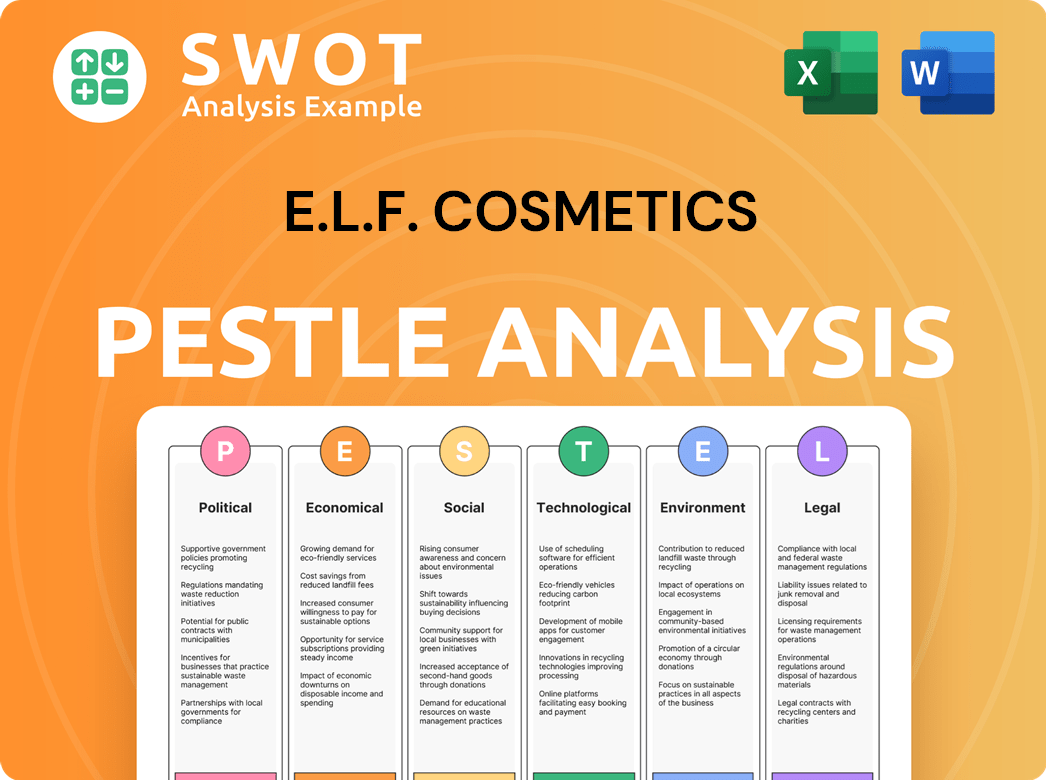

e.l.f. Cosmetics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

e.l.f. Cosmetics Bundle

What is included in the product

Provides a detailed assessment of e.l.f. Cosmetics, examining macro-environmental factors like Political, Economic, and Social.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

e.l.f. Cosmetics PESTLE Analysis

The content and format shown in the preview is the document you'll download. This e.l.f. Cosmetics PESTLE analysis covers the crucial external factors.

PESTLE Analysis Template

e.l.f. Cosmetics faces political scrutiny over its global sourcing and regulatory compliance.

Economic factors like inflation and consumer spending significantly impact sales.

Social trends, including inclusivity and ethical sourcing, drive brand perception.

Technological advancements offer opportunities for innovation in product and distribution.

This PESTLE analysis reveals the external forces shaping e.l.f.'s success. Uncover key insights and stay ahead of the curve. Purchase now for a deeper dive!

Political factors

e.l.f. Beauty faces increasing global regulatory scrutiny, impacting its ingredient choices and safety standards. The FDA and EU Cosmetic Regulation enforce restrictions; the EU bans or restricts 1,328 substances. In 2024, the FDA has over 30 specific restrictions. Compliance requires robust safety reporting and impacts product development costs.

Trade policies and tariffs significantly affect e.l.f. Cosmetics. Around 80% of e.l.f. products come from China. Tariffs, such as a 10% import tax, could raise consumer prices. In 2024, the U.S. imposed tariffs on $300 billion of Chinese goods. These tariffs could impact e.l.f.'s profitability.

e.l.f. Cosmetics relies on a concentrated supplier base, primarily in China. Political instability or trade disputes in China could disrupt e.l.f.'s supply chain. For instance, in 2024, a factory strike in China caused a 10% delay in product shipments for a competing beauty brand. This highlights the risk of production halts and potential financial losses.

