Equifax Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equifax Bundle

What is included in the product

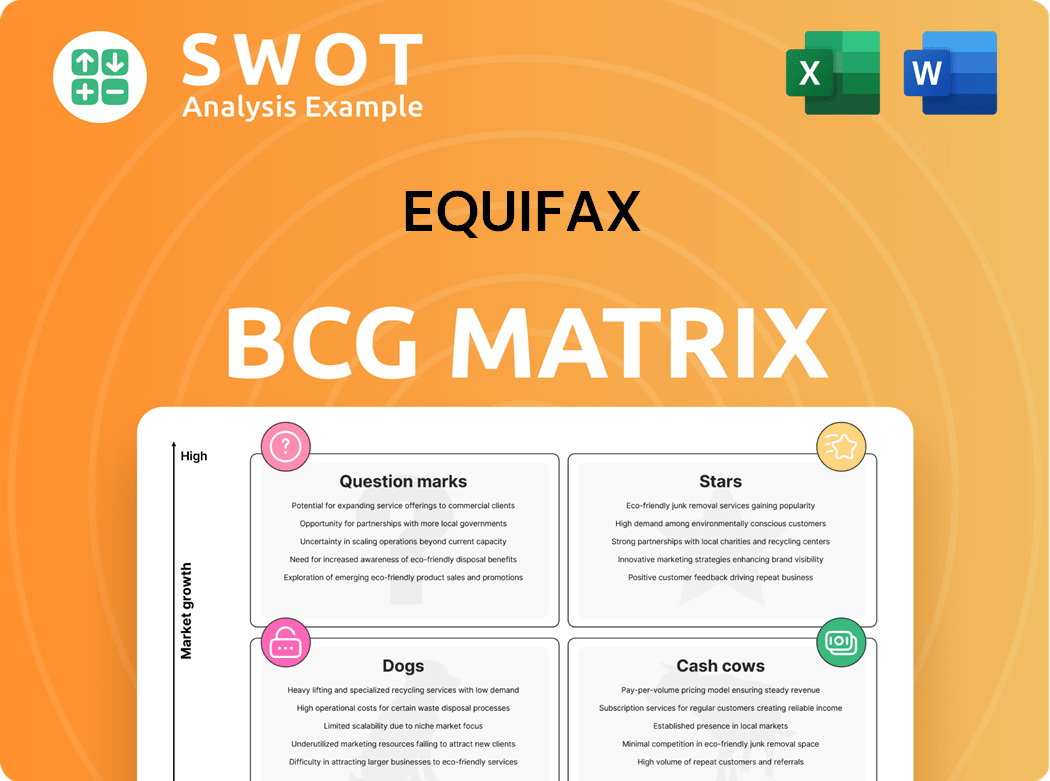

Equifax BCG Matrix analysis: strategic guidance on product portfolio investment, hold, or divestiture.

Clean, distraction-free view optimized for C-level presentation.

Preview = Final Product

Equifax BCG Matrix

The preview you see is the complete Equifax BCG Matrix report you’ll receive. This is the final, fully-formatted document ready for strategic planning and business analysis.

BCG Matrix Template

Equifax's products face varied market landscapes, demanding strategic attention. This preview hints at the positioning of its offerings across the BCG Matrix quadrants. Are some "Stars" shining bright, while others languish as "Dogs"? Understanding these placements is critical. Discover the full BCG Matrix and gain a clear, strategic advantage for informed decision-making.

Stars

Equifax's cloud transformation, with nearly 85% of its revenue generated from the Equifax Cloud, is a major success. This shift provides advantages such as better stability, quicker data transfer, and stronger security. In 2024, Equifax allocated a substantial portion of its budget towards cloud initiatives. Continuous investment and cloud innovation make it a Star.

Equifax's Workforce Solutions, especially Verification Services, shows robust growth. In 2024, this segment's revenue saw an increase, boosted by government and talent solutions. The Work Number database continues expanding, reflecting its strong market position. High EBITDA margins and growth in key areas classify it as a Star within the BCG Matrix.

Equifax's U.S. Information Solutions (USIS) is a Star in the BCG Matrix, showing robust revenue growth, especially in mortgages. In Q1 2024, USIS revenue increased by 6%, driven by mortgage growth. After the Equifax Cloud transformation, the segment accelerated new product innovation. USIS's continued growth and product development solidify its Star status.

International Expansion

Equifax's international segment, especially Latin America, is a Star due to significant growth. This segment showed strong revenue growth in constant currency. Strategic acquisitions, like Boa Vista Serviços S.A., boosted its position. Continued regional expansion and customized services are crucial for maintaining this status.

