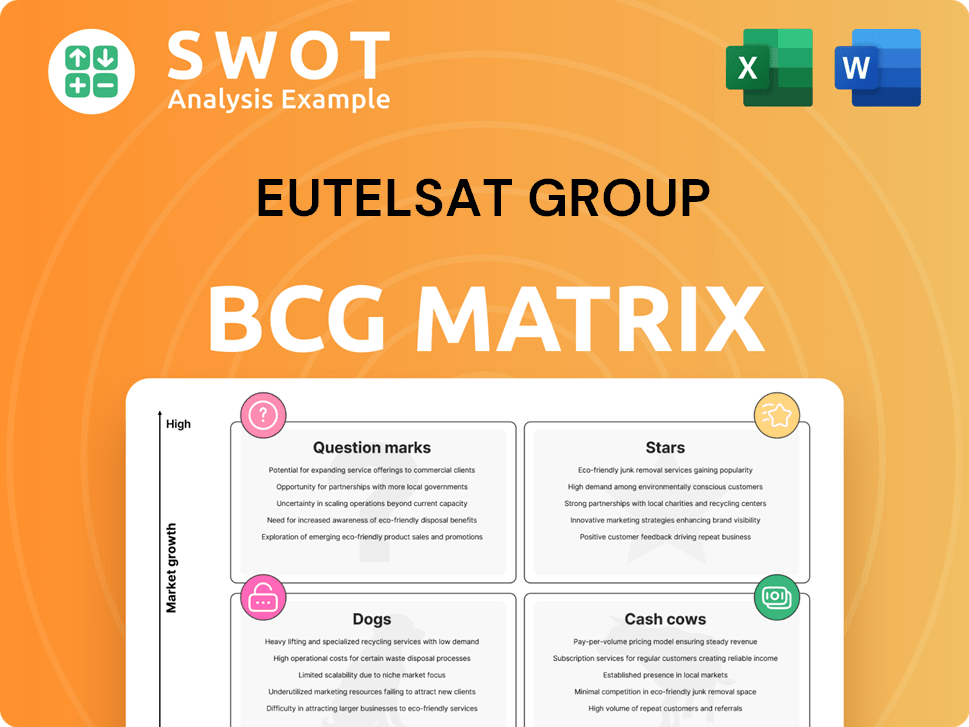

Eutelsat Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eutelsat Group Bundle

What is included in the product

Eutelsat's BCG Matrix: strategic insights for investments, holds, or divestments across quadrants.

Printable summary optimized for A4 and mobile PDFs, allowing for easy distribution and concise insights.

What You’re Viewing Is Included

Eutelsat Group BCG Matrix

The preview you see is identical to the Eutelsat Group BCG Matrix you'll receive after purchase. Download the full report directly; it's a ready-to-use strategic tool. Access a comprehensive, professionally designed analysis, formatted for your needs.

BCG Matrix Template

Eutelsat Group's BCG Matrix reveals its strategic landscape. This framework categorizes services into Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements is crucial for informed decision-making. Identifying growth drivers and resource allocation becomes simpler. Strategic insights offer a competitive edge in the dynamic satellite industry. Uncover detailed quadrant placements, recommendations, and a roadmap to smart investment. Purchase now for a ready-to-use strategic tool.

Stars

LEO Connectivity Solutions, driven by Eutelsat's OneWeb, is a star in the BCG Matrix. The LEO constellation offers low-latency, high-speed global connectivity. Eutelsat's revenue grew to €1.2 billion in 2024. The company is expanding LEO capabilities, with strong growth and future expansion potential.

Eutelsat's government services, including LEO-enabled solutions, are rapidly expanding. The renewal of contracts, like the one with the US Department of Defense, highlights this growth. In 2024, this segment's revenue increased, solidifying its Star status within the BCG Matrix. Investments in secure government connectivity further boost its position.

Eutelsat's multi-orbit solutions, a Star in its BCG matrix, leverage a unique GEO-LEO integration. This approach merges GEO's high throughput with LEO's low latency. The segment is set for substantial growth as demand for combined services rises. Recent data shows a 20% increase in multi-orbit service adoption in 2024.