Government Support for Sustainable Practices

Government support for sustainable practices significantly impacts e.l.f. Cosmetics. Initiatives and incentives, such as tax credits for using recycled materials, can lower operational costs. For example, the EU's Green Deal, with a budget of over €1 trillion, encourages businesses to adopt eco-friendly strategies. This pushes e.l.f. to invest in environmental initiatives.

- Tax credits can reduce operational costs.

- EU's Green Deal encourages eco-friendly strategies.

- Regulations push for sustainable packaging.

- Government grants support R&D in green tech.

Data Privacy Regulations

e.l.f. Cosmetics must navigate the complex landscape of data privacy regulations. Compliance with evolving laws, like those in Colorado and the GDPR in the EEA and UK, is essential. These regulations impact how e.l.f. collects and uses consumer data for marketing and personalized experiences. Failure to comply can result in significant financial penalties and reputational damage. In 2024, the average GDPR fine was €5.7 million.

- GDPR fines can reach up to 4% of annual global turnover.

- Colorado's Privacy Act requires specific consumer data handling practices.

- Data breaches can lead to substantial legal costs and consumer distrust.

e.l.f. faces regulatory challenges in ingredient selection and safety, with the FDA and EU enforcing restrictions. Trade policies and tariffs, especially from China where ~80% of products originate, impact costs. The company must adhere to data privacy laws like GDPR, with fines averaging €5.7 million in 2024.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Scrutiny | Ingredient & Safety Standards | EU bans ~1,328 substances; Average GDPR fine - €5.7M. |

| Trade Policies | Tariffs & Supply Chain | US tariffs on $300B Chinese goods; China factory strike delay ~10%. |

| Data Privacy | Compliance Costs & Penalties | GDPR fines up to 4% global turnover. |

Economic factors

Ongoing inflationary pressures pose a challenge for e.l.f. Beauty, potentially impacting product pricing and profit margins. The U.S. inflation rate decreased from 6.5% in December 2022 to 3.1% in December 2023, but cost management remains crucial. Maintaining affordability is key for e.l.f.'s value-driven consumer base. This requires careful monitoring of input costs and efficient operations.

Economic uncertainty significantly affects consumer spending, especially in the mass beauty sector. Softer demand can pressure sales growth, leading to a more conservative financial strategy. For instance, in Q3 2024, e.l.f. Cosmetics reported a 76% net sales increase, but future growth might be tempered by economic concerns. This necessitates careful inventory management and marketing adjustments.

The affordable beauty segment is experiencing growth, driven by consumer demand for budget-friendly options, especially amid economic uncertainty. e.l.f. Beauty is well-positioned to capitalize on this trend, thanks to its competitive pricing strategy. In the fiscal year 2024, e.l.f. reported net sales of $1.02 billion, a 77% increase year-over-year. This growth reflects the brand's success in capturing market share within the value-conscious beauty sector.

Foreign Exchange Rate Fluctuations

Fluctuations in foreign currency exchange rates, like between the British pound and the US dollar, significantly influence e.l.f. Beauty's financial outcomes. These shifts can directly affect the cost of goods, potentially squeezing gross margins. For instance, in 2024, a strengthening dollar could lower the cost of imported materials, boosting profitability. However, a weaker dollar might lead to higher costs and reduced margins.

- The US dollar index (DXY) has shown volatility, impacting currency exchange rates.

- e.l.f. Beauty sources products globally, making it vulnerable to currency fluctuations.

- Hedging strategies are crucial to mitigate currency risks and maintain profitability.

Supply Chain Costs

Supply chain costs are a significant economic factor for e.l.f. Beauty. Higher transportation expenses and potential hikes in raw material prices can squeeze e.l.f.'s profit margins. Effective supply chain management is essential to counter these financial pressures, ensuring cost-effectiveness. In Q1 2024, e.l.f. reported a gross margin of 69%, highlighting its ability to manage costs.

- Increased Logistics Costs: Global shipping rates remain volatile, impacting the cost of importing raw materials and finished goods.

