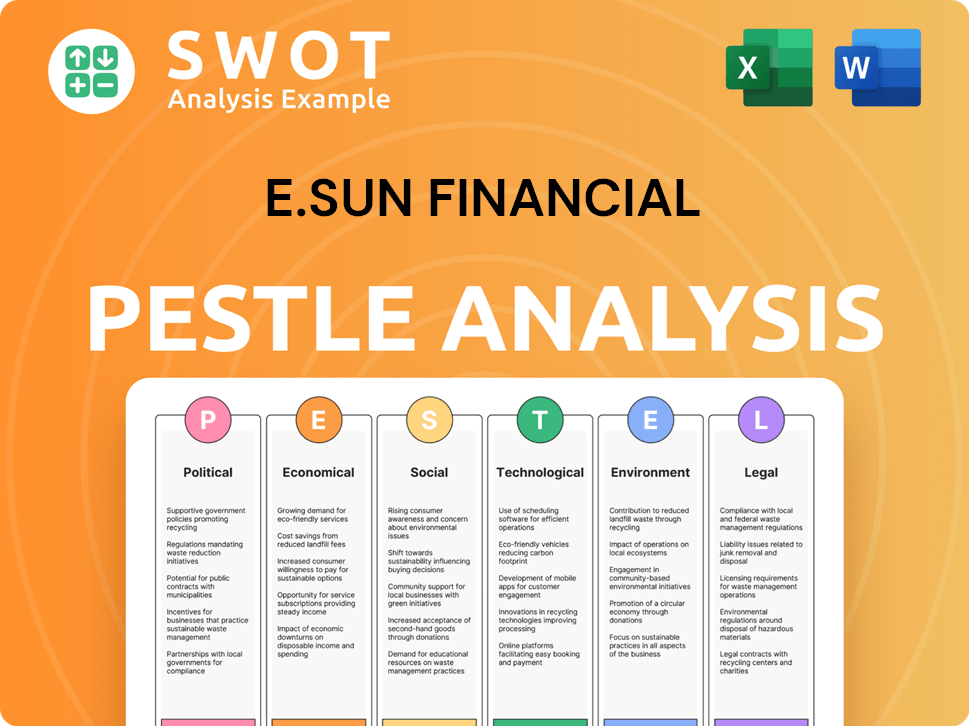

E.Sun Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

E.Sun Financial Bundle

What is included in the product

Analyzes E.Sun Financial's macro-environment using Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

E.Sun Financial PESTLE Analysis

The E.Sun Financial PESTLE Analysis preview showcases the full document. The layout, content, and structure shown here are exactly what you'll download instantly. Everything displayed is part of the final, ready-to-use product.

PESTLE Analysis Template

Uncover the external forces shaping E.Sun Financial with our PESTLE Analysis. Explore political stability's impact and economic shifts. Analyze social trends and technological advancements influencing their strategy. Examine legal and environmental factors affecting operations. Gain a competitive edge by understanding E.Sun's environment. Access the complete, actionable insights instantly.

Political factors

Government regulations in Taiwan heavily influence E.Sun Financial. Recent changes in banking regulations, such as those related to digital banking, require E.Sun to adapt. New policies on securities and insurance also affect its strategic moves. For example, Taiwan's financial regulators are focusing on fintech and cybersecurity.

E.Sun Financial Holding's operations are significantly influenced by political stability in Taiwan and its international markets. Taiwan's political landscape, marked by democratic processes, generally supports a stable environment. However, shifts in government or geopolitical tensions, like those with China, can impact investor confidence. For instance, Taiwan's GDP growth was projected at 3.4% in 2024, reflecting economic sensitivity to political factors.

Geopolitical shifts significantly affect E.Sun. Tensions in the Asia-Pacific region, where E.Sun has a strong presence, can disrupt trade and investment. For example, a 2024 report showed a 15% decrease in cross-border financial flows in the region due to instability. This impacts E.Sun's expansion plans and market performance.

Government Support and Initiatives

Government support and initiatives significantly shape E.Sun Financial's landscape. Initiatives like FinTech development, green finance, and financial inclusion create both opportunities and potential hurdles. For instance, Taiwan's Financial Supervisory Commission (FSC) has promoted digital transformation in the financial sector. This includes regulatory sandboxes and funding programs. These initiatives can impact E.Sun's strategic decisions.

- FSC's FinTech support saw over NT$10 billion in investments in 2024.

- Green finance initiatives have increased green bond issuances by 15% in 2024.

- Financial inclusion programs aim to expand access to banking services.

Trade Policies and Agreements

Trade policies and agreements are crucial. Changes in these areas can significantly impact capital flow and market access. E.Sun Financial's operations and growth are directly influenced by these shifts. For example, the Regional Comprehensive Economic Partnership (RCEP) agreement, effective since 2022, affects trade dynamics in the Asia-Pacific region, where E.Sun has a strong presence.