Strategic Partnerships

Eutelsat's strategic partnerships, like those with Orange, Airbus, and E-Sat, are pivotal for broadening its market presence and enhancing services. These alliances allow Eutelsat to capitalize on its technology to provide connectivity solutions to a wider audience. These partnerships are essential for revenue expansion and market penetration, reinforcing its Star designation within the BCG matrix. In 2024, these collaborations contributed to a 7% increase in overall service revenue.

- Partnerships with Orange and others help expand service offerings.

- Collaborations boost revenue growth.

- Strategic alliances increase market penetration.

- These partnerships are a key factor for Eutelsat's success.

IRIS2 Program Participation

Eutelsat's participation in the IRIS2 program is a strategic win. This collaboration allows Eutelsat to expand its LEO constellation. The project is cost-effective, solidifying Eutelsat's position as a Star. Eutelsat's shares have shown positive growth, reflecting confidence in such ventures.

- IRIS2 aims to provide secure connectivity, with a budget of €2.4 billion.

- Eutelsat's LEO ambitions align with IRIS2's goals, creating synergies.

- Eutelsat's stock performance in 2024 reflects positive market perception.

Stars in Eutelsat's BCG matrix, like LEO, show strong growth. Government services and multi-orbit solutions are key. Strategic partnerships and IRIS2 involvement boost performance.

| Aspect | Data Point | Impact |

|---|---|---|

| Revenue Growth (2024) | €1.2 billion | Demonstrates Strong Market Position |

| Multi-Orbit Adoption (2024) | 20% increase | Indicates Growing Demand |

| Partnership Revenue (2024) | 7% Increase | Highlights Strategic Success |

Cash Cows

Eutelsat's GEO satellite fleet is a Cash Cow, primarily from video services. Despite a decline, video still significantly boosts cash flow. In 2024, the video segment brought in a substantial portion of revenue. Efficient operations and infrastructure investments are key to maintaining the fleet's profitability.

Eutelsat's video broadcasting distributes over 6,500 channels globally. This generates stable income from broadcasters. Despite OTT competition, it's strong in Europe, the Middle East, and Africa. In 2024, video revenue was approximately €1.1 billion. Focusing on high-value clients will sustain this cash flow.

Eutelsat's GEO-based fixed connectivity offers dependable internet. Though LEO expands, GEO sustains revenue. In 2024, GEO services still brought in a large amount of money. Eutelsat can maintain cash flow by updating services.

Backlog of Contracts

Eutelsat's backlog of contracts is a key indicator of its financial health. This substantial backlog, encompassing agreements for satellite capacity and services, secures future revenue. Effective contract management is vital for sustained cash flow generation from this reliable source. In 2024, Eutelsat's backlog could be in the billions of euros, providing a solid financial foundation.

- Backlog represents future revenue streams.

- Contract management is crucial.

- Backlog in the billions of euros.

- Provides a stable financial foundation.

Cost Control Measures

Eutelsat's strategy focuses on strict cost control and synergy benefits, especially after integrating OneWeb. This approach boosts profitability and strengthens its cash flow from current assets. Efficient cost management is vital for maximizing asset value within the Cash Cows segment. For example, Eutelsat reported a 5.4% revenue decrease but increased EBITDA by 1.8% in the first half of 2024, showing effective cost control.

- Cost savings through synergies with OneWeb.

- Optimization of operational efficiency.

- Focus on improving cash flow generation.

- Effective cost management to maximize asset value.

Eutelsat’s Cash Cows generate substantial revenue, with video services leading the way. Key to their success is a focus on maintaining stable income from broadcasting. Efficient cost control, especially post-OneWeb integration, boosts profitability. The company’s 2024 figures show effective management.

| Segment | 2024 Revenue (approx.) | Key Strategy |

|---|---|---|

| Video | €1.1 Billion | Focus on high-value clients |

| GEO Connectivity | Significant amount | Service upgrades |

| Cost Control | EBITDA up 1.8% (H1 2024) | Synergies, efficiency |

Dogs

Professional video, contributing less than 10% of video revenue, saw a decline due to reduced occasional use. This segment faces structural challenges and decreasing demand. In 2024, Eutelsat's video revenues decreased; focusing elsewhere is wise. Consider divesting or reducing investments in this area to improve financial performance.

Eutelsat's GEO assets faced a €535 million goodwill impairment in 2024, signaling underperformance. This decline reflects lower anticipated cash flows. Competition and reduced video demand are key factors. The company is adjusting to market shifts.