- Raw Material Price Fluctuations: Prices of key ingredients like pigments and packaging materials can fluctuate, affecting production costs.

- Inventory Management: Efficient inventory control is needed to avoid excess costs associated with storage and potential obsolescence.

- Supplier Relationships: Strong relationships with suppliers are crucial to negotiate favorable terms and ensure supply stability.

Inflation and consumer spending influence e.l.f.'s profitability; affordability is crucial, while currency exchange rates affect margins. A strong dollar may cut costs; a weak one can raise them. Effective supply chain management combats rising costs, ensuring efficiency.

| Economic Factor | Impact on e.l.f. | Data Point (2024/2025) |

|---|---|---|

| Inflation | Product pricing, margin impact | US Inflation: 3.1% (Dec 2023) |

| Consumer Spending | Sales growth, financial strategy | e.l.f. Q3 2024 Net Sales increase 76% |

| Exchange Rates | Cost of goods, gross margins | USD/GBP volatility |

Sociological factors

Consumer demand for ethical beauty is surging. This shift toward clean, vegan, and cruelty-free products aligns with e.l.f. Beauty's values. e.l.f. has a strong appeal to Gen Z and Millennials, who prioritize ethical brands. The global vegan cosmetics market is expected to reach $25.1 billion by 2025.

Social media, especially TikTok, shapes beauty trends and consumer choices, especially for Gen Z. e.l.f. Beauty thrives on digital marketing and influencer partnerships to reach this audience. e.l.f. saw a 76% increase in digital marketing spend in 2024. This strategy helps boost brand visibility and sales.

e.l.f. Cosmetics thrives on diversity and inclusivity, a critical social factor. The brand's marketing mirrors this, appealing to a wide audience. Its commitment boosts brand loyalty. In 2024, 60% of consumers favor inclusive brands, driving e.l.f.'s success.

Changing Consumer Values and Expectations

Consumers, especially younger demographics, are prioritizing brands that reflect their values, such as social responsibility and eco-friendliness. e.l.f. Cosmetics has capitalized on this trend, enhancing its market position. In 2024, 68% of Gen Z consumers favored brands with ethical practices. This focus resonates with the growing demand for transparent and sustainable products. e.l.f.'s commitment boosts brand loyalty.

- 68% of Gen Z consumers prioritize brands with ethical practices (2024).

- e.l.f. Beauty's emphasis on social responsibility and sustainability enhances its appeal.

Generational Marketing and Targeting

e.l.f. Beauty excels in generational marketing, focusing on Gen Z and Millennials. These groups drive significant beauty industry trends. e.l.f. customizes its marketing and products to match their preferences. This targeted approach is key to e.l.f.'s ongoing success. In 2024, Gen Z and Millennials accounted for over 60% of beauty product purchases.

- Focus on digital platforms and social media engagement.

- Prioritize affordable pricing and value for money.

- Promote inclusivity and diverse representation.

- Utilize influencer marketing and user-generated content.

e.l.f. Cosmetics leverages social shifts, especially ethical consumerism and digital trends. Demand for cruelty-free and vegan cosmetics, like e.l.f.'s offerings, is high. The brand's appeal to Gen Z and Millennials is key, with these groups influencing beauty trends. By 2025, the global vegan cosmetics market is projected to reach $25.1 billion.

| Factor | Details | Impact on e.l.f. |

|---|---|---|

| Ethical Consumption | Rising demand for vegan and cruelty-free beauty. | Supports e.l.f.'s product alignment with consumer values, boosting appeal. |

| Social Media Trends | TikTok & influencers shape trends, impacting consumer choices, mainly for Gen Z. | Drives e.l.f.'s digital marketing and influencer campaigns to increase visibility. |

| Inclusivity | Emphasis on diverse representation in marketing. | Increases brand loyalty; in 2024, 60% favored inclusive brands, supporting growth. |

Technological factors

e.l.f. Beauty heavily uses digital marketing. In fiscal year 2024, digital sales rose 46%. Social media and influencer collaborations are key. E-commerce platforms boost accessibility. This strategy drives sales.

e.l.f. Cosmetics thrives on innovation in product formulation, constantly adapting to consumer preferences and market trends. This involves creating new products and enhancing existing ones with clean, effective ingredients. For instance, in Q3 2024, e.l.f. saw a 79% net sales increase, reflecting successful product launches and formulations. The company's R&D spending, a key indicator of innovation, rose by 25% in 2024. This focus helps e.l.f. stay ahead in the competitive beauty industry.

e.l.f. Cosmetics leverages data to understand consumers and trends. This approach guides marketing and product development, impacting sales. In 2024, e.l.f. saw a 76% net sales increase, showing the power of data-driven strategies. This focus allows for personalized shopping experiences. e.l.f.'s digital investments fueled this growth.