- RCEP involves fifteen countries, including China, Japan, and South Korea, and accounts for about 30% of global GDP.

- The agreement aims to eliminate tariffs on 90% of goods traded among member nations.

- This impacts E.Sun's trade finance activities and its ability to serve clients involved in international trade within the region.

E.Sun faces regulatory shifts, especially in digital banking and fintech. Political stability in Taiwan, influenced by global events like geopolitical tensions, impacts investor confidence and growth, with 2024's GDP projected at 3.4%. Government initiatives, such as FinTech support with over NT$10 billion in investments in 2024, and trade agreements, influence operations.

| Factor | Impact | Example |

|---|---|---|

| Banking Regulations | Digital Banking Evolution | Fintech investment: NT$10B (2024) |

| Geopolitical Tensions | Investor Confidence, Growth | Taiwan's GDP 3.4% (2024 projection) |

| Trade Agreements | Capital Flow, Market Access | RCEP affects regional trade dynamics |

Economic factors

Taiwan's GDP growth was 3.3% in 2023, and forecasts for 2024 range from 2.5% to 3%. This growth influences E.Sun's loan portfolio and investment returns. Economic expansions in key markets like China, with a 5.2% GDP growth in 2023, also affect E.Sun's international operations and investment strategies. The bank's performance is closely tied to these economic trends.

Interest rate shifts, dictated by Taiwan's central bank, directly impact E.Sun's profit margins and loan demand. In 2024, the Central Bank of the Republic of China (Taiwan) held its interest rate steady at 1.875% to manage economic stability. Changes affect the appeal of E.Sun's financial products and customer investment decisions. These rates are crucial for E.Sun's financial planning.

Inflation significantly impacts E.Sun's operational landscape by altering consumer and business purchasing power. High inflation can lead to decreased borrowing and investment, potentially affecting loan demand. In Taiwan, the consumer price index (CPI) rose by 2.14% in 2024, indicating moderate inflationary pressures relevant to E.Sun's strategies. The Central Bank of the Republic of China (Taiwan) closely monitors inflation, aiming for price stability, which is crucial for E.Sun's financial planning.

Exchange Rates

E.Sun Financial, with its global presence, faces currency exchange rate risks. These fluctuations impact the value of its foreign holdings, earnings, and overall financial performance. For instance, in 2024, the Taiwanese dollar's movement against the US dollar and other currencies directly influenced E.Sun's international revenue streams.

- Currency volatility can lead to both gains and losses on foreign investments.

- Hedging strategies are crucial to mitigate exchange rate risk.

- E.Sun's profitability is sensitive to global currency trends.

- The company actively monitors and manages its FX exposure.

Unemployment Rates

High unemployment poses a significant risk to E.Sun Financial. Elevated unemployment rates typically correlate with increased loan defaults, as individuals struggle to meet their financial obligations. This, in turn, can reduce consumer spending, further impacting the demand for E.Sun's services and overall credit risk. For example, in Taiwan, the unemployment rate stood at 3.3% in March 2024.

- Rising unemployment can lead to higher non-performing loan ratios.

- Decreased consumer confidence often accompanies job losses.

- Reduced demand for financial products and services.

Economic growth, pivotal for E.Sun, is projected between 2.5% and 3% in 2024. Interest rates, steady at 1.875% by the central bank, directly impact the bank’s profitability. Inflation, with a CPI of 2.14% in 2024, requires careful management for financial stability.

| Factor | Impact | Data |

|---|---|---|

| GDP Growth | Influences loan portfolio and investments | 2.5%-3% forecast (2024) |

| Interest Rates | Affects profit margins and loan demand | 1.875% (2024) |

| Inflation | Changes consumer/business purchasing power | CPI 2.14% (2024) |

Sociological factors

Taiwan's aging population, with a median age of 44.7 years in 2024, increases demand for retirement products. Urbanization continues, with over 79% living in urban areas, boosting digital banking needs. Population growth, although slow, impacts mortgage and insurance product demand. These shifts require E.Sun Financial to adapt its offerings.

Consumer behavior shifts impact E.Sun. Digital banking is booming; in 2024, mobile banking users in Taiwan reached 15 million. Personalized financial products are sought after, with a 20% growth in demand for customized investment portfolios. Socially responsible investing (SRI) is gaining traction, and E.Sun must integrate these elements to stay competitive.

Financial literacy profoundly shapes product use and marketing. In Taiwan, only about 60% of adults feel confident in their financial knowledge. E.Sun needs to tailor offerings and communications accordingly. This data highlights the need for educational initiatives. This directly impacts how E.Sun designs and promotes its financial products.

