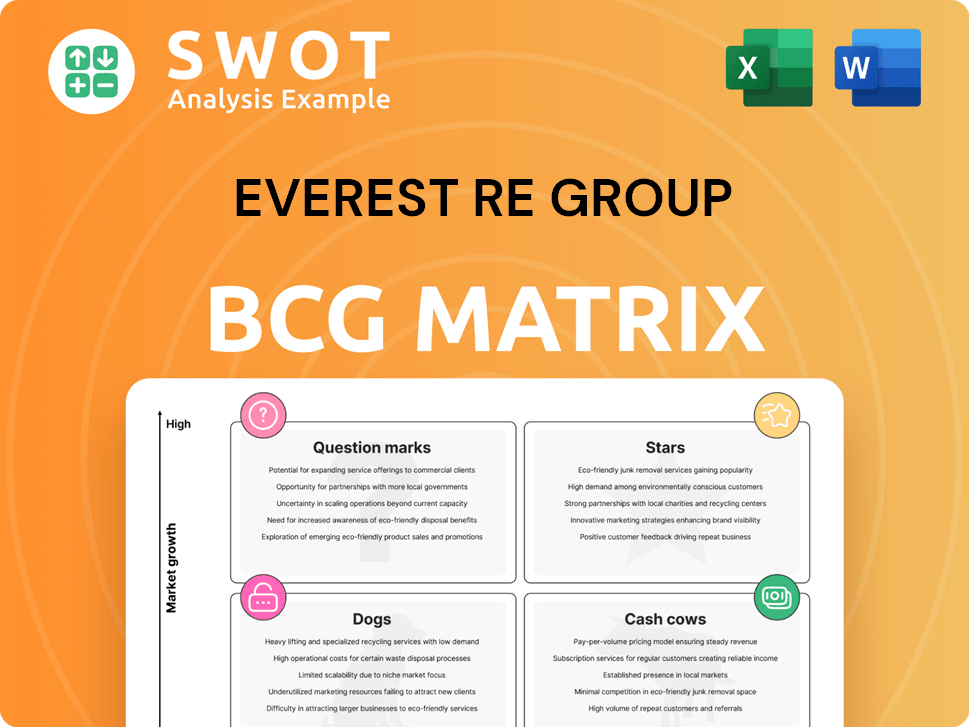

Everest Re Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everest Re Group Bundle

What is included in the product

BCG matrix breakdown for Everest Re, assessing business units' market positions and potential.

Easily update Everest Re Group's strategic positions with editable quadrants.

Preview = Final Product

Everest Re Group BCG Matrix

The Everest Re Group BCG Matrix preview is the complete document you'll receive after buying. This is the fully functional, ready-to-use report, designed for in-depth strategic insights.

BCG Matrix Template

Everest Re Group's BCG Matrix likely analyzes its diverse insurance and reinsurance offerings. This framework helps assess products' market share and growth potential. Are certain lines 'Stars' or 'Cash Cows' driving revenue? Others might be 'Dogs,' needing strategic attention. The full matrix offers detailed quadrant placements, data-driven recommendations, and actionable investment strategies.

Stars

The Reinsurance Property Catastrophe XOL segment for Everest Re Group is experiencing high growth, driven by rising catastrophe losses and coverage demand. Everest has shown considerable expansion in this area, establishing itself as a market leader. In 2024, the global insured losses from natural catastrophes reached $108 billion, highlighting the segment's importance. Further investment could solidify its position, potentially transitioning it into a cash cow as the market matures.

Reinsurance Property Pro-Rata, mirroring Catastrophe XOL, is experiencing significant growth. This segment utilizes a pro-rata method, proportionally sharing premiums and losses, appealing in dynamic markets. Everest Re's strategic focus here is crucial, with 2024's performance reflecting its ongoing market support.

Everest Re Group's international insurance business is a "Star" in its BCG matrix, experiencing notable growth. Specifically, property/short tail and specialty lines are thriving. In Q1 2024, international insurance gross written premiums surged to $1.5 billion.

Specialty Lines (Excluding Casualty)

Everest Re Group's Specialty Lines, excluding Casualty, are a focal point, exhibiting strong potential for attractive risk-adjusted returns. This focus allows Everest to capitalize on specific market demands and opportunities for growth. Strategic investments in these areas can lead to significant returns, enhancing the company's overall financial performance and resilience. This strategic approach is crucial for Everest's ability to adapt and succeed in the evolving insurance market.

