Euronext Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euronext Bundle

What is included in the product

Strategic assessment of Euronext's business units using the BCG Matrix.

Quickly share your BCG matrix with clients, instantly ready for your presentation.

What You See Is What You Get

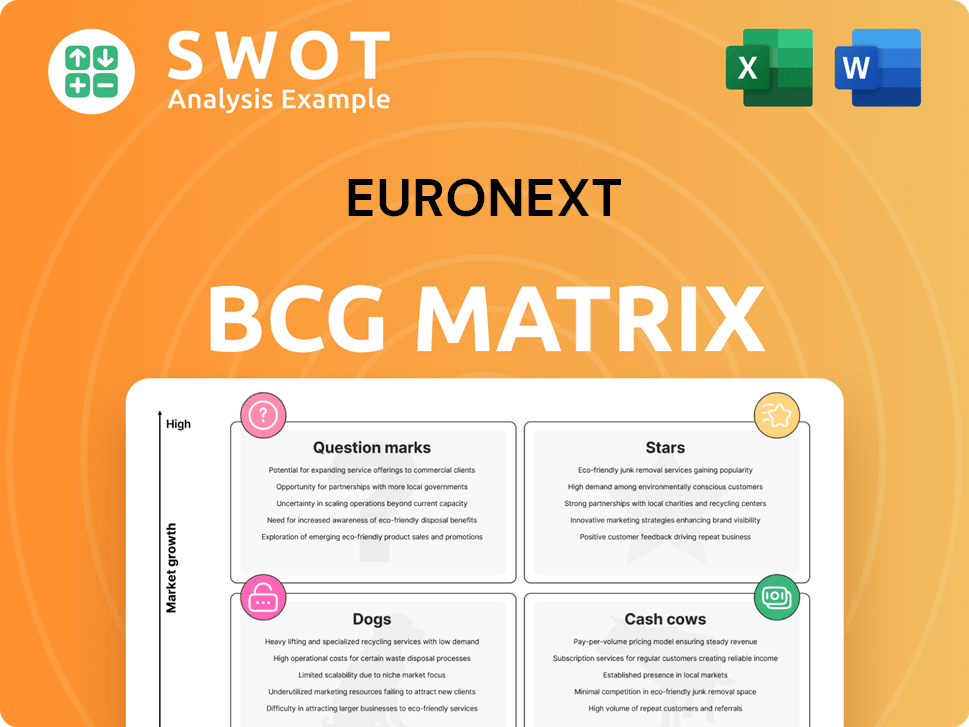

Euronext BCG Matrix

The Euronext BCG Matrix preview mirrors the complete report you'll receive instantly after purchase. This isn't a sample; it's the fully developed, ready-to-implement strategic tool. Get immediate access to a comprehensive analysis ready to enhance your market strategy. No hidden costs or alterations after buying.

BCG Matrix Template

Euronext's BCG Matrix gives a glimpse into its portfolio, categorizing offerings for strategic clarity. This snapshot shows how products fare in market growth and share. Understand the potential of Stars, Cash Cows, Dogs, and Question Marks. Purchase the full version for detailed analysis and strategic advantage.

Stars

Euronext's diversified trading, including fixed income and FX, is a star in its BCG Matrix. In 2024, these segments saw record results, highlighting strong growth. This positions Euronext as a market leader. Investing in and promoting these areas is key for sustained success.

Euronext's successful expansion of its clearing services across all derivatives markets is a major achievement. This enables innovative products and enhances collateral management. The clearing business is expected to generate substantial cash flow. Euronext’s 2024 revenue increased by 6.1% to €1.5 billion. The clearing business is pivotal to its market leadership.

Advanced Data Services at Euronext are thriving, fueled by demand for fixed income and power trading data, plus increasing retail usage. The acquisition of GRSS in 2024 strengthened this segment, offering services to benchmark administrators. In 2024, data revenue increased by 7.5% to €284.2 million. Euronext must capitalize on its data expertise to innovate new services.

Euronext Tech Leaders Initiative

Euronext is Europe's leading exchange for tech, boasting over 700 listed companies. The Euronext Tech Leaders initiative is expanding, drawing in rapidly growing tech unicorns. In 2024, Euronext saw a 15% increase in tech listings. Supporting this ecosystem is key to fostering innovation and growth.

