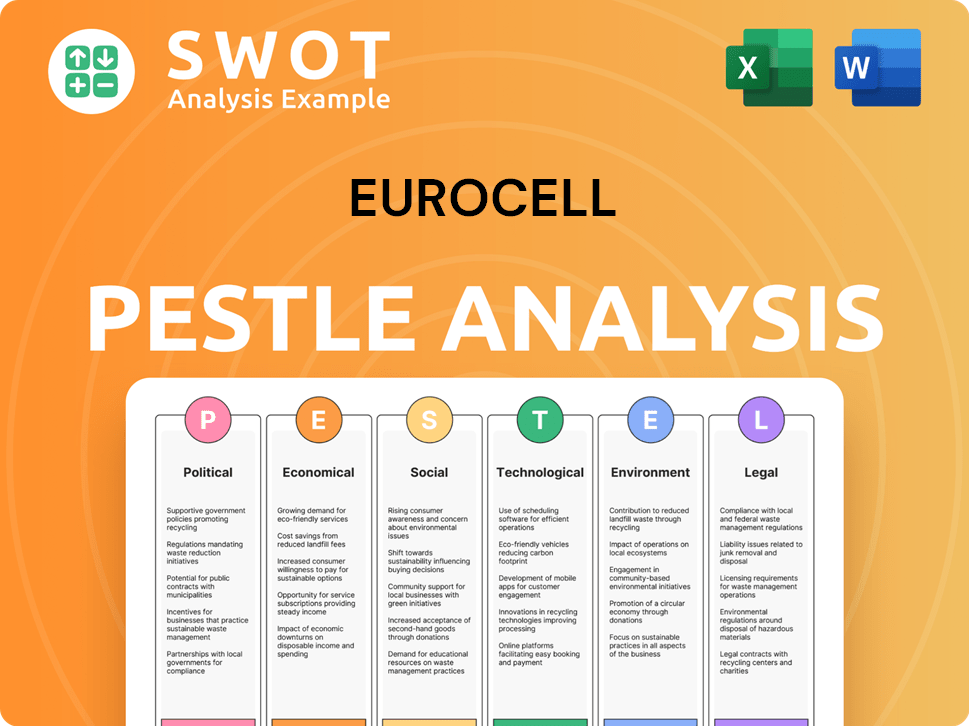

Eurocell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurocell Bundle

What is included in the product

It dissects external macro factors' impact on Eurocell. Includes political, economic, social, etc., dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Same Document Delivered

Eurocell PESTLE Analysis

See the Eurocell PESTLE analysis preview? This is the real deal.

What you’re seeing is the complete, ready-to-use document.

The format and content are identical post-purchase.

Download and use it instantly!

PESTLE Analysis Template

Navigate Eurocell's future with clarity. Our PESTLE Analysis unveils the external factors impacting its operations. Understand political, economic, social, technological, legal, and environmental influences. Access actionable insights for strategic decisions. Perfect for investors and business professionals. Download the full analysis now!

Political factors

Government policies and spending directly influence Eurocell. Investment in infrastructure boosts construction, increasing demand for Eurocell's products. For example, in 2024, the UK government allocated £96 billion for infrastructure projects. Austerity measures or budget cuts can decrease public sector construction, potentially reducing Eurocell's sales. The government's fiscal decisions are therefore critical.

Government housing policies are crucial. Initiatives like Help to Buy and stamp duty adjustments impact construction. The UK government aims to build 300,000 homes annually. Changes influence Eurocell's product demand in new builds and renovations. In 2024, the housing market saw varied activity due to policy shifts.

Eurocell faces significant regulatory hurdles. The construction sector is tightly governed by building codes, environmental rules, and safety standards. The Building Safety Act 2022 is a key regulation, introducing rigorous safety standards and compliance mandates. In 2024, the UK construction output decreased by 0.9%, reflecting the impact of these regulatory changes.

Brexit Impacts

Brexit continues to influence the construction sector. The UK's exit from the EU has introduced trade complexities, potentially raising material costs due to new tariffs and agreements. The availability of skilled labor from the EU has decreased, possibly increasing labor expenses for projects. In 2024, the Construction Leadership Council reported that 56% of construction firms faced challenges in sourcing skilled workers.

- Material cost inflation reached 10% in 2024.

- Labor shortages have increased project timelines by up to 15%.

- Trade deals with the EU are still evolving, impacting supply chains.

Political Stability

Political stability is crucial for Eurocell's operations. A stable political climate builds confidence within the construction market, promoting investment and growth in building projects. Conversely, political instability can lead to project delays and reduced investment, directly affecting Eurocell's sales. The UK's construction output in 2024 is projected to be around £176 billion, emphasizing the sector's sensitivity to political factors.

- Brexit's impact on supply chains and regulations.

- Government policies supporting green building initiatives.

