Eltel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eltel Bundle

What is included in the product

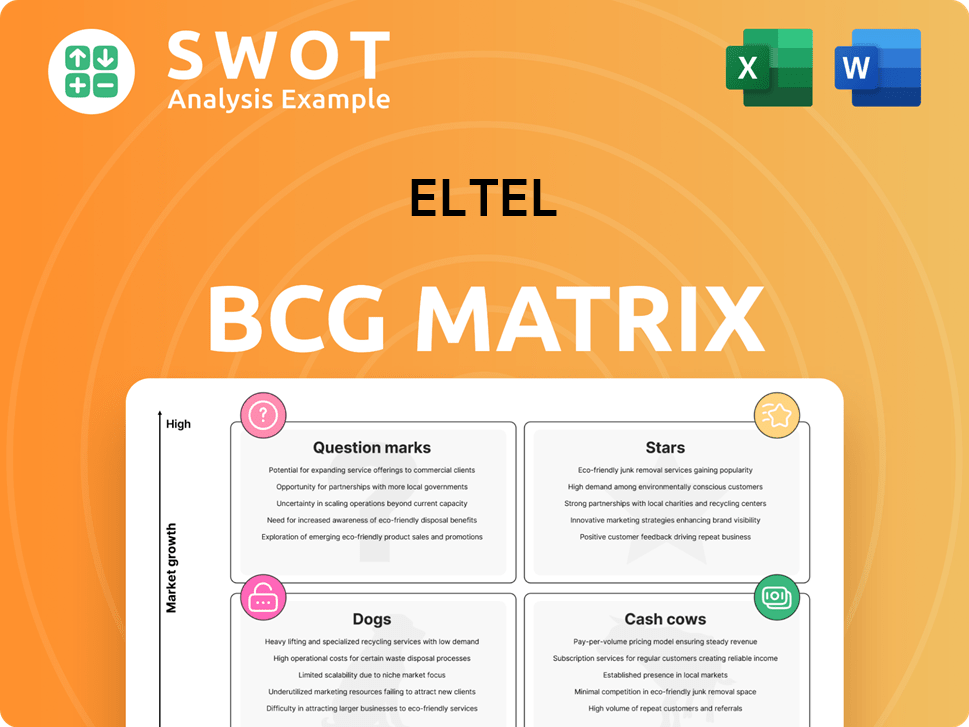

Eltel's BCG Matrix: Strategic guidance on product portfolio management.

Printable summary optimized for A4 and mobile PDFs, enabling easy sharing of the matrix.

What You’re Viewing Is Included

Eltel BCG Matrix

The preview displays the complete BCG Matrix report you'll receive after buying. It's a ready-to-use, professionally designed file for strategic planning and analysis—no hidden content or modifications.

BCG Matrix Template

Eltel's BCG Matrix offers a snapshot of its product portfolio. It categorizes products as Stars, Cash Cows, Dogs, and Question Marks. This helps visualize growth potential and resource allocation. Learn which products drive revenue and which need strategic attention. Discover Eltel’s competitive advantages through our analysis. Get the full BCG Matrix for comprehensive insights and strategic planning!

Stars

Eltel's focus on large solar and BESS projects solidifies its market leadership in renewable energy. These initiatives, including projects in the Nordics, align with the global push for clean energy. Long-term contracts for maintenance and operation ensure stable revenue. Demand for these services is rising, supported by a growing renewable energy sector, with investments in renewable energy expected to reach $2 trillion in 2024.

Eltel's Smart Grids business, especially in Sweden, shines as a Star, driven by strong performance and profitability. Smart grids are vital for efficient power distribution, fitting the move towards sustainable energy. In 2024, the smart grid market grew by 15% globally. Continued investment will strengthen Eltel's market position.

Eltel is seeing positive outcomes from expanding its public infrastructure customer base, especially in communication. Demand from the public sector for both energy and communication infrastructure is growing, opening up growth opportunities. Securing long-term contracts with public entities provides stability and room for expansion. In 2024, Eltel reported a 3.2% revenue increase in the public sector.

Fiber-to-the-Home (FTTH) in Finland

Fiber-to-the-home (FTTH) in Finland shows robust growth and profitability. Digitalization and high-speed internet needs fuel demand for FTTH infrastructure. Eltel can strengthen its market position by focusing on and expanding this segment. The Finnish telecom market saw approximately 40% FTTH penetration in 2024.

- Growing demand for high-speed internet.

- Strong profitability in the FTTH sector.

- Opportunity to increase market share.

- Alignment with digitalization trends.

