Eversource Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eversource Energy Bundle

What is included in the product

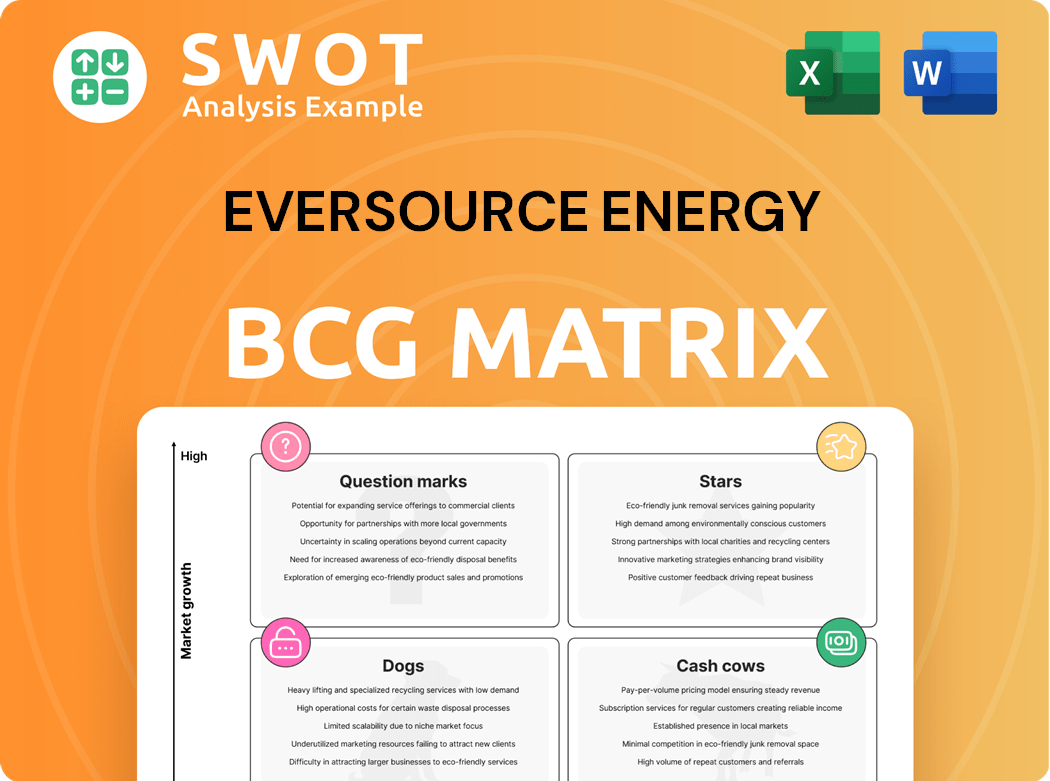

Eversource Energy's BCG Matrix unveils strategic moves for its units across quadrants. Focus is on investment, holding, and divesting.

Easy-to-understand graphics that help pinpoint high-potential areas and allocate resources effectively.

Preview = Final Product

Eversource Energy BCG Matrix

The displayed Eversource Energy BCG Matrix preview is the complete, downloadable version. Get the same strategic analysis instantly upon purchase; a fully-formatted, ready-to-use document awaits, designed for comprehensive insights.

BCG Matrix Template

Eversource Energy operates in a complex utility landscape, with diverse offerings from electricity to natural gas. Analyzing their portfolio using the BCG Matrix reveals interesting dynamics. Some offerings may be "Stars", others "Cash Cows" generating steady revenue.

However, certain ventures might struggle as "Dogs" or pose as "Question Marks", needing strategic decisions. Understanding these placements is key to their future growth and investment strategy.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Eversource is heavily investing in electric transmission upgrades. This area shows strong growth, driven by demand and renewables. These investments boost grid reliability and support long-term goals. In 2024, Eversource allocated a significant portion of its $4.5 billion capital expenditures towards transmission projects. This strategic focus aims to modernize the grid and meet evolving energy needs.

Eversource is modernizing grids, especially in Massachusetts, using advanced tech like smart meters. These upgrades boost grid capacity and support electrification of transport and heating. Clean energy goals and favorable regulations drive these initiatives. In 2024, Eversource invested heavily in grid modernization projects, with over $1 billion allocated.

Eversource's focus on clean energy is evident through its strategic investments. The company supports electric vehicle and heat pump adoption, aligning with decarbonization goals. In 2024, Eversource invested $100 million in clean energy projects. They are integrating solar, offshore wind, and battery storage. This boosts a sustainable energy future.