- Changes in building codes and standards.

Political decisions heavily shape Eurocell. Government infrastructure spending and housing policies directly influence demand. Regulatory changes and Brexit complexities also create both challenges and opportunities.

In 2024, material cost inflation impacted the company. Labour shortages and evolving trade deals within the EU play important role. Stability boosts confidence and promotes growth for Eurocell.

| Political Factor | Impact on Eurocell | 2024 Data/Examples |

|---|---|---|

| Infrastructure Spending | Increased Demand | £96B allocated by UK government. |

| Housing Policies | Influences demand | 300,000 homes annual goal. |

| Brexit | Trade Complexities | Material costs up by 10%. |

Economic factors

The UK's economic growth directly influences construction. In 2024, the UK construction output decreased. This decline affects companies like Eurocell. The new build and RMI sectors are sensitive to economic fluctuations. Weak growth can hinder Eurocell's performance.

Interest rates significantly influence the construction sector, affecting borrowing costs for businesses and consumers. Elevated rates can curb housebuilding and decrease consumer confidence, which impacts demand for Eurocell's products. The European Central Bank (ECB) held rates steady in April 2024, but future decisions will directly affect Eurocell's financial strategies. For example, a 0.25% rate hike could increase borrowing costs. This could impact sales.

Inflation significantly impacts Eurocell by driving up material and labor costs. Construction materials like steel and cement, vital for Eurocell's products, are vulnerable to price hikes. In the UK, inflation was 3.2% in March 2024, influencing Eurocell's cost structure. These rising costs pressure profitability and necessitate strategic pricing adjustments.

Consumer Confidence

Consumer confidence significantly influences Eurocell's performance, particularly within the home improvements and renovations (RMI) market. Weak confidence often translates to decreased spending, directly affecting demand for Eurocell's products. Factors like economic uncertainty and rising costs, such as increased national insurance contributions, further erode consumer willingness to undertake building projects.

- The GfK Consumer Confidence Index for the UK, a key indicator, registered -21 in March 2024, reflecting ongoing pessimism.

- UK retail sales volumes decreased by 0.4% in March 2024, according to the Office for National Statistics, signaling reduced consumer spending.

- High inflation rates continue to pressure household budgets, limiting discretionary spending on home improvements.

Investment Levels

Investment levels significantly shape demand within the UK construction sector, directly impacting Eurocell. Strong domestic and foreign investment, especially in infrastructure and housing, boosts demand for building materials. Conversely, weak investment due to uncertain economic policies can slow growth. The Office for National Statistics reported a 0.9% decrease in construction output in the three months to February 2024. This decline highlights the sensitivity of the sector to investment fluctuations.

- UK construction output decreased by 0.9% in the three months leading up to February 2024.

- Government policies play a crucial role in stimulating capital investment.

- Foreign investment can significantly boost demand for building products.

UK economic growth, sensitive to construction, faced challenges in 2024 with decreased output. Interest rates influence borrowing costs; the ECB’s April 2024 hold will impact Eurocell. Inflation at 3.2% (March 2024) increases costs. Consumer confidence, a factor, measured -21 (March 2024). Investment shapes demand with a 0.9% output drop (to Feb 2024).

| Factor | Impact on Eurocell | Data (2024) |

|---|---|---|

| Economic Growth | Affects construction output | UK construction output decrease |

| Interest Rates | Influence borrowing costs, consumer spending | ECB held rates steady (April) |

| Inflation | Increases material & labor costs | 3.2% (March) in UK |

| Consumer Confidence | Affects demand for products | GfK Index: -21 (March) |

| Investment Levels | Shapes demand | 0.9% drop in output (to Feb) |

Sociological factors

Population growth fuels demand for homes and infrastructure, boosting construction and building product needs. An aging construction workforce creates labor challenges. The EU's population is projected to reach 448 million by 2025. The construction industry's workforce faces a significant aging trend across Europe.

Evolving work-life patterns, like the rise of remote work, are reshaping housing preferences. This shift drives demand for home enhancements. Eurocell can capitalize on this, with 2024-2025 data showing a 15% increase in demand for home office-related products. This includes windows and insulation.

Public perception of the construction sector, shaped by delays and quality, affects project approvals and demand. Trust is crucial; Eurocell needs to prioritize quality and responsibility. In 2024, construction project delays increased by 15% in the UK, impacting public trust. Eurocell's focus on sustainable practices helps build positive perceptions. It is expected that consumer trust in the building sector will increase by 8% by the end of 2025.

Health and Safety Awareness

Health and safety are increasingly crucial in construction, impacting Eurocell. Stricter regulations and growing awareness demand safer practices. This drives demand for products and methods that enhance worker safety. In 2024, construction-related fatalities in the UK rose, emphasizing the need for improved safety protocols.

