Energy Transfer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Energy Transfer Bundle

What is included in the product

Strategic overview of Energy Transfer's assets using the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, offering a compact, easily digestible format for all stakeholders.

Full Transparency, Always

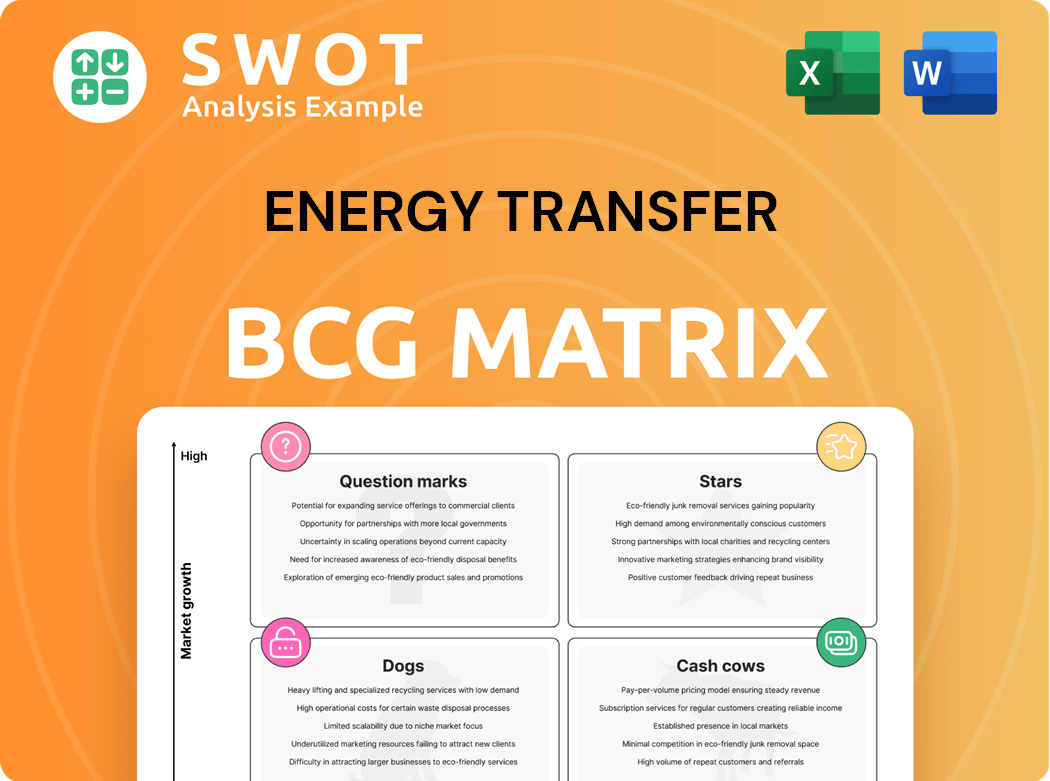

Energy Transfer BCG Matrix

This preview showcases the complete Energy Transfer BCG Matrix you'll receive post-purchase. The full document is ready for your strategic planning, with no alterations required after you download it.

BCG Matrix Template

Energy Transfer's BCG Matrix categorizes its diverse portfolio, showing which segments thrive and which need strategic adjustments. Stars drive growth, while Cash Cows generate profits, funding further ventures. Identifying Question Marks helps assess future potential, while Dogs require careful consideration. This simplified view offers a glimpse into their strategic landscape. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Energy Transfer's NGL fractionation business is positioned to capitalize on rising demand for natural gas liquids. The company's growth strategy includes projects like the ninth fractionator at Mont Belvieu. This expansion will likely boost market share in a high-growth sector. The company's NGL segment generated approximately $2.6 billion in revenue in the first nine months of 2024.

Energy Transfer's Permian Basin assets, including processing plants and pipelines, are strategically vital. Investments, such as the Mustang Draw plant, enhance its footprint. The Hugh Brinson Pipeline further supports growth. These moves align with increasing production, potentially boosting market share. In Q3 2023, Energy Transfer reported $2.97 billion in adjusted EBITDA from its midstream operations, highlighting the value of these assets.

The Lake Charles LNG project is a star in Energy Transfer's portfolio, poised for significant growth. The MidOcean Energy deal and Chevron's 20-year agreement highlight its potential. Energy Transfer aims for a final investment decision (FID) to solidify its position. In 2024, natural gas spot prices averaged about $2.50-$3.00 per MMBtu, influencing project economics.

Crude Oil Transportation

Energy Transfer's crude oil transportation is a key segment, experiencing significant volume growth due to rising production and strategic expansions. Its vast pipeline network and terminal assets offer a competitive edge in delivering crude oil to vital markets. Maintaining and enhancing this infrastructure is essential for sustained market leadership.

- In Q1 2024, Energy Transfer transported approximately 1.7 million barrels per day of crude oil.

- The company's crude oil pipelines include the Dakota Access Pipeline (DAPL).