- Specialty lines offer higher profitability compared to standard lines.

- Everest Re reported a combined ratio of 87.2% for the first nine months of 2023.

- Gross written premiums for Specialty lines grew by 27% in Q3 2023.

- Everest Re's strategic focus on specialty lines is designed to capitalize on market opportunities.

Data-Driven Underwriting

Everest Re Group excels in data-driven underwriting, leveraging technology to refine risk assessment. This approach integrates advanced analytics and real-time portfolio management. The result is improved loss estimates and a competitive edge. Technology enhances underwriting capabilities, maximizing profitability.

- Everest Re's net premiums written in 2023 reached $15.2 billion, reflecting strong underwriting performance.

- The company's combined ratio in 2023 was 86.7%, indicating efficient risk management.

- Investments in technology and data analytics are ongoing, with increased spending in 2024.

- Everest Re's focus on data-driven underwriting is a key factor in maintaining profitability and market position.

Everest Re Group's international insurance is a "Star," with property/short tail and specialty lines leading growth. In Q1 2024, gross written premiums hit $1.5 billion, reflecting strong expansion. Specialty lines offer higher profitability, driving strategic focus and market capitalization.

| Key Metric | 2023 | Q1 2024 |

|---|---|---|

| Int. Insurance GWP | $5.1B (Annual) | $1.5B |

| Specialty Lines Growth (Q3 2023) | 27% | N/A |

| Combined Ratio (2023) | 86.7% | N/A |

Cash Cows

Everest Re's reinsurance segment is a cash cow. It boasts a strong track record, with a combined ratio of 89.7% in 2024. This segment generates substantial cash flow. Its lead market position and successful renewals bolster stability. Underwriting discipline and client relationships are key to maintaining this status.

Everest Re Group's net investment income hit a record $2 billion in 2024, significantly up from previous years. This robust income stream acts as a reliable cash source. Maintaining this "cash cow" requires careful investment allocation and financial management. It's a key component of their financial strength.

Everest Re Group demonstrated financial strength with a robust operating cash flow. The company reported a strong operating cash flow of $5.0 billion for 2024. This cash flow reflects effective financial resource management. Maintaining operational efficiency and financial discipline are key to sustaining this performance.

Well-Seasoned Property and Mortgage Lines (Reinsurance)

Everest Re Group's reinsurance segment includes well-seasoned property and mortgage lines, acting as cash cows. These lines benefit from years of risk management, providing consistent cash flow. The strategy involves monitoring existing reserves rather than significant new investments. This approach is evident in the company's financial results.

- In 2024, Everest Re reported a solid combined ratio in its reinsurance segment, indicating effective management.

- The company's focus on disciplined underwriting contributes to the stability of these cash-generating lines.

- The reinsurance segment's performance is a key factor in Everest Re's overall financial health.

Global Franchise and Brand

Everest Re's strong global brand and underwriting discipline underpin its revenue generation. This solid reputation draws in clients and partners worldwide. Strategic marketing and client relationship management can boost its cash cow status. In 2024, Everest reported a net premium written of $15.8 billion, reflecting its market position.

- Global Presence: Operates in key insurance markets worldwide.

- Brand Reputation: Known for underwriting expertise and financial stability.

- Revenue Generation: Stable income from established insurance lines.

- Strategic Marketing: Focus on client relationships to maximize returns.

Everest Re's cash cows include reinsurance and investments. These segments consistently generate strong cash flow. Its 2024 net investment income was $2B. Key to maintaining this is disciplined underwriting and strategic financial management.

| Cash Cow Attributes | Description | 2024 Data |

|---|---|---|

| Reinsurance Combined Ratio | Measures underwriting profitability. | 89.7% |

| Net Investment Income | Income from investments. | $2B |

| Operating Cash Flow | Cash from core business activities. | $5.0B |

Dogs

The Accident and Health segment faced a downturn, especially with Everest's exit from the medical stop loss sector. This suggests underperformance and a strategic pivot. In Q3 2023, Everest's A&H gross premiums decreased. Divesting from or minimizing this segment is prudent to mitigate further financial setbacks.

Specialty Casualty in North America, part of Everest Re Group's BCG Matrix, saw reductions. This indicates a shift towards more profitable areas. The segment's underperformance requires strategic changes. In 2024, Everest Re's gross written premiums for specialty casualty were approximately $1.2 billion, down from $1.4 billion in 2023.