Social Inequality and Financial Inclusion

Rising social inequality significantly influences the demand for inclusive financial products. E.Sun Financial actively tackles this through services tailored to marginalized communities. For example, the World Bank estimates that in 2024, 24% of adults globally remain unbanked, highlighting the need for accessible financial solutions. E.Sun's focus on financial inclusion aligns with efforts to bridge this gap.

- In 2024, 24% of adults globally remain unbanked.

- E.Sun provides services to disadvantaged groups.

Cultural Values and Trust

Cultural values significantly affect financial behaviors. In Taiwan, strong saving habits are prevalent, influencing how people interact with financial products. Trust in financial institutions is crucial; E.Sun's reputation hinges on maintaining this trust. E.Sun must align with cultural norms to foster positive customer relationships and ensure long-term success in the financial market.

- Taiwan's household savings rate in 2024 was approximately 34%.

- E.Sun's customer satisfaction scores are consistently above 80%.

- A 2024 survey indicated that 75% of Taiwanese trust local banks.

Taiwan's high savings rate, about 34% in 2024, guides E.Sun's product focus. Trust levels, with 75% of Taiwanese trusting local banks, influence marketing. Financial inclusion remains key; 24% of global adults were unbanked in 2024.

| Factor | Impact | E.Sun's Response |

|---|---|---|

| Savings Culture | Strong saving habits in Taiwan | Offers saving and investment products |

| Trust in Banks | High trust levels | Maintain reputation for reliability |

| Financial Inclusion | Global unbanked population | Services for underserved communities |

Technological factors

Digital transformation and FinTech are reshaping finance. E.Sun must boost digital platforms and mobile banking. In 2024, mobile banking users grew by 15%. Investment in tech is crucial for staying competitive. Online services are key to meeting customer needs.

E.Sun Financial leverages AI and data analytics to refine risk assessment, customer service, and internal processes. In 2024, AI-driven fraud detection reduced losses by 15%. Data analytics improved customer retention by 10% through personalized services. This technology also boosted operational efficiency, saving the bank approximately $5 million annually.

Cybersecurity threats are escalating for financial institutions like E.Sun. In 2024, cyberattacks cost the financial sector billions globally. E.Sun must invest in security to safeguard customer data and uphold trust. The costs of data breaches include regulatory fines and reputational damage, increasing operational expenses. Robust cybersecurity is crucial to maintaining financial stability and customer confidence in 2025.

Mobile Technology and Connectivity

Mobile technology and connectivity are crucial for E.Sun Financial. The widespread adoption of smartphones and fast internet access necessitates offering convenient mobile banking. In Taiwan, over 80% of the population uses smartphones, highlighting the need for robust mobile platforms. E.Sun must invest in user-friendly apps and secure online services to stay competitive.

- Smartphone penetration in Taiwan is over 80% as of late 2024.

- Mobile banking transactions in Taiwan increased by 25% in 2024.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) are emerging as transformative forces, potentially reshaping E.Sun's operations. E.Sun must assess blockchain's impact on transaction security, efficiency, and transparency. The global blockchain market is projected to reach $94.08 billion by 2024. This includes exploring applications like cross-border payments and digital asset management, which can improve customer service and reduce costs.

- Market size expected to grow to $94.08 billion by 2024.

- Blockchain can improve transaction efficiency and security.

- E.Sun can use DLT for cross-border payments.

E.Sun must enhance its tech, focusing on mobile banking. Mobile transactions in Taiwan grew by 25% in 2024. Cybersecurity investments are critical to prevent breaches. Explore blockchain, the market size expected $94.08 billion by 2024.

| Technology Area | Impact on E.Sun | 2024 Data Points |

|---|---|---|

| Mobile Banking | Enhances customer access | 25% growth in mobile transactions |

| Cybersecurity | Protects customer data | Cyberattacks cost billions globally |

| Blockchain | Improves transaction efficiency | Market size projected $94.08B |

Legal factors

E.Sun Financial Holding faces stringent banking regulations. It must adhere to capital requirements and consumer protection laws. In 2024, the Financial Supervisory Commission (FSC) closely monitors Taiwanese banks. Compliance costs can be significant. The FSC imposed fines totaling NT$100 million in Q1 2024 for regulatory breaches.

Securities and insurance regulations are crucial for E.Sun Financial. These rules affect subsidiaries, products, and operations. Compliance is essential to avoid penalties. For example, Taiwan's FSC regularly updates financial regulations. In 2024, the FSC fined several firms for non-compliance. These fines ranged from NT$1 million to NT$5 million.

E.Sun must strictly follow Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) laws. These measures are vital to prevent financial crimes and protect the bank's reputation. In 2024, the Financial Supervisory Commission (FSC) of Taiwan issued several updates to AML regulations. The FSC imposed fines totaling NT$18.5 million (about $0.57 million USD) on financial institutions for AML violations in Q1 2024.