- Equifax's International revenue grew 10% in 2023, with 13% in constant currency.

- Latin America's revenue increased 19% in 2023.

- Boa Vista Serviços S.A. acquisition has been key to regional growth.

- Equifax aims to expand its global footprint further.

New Product Innovation

Equifax shines as a "Star" due to its strong commitment to new product innovation. The company's high Vitality Index reflects this dedication, with over 100 new products launched. These innovations significantly contribute to revenue growth, solidifying Equifax's market position. Equifax's focus on innovation and leveraging the Equifax Cloud for product development further strengthens its "Star" status.

- Equifax's revenue from new products in 2023 was approximately $200 million.

- The Vitality Index, a measure of revenue from new products, is consistently above 15%.

- Equifax invested approximately $100 million in R&D in 2024.

Equifax's Stars are marked by robust revenue growth and market leadership. Workforce Solutions and USIS, particularly in mortgages, have shown significant expansion. The international segment, with strong contributions from Latin America, also contributes to the Star status.

| Feature | Details |

|---|---|

| Revenue Growth (2024) | USIS: 6% increase in Q1; International: 10% (2023) |

| Key Drivers | Mortgages, Government, Talent Solutions |

| Strategic Actions | Cloud transformation, acquisitions, product innovation |

Cash Cows

Equifax's credit reporting services are a core cash cow. This established business generates substantial revenue, despite market challenges. Maintaining market share and operational efficiency is critical for this segment. In 2024, Equifax reported over $1.4 billion in U.S. Credit Reporting revenue. This steady income stream supports other business ventures.

Equifax's data analytics solutions, a cash cow in their BCG Matrix, provide businesses with valuable insights. These solutions utilize Equifax's extensive data assets for informed decision-making. In 2024, Equifax's data & analytics revenue grew, demonstrating its profitability. Investments in infrastructure remain crucial for efficiency and future growth.

Identity theft protection services generate reliable revenue, vital in today's data-sensitive world. Equifax leverages its brand and customer trust for this cash cow. Focusing on customer retention and service excellence is key. In 2024, identity theft complaints grew, making these services crucial.

The Work Number (TWN) Database

The Work Number (TWN) database, managed by Equifax, is a solid cash cow due to its vast employment data. TWN's value grows as more employment records are added, attracting more users. Maintaining data accuracy and expanding the contributor base are key for ongoing success. This is particularly relevant as of late 2024.

- TWN has over 800 million employment records as of late 2024.

- The database serves over 11,000 employers as of 2024.

- Data accuracy is constantly updated through regular audits.

- TWN's revenue in 2023 was approximately $500 million.

Mortgage-Related Services (selective)

Some mortgage-related services are cash cows, especially those with strong pricing and new product integration, even with market challenges. Equifax's ability to outperform the market, even with mortgage declines, is a key strength. Innovation and adaptation are vital for maintaining this status.

- Equifax's Mortgage business reported $274 million in revenue for Q1 2024.

- The company's mortgage business grew 1% year-over-year in Q1 2024.

- Equifax's total revenue for Q1 2024 was $1.38 billion.

Equifax leverages its established credit reporting for steady revenue streams. Data analytics solutions offer valuable business insights, fueling profitability. Identity protection services bring reliable income, crucial in a data-driven world.

| Cash Cow | Key Features | 2024 Data Points |

|---|---|---|

| Credit Reporting | Generates substantial revenue | U.S. Credit Reporting revenue over $1.4B |

| Data & Analytics | Provides valuable insights | Revenue grew in 2024 |

| Identity Protection | Reliable revenue source | Identity theft complaints increased |

Dogs

Equifax's Employer Services, a legacy segment, faces challenges with declining revenue, notably from reduced Employee Retention Credit income. This segment likely fits the "Dog" profile in the BCG Matrix, marked by low growth and market share. In Q1 2024, Employer Services revenue decreased by 10% year-over-year. Divestiture or significant restructuring could be strategic options.

Legacy on-premise systems, a drain on resources, are being decommissioned during cloud transformation. These systems show low growth prospects and require minimization. Equifax's 2024 reports indicated ongoing efforts to reduce operational costs associated with these systems. Accelerating decommissioning is crucial for efficiency and financial optimization.