Eltel Sweden

Eltel Sweden shines as a 'Star' within Eltel's portfolio, showing robust growth and profitability, particularly in Communications and Power sectors, including Smart Grids. Securing substantial projects with entities like the Swedish Transport Administration and the Swedish Armed Forces underscores its project acquisition capabilities. To maintain this stellar performance, continued positive momentum and capitalizing on emerging opportunities are vital. In 2023, Eltel Group reported net sales of EUR 1.2 billion, with Sweden contributing significantly.

- Strong revenue growth in 2023.

- Successful project acquisitions.

- Focus on Communications and Power.

- Strategic partnerships with key clients.

Eltel's "Stars" include Smart Grids and FTTH in Finland, demonstrating strong growth and profitability. Sweden's Communications and Power sectors also shine, backed by major project wins. These segments benefit from digitalization and sustainable energy trends. Eltel's Swedish operations contributed significantly to the EUR 1.2 billion net sales in 2023.

| Segment | Performance | 2024 Growth |

|---|---|---|

| Smart Grids | Strong Profitability | 15% (Global) |

| FTTH (Finland) | Robust Growth | ~40% Penetration |

| Sweden (Comm/Power) | Significant Contribution | N/A (Contributed to EUR 1.2B in 2023) |

Cash Cows

Eltel's power distribution maintenance in Finland is a cash cow. This core business provides reliable revenue. It ensures a stable power supply. Growth is limited but cash flow is significant. In 2024, Eltel's revenue was approximately EUR 800 million.

Eltel's fixed and mobile network services, including planning, building, and maintenance, are cash cows. These services consistently generate revenue, driven by ongoing network maintenance needs. The sector's challenges are offset by the steady demand for upgrades. This segment benefits from existing infrastructure and relationships, requiring less capital. In 2024, network services contributed significantly to the company's revenue, reflecting its cash cow status.

Eltel's critical infrastructure maintenance in the Nordics is a cash cow due to the essential services it provides. This segment focuses on maintaining existing power and communication networks, ensuring a steady revenue flow. In 2024, the demand for these services remained stable, reflecting the consistent need for infrastructure upkeep. Eltel's investments here are moderate, supporting its reliable cash generation.

Long-Term Agreements

Eltel's long-term agreements, such as the one with Helen Electricity Network Ltd, create stable cash flows. These deals, covering construction and maintenance, are crucial for financial stability. Eltel focuses on operational efficiency and client relationships to maximize returns from these agreements. This strategy ensures predictable revenue streams. In 2024, Eltel's service backlog amounted to €1.2 billion, showing the importance of these long-term contracts.

- Stable revenue streams are secured through long-term contracts.

- Operational efficiency and client relationships are key for maximizing profits.

- Backlog of €1.2 billion in 2024 demonstrates the significance of these agreements.

- These contracts provide predictable cash flows.

Existing Power Transmission Lines

Eltel's work on existing power transmission lines is a cash cow. This involves maintaining and upgrading lines and substations, a stable market that ensures reliable power transmission. These services generate consistent revenue, requiring less investment than high-growth areas. For example, in 2024, the global power transmission market was valued at approximately $23 billion, growing steadily.

- The global power transmission market was valued at $23 billion in 2024.

- These services provide a solid financial foundation.

- Eltel's focus is on mature market.

Eltel's cash cows are revenue-generating segments with low growth potential but significant cash flow. These include power distribution maintenance, network services, and critical infrastructure maintenance. Long-term agreements and work on power transmission lines further stabilize revenue. In 2024, Eltel’s focus on these areas yielded stable financial results.

| Cash Cow Segment | 2024 Revenue (Approx.) | Market Context |

|---|---|---|

| Power Distribution | €800M | Stable market, essential service. |

| Network Services | Significant | Ongoing maintenance needs, upgrades. |

| Infra Maintenance | Stable | Consistent demand for infrastructure upkeep. |

Dogs

The Norwegian communication sector, a "Dog" in Eltel's BCG Matrix, struggles with decreased customer investments, affecting profitability. This market, facing reduced demand and heightened competition, finds it hard to achieve significant returns. In 2024, the sector saw a decline in revenue, with margins under pressure. Restructuring and cost-cutting may not suffice, hinting at potential divestment or minimization.

High Voltage Poland, divested by Eltel, probably aligns with the "Dog" category in a BCG matrix. This is due to its low growth and market share within Eltel's business. The divestment, completed to reduce risk, was finalized on December 20, 2023. Eltel's strategic shift aims to prioritize core operations.

Smart Grids Germany, previously outside Eltel's core, likely underperformed. Its 'Dog' status reflected this, potentially lacking strategic alignment. The 2025 integration into the Denmark & Germany segment aims to boost performance. In 2024, Eltel's revenue was €1.1 billion, with segment performance needing improvement.

