ESA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESA Bundle

What is included in the product

Analyzes external macro-environmental factors impacting ESA through Political, Economic, etc. dimensions.

Offers an immediate view of trends, risks and potential impacts on the business

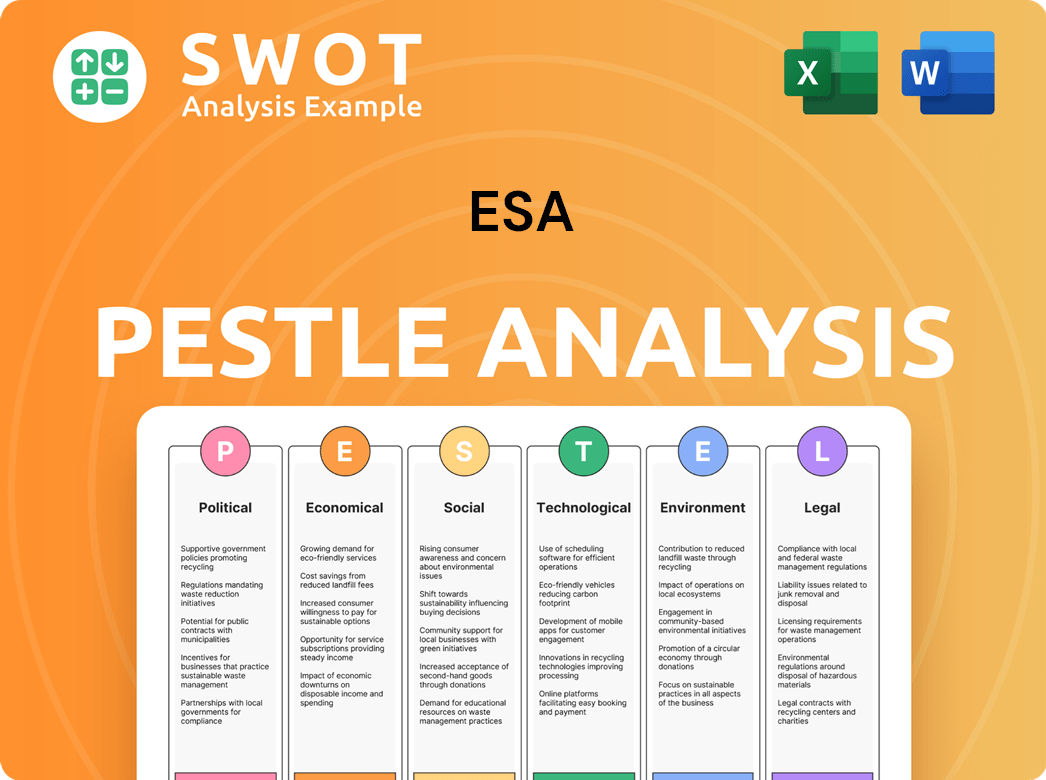

Preview the Actual Deliverable

ESA PESTLE Analysis

See what you get! The ESA PESTLE Analysis preview reveals the exact, fully formatted document you'll download after purchase.

PESTLE Analysis Template

Are you curious how external factors are impacting the European Space Agency (ESA)? Our detailed PESTLE analysis examines the political climate, economic conditions, social trends, technological advancements, legal regulations, and environmental considerations impacting ESA. Understand the opportunities and threats facing ESA. This in-depth report provides crucial insights for strategists and investors. Download the full version today and gain a competitive edge!

Political factors

Government infrastructure spending, notably through initiatives like the Infrastructure Investment and Jobs Act (IIJA), is crucial for ESA. The IIJA earmarked billions for roads, bridges, and clean energy. Analysts predict continued investment in grid and water systems. This creates opportunities for construction, maintenance, and repair services.

Changes in the political scene drastically influence the energy sector's regulations. A new U.S. administration could alter environmental rules, potentially supporting fossil fuels. For instance, the Inflation Reduction Act of 2022 allocated $369 billion for clean energy, impacting project types for firms like Energy Services of America. This directly affects investment decisions by utility companies.

State-level energy policies greatly affect the utility sector, especially for companies like Energy Services of America. For example, California aims for 100% clean energy by 2045, driving investments in renewables. New York's Climate Leadership and Community Protection Act sets ambitious emissions reduction targets. These policies create localized demand, potentially boosting ESA's business in those regions. In 2024, states like Illinois and Virginia are also pushing for grid modernization, indicating ongoing opportunities.

Permitting Reform

Permitting reform is a key political factor impacting infrastructure. Efforts to streamline processes at federal and state levels affect project timelines. Delays can slow projects, while reforms accelerating approvals create opportunities. The Infrastructure Investment and Jobs Act aims to expedite permitting.

