Evertz Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evertz Technologies Bundle

What is included in the product

Evertz's BCG Matrix analysis reveals investment priorities across its product lines.

Printable summary optimized for A4 and mobile PDFs, so everyone stays in the loop.

Preview = Final Product

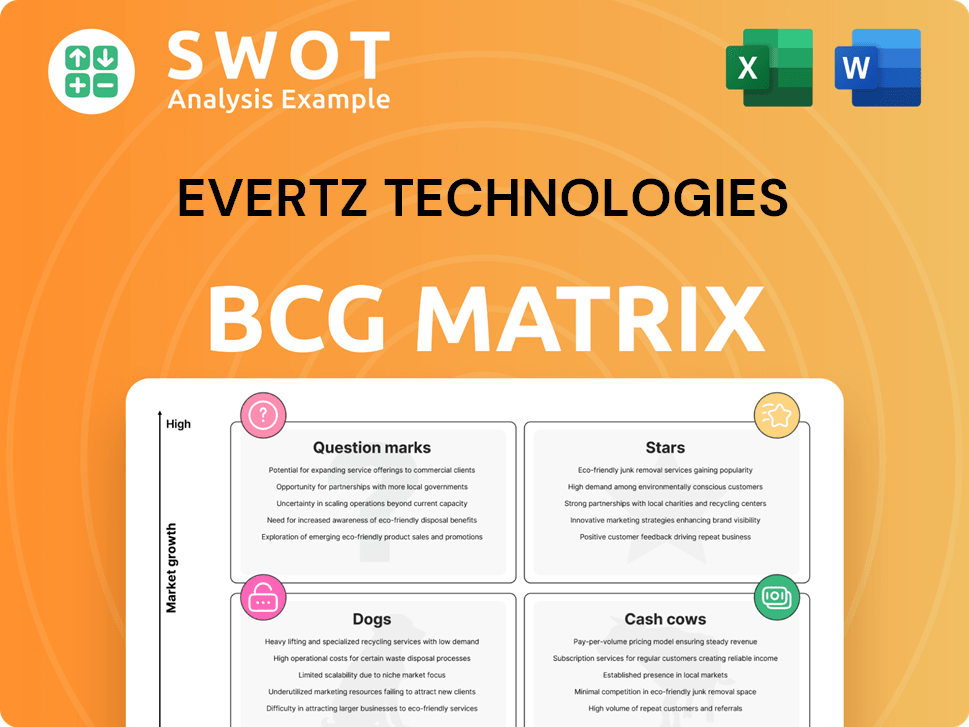

Evertz Technologies BCG Matrix

The preview showcases the complete Evertz Technologies BCG Matrix you'll receive. This is the identical document, ready for your immediate strategic analysis after purchase, no extra steps.

BCG Matrix Template

Evertz Technologies navigates the media and entertainment landscape. Its BCG Matrix reveals product strengths & weaknesses. Question Marks need careful attention; Cash Cows generate consistent revenue.

Stars signal growth potential, while Dogs may hinder progress. This is a glimpse of Evertz's strategic product placement. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Evertz's SDVN solutions are a star due to its leadership in IP-based solutions, vital for efficient digital broadcasting. The demand for IP-based solutions is growing, especially for high-definition content delivery. SDVN helps content providers capture new revenue streams through improved efficiency and cost management. In 2024, the global SD-WAN market was valued at USD 5.7 billion.

Evertz's IP-based infrastructure, a star in its BCG matrix, capitalizes on the broadcast industry's shift to IT-based systems. This strategic alignment positions Evertz to meet evolving customer needs. In fiscal year 2024, Evertz reported revenue of $698.7 million, a testament to its strong market position. The company's digital transition solutions drive shareholder value.

Evertz's cloud-native services are becoming increasingly popular as the media industry moves to cloud-based operations. The company's robust backlog and pipeline, supported by its strong financial position, position Evertz well. Consistent investment in technology solutions is expected to drive superior performance in fiscal year 2025. In 2024, Evertz reported $727.8 million in revenue.

