Eurofins Scientific Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurofins Scientific Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, allowing easy sharing with stakeholders.

What You’re Viewing Is Included

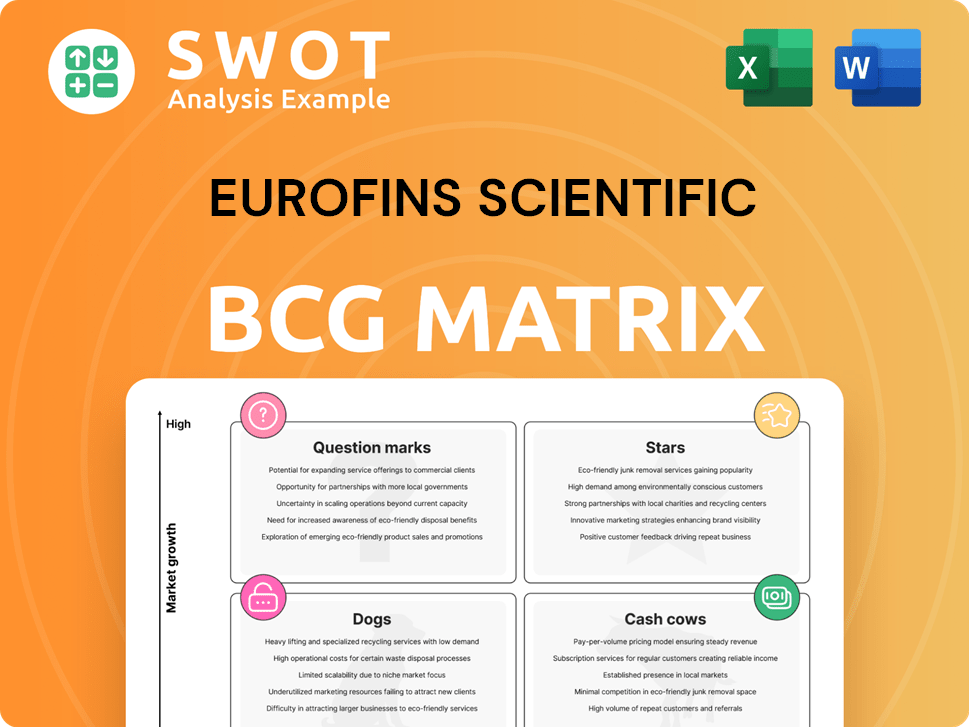

Eurofins Scientific BCG Matrix

The BCG Matrix preview displays the complete, downloadable document you'll receive after purchase. This includes all the charts and data—ready for you to integrate into your strategic planning without any alterations.

BCG Matrix Template

Eurofins Scientific's BCG Matrix offers a snapshot of its diverse portfolio, classifying products based on market share and growth. This analysis helps identify strong performers and areas needing strategic attention. Stars shine brightly, while Cash Cows generate steady revenue. Dogs may be dragging down performance and Question Marks need careful evaluation. Ready to unlock a comprehensive view? Purchase the full BCG Matrix for detailed quadrant breakdowns and actionable recommendations.

Stars

Eurofins' food and feed testing shows strong performance, especially in North America. The company has seen growth thanks to consistent demand and increased market share. Consumer focus on food safety and strict regulations are key drivers. In 2024, this sector's revenue reached €2.1 billion, a 7% increase year-over-year, with North America contributing significantly to this growth.

Eurofins demonstrates leadership in environment testing, capitalizing on stricter regulations and public awareness. In 2024, North American organic growth was strong, driven by market share gains. Its extensive geographic reach and service offerings fuel its success. Eurofins' environment testing revenue in 2023 was significant, reflecting its market dominance.

Eurofins' BioPharma product testing is growing, particularly in North America. This growth is fueled by the increasing demand for biopharmaceutical development. Investments in advanced labs help meet industry standards. In 2024, Eurofins' revenues reached €6.7 billion, a 3.1% increase.

Acquisition of SYNLAB's Clinical Diagnostics Operations in Spain

Eurofins Scientific's acquisition of SYNLAB's clinical diagnostics operations in Spain is a strategic move. It aims to increase revenue and market share in the European clinical diagnostics sector. This acquisition is part of Eurofins' long-term plan for market expansion and service diversification, with earnings expected to grow in the next few years. In 2024, Eurofins' revenue reached €6.7 billion, a 9.5% increase year-over-year.