Energy Efficiency Programs

Eversource's energy efficiency programs are a bright spot, helping customers cut energy use and costs. These programs support sustainability goals and meet regulatory needs, crucial for growth. The company's innovative solutions boost its reputation as an energy leader. In 2024, these programs saved customers millions of dollars.

- Savings: In 2024, these programs saved customers over $200 million.

- Participation: Over 500,000 customers participated in 2024.

- Impact: Reduced carbon emissions by over 1 million tons in 2024.

- Investment: Eversource invested over $300 million in these programs in 2024.

Strategic Partnerships

Eversource's strategic partnerships, like the one with BXP and the Greater Cambridge Energy Program, highlight its commitment to innovation. These collaborations support electrification and decarbonization goals. Such initiatives enhance Eversource's market position by addressing regional energy needs effectively. In 2024, Eversource allocated $270 million for grid modernization projects.

- Partnerships focus on sustainable solutions.

- Collaboration supports electrification efforts.

- Enhances market position.

- 2024 grid modernization investment: $270M.

Eversource's energy efficiency programs are classified as Stars in the BCG Matrix due to high growth and market share. These programs save customers money and cut carbon emissions, indicating a robust position. In 2024, Eversource invested over $300 million in these programs, demonstrating their importance.

| Category | Details |

|---|---|

| Savings in 2024 | Over $200 million |

| Customer Participation in 2024 | Over 500,000 |

| Carbon Emission Reduction in 2024 | Over 1 million tons |

Cash Cows

Eversource's electric distribution business is a cash cow, serving millions in CT, MA, and NH. This segment generates steady revenue due to essential services. In 2024, Eversource invested heavily in infrastructure, about $2.3 billion. This investment supports reliable service, ensuring consistent cash flow for the company.

Eversource's natural gas distribution, mainly in Massachusetts and Connecticut, is a cash cow. This segment reliably generates revenue, supported by rate hikes and infrastructure spending. Despite electrification's rise, it remains a dependable income source. In 2024, gas distribution represented a significant portion of Eversource's earnings. The segment's consistent performance is crucial.

Eversource's regulated utility operations are a cash cow, providing stable revenue. In 2024, these operations generated a significant portion of the company's $12+ billion in revenue. Investments in infrastructure, like the $3.8B plan in Connecticut, are supported by regulatory frameworks. This ensures cost recovery and a reliable financial foundation.

Infrastructure Investments

Eversource's infrastructure investments, vital for reliable energy delivery, are considered cash cows. These include replacing aging assets and building new substations, boosting system efficiency. Such investments ensure regulatory compliance and stable cash flows. Eversource allocated approximately $2.4 billion for capital projects in 2024.

- Capital expenditures support long-term stability.

- Investments focus on upgrading existing infrastructure.

- These projects maintain service quality.

- They ensure regulatory compliance.

Dividend Payments

Eversource Energy, a "Cash Cow" in its BCG Matrix, consistently rewards shareholders through dividends, showcasing its stable core operations and profitability. The company's financial strength is evident in its history of dividend increases. This makes it a solid choice for income investors.

- Eversource's dividend yield was approximately 4.0% as of late 2024.

- The company has increased its dividend annually for over a decade.

- In 2024, Eversource paid out around $2.6 billion in dividends.

- Eversource's payout ratio is typically between 60-70%.

Eversource's cash cows, including electric and gas distribution, and regulated utility operations, consistently generate steady revenue. Infrastructure investments, vital for reliable energy delivery, further support stable cash flows. The company's commitment to shareholder value is evident in its history of dividend increases.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Total Revenue | Over $12 billion |

| Dividends | Total Dividends Paid | Approximately $2.6 billion |

| Dividend Yield | Approximate Yield | Around 4.0% |

Dogs

Eversource divested from offshore wind due to project challenges. In 2024, the company recorded significant losses. These losses were a result of cost overruns and regulatory issues. The move allows Eversource to concentrate on its core utility operations. This also helps to fortify its financial position.

The pending sale of Aquarion Water Company by Eversource signals a strategic shift away from the water business. Despite improved financial results, its divestiture suggests it's not a core focus. The sale, expected in 2024, aims to bolster Eversource's balance sheet. This allows reinvestment in regulated electric and natural gas operations, aligning with its long-term goals. In Q1 2024, Eversource's net income was $420.5 million.