- The IIJA allocated $1.2 trillion, some of which is contingent on faster permitting.

- Permitting timelines can vary widely; some projects face multi-year delays.

- Proposed reforms target environmental reviews and interagency coordination.

Geopolitical Events and Energy Security

Geopolitical instability and energy security concerns significantly shape domestic energy policies. Governments may prioritize boosting domestic oil and gas production or fortifying energy grids due to international events. These decisions can trigger increased investment in related infrastructure, directly affecting the demand for Energy Services of America's offerings. For example, the U.S. Department of Energy awarded over $3.5 billion in 2024 for grid resilience projects.

- U.S. grid resilience projects received over $3.5B in 2024.

- Geopolitical events can drive domestic energy policy shifts.

- Increased infrastructure investment affects demand.

Political factors shape Energy Services of America (ESA) through government spending and regulations. The Infrastructure Investment and Jobs Act (IIJA) and state-level clean energy mandates, like California's 100% target by 2045, influence project opportunities. Geopolitical instability, as seen with $3.5B for U.S. grid resilience projects in 2024, impacts energy policy and ESA's market.

| Factor | Impact on ESA | 2024/2025 Data |

|---|---|---|

| Infrastructure Spending | Creates demand for services | IIJA: $1.2T allocated; $3.5B for grid resilience projects. |

| Energy Regulations | Shifts project priorities | Clean energy goals in CA and NY drive investments. |

| Permitting Reform | Affects project timelines | Efforts to streamline processes at federal and state levels |

Economic factors

Infrastructure investment significantly influences Energy Services of America. While 2024 saw major growth, some anticipate a slowdown in large power projects for 2025. Water and wastewater projects should remain strong due to needs and funding. The ASCE’s 2025 Report Card shows a large investment gap.

Inflation and interest rates significantly affect the construction sector. Rising inflation in 2024, with material costs up 5-7%, increased project expenses. Higher interest rates, like the Federal Reserve's 5.25%-5.50% range, made financing capital projects costlier. Anticipated rate cuts in late 2024/early 2025 could ease these financial pressures, stimulating investment.

The demand for electricity is surging, fueled by data centers and the shift to electric vehicles. This trend, which saw U.S. electricity sales reach approximately 3,900 terawatt-hours in 2024, demands grid expansion. Energy Services of America plays a vital role in meeting this growing need.

Labor Costs and Availability

Labor costs and the availability of skilled workers significantly impact the construction and utility service industries. These sectors often grapple with talent shortages, which can inflate wage expenses. For instance, in 2024, the construction industry's average hourly earnings rose to $35.20, reflecting these pressures. The need for training and development is a constant cost.

- Construction labor costs increased by 4.4% in 2024.

- The utility sector faces a 30% skills gap.

- Training programs are expected to cost $10,000 per worker.

Supply Chain Disruptions

Supply chain disruptions, especially for transformers, are a major concern. They can significantly slow down infrastructure projects and inflate costs. Extended lead times for materials can create delays and increase project expenses for utilities and contractors. In 2024, the average lead time for transformers was 26-52 weeks, up from 16-28 weeks in 2022. This has increased project costs by 15-25%.

- Transformer lead times have doubled since 2022.

- Project cost increases range from 15-25% due to delays.

- Utilities face significant financial and operational challenges.

Economic factors like infrastructure spending, inflation, interest rates, electricity demand, labor costs, and supply chain disruptions impact Energy Services of America (ESA). Growth slowed in 2025 as large power projects are forecasted to decrease. Inflation pushed material costs up by 5-7% in 2024 and financing costs rose. Surging electricity demand and supply chain issues pose ongoing challenges.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Infrastructure Investment | Influences ESA growth. | Anticipated slowdown in large power projects for 2025. |

| Inflation/Interest Rates | Affects construction expenses/financing. | Material costs rose 5-7% in 2024. Interest rates at 5.25%-5.50%. |

| Electricity Demand | Drives the need for grid expansion. | U.S. electricity sales ~3,900 terawatt-hours in 2024. |

Sociological factors

Public concern over aging infrastructure boosts demand for maintenance, repairs, and replacements. Ensuring the safety and reliability of natural gas pipelines and electric grids is critical. In 2024, the U.S. spent $415 billion on infrastructure. Energy Services of America directly benefits from these societal needs.

The utility and construction sectors face an aging workforce and a skills gap, with many workers nearing retirement. For instance, a significant portion of the current utility workforce has less than 10 years of experience. This shift requires investment in recruitment and training. The labor market dynamics may impact operational costs for ESA.

Community acceptance significantly impacts infrastructure projects like pipelines or power lines. Public perception can cause delays or even halt projects. Addressing community concerns is vital for Energy Services of America. A 2024 study showed 60% of projects faced delays due to community opposition. Successful projects often involve early and transparent community engagement.