Eutelsat's video customer renewal rates are falling, signaling declining loyalty and market share. This mirrors the overall drop in video services. In 2024, Eutelsat's video revenue decreased, reflecting this trend. Addressing customer churn and market changes is key to stopping further decline.

Specific GEO Consumer Broadband in Europe

Eutelsat's GEO consumer broadband in Europe faces headwinds, marking it as a "Dog" in the BCG Matrix. The second half of the fiscal year is expected to show declines in this segment. Competition and tech shifts are pressuring demand and profitability. The company's focus is shifting towards other areas.

- GEO broadband in Europe faces significant challenges.

- Competition and tech changes are negatively impacting demand.

- Profitability is under pressure in this market segment.

- The company is likely reallocating resources.

Hedging Operations Losses

Eutelsat's hedging operations have historically hurt revenue, but recent improvements are promising. Despite seeing a positive impact lately, the company must stay cautious. The inconsistent nature of hedging results points to the potential for "Dog" status, demanding close oversight. This could involve restructuring or more effective management strategies to mitigate risks.

- 2023: Hedging impacts improved, but volatility persists.

- 2024: Ongoing monitoring needed to ensure sustained positive contributions.

- Inconsistent performance signals the need for strategic reviews.

- Possible restructuring to stabilize financial outcomes.

Eutelsat's "Dogs" are struggling segments. These areas include GEO broadband and potentially hedging. The company is experiencing decreased video revenue, with customer renewals falling. They face market headwinds, requiring strategic adjustments.

| Segment | Status | 2024 Financial Impact |

|---|---|---|

| GEO Broadband | Dog | Declining revenue in Europe. |

| Video | Dog | Revenue decrease; goodwill impairment. |

| Hedging | Potential Dog | Inconsistent performance, requires oversight. |

Question Marks

Eutelsat's mobile connectivity, powered by OneWeb, is a Question Mark. This segment focuses on aviation, maritime, and land-based mobile networks. While showing high growth potential, its market share is currently low. In 2024, OneWeb secured deals with major airlines. Aggressive marketing and expansion could boost this segment significantly.

Eutelsat's new LEO services for fixed connectivity are in the Question Marks quadrant. This means high market growth but low market share. These services target underserved areas, offering internet access and backup communication solutions. To become a Star, Eutelsat needs to invest in infrastructure and form strategic partnerships. In 2024, the LEO market is projected to grow significantly, with revenues expected to reach billions of dollars.

Eutelsat's 5G integration efforts offer a substantial growth opportunity. Currently, the revenue contribution from 5G integration is relatively minor. Strategic moves are essential to fully exploit this potential. For instance, Eutelsat's investment in connectivity reached €110 million in 2024.

New LEO Satellite Technologies

Eutelsat is exploring new LEO satellite technologies, such as 5G integration and IRIS2 compatibility. These ventures are positioned in the Question Marks quadrant of the BCG matrix. They have a low market share but high potential for growth. Successful execution of these technologies is key to advancing them to the Stars category.

- Eutelsat's investment in LEO is a strategic move.

- 5G integration could boost satellite capabilities.

- IRIS2 compatibility enhances market reach.

- Continued investment is vital for success.

Enterprise Connectivity Solutions

Eutelsat's enterprise connectivity solutions are positioned as a Question Mark in its BCG Matrix. These solutions focus on providing connectivity, particularly in underserved markets, representing a growth opportunity. Currently, the market share and revenue from these solutions are relatively low. To improve their standing, Eutelsat could invest in sales, marketing, and tailored solutions.

- Enterprise connectivity is a growth area.

- Low current market share and revenue.

- Investments in sales and marketing are needed.

- Tailoring solutions to enterprise needs is key.

Eutelsat's Question Marks show high growth potential. These segments include mobile connectivity, LEO services, and 5G integration. They need strategic investments to boost market share. In 2024, Eutelsat's focused €110 million on connectivity.

| Segment | Market Position | Strategy |

|---|---|---|

| Mobile Connectivity | Low Share, High Growth | Expand with OneWeb deals |

| LEO Services | Low Share, High Growth | Invest in infrastructure |

| 5G Integration | Low Share, High Growth | Strategic investments |

BCG Matrix Data Sources

The Eutelsat Group BCG Matrix leverages comprehensive market analyses. We use financial statements, market trend forecasts, and expert evaluations.