Euskaltel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Euskaltel Bundle

What is included in the product

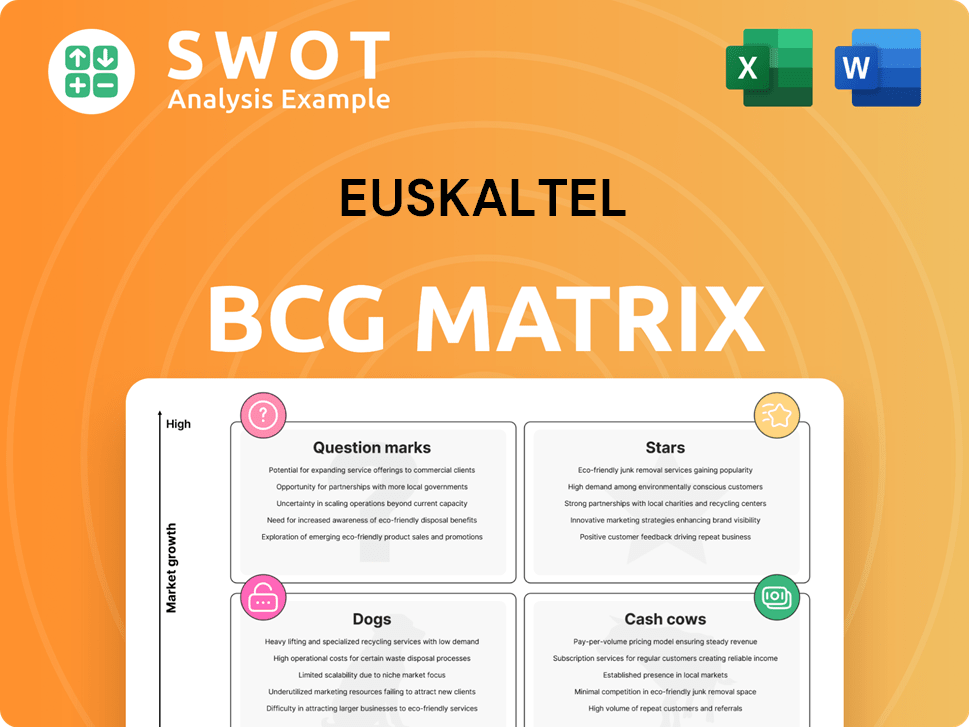

Euskaltel's BCG Matrix: strategic analysis of product units.

One-page overview placing each business unit in a quadrant

Delivered as Shown

Euskaltel BCG Matrix

The preview presents the complete Euskaltel BCG Matrix you'll receive. This detailed document provides the same strategic insights after purchase, fully formatted for immediate use in your analysis. No hidden content or changes—it's ready to integrate into your business strategy. The final version is accessible instantly upon purchase.

BCG Matrix Template

Explore Euskaltel's product portfolio through its BCG Matrix! Discover how its offerings are categorized: Stars, Cash Cows, Dogs, and Question Marks. This snapshot only hints at the full strategic picture. Gain a complete understanding of their market positioning. Get the full report for detailed analysis, recommendations, and actionable insights. Purchase now for a competitive edge!

Stars

Euskaltel, now part of MásOrange, leverages Spain's 5G expansion. This boosts mobile service offerings, aiding market competition. Ongoing 5G infrastructure investment is vital. In 2024, MásOrange increased its 5G coverage, reaching 85% of the population.

Euskaltel's strong presence in the Basque region's FTTP market positions it as a "Star." Spain boasts high FTTP coverage, essential for fast internet. This infrastructure enables high-speed services, a growing market need. In 2024, FTTP connections in Spain reached over 18 million, highlighting its significance.

Euskaltel enjoys robust brand recognition and a loyal customer base within the Basque Country, a strategic advantage. This regional stronghold is reflected in its financial performance; in 2024, Euskaltel reported significant revenue from its Basque operations. Targeted marketing efforts, tailored to local preferences, bolster customer loyalty. Maintaining and expanding this regional dominance is key for sustained success.

Innovative Service Offerings

Euskaltel's "Stars" include innovative offerings like "WIFI Kubi" and triple-play services. These solutions attract customers by providing a comprehensive communication package, setting them apart from competitors. Continuous innovation is crucial for maintaining a competitive edge in the telecom sector. In 2024, Euskaltel invested heavily in expanding its fiber optic network to support these services, with a reported capital expenditure of €120 million.