- Energy Transfer continues to invest in pipeline expansions.

- The company's crude oil segment contributes significantly to overall revenue.

Natural Gas Gathering and Processing

Energy Transfer's natural gas gathering and processing segment is a "Star" in its BCG matrix. The company benefits from rising natural gas demand, with strategic moves like the WTG Midstream acquisition boosting volumes. Operational efficiency and capacity expansion are key to maximizing this segment's potential. In Q1 2024, Energy Transfer's gathering and processing segment saw adjusted EBITDA increase by 11% to $1.34 billion.

- Increased demand drives growth in natural gas.

- Acquisitions, like WTG Midstream, boost volumes.

- Operational efficiency maximizes potential.

- Q1 2024 adjusted EBITDA was $1.34B.

Energy Transfer's natural gas gathering and processing segment is a "Star" due to rising natural gas demand and strategic acquisitions like WTG Midstream. Operational efficiency and capacity expansions are key drivers. The segment's Q1 2024 adjusted EBITDA increased to $1.34 billion.

| Key Metric | Q1 2024 | Growth Driver |

|---|---|---|

| Adjusted EBITDA | $1.34 Billion | Increased demand and acquisitions |

| Volume Boost | WTG Midstream acquisition | Operational Efficiency |

| Segment Status | "Star" | Capacity Expansion |

Cash Cows

Energy Transfer's natural gas pipelines are a cash cow, providing consistent revenue due to the essential need for gas transportation. In Q3 2024, Energy Transfer's natural gas transportation and storage segment generated $1.67 billion in revenue. This segment requires minimal capital expenditure. Securing long-term contracts is key.

Energy Transfer's Texas intrastate pipelines thrive due to the state's strong energy sector. These pipelines have a strategic advantage, connecting vital markets. Investment in infrastructure can boost efficiency. In Q3 2023, Energy Transfer's intrastate transport volumes were 2.3 million MMBtu/d.

Energy Transfer's NGL transportation, fueled by a vast pipeline network, thrives on long-term contracts and steady demand. Operational efficiency and strategic expansions are key to boosting cash flow. In 2024, NGL transportation contributed significantly to Energy Transfer's revenue. Strong market share and infrastructure ensure consistent returns.

Refined Products Transportation and Terminalling

Energy Transfer's refined products transportation and terminalling is a cash cow, handling gasoline, diesel, and other refined products. This segment's growth is steady, driven by the consistent demand for these products. Optimizing terminal operations and securing long-term contracts are crucial for sustaining this steady cash flow. In 2024, Energy Transfer's transportation and storage segment generated significant revenue.

- Energy Transfer's transportation and storage segment revenue in Q3 2024 was $2.56 billion.

- The company's refined products pipeline network spans over 1,000 miles.

- Terminal throughput volumes remained stable, reflecting consistent demand.

- Long-term contracts provide revenue stability.

Equity Investments in Sunoco LP (SUN) and USA Compression Partners, LP (USAC)

Energy Transfer's equity investments in Sunoco LP (SUN) and USA Compression Partners, LP (USAC) are crucial cash cows. These holdings generate consistent income through distributions, enhancing Energy Transfer's financial stability. The passive nature of these investments minimizes management overhead, optimizing resource allocation. Strategic oversight of these partnerships is vital for maximizing returns.

- Energy Transfer owns ~30% of SUN and ~10% of USAC.

- SUN's 2024 distribution yield is ~8%. USAC's is ~9%.

- These investments provide a stable income stream.

- Minimal management effort is required from Energy Transfer.

Energy Transfer's cash cows generate stable revenue with minimal capital needs, including natural gas pipelines. In Q3 2024, the company's transportation and storage segment brought in $2.56 billion. Equity investments in SUN and USAC are also key, generating consistent income. This strategy reduces overhead.

| Cash Cow | Key Features | 2024 Data |

|---|---|---|

| Natural Gas Pipelines | Essential transportation, long-term contracts | Q3 Revenue: $1.67B |

| Intrastate Pipelines | Strategic advantage, strong market | Q3 Volume: 2.3M MMBtu/d |

| NGL Transportation | Vast network, steady demand | Significant revenue |

| Refined Products | Consistent demand | Revenue generated |

| Equity Investments | Stable income, minimal overhead | SUN yield ~8%, USAC ~9% |

Dogs

Energy Transfer's refining and marketing operations, categorized as "Dogs" in a BCG matrix, grapple with volatile commodity prices. These areas may require substantial capital for maintenance, potentially yielding uncertain profits. Considering a restructuring or divestiture could enhance profitability, especially as refining margins experienced volatility in 2024. For instance, according to the 2024 annual report, Energy Transfer's midstream operations generated $2.7 billion in adjusted EBITDA, which is a decrease of 10% compared to the prior year, highlighting the challenges.

