBITDA hit a record €123.7 million, a 40% rise year-over-year, with cash generation up 91% to €68.4 million.

- Record Cash EBITDA: €123.7 million

- Cash Generation Growth: 91%

- Strong Revenue Growth

- Consistent Profitability

Strategic Partnerships

eDreams ODIGEO's "Stars" status in the BCG Matrix is bolstered by strategic partnerships. These collaborations, like the one with Travelport, improve technology and expand market reach. These partnerships broaden service offerings, enhancing customer experience. The Travelport agreement is a key step in NDC technology adoption.

- Partnerships drive innovation and market penetration.

- Agreements like Travelport's boost technological capabilities.

- Wider service range improves customer satisfaction.

- NDC adoption signifies industry advancement.

eDreams ODIGEO is a "Star" due to its financial prowess. They had record cash EBITDA of €123.7M in 2024, up 40%. Cash generation soared 91% demonstrating strong growth. They also enjoy strong revenue, profitability, and strategic partnerships, such as Travelport.

| Metric | 2024 Figures | % Change |

|---|---|---|

| Cash EBITDA | €123.7 million | +40% YoY |

| Cash Generation | €68.4 million | +91% YoY |

| Gross Bookings | €6.4 billion |

Cash Cows

eDreams ODIGEO's established online travel agencies, including eDreams, Opodo, GO Voyages, and Travellink, are considered cash cows. These brands have a large, loyal customer base. In 2024, eDreams ODIGEO reported over €500 million in revenue. They offer flights, hotels, and car rentals.

eDreams ODIGEO's flight booking services are a cash cow, generating consistent revenue from a large customer base with high repeat rates. As the top flight booking platform outside of China, eDreams uses AI for customer acquisition and retention, giving it an edge. In fiscal year 2024, eDreams reported €557.9 million in revenues. Its Prime subscription and scale in flights provide a significant competitive advantage.

eDreams ODIGEO's hotel booking services are a key revenue source, providing diverse lodging options. Partnering with ~700 airlines and 2.1M hotels, they offer extensive choices. Prime members enjoy significant savings, averaging €250 per trip when bundling hotels and flights. This segment is crucial for sustained financial performance.

Car Rental Services

Car rental services function as a reliable source of revenue for eDreams ODIGEO, serving travelers needing ground transportation. eDreams ODIGEO simplifies the process by offering various car rental options, ensuring competitive pricing. The company's brand is known for providing diverse travel products. In 2023, the global car rental market was valued at approximately $85 billion.

- Steady Income: Car rentals contribute to a consistent revenue stream.

- Aggregation: eDreams ODIGEO provides various rental choices.

- Customer Focus: Convenience and competitive pricing are key.

- Market Value: The car rental market is significant globally.

Travel Insurance Products

Travel insurance is a cash cow for eDreams ODIGEO, providing a steady revenue stream. The company capitalizes on the demand for travel protection, offering various insurance products. eDreams ODIGEO serves over 21 million customers across 44 countries, ensuring a large market for these products. This segment benefits from the wide range of travel services offered by eDreams ODIGEO.

- eDreams ODIGEO operates in 44 countries, creating a broad customer base.

- The company offers over 40,000 destinations.

- eDreams ODIGEO works with nearly 700 airlines.

eDreams ODIGEO's cash cows, including flight, hotel, car rental, and insurance services, generate consistent revenue. Flight booking is a key driver, with €557.9M revenue in FY24. Services like travel insurance add to the financial stability, serving millions globally.

| Service | Revenue (FY24) | Customer Base |

|---|---|---|

| Flights | €557.9M | Millions worldwide |

| Hotels | Significant | Prime members |

| Car Rentals | Steady | Travelers |

Dogs

Relying on traditional advertising is a weakness for eDreams ODIGEO. The non-Prime business is expected to decline. eDreams went public too early. In 2024, the company's stock performance reflects these challenges. The company's value faces market fluctuations.

The non-Prime customer base at eDreams ODIGEO is seen as a "dog" in the BCG Matrix. They bring in less revenue and need more marketing. eDreams is pushing to get these customers to sign up for its Prime subscription, which provides a more stable income. In 2024, Prime membership drove the most revenue growth, making up for the drop in non-Prime sales.

eDreams ODIGEO's "Dogs" category includes underperforming ancillary services like certain travel insurance or less popular package deals. These services, sourced from various suppliers, may need optimization or could be divested. In 2024, the company's focus on ancillaries and dynamic packages aimed to boost revenue, but underperforming areas still need attention. The company's travel solutions content includes flights, hotels, dynamic packages (flight plus hotel), trains, car rentals, and ancillaries (such as seats, bags, and insurance).