- Enhances Eurofins' market position in clinical diagnostics.

- Supports growth through strategic market expansion.

- Expected to positively influence Eurofins' financial performance.

- Eurofins' 2024 revenue reached €6.7 billion.

Strategic Acquisitions and Start-ups

Eurofins strategically acquires and invests in start-ups to enhance its capabilities and global footprint. In Q1 2025, Eurofins completed 11 business combinations. These moves are crucial for Eurofins' organic growth and financial performance.

- Q1 2025 saw 11 business deals finalized.

- FY 2024 pro-forma revenues exceeded €160m.

- Acquisitions boost organic growth.

Stars represent sectors with high market share and growth potential, like food & feed and BioPharma testing. These segments, especially in North America, are fueled by demand and acquisitions. Eurofins' strategic moves support its financial growth. In 2024, revenue was €6.7B, a 9.5% increase.

| Segment | 2024 Revenue (B) | Growth |

|---|---|---|

| Food & Feed | €2.1 | 7% |

| BioPharma | €6.7 | 3.1% |

| Overall | €6.7 | 9.5% |

Cash Cows

Eurofins' core food and feed testing in mature markets, like Europe, are cash cows. These markets offer steady cash flow due to stable demand and strong market positions. Long-term contracts with food manufacturers and retailers ensure a dependable revenue stream. In 2024, Eurofins reported strong growth in its food and environment testing, reflecting the stability of these core businesses.

Eurofins Scientific's environment testing services are a cash cow, especially in developed regions. These services benefit from strong environmental regulations. They also have established client relationships. In 2024, this segment contributed significantly to the company's stable revenue.

Eurofins' routine clinical diagnostics, especially in developed healthcare markets, are a steady source of income. These services thrive on a high test volume and stable reimbursement. In 2024, this segment generated substantial revenue, reflecting its consistent performance. This stability is crucial for Eurofins' overall financial health.

Cosmetic Product Testing

The cosmetic product testing segment is a consistent cash generator for Eurofins, fueled by growing consumer demand for safe and high-quality products. Eurofins' strong market position and brand recognition support its steady revenue. In 2024, the global cosmetic testing market was valued at approximately $2.1 billion, with an expected annual growth rate of 6%.

- Steady Revenue: Consistent cash flow due to ongoing demand.

- Market Growth: Expansion driven by rising consumer awareness.

- Eurofins' Strength: Benefiting from its established market presence.

- Financial Data: Market valued at $2.1B in 2024.

Strong Free Cash Flow Generation

Eurofins Scientific's "Cash Cows" status reflects its robust free cash flow (FCF) generation, crucial for strategic investments. This financial strength supports growth, acquisitions, and shareholder returns. In 2023, Eurofins reported a significant FCF, demonstrating its operational prowess. This cash flow supports Eurofins' capital allocation decisions.

- Strong FCF supports investments.

- Operational efficiency drives cash flow.

- Supports acquisitions and returns.

Eurofins Scientific's cash cows, including food and environmental testing, generate stable revenue streams, essential for sustained financial health. Their market positions ensure consistent cash flow. The cosmetics testing market was valued at $2.1B in 2024, with 6% annual growth.

| Segment | Market Value (2024) | Annual Growth Rate |

|---|---|---|

| Cosmetics Testing | $2.1B | 6% |

| Food & Environment | Stable | Steady |

| Clinical Diagnostics | High Volume | Stable |

Dogs

The Agrosciences testing market confronts obstacles, including decreased spending from agrochemical firms and registration hurdles for new products. In 2024, Eurofins' Agrosciences segment saw a revenue decrease. This segment's near-term growth and profitability might be constrained. The market's volatility is influenced by factors like regulatory changes.

The Discovery Services segment of Eurofins Scientific has encountered headwinds, affecting its expansion and financial health. The segment's performance reflected signs of recuperation from tough market conditions in 2022 and 2023. Eurofins' Discovery Services division saw a revenue decrease in the first half of 2023. Eurofins might need to rethink its approach to boost its results in this area.