Energy Transfer's legacy assets, facing declining utilization, increase maintenance costs. These assets, like some pipelines, yield minimal cash flow, tying up capital. In 2024, significant capital was allocated to maintaining aging infrastructure. Divesting these underperforming assets can boost efficiency. For instance, in Q3 2024, maintenance expenses rose by 7% due to older assets.

Energy Transfer's assets might be in areas where oil and gas output is decreasing, affecting income. These assets could face challenges in producing enough cash to keep running. For instance, in 2024, some regions saw production declines, impacting pipeline volumes. Considering different uses for these assets or selling them could be wise moves, as demonstrated by industry adjustments in response to fluctuating market demands.

Commodity Price Sensitive Operations without Hedging

Certain energy operations, particularly those without hedging, are vulnerable to commodity price swings. These can see big shifts in profits and cash, making them risky. For example, in 2024, unhedged natural gas producers faced substantial earnings volatility due to price volatility. This volatility can impact investment attractiveness and operational stability.

- Unhedged operations can experience substantial earnings volatility.

- Commodity price fluctuations directly impact profitability.

- Effective hedging or restructuring is crucial to mitigate risks.

- Lack of hedging can deter investors.

Non-Strategic Assets with Limited Synergies

Energy Transfer might hold assets that don't fit its main strategy or don't work well with its current operations. These assets may not boost overall profits much and can divert management's focus. Selling off these non-strategic assets lets the company concentrate on its key strengths. In 2023, Energy Transfer's total revenue was about $82 billion, showing the scale of its operations.

- Lack of strategic alignment hinders growth.

- Limited synergies impact operational efficiency.

- Divestiture improves capital allocation.

- Focusing on core business enhances profitability.

Energy Transfer's "Dogs" in the BCG matrix, like refining, face volatile markets and need significant maintenance capital. These assets often yield uncertain returns, particularly in sectors sensitive to commodity price fluctuations. A restructuring or divestiture of these underperforming assets could improve overall profitability, enhancing financial efficiency. For example, in 2024, midstream operations generated $2.7B in adjusted EBITDA, a 10% decrease.

| Aspect | Challenge | Impact |

|---|---|---|

| Volatility | Commodity price swings | Unpredictable earnings |

| Legacy Assets | Declining utilization, high maintenance costs | Reduced cash flow |

| Strategic Fit | Misalignment with core strategy | Diverted resources, lower returns |

Question Marks

Energy Transfer's data center power supply agreement with CloudBurst is a question mark. This hinges on CloudBurst's FID and data center market expansion. The global data center market was valued at $498 billion in 2023. Securing contracts and reliability are key for success.

Energy Transfer's ethane export facilities are poised for growth, fueled by rising global demand. They face competition, requiring long-term contracts for stability. Expanding capacity and optimizing logistics are key for maximizing potential. In 2024, the U.S. exported over 1.3 million barrels per day of ethane.

Energy Transfer's foray into Carbon Capture and Storage (CCS) is a question mark, offering growth prospects but with high uncertainty. The CCS market is nascent, with evolving regulations and technology. As of late 2024, CCS project costs can range from $50 to $100+ per ton of CO2 captured. Pilot projects and strategic partnerships are crucial to navigate this evolving landscape.

Renewable Energy Investments

Energy Transfer's move into renewable energy, like solar or wind, could attract investors focused on sustainability. They could diversify and reduce reliance on fossil fuels. Given their experience in traditional energy, a move into renewables poses challenges. Partnerships and smart project choices are key for success. Consider that in 2024, renewable energy investments hit record highs globally.

- Strategic partnerships are essential to mitigate risks.

- Careful project selection must prioritize high returns.

- Competition from established renewable energy firms is high.

- Diversification can attract ESG-focused investors.

Hydrogen Transportation and Storage

Energy Transfer could tap into the emerging hydrogen market by repurposing its existing pipeline network for hydrogen transportation and storage. This presents a significant opportunity, but also necessitates substantial investments for pipeline adaptation. The hydrogen market is still developing, making it crucial to assess its long-term viability through careful evaluation. Engaging in feasibility studies and collaborating with industry groups will be vital for understanding hydrogen's potential.

- Energy Transfer's existing infrastructure could be adapted for hydrogen.

- Significant investments are needed for pipeline modifications.

- The hydrogen market's infancy requires thorough evaluation.

- Feasibility studies and industry partnerships are essential.

Energy Transfer's ventures present opportunities, yet face uncertainties. CloudBurst's success, influenced by data center growth, is a question mark. CCS, although promising, demands strategic navigation amid evolving regulations. Renewable energy integration and hydrogen's potential also carry inherent risks.

| Initiative | Market Status (2024) | Key Challenges |

|---|---|---|

| Data Centers | $500B+ market value | Securing Contracts, Reliability |

| CCS | Nascent, evolving | High project costs, regulation |

| Renewables | Record investment levels | Competition, ESG focus |

BCG Matrix Data Sources

Energy Transfer's BCG Matrix uses public financial statements, energy sector market reports, and expert opinions for accurate quadrant placement.