- UK construction saw a 5% increase in workplace injuries in 2024.

- Eurocell's safety-focused products could gain market share.

- Compliance with new safety standards is essential.

- Investment in training and protective equipment is rising.

Social Value and Community Engagement

There's a rising emphasis on social value in construction, with projects expected to boost local employment and support local businesses. Eurocell's dedication to community engagement and responsible practices fits this evolving landscape. This approach can improve brand perception and foster positive relationships. Statistics show that 70% of consumers consider a company's social responsibility when making purchasing decisions. Eurocell can capitalize on these trends.

- Job creation in local areas.

- Investment in local suppliers.

- Community partnership programs.

Societal trends significantly influence Eurocell's market position, from workforce dynamics to evolving lifestyle needs.

Increased emphasis on health, safety, and social value is reshaping the construction industry.

Eurocell can enhance its brand reputation and market share by aligning with these societal changes and prioritizing sustainable practices.

| Factor | Impact on Eurocell | 2024-2025 Data |

|---|---|---|

| Aging Workforce | Labor challenges, need for efficiency | 20% construction workers over 55 by 2025 |

| Home Office Demand | Increased demand for home products | 15% increase in relevant product sales (2024) |

| Safety Regulations | Demand for safer products | UK construction fatalities rose, influencing standards |

Technological factors

Building Information Modelling (BIM) is transforming construction with detailed digital project representations. This technology boosts collaboration, cuts errors, and raises efficiency. BIM adoption impacts building product specs and needs, influencing Eurocell's offerings. The global BIM market is forecast to reach $11.7 billion by 2025, showing its growing importance.

Automation and robotics are increasingly used in construction, enhancing precision and efficiency. This trend addresses labor shortages and improves project timelines. For example, the global construction robotics market is projected to reach $1.2 billion by 2025, with a CAGR of 13.5% from 2018 to 2025. These technologies will likely transform manufacturing and on-site assembly.

Advanced materials and manufacturing are key for sustainable building. Eurocell uses recycled PVC, supporting a circular economy. The global green building materials market, valued at $368.8 billion in 2023, is projected to reach $700.6 billion by 2032. This growth highlights the importance of eco-friendly materials.

Digitalization and Data Analysis

Digitalization is transforming the construction sector, with AI and machine learning becoming increasingly vital. This shift enables better process optimization, risk prediction, and informed decision-making. Enhanced project planning and cost estimations are direct benefits, boosting efficiency. The global construction AI market is projected to reach $2.4 billion by 2025, showing rapid growth.

- AI adoption in construction is growing, with a projected market value of $2.4B by 2025.

- Digital tools improve project planning and cost management.

- Data analysis helps to predict and mitigate risks effectively.

E-commerce and Digital Platforms

The rise of e-commerce and digital platforms is reshaping the building materials market. Eurocell is adapting by prioritizing digital growth and online sales. In 2024, online sales in the construction sector increased by 15%. This shift impacts distribution and customer access. Eurocell's strategy includes enhancing its digital presence.

- Online sales in construction grew 15% in 2024.

- Digital platforms change distribution.

- Eurocell focuses on digital growth.

AI is growing fast in construction, with a $2.4B market expected by 2025, improving planning and cost controls.

Digital tools boost project management and risk mitigation. E-commerce is also reshaping sales, with 15% growth in online construction sales in 2024, pushing Eurocell's digital efforts.

These technologies transform operations, improve access, and influence the future.

| Technology | Market Size/Growth | Impact on Eurocell |

|---|---|---|

| Construction AI | $2.4B by 2025 | Enhanced planning, cost control |

| Online Sales | 15% growth in 2024 | Changes in distribution and access |

| BIM Market | $11.7B by 2025 | Influences specs and needs |

Legal factors

The construction sector faces strict building regulations dictating structural integrity, fire safety, and energy efficiency. Eurocell's products must adhere to these, including the Building Safety Act. Compliance is crucial, with potential penalties for non-conformity. Updated standards, like those in 2024/2025, influence product design and manufacturing. These regulations impact Eurocell's operational costs and market access.

Eurocell must adhere to health and safety laws, including the Health and Safety at Work Act 1974. The Construction (Design and Management) Regulations 2015 (CDM Regulations) are also critical, especially for construction projects. Non-compliance can lead to significant penalties; in 2024, the average fine for health and safety breaches in the UK was £150,000. Ensuring worker safety and regulatory adherence is vital for Eurocell's operations.

Environmental legislation, a critical legal factor, significantly affects the construction sector. Laws on pollution, waste, and emissions directly influence Eurocell's operations. For instance, the UK's waste recycling rate was 42.3% in 2023. Eurocell's recycling initiatives align with these regulations, impacting its environmental footprint.