Eurofins Scientific's BioPharma activities include early-stage clinical work and central lab services. In 2024, these areas faced softer demand, affecting revenue growth. The company anticipates replacing major studies in the Central Lab and Bioanalysis within a few quarters. For example, Eurofins reported a revenue of €6.71 billion in 2023, and a slight slowdown in certain segments was noted.

Commoditized Testing Services

Commoditized testing services, like those in the Dogs quadrant of Eurofins Scientific's BCG Matrix, often struggle with intense competition and limited differentiation. This situation can lead to pricing pressures and reduced profit margins. Eurofins might need to emphasize value-added services and specialized testing to boost profitability. In 2023, Eurofins' revenue was approximately €6.7 billion.

- Dogs face intense competition.

- Focus on value-added services.

- 2023 revenue was around €6.7B.

Underperforming Geographic Regions

Underperforming geographic regions can drag down Eurofins' financial results. These areas often struggle with economic downturns or tough regulatory hurdles. For example, in 2024, certain regions showed slower growth compared to the company's overall performance. Eurofins must carefully evaluate its approach in these areas.

- Specific regions faced challenges in 2024, impacting growth.

- Regulatory issues in some areas increased operational costs.

- Strategic reassessment is crucial for optimizing performance.

- Focusing on stronger regions could boost overall profitability.

The "Dogs" quadrant includes commoditized testing services facing intense competition, which leads to pricing pressures and decreased profit margins. To improve profitability, Eurofins needs to emphasize value-added and specialized testing.

| Metric | 2023 | Impact |

|---|---|---|

| Revenue (approx.) | €6.7B | Competitive pressure |

| Profit Margin | Decreased | Intense competition |

| Strategy | Focus on value-added services | Enhance profitability |

Question Marks

The genomics testing market presents substantial growth opportunities, fueled by technological progress and personalized medicine demand. Eurofins is expanding its presence in molecular clinical diagnostic testing. In 2024, the global genomics market was valued at $27.8 billion. Eurofins' focus aligns with this growing sector.

Specialized clinical diagnostic testing, including clinical genetics and NIPT, is a high-growth area for Eurofins. The demand for advanced diagnostic solutions is increasing. In 2024, Eurofins acquired Ascend Clinical, the largest independent lab for kidney dialysis testing in the US. This strategic move is set to bolster their market position. The acquisition strengthens Eurofins' service offerings.

Eurofins Scientific's Advanced Material Sciences segment focuses on growth opportunities. Innovation and testing demand drive this sector. However, growth is currently slow due to industry inventory corrections. In 2024, the semiconductor industry faced challenges. The electronics sector saw a demand slowdown.

Digitalization and IT Solutions

Eurofins' commitment to digitalization and IT solutions is key for future success. These investments boost efficiency and customer service. The company plans significant spending in 2025 on digitalization and lab networks. This strategy aims to drive growth and improve profitability.

- In 2024, Eurofins invested €300 million in digitalization efforts.

- The hub-and-spoke lab network saw a 15% efficiency increase in 2024.

- Customer satisfaction scores rose by 10% due to improved IT solutions in 2024.

- Eurofins expects a 20% return on investment from digitalization by 2026.

New Testing Methods and Technologies

Eurofins Scientific's focus on new testing methods, like the advanced phenolic testing for olive oil, is strategic. This approach taps into growing market demands, such as the rising interest in high-quality olive oil and its health benefits. Eurofins Craft Technologies Inc. developed a method to quantify Valuable Olive Polyphenols (VOPs).

- Innovation in testing creates new revenue streams.

- The olive oil market is expanding.

- Focus on health and quality drives consumer choice.

- Eurofins expands services through innovation.

Question Marks in Eurofins' BCG Matrix often represent emerging markets or new service offerings with high growth potential but low market share. These areas require significant investment and strategic focus to increase market share and transition into Stars. Eurofins' genomics and new testing methods could be examples. Success depends on strategic investments.

| BCG Matrix Component | Eurofins Example | Strategy |

|---|---|---|

| Question Marks | New Testing Methods (e.g., Olive Oil) | Invest, build market share, evaluate |

| Growth Rate | High, Emerging Market | High, Potential |

| Market Share | Low, Needs Growth | Low, Potential |

BCG Matrix Data Sources

Eurofins' BCG Matrix draws on diverse sources: financial statements, market studies, competitor analyses, and expert assessments.