Non-core international operations within Equifax's portfolio, those that aren't experiencing substantial growth or profitability, are often categorized as "dogs" in a BCG Matrix analysis. These operations may need restructuring or potentially divestiture to optimize resource allocation. In 2024, Equifax's international revenue represented approximately 30% of its total revenue, indicating the importance of strategic focus in these markets. Equifax's growth strategy prioritizes high-growth international markets, aiming to increase its global footprint and market share.

Outdated Technology Platforms

Outdated technology platforms at Equifax, not integrated with the Equifax Cloud, are "Dogs" in the BCG Matrix. These legacy systems slow down innovation and operational efficiency. In 2024, Equifax's cloud migration efforts aimed to modernize infrastructure and reduce costs. Decommissioning these platforms is crucial for future growth.

- Cloud migration is a key focus to enhance agility and reduce costs.

- Outdated systems can lead to security vulnerabilities and increased operational expenses.

- Equifax invested heavily in technology upgrades in 2024, with cloud adoption as a priority.

- The goal is to improve data processing speeds and enhance customer service capabilities.

Low-Margin, High-Maintenance Products

Dogs in the Equifax BCG Matrix represent low-margin, high-maintenance offerings. These products, not strategically aligned, require careful evaluation for potential discontinuation. Focusing resources on high-margin, strategically aligned products is crucial for sustained growth. For instance, in 2024, Equifax's revenue saw fluctuations, with some segments potentially fitting this description.

- Low profit margins characterize these products.

- High maintenance costs drain resources.

- Discontinuation should be considered.

- Strategic alignment is lacking.

In the Equifax BCG Matrix, "Dogs" include low-growth, low-share offerings, such as legacy services and outdated systems. These segments often require significant resources but yield limited returns. Equifax focused on cost reduction in 2024, streamlining operations, and divesting underperforming assets. For example, Employer Services revenue declined by 10% YOY in Q1 2024.

| Category | Characteristics | Strategic Actions |

|---|---|---|

| Legacy Systems | Low Growth, High Cost | Decommission, Minimize Costs |

| Non-Core Int'l Ops | Low Profitability | Restructure, Divest |

| Outdated Tech | Slows Innovation | Cloud Migration, Replace |

Question Marks

Equifax's AI initiatives, like EFX.AI, are in early stages. They show high growth potential but have low market share currently. Equifax invested $200 million in 2024 for tech advancements. Options include boosting market share or potentially selling these assets.

New data analytics products, particularly those using alternative data, represent a question mark in Equifax's BCG Matrix. These products, like those targeting fraud detection, show promise for high growth. In 2024, Equifax invested heavily in analytics, aiming for a 10-15% revenue increase in this area. Thorough market research and strategic investments are crucial for success.

Equifax's foray into government and talent solutions represents a strategic move into high-growth sectors. These new verticals, while promising, demand considerable investment and resource allocation. In 2024, Equifax allocated approximately $200 million towards strategic acquisitions, indicative of its commitment to expansion. Partnerships and focused investments will be crucial for success.

Passwordless Authentication Transformation

Passwordless authentication boosts security but demands considerable investment and faces adoption hurdles. This transformation could set Equifax apart, but it needs careful planning. User education and sustained investment are critical for success. In 2024, the global passwordless authentication market was valued at $14.5 billion.

- Investment in passwordless tech can reach millions, varying with scope.

- User adoption rates for new authentication methods typically start slow.

- Enhanced security reduces fraud, potentially saving costs.

- Successful implementation can improve customer trust and brand value.

TotalVerify Solution

Equifax's TotalVerify solution, launched recently, is categorized as a "Question Mark" in the BCG Matrix. This offering includes trended employment, incarceration, education, and licensing data, aiming to capitalize on the growing verification market. Its current position reflects high growth potential but requires strategic focus for market penetration. To succeed, Equifax needs to invest in targeted marketing and forge strategic partnerships.

- TotalVerify is relatively new, indicating its position in the market.

- It targets a market with significant growth potential.

- Focused marketing and strategic partnerships are critical for its success.

- The solution provides comprehensive data verification services.

Question Marks like TotalVerify require strategic moves. These offerings show high growth potential but have low market share currently. Equifax needs to invest in marketing and partnerships for market penetration. Successful strategies can lead to significant growth and market leadership.

| Aspect | Details | 2024 Data |

|---|---|---|

| TotalVerify Status | New Offering | Launched recently |

| Market Focus | Verification Market | Growing, $10B+ annually |

| Key Strategies | Marketing, Partnerships | Investment of $50M+ |

BCG Matrix Data Sources

Equifax BCG Matrix relies on credit reports, market share data, and economic indicators for detailed business insights.