Contract Law and Disputes

Construction projects inherently involve intricate contracts, leading to potential legal disputes. These disputes often concern contract terms, payment schedules, project delays, and modifications to the project's scope. Eurocell, like other construction-related businesses, must navigate these challenges by having a robust grasp of construction law and efficient dispute resolution processes to protect its interests. Understanding and mitigating legal risks is crucial for financial stability and project success in the construction industry.

- In 2024, construction disputes in the UK cost approximately £2.2 billion.

- Around 60% of construction projects experience disputes, impacting profitability.

- Effective contract management can reduce dispute costs by up to 20%.

Planning Laws and Permissions

Planning laws and the necessary permissions are crucial for Eurocell's operations, especially in construction. Delays in obtaining these permissions can directly affect project timelines and profitability. The UK government's recent focus on streamlining planning processes could benefit Eurocell. However, complex regulations and local council variations remain a challenge. For instance, in 2024, the average time for a planning decision in England was around 25 weeks, which can be a significant hurdle for new projects.

- Planning permission delays can cost construction firms significantly.

- Streamlining planning processes is a key government objective.

- Local council variations create operational complexities.

- Average planning decision time in England: ~25 weeks (2024).

Legal compliance demands strict adherence to building regulations affecting Eurocell’s product design and operations, like the Building Safety Act, with potential penalties. Health and safety laws are crucial; in 2024, average fines for breaches reached £150,000 in the UK, necessitating strong worker safety measures. Navigating construction contracts and dispute resolution, alongside streamlining planning permissions, influences project timelines and profitability significantly.

| Aspect | Details | Impact |

|---|---|---|

| Building Regulations | Focus on structural integrity, fire safety, and energy efficiency, as per standards set in 2024/2025. | Affects product design, manufacturing, and operational costs. |

| Health & Safety | Adherence to acts such as the Health and Safety at Work Act 1974. | Significant penalties; in 2024, UK average breach fine: £150,000. |

| Planning Permissions | Required for construction projects. Average decision time in England: ~25 weeks (2024). | Delays can impact project timelines and profitability. |

Environmental factors

The construction sector significantly impacts carbon emissions, driving the need for net-zero targets. Eurocell's commitment to lowering its carbon footprint supports these environmental objectives. The UK construction industry's emissions in 2023 were approximately 50 million tonnes of CO2e. Eurocell's actions align with the UK's goal to cut emissions by 78% by 2035, compared to 1990 levels.

The construction industry's heavy reliance on resources drives the need for efficient use and recycling. Eurocell's business model directly addresses this through its focus on recycling PVC window profiles. This circular approach is essential, especially with the EU aiming for a 55% emissions reduction by 2030. In 2024, Eurocell recycled over 25,000 tonnes of PVC.

Construction generates considerable waste, prompting stringent waste management regulations and environmental concerns. Eurocell's initiatives and recycling operations are key to addressing this.

Sustainable Materials and Energy Efficiency

The construction industry faces growing pressure to adopt sustainable practices, driving demand for eco-friendly materials and energy-efficient solutions. Eurocell's offerings, designed to minimize heat loss, directly address this need, contributing to reduced energy consumption in buildings. In 2024, the global green building materials market was valued at $360 billion, with a projected rise to $550 billion by 2028. Eurocell's focus aligns with these trends, enhancing its market position.

- Demand for sustainable building materials is on the rise.

- Eurocell's products help improve energy efficiency.

- The green building materials market is expanding.

- Eurocell is well-positioned to capitalize on these trends.

Biodiversity and Ecosystem Protection

Eurocell's construction activities may affect local ecosystems and biodiversity, necessitating environmental impact assessments to mitigate harm. Responsible land use and development practices are crucial for minimizing ecological disruption. The construction sector faces increasing pressure to adopt sustainable practices, with regulations like the EU Biodiversity Strategy for 2030 playing a significant role. According to the European Environment Agency, habitat loss and fragmentation are major threats to biodiversity.

- EU Biodiversity Strategy aims to protect 30% of the EU's land and sea areas by 2030.

- Construction projects must comply with environmental impact assessments (EIAs).

- Sustainable building materials and methods are becoming increasingly important.

Environmental factors significantly shape Eurocell's operations, especially due to the construction sector's impact on emissions and waste. Eurocell addresses these concerns via its recycling programs and sustainable material offerings, responding to rising market demand. This strategy aligns with ambitious goals like the EU's 55% emissions cut by 2030.

| Factor | Impact | Eurocell Response |

|---|---|---|

| Carbon Emissions | Construction is a major source | Focus on reduced carbon footprint |

| Resource Use/Waste | High consumption & waste generation | PVC recycling and circular economy |

| Sustainability | Demand for green materials & practices | Eco-friendly products & energy-efficient designs |

PESTLE Analysis Data Sources

Eurocell's PESTLE analysis uses economic data from market reports & government publications. It includes analysis of policies, regulations & industry trends.