Data Privacy and Protection Laws

E.Sun Financial faces growing pressure from data privacy laws, similar to GDPR, demanding strong customer data protection. These regulations necessitate significant investments in cybersecurity and data management. Non-compliance risks substantial fines and reputational damage. The financial sector's vulnerability makes adherence crucial, with potential impacts on operational costs and customer trust.

- GDPR fines can reach up to 4% of annual global turnover.

- Cybersecurity spending in finance is projected to hit $40.9 billion in 2024.

Contract Law and Legal Disputes

E.Sun Financial must navigate contract law and potential legal disputes, crucial for its business. Legal frameworks influence agreements with clients, partners, and vendors, affecting operational efficiency. In 2024, the financial sector saw a 15% increase in contract-related litigation. Managing these risks is essential for stability and success.

- Legal compliance costs for financial institutions rose by 10% in 2024.

- Contract disputes in the banking sector averaged $2.5 million per case.

- E.Sun's legal department budget increased by 8% to manage legal risks.

E.Sun Financial must comply with strict regulations including AML and data privacy. These measures aim to prevent financial crimes and protect customer data. Non-compliance could lead to high fines and damage the bank's reputation. Cyber spending in finance is expected to reach $40.9 billion in 2024.

| Regulation Area | Compliance Impact | 2024 Data Points |

|---|---|---|

| Banking Laws | Capital Requirements, Consumer Protection | FSC fines totaled NT$100 million in Q1 2024. |

| Securities and Insurance | Subsidiary operations and product rules | FSC fines ranging from NT$1M to NT$5M. |

| AML/CFT | Preventing financial crimes | FSC fined financial institutions NT$18.5M in Q1. |

| Data Privacy | Customer data protection, cybersecurity investment | Cybersecurity spending in finance at $40.9B in 2024. |

| Contract Law | Agreements and legal disputes. | Contract-related litigation increased 15% in 2024. |

Environmental factors

Climate change poses significant risks to E.Sun Financial. Physical risks include extreme weather events, potentially damaging assets and disrupting operations. Transitional risks involve shifts toward a low-carbon economy, which could affect loan portfolios and investments. For example, in 2024, the insurance industry faced about $100 billion in losses from climate disasters. These factors necessitate proactive risk management and strategic adjustments.

E.Sun Financial faces growing environmental regulations, affecting lending and investments. These include rules on carbon emissions and green finance. The bank must adapt its strategies and create sustainable financial products. In 2024, the global green bond market reached $570 billion, indicating rising demand for green finance.

Resource scarcity, particularly water and energy, presents a growing challenge. E.Sun and its clients may see rising operational costs due to these shortages. For example, energy prices in Taiwan rose by 5.6% in 2024, impacting various sectors. This could threaten financial stability.

Biodiversity Loss

Biodiversity loss presents significant environmental challenges for E.Sun Financial. Industries financed by E.Sun, such as agriculture and forestry, are directly exposed to biodiversity risks, which can impact their operational sustainability. This could affect borrower creditworthiness and E.Sun’s portfolio quality. The World Economic Forum estimates over half of the world's GDP is moderately or highly dependent on nature and its services.

- Climate-related financial risks could reach $300 billion annually by 2030.

- Deforestation rates continue to rise, with significant implications for biodiversity.

- E.Sun must assess biodiversity impacts across its investment portfolio.

Stakeholder Expectations on Sustainability

Stakeholder expectations around environmental sustainability are significantly influencing E.Sun's operations. Customers, investors, and regulators are increasingly demanding that the bank incorporates Environmental, Social, and Governance (ESG) factors into its strategies. This includes transparent reporting and demonstrable efforts to reduce environmental impact. Failure to meet these expectations could lead to reputational damage and financial repercussions. For example, in 2024, ESG-focused funds saw inflows of over $1 trillion globally.

E.Sun Financial confronts climate risks, resource scarcity, biodiversity loss, and stakeholder expectations.

These environmental factors pose financial risks to its operations, loan portfolios, and investments. By 2030, climate-related financial risks may reach $300 billion annually.

Adaptation is critical, requiring sustainable strategies and transparent ESG reporting to maintain competitiveness.

| Environmental Factor | Impact on E.Sun | 2024/2025 Data |

|---|---|---|

| Climate Change | Physical & Transitional Risks | $100B insurance losses from climate disasters (2024), $300B climate risk by 2030 |

| Regulations | Compliance & Green Finance | $570B global green bond market (2024) |

| Resource Scarcity | Operational Costs & Instability | 5.6% energy price increase in Taiwan (2024) |

PESTLE Analysis Data Sources

E.Sun Financial's PESTLE draws on reputable sources: financial reports, industry analyses, government data & market research.