Supply Chain Technology and Efficiency

Technology significantly influences e.l.f. Cosmetics' supply chain, encompassing sourcing, manufacturing, and distribution. Efficient systems are essential for timely production and delivery, impacting operational costs and responsiveness to market demands. Advanced technologies can optimize inventory management and reduce lead times. This includes leveraging AI and machine learning for demand forecasting.

- e.l.f. Cosmetics' supply chain efficiency is critical for profitability.

- Supply chain optimization can lead to significant cost savings.

- Demand forecasting accuracy is crucial for inventory management.

- Technology integration enhances supply chain visibility and control.

Exploring New Digital Platforms and Technologies

e.l.f. Cosmetics actively embraces new digital platforms and technologies to enhance consumer engagement and maintain its competitive edge. This includes exploring non-fungible tokens (NFTs) and other innovative digital strategies. In 2024, the global beauty tech market was valued at approximately $14.5 billion, showcasing the industry's digital transformation. By leveraging these technologies, e.l.f. aims to stay ahead of trends.

- Beauty tech market valued at $14.5 billion in 2024.

- e.l.f. explores NFTs and digital strategies.

- Focus on innovative consumer engagement.

e.l.f. Cosmetics uses technology for digital marketing and product development. E-commerce, social media, and influencer collaborations boosted sales, with digital sales rising 46% in fiscal year 2024. The company also leverages tech to optimize its supply chain.

| Aspect | Details | Impact |

|---|---|---|

| Digital Marketing | Digital sales up 46% in fiscal year 2024. | Drives sales growth and market reach. |

| Product Innovation | R&D spending up 25% in 2024; Q3 sales up 79%. | Maintains competitiveness through new product offerings. |

| Supply Chain | Focus on efficiency via demand forecasting and AI. | Optimizes operations, reduces costs, improves response. |

Legal factors

e.l.f. Beauty adheres to stringent cosmetic ingredient and safety regulations, including those of the FDA and EU. The company's proactive approach includes exceeding these standards by excluding over 2,500 ingredients. In 2024, the global cosmetics market was valued at approximately $340 billion, with e.l.f. Cosmetics showing strong growth. This commitment to safety provides a competitive edge.

e.l.f. Beauty must comply with packaging and labeling regulations for cosmetic products. These rules cover ingredient lists, safety warnings, and environmental claims. The FDA monitors cosmetic labeling, with specific requirements for product names and net quantity. In 2024, the global cosmetics market was valued at $600 billion, with packaging playing a crucial role. Sustainability in packaging is increasingly important, influencing e.l.f.'s brand image and costs.

e.l.f. Beauty must safeguard its intellectual property, including trademarks and designs, to fend off infringement and preserve its brand image. In 2024, the company faced legal challenges like the 'dupe' mascara lawsuit, underscoring the significance of robust IP protection. Maintaining brand exclusivity is crucial for e.l.f.'s market position. The company's success relies on its ability to legally defend its unique products and designs.

Consumer Protection Laws

e.l.f. Beauty is obligated to comply with consumer protection laws that regulate marketing, advertising, and product claims, fostering transparency and consumer trust. These laws ensure that the company's product descriptions and promotional materials are accurate and not misleading. In 2024, the Federal Trade Commission (FTC) and similar agencies worldwide continued to actively enforce these regulations, with penalties for non-compliance. This adherence is critical for maintaining brand reputation and avoiding legal issues.

- FTC fines for deceptive advertising can range from thousands to millions of dollars.

- EU's General Product Safety Directive sets rigorous standards for product safety.

- Class-action lawsuits related to misleading claims are a constant risk.

Securities Regulations and Shareholder Lawsuits

As a publicly traded company, e.l.f. Beauty faces securities regulations. Shareholder lawsuits, like those seen in 2023, can arise from claims of misleading financial statements. These lawsuits can lead to significant legal costs and potential financial penalties. For instance, settlements in similar cases can range from millions to tens of millions of dollars.