Safety Culture and Training

Safety culture and training are paramount in utility and pipeline operations. Societal pressure and regulations demand robust safety programs and skilled workers. The industry faces scrutiny, with incidents often leading to reputational damage and financial penalties. In 2024, OSHA reported over 1,000 serious violations in the pipeline sector.

- OSHA fines for safety violations can range from $16,131 to over $16,000 per violation as of 2024.

- Companies with strong safety cultures experience 30-50% fewer incidents.

- Training programs need regular updates to reflect changing safety standards.

Impact of Extreme Weather Events

Extreme weather events are increasing, affecting infrastructure and societal well-being. Power outages and damage from weather events drive investment in resilient systems, boosting demand for related services. For example, in 2024, the US experienced over 20 billion-dollar weather disasters. This trend underscores the need for robust infrastructure. These events also lead to increased public awareness.

- The US saw over 20 billion-dollar weather disasters in 2024.

- Increased public awareness.

Public demand drives infrastructure maintenance, crucial for safety and reliability, fueled by rising concerns and government spending, with $415 billion spent in 2024. An aging workforce necessitates investment in recruitment, impacting operational costs. Community acceptance is crucial; delays caused by opposition impact projects significantly, with transparent engagement key for success.

| Sociological Factor | Impact on ESA | 2024/2025 Data |

|---|---|---|

| Aging Infrastructure | Increased demand for services | U.S. infrastructure spending: $415B in 2024 |

| Workforce Dynamics | Potential cost increases, need for training | Significant portion of workforce has <10 years exp. |

| Community Acceptance | Project delays/success, need for engagement | 60% projects faced delays due to opposition in 2024 |

Technological factors

New technologies, including drones and AI-powered analytics, are changing how infrastructure is inspected and maintained. These advancements boost efficiency and safety, impacting companies like Energy Services of America. For example, the global drone services market is projected to reach $63.6 billion by 2025. This growth highlights the increasing adoption of tech in infrastructure management.

The energy sector is undergoing significant digital transformation, with smart grids and connected assets generating vast datasets. Data analytics enables better decision-making in maintenance, grid management, and resource allocation. The global smart grid market is projected to reach $61.3 billion by 2024, growing to $91.1 billion by 2029. This enhances operational efficiency and shapes service offerings.

New construction methods, like horizontal directional drilling, are changing how we install pipelines. The use of advanced materials is also key. For instance, in 2024, the global market for advanced materials in construction reached $65 billion. Keeping up with these advancements is crucial for industry players to remain competitive and efficient.

Cybersecurity of Infrastructure

The energy sector's shift towards smart grids and digital controls heightens cybersecurity risks. Protecting infrastructure from cyberattacks is now essential, driving demand for advanced security solutions. Investment in cybersecurity for energy systems is projected to reach $16.8 billion by 2025, a significant increase from $11.3 billion in 2022. This growth reflects the critical need to safeguard against disruptions.

- Cybersecurity spending in the energy sector is growing rapidly.

- Smart grid technologies increase vulnerability to cyber threats.

- Advanced security protocols are becoming increasingly important.

- Demand for cybersecurity services is on the rise.

Integration of Renewable Energy Technologies

Integrating renewable energy sources like solar and wind is transforming grid infrastructure. This shift necessitates advancements in energy storage and transmission, driving job growth in the utility sector. Investments in smart grid technologies are crucial for managing the intermittent nature of renewables. The global renewable energy market is projected to reach $1.977.7 billion by 2030.

- Global renewable energy capacity is expected to grow by over 50% between 2023 and 2028.

- Investments in grid infrastructure are increasing, with over $300 billion expected in the US by 2030.

- The energy storage market is rapidly expanding, with a projected value of $18.2 billion by 2027.

Technological advancements are reshaping the energy sector, with drones, AI, and smart grids optimizing operations. Cybersecurity spending in this sector is set to hit $16.8 billion by 2025 due to increasing threats. Renewables integration requires upgrades in grid infrastructure.

| Technology Area | Market Size/Projection (2024/2025) | Impact on ESA |

|---|---|---|

| Drone Services | $63.6B by 2025 | Improved inspection, efficiency. |

| Smart Grid Market | $61.3B (2024) | Enhances operational capabilities. |

| Cybersecurity in Energy | $16.8B by 2025 | Protect vital infrastructure. |

Legal factors

Energy Services of America (ESA) faces significant legal hurdles due to federal and state regulations. The Federal Energy Regulatory Commission (FERC) and state public utility commissions oversee safety standards and operational procedures. These bodies also dictate infrastructure investment, which can affect ESA's financial planning and operational scope. For instance, in 2024, FERC issued over 100 regulatory orders impacting utility operations. In 2025, anticipate more stringent compliance requirements impacting ESA's investments.