Everest Re's "Other" segment, featuring discontinued insurance, is a "Dog" in the BCG Matrix. These casualty lines, no longer core, are cash traps. In 2023, Everest Re's net premiums written decreased, reflecting strategic shifts. Divestiture or run-off is the ideal strategy for these underperforming segments.

U.S. Casualty Lines (Prior to Reserve Strengthening)

In 2024, before reserve strengthening, Everest Re Group's U.S. casualty lines faced challenges. These lines, influenced by social inflation and portfolio concentration, showed underperformance. Significant reserve adjustments were needed, affecting profitability negatively.

- Social inflation increased loss costs.

- Portfolio concentrations amplified risk.

- Reserve adjustments decreased profitability.

- Strategic changes are crucial.

Sports and Leisure Business (Sold in Oct 2024)

The sale of Everest Re Group's sports and leisure business in October 2024 signals a strategic shift. This move suggests the segment wasn't a key profit driver. Divesting it frees up capital for more lucrative ventures.

- Sale finalized in October 2024.

- Focus on core insurance and reinsurance.

- Improved capital allocation.

- Streamlines business focus.

The "Other" segment represents discontinued insurance lines, fitting the "Dog" category in Everest Re Group's BCG Matrix. These segments are cash traps due to underperformance. In Q3 2024, net premiums written declined. Divestiture or strategic run-off is crucial for these underperforming areas.

| Metric | 2023 | Q3 2024 (Projected) |

|---|---|---|

| Net Premiums Written (Other Segment, $B) | 0.4 | 0.3 (Estimate) |

| Strategic Action | Run-off/Divestiture | Continued Run-off |

| Market Position | Weak | Weak |

Question Marks

The "Other" segment in Everest Re Group's BCG matrix includes post-sale sports/leisure, asbestos/environmental exposures, and discontinued programs. This segment faces high uncertainty, and its current performance is unfavorable. In 2024, this segment's impact on overall profitability requires close scrutiny. Careful strategic decisions are essential for this segment's future.

Everest Re Group's generative AI initiatives are still evolving, representing a question mark in its BCG matrix. These projects demand considerable investment and strategic planning. The precise impact of these AI endeavors remains unclear, necessitating careful assessment. In 2024, Everest Re allocated $50 million to technology upgrades, including AI, as reported in their Q2 earnings.

Expansion into emerging markets, like those in Southeast Asia, offers Everest Re Group high growth potential, yet substantial risks exist. Success demands meticulous planning, including market research and risk assessment. Strategic investments and partnerships, such as those in India's insurance sector, are crucial. In 2024, emerging markets contributed 15% to Everest Re Group's total revenue.

New Product Development

New product development at Everest Re, categorized as a Question Mark in the BCG matrix, faces considerable risks. Success hinges on market acceptance and profitability, both uncertain elements. In 2024, Everest Re invested heavily in innovative insurance solutions. Rigorous testing and research are crucial for risk mitigation.

- Market uncertainty poses a significant challenge.

- Profitability is not assured in new ventures.

- Investment in market research is essential.

- Thorough product testing is a must.

Sustainable Engineering Services

Sustainable Engineering Services at Everest Re Group currently represent a Question Mark in the BCG Matrix. As Everest invests in sustainability, the financial impact remains uncertain. These services require substantial investment and innovation to develop.

- Everest Re Group's 2024 sustainability initiatives include reducing carbon emissions.

- Investments in green technologies and infrastructure are essential.

- Market impact analysis needs to be carefully monitored.

- Adaptations are critical to ensure long-term value.

Everest Re's Question Marks face high uncertainty and require strategic investment. Generative AI initiatives and new product development are examples, with investments reaching $50 million in tech in 2024. Emerging market expansion is also a Question Mark, with 15% revenue contribution in 2024, demanding careful planning. Sustainable Engineering Services, part of Everest's sustainability focus, also falls under this category.

| Category | Description | 2024 Data |

|---|---|---|

| AI & Tech Investment | Generative AI projects, technology upgrades. | $50M allocated in Q2 |

| Emerging Markets | Expansion in Southeast Asia and India. | 15% of total revenue |

| New Products & Sustainability | Innovative insurance solutions & green initiatives. | Focus on risk mitigation & carbon emission reduction |

BCG Matrix Data Sources

The Everest Re Group BCG Matrix uses SEC filings, financial reports, and market analysis data for an informed strategic view.