Eversource's interstate transmission faces rate regulation issues, affecting earnings. Regulatory decisions can cut profits. The company deals with pending FERC challenges, increasing risks. In 2024, challenges persist as the company navigates these financial hurdles. For instance, in Q1 2024, earnings were impacted by these regulatory matters.

Third-Party Supplier Risks

Eversource Energy's reliance on third-party suppliers presents operational risks. Substandard performance or supply chain issues could disrupt services. Effective management of these relationships is key to maintaining service quality and mitigating disruptions. In 2024, supply chain disruptions impacted the energy sector, increasing costs.

- 2024 saw a rise in energy sector supply chain disruptions.

- Substandard performance can affect service reliability.

- Managing suppliers is crucial for stability.

- Disruptions can lead to increased operational costs.

Regulatory and Environmental Compliance Costs

Eversource faces hefty regulatory and environmental compliance costs. They must adhere to numerous federal, state, and local environmental rules, leading to substantial expenses. Resiliency improvements due to climate change also demand significant investments, impacting their financial resources. These costs can squeeze profitability, as seen in 2024 with rising operational expenditures.

- Compliance costs include environmental remediation and permitting fees.

- Investments in grid modernization and climate change adaptation are crucial.

- These costs can affect earnings and shareholder returns.

- Eversource reported $8.3 billion in operating expenses in 2024.

Eversource faces challenges with assets like offshore wind. The sale of Aquarion Water also suggests issues. Regulatory hurdles and supplier risks continue to be costly.

| Category | Details | Impact |

|---|---|---|

| Offshore Wind | Divestiture due to losses, cost overruns. | Significant losses in 2024. |

| Aquarion Water | Pending sale; not core focus. | Bolstering balance sheet. |

| Regulation, Suppliers | Rate issues, third-party supplier risks. | Impacted earnings, increased costs in 2024. |

Question Marks

Eversource's battery storage projects are a question mark in its BCG Matrix. These projects aim to improve grid reliability and integrate renewables. The battery storage market is still evolving. Regulatory support and tech advancements are key. In 2024, the US battery storage market grew by 60%.

Eversource's EV infrastructure investments are a question mark due to high costs and regulatory risks. The company supports regional clean energy goals by expanding charging networks. Yet, EV adoption pace and regulations will dictate success. In 2024, Eversource invested $20 million in EV charging infrastructure.

Eversource's geothermal pilots are innovative, aiming for clean heating/cooling. These projects cut emissions and may lower customer energy costs. Yet, scalability and cost-effectiveness must be proven for broad use. As of Q3 2024, pilot project data shows potential but requires further assessment before larger-scale investment.

Large-Scale Solar Projects

Eversource is assessing large-scale solar projects to boost renewable energy. These ventures demand considerable investment and regulatory clearance. Success hinges on securing beneficial terms and seamless project integration. In 2024, the company has allocated $1.6 billion for renewable energy projects, including solar initiatives. The company's strategic focus includes expanding its solar capacity by 30% by 2026.

- Investment: $1.6 billion allocated for renewables in 2024.

- Capacity: Targeting a 30% increase in solar capacity by 2026.

- Regulatory: Requires approvals for project commencement.

- Integration: Success depends on effective project integration.

Grid Flexibility Marketplace

Eversource's Grid Flexibility Marketplace, launched in Connecticut with United Illuminating, is a question mark in the BCG matrix. This initiative aims to integrate distributed energy resources and manage energy demand. Its success hinges on attracting DER owners and aggregators to ensure grid reliability and reduce customer costs. The marketplace is still developing, and its profitability and market share are uncertain.

- Partnership with United Illuminating in Connecticut.

- Focus on managing energy demand and integrating distributed energy resources.

- Aims to enhance grid reliability and lower customer costs.

- Success depends on attracting DER owners and aggregators.

Eversource's renewable energy projects, like solar initiatives, are considered question marks within the BCG matrix, requiring substantial investment and regulatory approvals. Success depends on favorable project integration and securing beneficial terms. In 2024, Eversource dedicated $1.6 billion to renewable projects, including solar, aiming for a 30% capacity boost by 2026.

| Project | Investment (2024) | Strategic Goal |

|---|---|---|

| Solar | $1.6B (Renewables) | 30% Capacity Increase (2026) |

| Battery Storage | Ongoing | Improve Grid Reliability |

| EV Infrastructure | $20M (2024) | Expand Charging Networks |

BCG Matrix Data Sources

The Eversource Energy BCG Matrix leverages financial statements, market share data, industry analysis, and expert opinions to guide strategic decisions.