- Euronext's tech sector represents a substantial portion of its market capitalization.

- The initiative aims to increase visibility and access to capital for tech firms.

- Euronext provides resources for tech companies to scale.

- The initiative's success is measured by the growth and performance of its member companies.

Strategic Acquisitions

Euronext's strategic acquisitions, including GRSS, Substantive Research, and Acupay, are key. These moves bolster its non-volume business. They expand its reach across capital markets. Such acquisitions boost revenue and create performance synergies. In 2024, Euronext's revenue was over €1.4 billion.

- GRSS acquisition enhanced Euronext's data services.

- Substantive Research added to its research offerings.

- Acupay strengthened post-trade services.

- These acquisitions support a diversified revenue model.

Euronext's tech sector, a star, supports its market cap and fuels growth. In 2024, tech listings rose by 15%, indicating strong expansion. Euronext’s focus on tech leaders and providing resources is essential for scaling and innovation.

| Metric | 2024 | Change |

|---|---|---|

| Tech Listing Growth | +15% | Increase |

| Market Cap Contribution | Substantial | Significant |

| Tech Leaders Initiative | Expanding | Growing |

Cash Cows

Euronext excels in equity listings in Europe and globally in debt listings. Its infrastructure draws many new listings each year. In 2024, Euronext saw over €200 billion raised through debt listings. The company should focus on maintaining its listing leadership by attracting new issuers.

Euronext's custody and settlement services are a solid revenue stream. These services thrive on growing assets, active settlements, and value-added offerings. Strong infrastructure and partnerships boost efficiency, improving cash flow. In 2024, Euronext's post-trade revenue reached €255.8 million, showcasing this stability.

Euronext's Pan-European Exchange Operations, a cash cow, generates consistent revenue. Its integrated platform and harmonized rules boost efficiency and attract participants. In 2024, Euronext's revenue was €1.4 billion. They should optimize operations and expand to maximize cash flow.

Technology Solutions

Euronext's technology solutions are a cash cow, generating consistent revenue. Its proprietary trading platform, Optiq, is a valuable asset. Continued investment in these solutions will boost growth. In 2024, Euronext's technology services revenue was a significant contributor. This highlights their importance to overall financial performance.

- Optiq is a key technology asset.

- Technology solutions generate consistent revenue.

- Investment drives growth and profitability.

- Technology services contributed significantly in 2024.

Euronext Securities (CSDs)

Euronext Securities, a key part of Euronext's business, operates as a Central Securities Depository (CSD). It links European economies with global capital markets. In 2024, Euronext Securities managed roughly €7 trillion in assets. Their focus should be on streamlining operations and expanding services.

- Connects European economies to global capital markets.

- Manages around €7 trillion in assets.

- Offers secure settlement and custody solutions.

- Needs to optimize operations and expand.

Euronext's cash cows, including Pan-European Exchange Operations and technology solutions, consistently generate revenue. These areas, such as Optiq, provide a stable financial base. Strategic investments in these sectors can drive substantial growth. In 2024, tech services saw significant revenue.

| Cash Cow | Key Features | 2024 Performance |

|---|---|---|

| Exchange Operations | Integrated platform, harmonized rules | €1.4B Revenue |

| Technology Solutions | Optiq, proprietary trading platform | Significant revenue contribution |

| Custody & Settlement | Growing assets, active settlements | €255.8M post-trade revenue |

Dogs

Euronext's single-stock options haven't thrived, facing a downturn in traded contracts. Market share has shrunk, despite launching new options. Competition is tough, hindering Euronext's progress. A strategic reassessment is critical, potentially involving restructuring or divestment. Data from 2024 shows a 15% drop in trading volume.

Euronext's derivatives trading saw a revenue decline, impacted by reduced volatility in equity and index derivatives. Their market share in equity index futures and options is notably low versus rivals. In 2024, Euronext's focus should be on boosting volumes or re-evaluating its involvement in this segment. Consider the 2023 data, where the equity derivatives average daily volume was 1.6 million contracts.

The discontinuation of Borsa Italiana's legacy services led to a revenue decrease in technology solutions. These services, not generating income, potentially consume resources. Euronext must concentrate on migrating clients to Optiq and phasing out legacy systems. In Q1 2024, Euronext's revenue was €408.5 million.