Traditional Telecom Investments

Traditional telecom investments, not linked to public infrastructure, might be "Dogs" for Eltel due to shrinking market share and slower growth. These segments struggle against new tech and evolving customer demands. For instance, traditional voice services have seen revenues drop, with a 5-10% annual decline in many regions. Reallocating resources is key for Eltel's strategic shift.

- Declining Revenues: Traditional voice services facing 5-10% yearly revenue drops.

- Market Share Erosion: Older technologies lose ground to newer ones.

- Resource Reallocation: Shifting investments away from these areas.

- Customer Preference Changes: Adapting to evolving user demands.

Low-Margin Projects

Low-margin projects are like dogs in Eltel's BCG Matrix, consistently underperforming. These projects drain resources without substantial returns, demanding attention. Eltel should reduce its involvement in these areas to free up capital. This shift allows focus on more profitable opportunities, improving overall financial health.

- Eltel's 2024 financial reports may reveal specific projects with low-profit margins.

- Identify projects that consistently underperform in terms of profitability.

- Reallocate resources from low-margin projects to more promising ventures.

- Aim to improve overall profitability and resource utilization.

Eltel's "Dogs" face reduced investments and profitability, particularly in declining markets. This includes traditional telecom and low-margin projects that drain resources. For 2024, Eltel reported a revenue of €1.1 billion, emphasizing the need for strategic shifts.

| Segment | Status | 2024 Revenue Impact |

|---|---|---|

| Traditional Telecom | Dog | Revenue decline of 5-10% annually |

| Low-Margin Projects | Dog | Drains resources, low returns |

| Norwegian Comm. Sector | Dog | Reduced customer investments |

Question Marks

Eltel's e-mobility turnkey solutions are in a high-growth market, but with a low market share currently. The EV charging infrastructure demand is soaring; however, substantial investment is needed. Eltel's success could position it as a 'Star'. The global EV charging market was valued at $16.7 billion in 2023, and is projected to reach $113.1 billion by 2032.

For Eltel, solar photovoltaic solutions represent a 'Question Mark' in their BCG Matrix. The global solar energy market is projected to reach $297.8 billion by 2024, with a CAGR of 13.9% from 2024 to 2032. Eltel needs substantial investment in tech and partnerships. Success could significantly boost growth.

The BESS market is booming, fueled by renewable energy's rise. Eltel's BESS projects show potential but demand heavy investment. Securing market share requires strategic moves. Partnerships and tech advancements are key. In 2024, the global BESS market was valued at $15.6 billion.

New Business Areas (Adjacent Markets)

Eltel's move into new areas like electric car charging and private 5G solutions is a strategic play. These markets offer high growth, but require investment to gain traction. Success hinges on careful assessment and smart resource use. For example, the EV charging market is projected to reach $40 billion by 2028.

- EV charging market projected to reach $40B by 2028.

- Private 5G is growing rapidly, with significant expansion in 2024.

- Requires substantial investment in R&D and market entry.

- Strategic resource allocation is critical for viability.

Lithuania Operations

Eltel's operations in Lithuania could be categorized as a 'Question Mark' within the BCG matrix. This designation typically arises when a business unit operates in a high-growth market but holds a low market share. In 2024, the telecommunications sector in the Baltic states, including Lithuania, saw moderate growth, with investments in 5G infrastructure. Further analysis is needed to assess Eltel's specific market share and service offerings within Lithuania to determine its potential for growth and profitability. Strategic investments could transform Lithuania into a 'Star.'

- Market Growth: The telecommunications market in Lithuania experienced approximately 4-6% growth in 2024.

- Eltel's Position: Eltel's market share in Lithuania needs to be evaluated to determine its standing.

- Investment Strategy: Focused investments in Lithuania could improve Eltel's market position.

- Service Focus: The specific services Eltel offers in Lithuania (e.g., 5G deployment) are crucial.

Eltel's solar, Lithuanian operations, and new tech ventures fall under the 'Question Mark' category. These areas operate in high-growth markets but have low market shares. Investments in tech, partnerships, and strategic resource allocation are crucial for growth.

| Area | Market Growth (2024) | Eltel's Status |

|---|---|---|

| Solar | $297.8B | Low market share, needs investment |

| Lithuania Telecom | 4-6% growth | Needs market share evaluation |

| EV Charging | $40B (by 2028) | Investment needed |

BCG Matrix Data Sources

Eltel's BCG Matrix uses diverse sources: financial data, market reports, industry analysis, and expert opinions to ensure well-informed strategic decisions.