- WIFI Kubi and triple-play services attract and retain customers.

- Value-added services differentiate Euskaltel.

- Continuous innovation is essential for success.

- 2024: €120 million in fiber optic network investment.

Strategic Partnerships

Euskaltel, now part of MásOrange, leverages strategic partnerships to boost its market position. Collaborations, like those with MAPFRE for home insurance and ADT for alarm services, are vital. These partnerships extend service offerings and enhance customer value. Strategic alliances are key for expanding beyond core telecom services.

- MásOrange aimed to achieve €50 million in synergies in 2023.

- Orange Spain's B2B revenues grew by 4.3% in 2023, indicating strong performance in partnerships.

- The Spanish insurance market saw a turnover of approximately €79 billion in 2023, showing partnership potential.

Euskaltel’s "Stars" benefit from strategic collaborations. These partnerships expand services, enhancing customer value, and boosting market reach. Innovation is essential for success in the telecom sector. In 2024, the Spanish insurance market, a key area, saw about €79 billion in turnover.

| Feature | Details | 2024 Data |

|---|---|---|

| Key Partnerships | MAPFRE, ADT | Collaboration drives expanded service offerings. |

| Market Focus | Spain, especially Basque region | Basque FTTP market contributes to revenue growth. |

| Innovation | WIFI Kubi, triple-play | €120M fiber optic investment supports these in 2024. |

Cash Cows

Euskaltel's strong customer base in the Basque Country generates consistent revenue. This loyal base supports upselling and cross-selling strategies. In 2024, customer retention rates for Euskaltel were approximately 85%. High customer satisfaction is essential for sustaining this cash flow.

Fixed broadband services are a cash cow for Euskaltel. Demand stays high due to remote work and streaming. Euskaltel's fiber network is a key asset. Maintaining service quality is crucial; in 2024, broadband penetration in Spain was around 80%.

Euskaltel's bundled services, including internet, TV, and phone, are a cash cow. These packages boost customer loyalty and revenue. In 2024, bundled services saw a 10% increase in subscribers. Continuous improvements are key to maintaining this value.

Operational Synergies

As part of the MásOrange group, Euskaltel gains operational synergies, cutting costs and boosting efficiency. These include shared infrastructure, marketing resources, and admin functions. These synergies are key to profitability improvement for the company. For example, in 2024, MásOrange reported €1.5 billion in operational cost savings.

- Shared infrastructure reduces capital expenditure.

- Consolidated marketing efforts improve brand reach.

- Centralized administration streamlines processes.

- Improved operational efficiency drives profitability.

Focus on Basque Region

Euskaltel's "Cash Cows" status, centered on the Basque region, streamlines resource use and marketing. This regional focus fosters a deep understanding of local customer needs, enhancing service delivery. Concentrating efforts in the Basque Country supports a robust market presence for Euskaltel. The company's 2024 revenue in the Basque region was approximately €600 million.

- Targeted Marketing: Focused advertising campaigns within the Basque region.

- Customer Insight: Enhanced understanding of local preferences and needs.

- Market Position: Maintaining a strong, localized market share.

- Financial Stability: Consistent revenue generation from the region.

Euskaltel's cash cows are core services in the Basque Country, ensuring steady revenue. High customer retention, about 85% in 2024, supports this. Bundled services and fixed broadband fuel cash generation. Operational efficiencies boost profitability.

| Service | 2024 Revenue (approx.) | Key Factor |

|---|---|---|

| Bundled Services | 10% Subscriber Growth | Customer Loyalty |

| Fixed Broadband | 80% Penetration (Spain) | Network Quality |

| Basque Region | €600 Million | Market Focus |

Dogs

Legacy technologies, such as ADSL and older cable TV, face decline as customers switch to faster options. These services could negatively impact Euskaltel's performance. In 2024, ADSL users decreased by 15% and cable TV subscriptions by 10%. Transitioning customers to modern solutions is vital for Euskaltel's future.

Declining landline usage presents a challenge for Euskaltel. Traditional landline telephony is losing ground to mobile and internet-based options. This shift could lead to lower revenues for Euskaltel's landline services. In 2024, landline subscriptions continued to fall. Adapting by emphasizing mobile and broadband is crucial for sustained growth.

Euskaltel's outdated infrastructure, especially in areas lacking fiber optic upgrades, faces stiff competition. These regions risk becoming a financial burden. In 2024, Euskaltel allocated €100 million for network upgrades. Prioritizing infrastructure improvements is essential to maintain market share.