Euronext Access Paris

Euronext Access Paris focuses on early-stage growth companies, which may not yield substantial returns. This platform eases listing with less strict requirements, potentially straining resources relative to revenue. Euronext should evaluate Euronext Access Paris’s performance, possibly optimizing operations or divesting if underperforming. In 2024, Euronext reported a 5.3% increase in revenue, with strategic initiatives needing careful resource allocation.

- Early-stage companies often require more support.

- Less stringent criteria can affect quality.

- Resource allocation is crucial for profitability.

- Performance reviews are vital for strategic alignment.

Specific Underperforming Acquisitions

Euronext's BCG matrix identifies underperforming acquisitions, potentially categorized as "Dogs." These acquisitions may struggle to generate substantial revenue or profit. A review is crucial to assess their impact on the overall portfolio. Euronext might need to consider divestiture if these assets remain a drag.

- Identify acquisitions not meeting growth targets.

- Assess their impact on overall profitability.

- Review and potentially divest underperforming assets.

- Focus on strategic alignment and synergy.

Euronext's "Dogs" include underperforming acquisitions. These assets may struggle with revenue and profit generation. Euronext should review these to assess their portfolio impact. Consider divesting if they are a drag on performance. In 2024, such assets need careful management.

| Category | Impact | Action |

|---|---|---|

| Underperforming Acquisitions | Low Revenue/Profit | Review and Assess |

| Portfolio Drag | Negative Impact | Consider Divestiture |

| 2024 Focus | Strategic Management | Optimize Performance |

Question Marks

Euronext is expanding into fixed income derivatives. This includes cash-settled mini futures on European government bonds, a high-growth area. In 2024, the European bond market saw trading volumes increase, signaling potential for these new products. Significant investment will be needed to compete. Success hinges on monitoring performance and committing resources.

Euronext eyes growth with its Nordic and Baltic power futures market. The acquisition of Nasdaq's business boosts this expansion. To succeed, Euronext must attract participants and invest in development. In 2024, the Nordic power market saw significant activity, with over 1,000 TWh traded annually. Euronext aims to capture a substantial share of this market.

Euronext is growing its repo clearing franchise, partnering with Euroclear. This requires major investment in technology and risk controls. Euronext must attract clients and broaden services. In 2024, the repo market saw over €10 trillion in daily transactions, highlighting its importance.

ESG Initiatives

Euronext is significantly boosting its sustainable finance efforts. A rising number of ESG bond listings reflects this commitment, requiring ongoing investment. Innovation and leadership in sustainable finance are key to attracting issuers and investors. Euronext's focus on ESG is evident in its market activities.

- In 2024, Euronext saw a substantial increase in ESG bond listings.

- Euronext's sustainable finance initiatives require continuous financial backing.

- Euronext should aim to be a frontrunner in sustainable finance.

- The ESG focus attracts new market participants.

Euronext Growth Oslo Listing

Euronext Growth Oslo serves as a marketplace for small and medium-sized enterprises (SMEs) to list their shares. This platform presents a growth opportunity, but attracting new listings and boosting trading activity necessitates investment. Euronext should emphasize the advantages of Euronext Growth Oslo to SMEs and offer resources to aid their expansion.

- In 2024, Euronext Growth Oslo saw a total of 12 new listings, reflecting its ongoing development.

- The trading volume on Euronext Growth Oslo has shown an increase of 8% year-over-year, suggesting growing interest.

- To support growth, Euronext is investing €2 million in marketing and support programs for listed companies.

- Currently, there are over 60 companies listed on Euronext Growth Oslo, with a combined market capitalization of approximately €1.5 billion.

Question Marks represent business units in a high-growth market but with a low market share. These ventures need significant investment to grow market share. Success depends on converting these into Stars through strategic resource allocation and focused execution.

| Metric | Description | 2024 Data (Approximate) |

|---|---|---|

| Market Growth Rate | Annual growth of the market the business unit operates in. | Over 10% (varies by sector). |

| Market Share | Percentage of the market the business unit controls. | Less than 10%. |

| Investment Needs | Capital required for future growth initiatives. | Significant, often exceeding initial revenue. |

BCG Matrix Data Sources

Euronext's BCG Matrix is data-driven, using financial statements, market research, and expert analysis for accurate insights.