Pipeline and Hazardous Materials Safety Administration (PHMSA) regulations are critical for pipeline safety. Companies must comply with these standards, impacting operational costs. In 2024, PHMSA increased civil penalties for non-compliance. This drives demand for inspection and maintenance services.

Environmental laws and permitting significantly affect infrastructure projects. Regulations on emissions and water quality are crucial. Changes in these areas can lead to delays and increased costs. For example, updated emission standards in 2024 caused some projects to require additional environmental mitigation, increasing expenses by up to 15%.

Workforce Safety Regulations

Workforce safety regulations, such as those enforced by OSHA, are crucial for construction and utility companies. Compliance ensures worker protection and prevents substantial financial penalties. These regulations directly impact operational procedures and training programs, mandating specific safety protocols. In 2024, OSHA reported over 2,000 construction-related fatalities.

- OSHA's budget for 2025 is approximately $680 million.

- Non-compliance can lead to fines exceeding $15,000 per violation.

- Training costs can increase operational expenses.

- Safety audits are crucial for regulatory adherence.

Contract Law and Compliance

Energy Services of America (ESA) must adhere to contract law in all its dealings. This ensures compliance with agreements with utility companies and other clients. Legal adherence is vital for smooth operations, and any breaches can lead to penalties or litigation. ESA's legal team regularly reviews contracts to mitigate risks and maintain compliance. In 2024, contract disputes in the energy sector increased by 15%.

- Compliance with contract terms is paramount.

- Breaches may lead to financial penalties.

- Legal teams constantly review contracts.

- Contract disputes in the energy sector increased.

Energy Services of America (ESA) operates within a heavily regulated legal landscape. Federal agencies like FERC and PHMSA enforce standards, with increased penalties in 2024 and 2025. Environmental regulations on emissions and permitting add costs and potential delays. Contract compliance and workforce safety are critical.

| Regulation | Impact | Data (2024/2025) |

|---|---|---|

| FERC Orders | Infrastructure Investment | 100+ orders in 2024; more stringent in 2025. |

| PHMSA Penalties | Operational Costs | Increased in 2024, > $10,000 per violation |

| Emission Standards | Project Costs | Up to 15% cost increase for some projects. |

Environmental factors

Climate change intensifies extreme weather, demanding resilient infrastructure investments. The U.S. government allocated $9.5 billion in 2024 for climate resilience projects. This creates demand for construction and maintenance services.

The escalating worries about climate change and environmental sustainability are fueling a move towards cleaner energy sources. This transition is significantly affecting investments in renewable energy infrastructure. For instance, in 2024, global investments in renewable energy reached approximately $360 billion, with projections for continued growth in 2025. This shift could affect the long-term demand for services related to fossil fuel infrastructure, though natural gas may still serve as a transitional fuel. The International Energy Agency (IEA) forecasts that natural gas consumption will increase moderately through 2030, despite the expansion of renewables.

Methane emission regulations are tightening, especially for oil and gas. The EPA finalized rules in 2024 to cut methane from new and existing sources. This drives demand for monitoring and repair services. Companies in the natural gas sector face increased compliance costs.

Environmental Permitting and Assessments

Infrastructure projects need environmental permits to protect ecosystems. Assessments and compliance are key, impacting project timelines and costs. Delays can be costly; for example, a 2024 study showed permitting issues added 15% to project budgets. Environmental regulations are increasingly strict.

- Permitting delays can increase project costs significantly.

- Environmental regulations are constantly evolving.

- Environmental protection measures are crucial for compliance.

- Assessments are essential for identifying impacts.

Water Resource Management and Wastewater Infrastructure Needs

Environmental concerns about water quality and population growth spur upgrades to wastewater infrastructure, creating investment opportunities. Aging systems need modernization. Energy Services of America's water distribution role aligns with these environmental needs.

- The global water and wastewater treatment market is projected to reach $1.1 trillion by 2028.

- In the U.S., over $300 billion is needed to repair and upgrade water infrastructure over the next 20 years.

- Energy Services of America's involvement in water distribution positions it to benefit from these trends.

Environmental factors critically influence business. Climate change spurs demand for climate-resilient infrastructure; the US allocated $9.5B in 2024. Renewable energy investments hit $360B in 2024.

| Environmental Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Climate Change | Resilient infrastructure demand | US Climate Resilience Funds: $9.5B (2024) |

| Renewable Energy | Investment shift, infrastructure changes | Global Renewable Energy Investment: ~$360B (2024) |

| Methane Regulations | Increased Compliance Costs | EPA Methane Rule finalized in 2024 |

PESTLE Analysis Data Sources

Our PESTLE uses data from financial reports, environmental databases, tech analysis, and legal documents, ensuring precision.