Unsuccessful Geographic Markets

eDreams ODIGEO might struggle in some geographic markets, failing to achieve substantial revenue or profit. These underperforming markets, classified as "Dogs" in the BCG Matrix, demand strategic reassessment. For instance, in 2024, specific regions might show low customer acquisition costs. Customer acquisition is changing. Strategic investments in new geographies are balanced by efficient customer acquisition through referrals now replacing old customers.

- Ineffective markets require strategic review.

- Customer acquisition is changing.

- Referrals are replacing old customers.

- Specific regions may show low customer acquisition costs.

Outdated Technology or Platforms

Outdated technology at eDreams ODIGEO could hinder efficiency and competitiveness. This includes systems not supporting the company's strategic goals. Modernizing or replacing these assets is crucial. eDreams ODIGEO's Prime subscription, launched in 2017, now boasts over 5.2 million members. This highlights the importance of adaptable technology.

- Legacy systems can slow down operations.

- Prime's success underscores the need for tech agility.

- Outdated tech may lead to higher operational costs.

- Investment in tech modernization is essential.

In the BCG Matrix, eDreams ODIGEO's "Dogs" include non-Prime customers and underperforming services. These areas generate less revenue and need more marketing, contrasting with the success of Prime memberships. The company addresses this by driving Prime sign-ups and optimizing ancillary services. In 2024, ancillaries' focus was to boost revenue.

| Category | Details | 2024 Data Points |

|---|---|---|

| Non-Prime | Customers needing more marketing; lower revenue | Non-Prime sales declined; Prime drove revenue growth. |

| Ancillary Services | Underperforming services like travel insurance | Focus on ancillaries and dynamic packages to boost revenue. |

| Geographic Markets | Regions struggling with revenue or profit | Specific regions may show low customer acquisition costs. |

Question Marks

Expanding into new geographic markets offers eDreams ODIGEO significant growth potential, aligning with its "Star" quadrant in the BCG Matrix. These markets, while promising, demand substantial investment for brand building and market share acquisition. eDreams ODIGEO already serves millions globally, with 2024's revenue reaching approximately €550 million, showing its existing international presence. The company's strategic expansion aims to capitalize on this global footprint.

eDreams ODIGEO's investment in new travel products, like specialized packages or booking tools, balances risk with high growth potential. These ventures need thorough market research and substantial initial investment. eDreams ODIGEO's revenue for FY2024 was €599.6 million, showing the scale of its operations. The brand focuses on regular flights, hotels, and car rentals to improve travel for consumers globally.

AI-powered personalized travel is a high-growth area, demanding tech investment. eDreams ODIGEO uses AI for customer optimization. 73% of global travelers use AI for travel, and nearly 90% of Gen Z does.

New Distribution Capability (NDC) Technology

Investing in New Distribution Capability (NDC) technology positions eDreams ODIGEO as a Question Mark within the BCG Matrix, due to its high investment demands and uncertain future returns. The company is co-developing an advanced NDC platform, focusing on retail functions and ancillaries. Leading airlines are actively participating in NDC distribution, signaling potential for growth. The success hinges on effective airline collaboration and market adoption.

- eDreams ODIGEO invested €100 million in technology and development in 2024.

- NDC adoption is projected to increase airline revenue by 15% by 2026.

- Over 20 airlines are actively engaged with eDreams ODIGEO's NDC platform as of late 2024.

Partnerships with Emerging Travel Tech Companies

Partnerships with emerging travel tech companies, like the recent one with Avirato, represent a Question Mark for eDreams ODIGEO in the BCG Matrix. This strategy allows access to cutting-edge technologies and potentially new markets, which could significantly boost eDreams ODIGEO's offerings. However, it also brings risks such as integration difficulties and uncertain financial returns, which could impact the company's profitability.

- Avirato, a hotel management software, may enhance eDreams ODIGEO's conversion rates.

- Integration challenges and returns are uncertain.

- Partnerships aim to access new technologies and markets.

- eDreams ODIGEO is seeking to expand its service offerings.

eDreams ODIGEO's strategic moves, such as investing in NDC tech and partnering with travel tech firms, position them as a "Question Mark." These ventures promise high growth but involve significant investment and uncertain outcomes. The company's 2024 tech investment of €100 million reflects this high-stakes approach.

| Strategy | Investment | Potential Impact |

|---|---|---|

| NDC Tech | High | Airline Revenue Up 15% by 2026 |

| Partnerships | Medium | Enhance Conversion, New Markets |

| Overall Risk | High | Uncertain Returns |

BCG Matrix Data Sources

The BCG Matrix uses eDreams ODIGEO's financial reports, market share data, and competitive analysis. Industry publications & growth forecasts add further insight.