- Securities regulations compliance is crucial.

- Shareholder lawsuits can impact stock prices.

- Settlements often involve substantial financial payouts.

- e.l.f. Beauty must maintain transparent reporting.

e.l.f. Beauty complies with FDA, EU and other international regulations. In 2024, the global cosmetics market hit $600B; e.l.f.'s safety focus boosts its brand. Packaging rules and labeling standards, key in the $600B market, also affect the firm.

e.l.f. safeguards its trademarks, facing legal challenges, like the "dupe" mascara lawsuit. Protecting brand IP and unique designs is key. The FTC actively enforces rules on accurate ads. In 2024, fines were millions.

Securities laws impact e.l.f. Beauty, as seen in past shareholder lawsuits. Transparent reporting and compliance are critical. Similar settlements may cost millions.

| Regulation Type | Regulatory Body | Impact on e.l.f. |

|---|---|---|

| Ingredient Safety | FDA, EU | Exceeding standards, boosts brand |

| Packaging/Labeling | FDA | Impacts costs, image, & compliance |

| Intellectual Property | Legal System | Protects brands & designs |

Environmental factors

e.l.f. Beauty is dedicated to sustainable packaging, aiming for recyclable, refillable, or recoverable materials. They are also increasing post-consumer recycled content in their packaging. This commitment reflects rising consumer interest in eco-friendly brands. In 2024, the beauty industry saw a 15% increase in demand for sustainable packaging options.

e.l.f. Cosmetics is actively reducing its environmental footprint. The company focuses on decreasing virgin plastic use in packaging and supply chains. They aim to cut hundreds of tons of packaging annually via lightweighting strategies. In 2024, e.l.f. reported a 25% reduction in packaging weight. They are on track to meet their 2025 goal of 100% recyclable packaging.

e.l.f. Beauty prioritizes responsible sourcing, a core element of its PESTLE analysis. A significant portion of products are made in Fair Trade Certified facilities, reflecting ethical and environmental commitments. This approach helps reduce the environmental impact. It also supports fair labor practices in its supply chain, aligning with sustainability goals. e.l.f. Beauty's commitment to responsible sourcing is reflected in its environmental, social, and governance (ESG) initiatives.

Reducing Environmental Footprint in Manufacturing

e.l.f. Beauty focuses on lessening its environmental footprint in manufacturing. This includes cutting down water use and sticking to renewable energy targets at its managed sites. In 2024, the company announced a commitment to achieve net-zero emissions by 2030.

- Water usage reduction in manufacturing processes.

- Meeting renewable energy commitments at managed sites.

- Net-zero emissions target by 2030.

- Sustainable packaging initiatives.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products significantly influences e.l.f. Beauty's strategies. Growing consumer preference for sustainable beauty brands is evident. Recent data shows a 20% increase in demand for eco-friendly cosmetics in 2024. This shift pushes e.l.f. to prioritize sustainable practices to meet consumer expectations and maintain a competitive edge.

- 20% increase in demand for eco-friendly cosmetics in 2024.

- Consumers increasingly prefer brands with sustainable practices.

- e.l.f. Beauty adapts to consumer demand for sustainability.

e.l.f. Beauty emphasizes sustainable practices, from packaging to sourcing, reflecting consumer demand for eco-friendly products. In 2024, the brand reported a 25% reduction in packaging weight and a 20% rise in demand for sustainable cosmetics.

The company focuses on lessening its environmental footprint through water usage reduction and renewable energy use. e.l.f. aims for 100% recyclable packaging by 2025.

e.l.f. also focuses on responsible sourcing, using Fair Trade Certified facilities to reduce its environmental impact and support fair labor. They also announced a commitment to achieve net-zero emissions by 2030.

| Initiative | Data | Year |

|---|---|---|

| Packaging Weight Reduction | 25% | 2024 |

| Eco-friendly Cosmetics Demand Increase | 20% | 2024 |

| Target for Recyclable Packaging | 100% | 2025 |

PESTLE Analysis Data Sources

e.l.f.'s PESTLE Analysis draws from market reports, financial data, regulatory updates, and consumer behavior analytics for accuracy.