Lack of National Presence

Euskaltel's limited national reach is a key weakness. It struggles to compete with giants like Telefónica and Vodafone for nationwide business. Expanding beyond its current area will likely be tough. Strategic partnerships might help them grow. In 2024, Telefónica had about 40% of the mobile market.

- Market Share: Euskaltel's market share is significantly smaller than its national competitors.

- Expansion Challenges: Difficulties in growing beyond its primary service area.

- Partnership Potential: Strategic alliances could broaden its coverage.

- Competitive Disadvantage: Limited national presence hinders attracting large business clients.

Commoditized Services

Basic internet and mobile services at Euskaltel are becoming commoditized, intensifying price competition and shrinking profit margins. This is a significant challenge, as evidenced by the declining average revenue per user (ARPU) in the telecommunications sector. Euskaltel must innovate. Prioritizing value-added services and enhancing customer experience is crucial to differentiate itself.

- Declining ARPU: Telecommunications ARPU decreased by about 3-5% annually in 2024 due to commoditization.

- Price Wars: Competitors engage in aggressive pricing strategies to gain market share.

- Value-Added Services: Focus on content, security, and personalized services.

Dogs represent services with low market share and growth potential, posing a challenge for Euskaltel.

These include declining technologies and services in competitive markets.

Strategies involve cost-cutting or possible discontinuation, focusing on more promising areas.

| Category | Description | Impact |

|---|---|---|

| ADSL & Cable TV | Declining use | -10% to -15% users in 2024 |

| Landlines | Decreasing subscriptions | Revenue reduction |

| Outdated Infrastructure | Lacking fiber optic upgrades | €100M allocated for 2024 upgrades |

Question Marks

The emergence of new 5G applications presents a strong growth opportunity for Euskaltel. Exploring innovative 5G use cases is key to attracting new customers and increasing revenue. Euskaltel should invest in R&D to capitalize on this potential. Globally, 5G connections are projected to reach 5.5 billion by 2029, offering significant market expansion possibilities.

The Internet of Things (IoT) market is expanding, offering Euskaltel a growth opportunity. Connecting IoT devices and offering related services could boost Euskaltel's income. Collaborating with IoT platform providers is key for success. The global IoT market was valued at $201.5 billion in 2019 and is projected to reach $1,386.0 billion by 2026.

Euskaltel can capitalize on rising smart home demand. Offering integrated packages could boost customer acquisition and retention. User-friendly, secure solutions are crucial for success. Smart home market revenue is projected to reach $186.6 billion in 2024.

Expansion into New Regions

Euskaltel's expansion into new regions is a strategic move to boost growth beyond its traditional Basque Country market. However, this expansion introduces challenges, including increased competition and the need for localized strategies. Selecting the right target markets and adapting services accordingly is crucial for success. Strategic partnerships with local telecommunications companies could help Euskaltel navigate new markets effectively.

- Market diversification reduces reliance on a single region, mitigating risks.

- Expansion requires significant investment in infrastructure and marketing.

- Partnerships can leverage existing market knowledge and customer bases.

- Careful market analysis is vital for identifying growth opportunities.

Value-Added Services

Euskaltel can boost its market position by providing value-added services. Offering services like cybersecurity or cloud storage can set them apart from competitors. These services can potentially increase revenue per user, enhancing customer loyalty. Identifying and developing services that meet evolving customer needs is crucial for sustained growth.

- By 2024, the cybersecurity market is projected to reach over $300 billion globally.

- Cloud storage services are experiencing significant growth, with a market size exceeding $100 billion.

- Customer retention can improve by up to 25% by offering value-added services.

- Euskaltel's revenue growth could increase by 10-15% by incorporating new services.

Question Marks represent high-growth market segments but hold low market share for Euskaltel, necessitating strategic investment. These ventures, like 5G applications and IoT, require careful resource allocation to foster growth. Success hinges on innovation and effective market penetration strategies to capture market share. Euskaltel must assess risks associated with these ventures.

| Category | Description | Strategic Implication |

|---|---|---|

| Market Position | Low market share, high growth potential. | Requires significant investment and strategic focus. |

| Investment Needs | High, to capture market share and drive growth. | Focus on R&D and marketing to increase visibility. |

| Risk Profile | High, due to market uncertainty and competition. | Needs careful market analysis to minimize risks. |

BCG Matrix Data Sources

The Euskaltel BCG Matrix leverages financial statements, market share analysis, and industry publications for robust data backing.