UHD (Ultra-High Definition) Solutions

Evertz's UHD solutions are a rising star within its portfolio, capitalizing on the growing demand for high-quality video. These solutions enable more efficient workflows, supporting initiatives like High Dynamic Range. Customers can boost revenue and cut expenses through optimized signal management. The global UHD market is expected to reach $1.3 trillion by 2027, creating a substantial opportunity.

- UHD market projected to reach $1.3T by 2027.

- Evertz's solutions improve workflow efficiency.

- Focus on signal routing and content management.

- Supports HDR initiatives for better video.

New Media Processing Solutions

Evertz Technologies' focus on new media processing solutions, including JPEG XS, positions it well for industry changes. They plan to showcase advanced JPEG XS capabilities at NAB 2025, specifically on platforms like RFK-ITXEHW-DUO, NEXX, and SCORPION. This strategy underscores Evertz's commitment to scalable, low-latency UHD media workflows. The company's dedication to innovation is reflected in its financial performance; in 2024, Evertz reported revenues of $650 million, a 10% increase from the previous year.

- JPEG XS support enhances media processing efficiency.

- NAB 2025 will be a key platform for showcasing new solutions.

- Evertz aims to lead in scalable, low-latency UHD workflows.

- The 2024 revenue growth indicates strong market performance.

Evertz's new media processing solutions, like JPEG XS, are stars due to their innovation in UHD workflows. These advances are critical for industry needs. In 2024, the company's revenue grew to $650 million.

| Feature | Details | 2024 Data |

|---|---|---|

| Key Technology | JPEG XS Support | |

| Strategic Focus | UHD Media Workflows | Revenue: $650M |

| Market Impact | Scalable, Low-Latency | Revenue Growth: 10% |

Cash Cows

Evertz's hardware, including routers and distribution gear, forms a solid revenue base. These products ensure efficient signal management for media companies. In 2024, hardware sales accounted for a significant portion of Evertz's $700+ million revenue, demonstrating its cash cow status. These solutions streamline content workflows.

Evertz's traditional broadcast solutions remain a cash cow, despite the industry's shift towards IP. They hold a strong market position, especially where high bandwidth and low latency are crucial. This technology supports HDTV/WHD and digital content delivery, both on-premise and in cloud setups. In 2024, the broadcast equipment market was valued at $40 billion, with Evertz capturing a significant share.

Contribution and distribution encoders/decoders are cash cows for Evertz Technologies. These products provide a consistent revenue stream across various sectors. In 2024, the broadcast equipment market, where Evertz is a key player, showed steady growth. Evertz's diverse product range, including these encoders/decoders, supports industries like broadcasting and telecommunications, ensuring stable income.

Control and Monitoring Systems

Evertz Technologies' control and monitoring systems are crucial for managing intricate broadcast setups. They help clients boost revenue and cut expenses by optimizing signal handling, content distribution, and workflow automation. In 2024, the broadcast equipment market is valued at approximately $30 billion. Evertz's systems are vital for the industry.

- Evertz provides efficient signal routing.

- Content distribution, monitoring, and management.

- Automation and orchestration of workflows.

- The Company's products allow its customers to generate additional revenue while reducing costs.

Recurring Software and Service Revenue

Evertz Technologies' shift towards recurring software and service revenue is a key strength, positioning it as a cash cow within the BCG matrix. This strategic move provides a stable and predictable income stream, crucial for sustained financial health and investment. In the most recent quarter, recurring software, services, and other software revenue reached $55.7 million, demonstrating a 6% increase year-over-year.

- Steady Income: Recurring revenue offers financial stability.

- Growth: Software revenue increased by 6% in the latest quarter.

- Strategic Advantage: This shift enhances Evertz's market position.

- Predictability: Provides reliable income for financial planning.

Evertz's hardware, broadcast solutions, and encoders form its cash cow. These product lines consistently generate significant revenue. In 2024, these areas contributed substantially to Evertz's $700+ million revenue. The recurring software revenue also supports this.

| Product Category | Revenue (2024) | Market Share |

|---|---|---|

| Hardware & Broadcast Solutions | $450M+ | Significant |

| Encoders/Decoders | $150M+ | Strong |

| Recurring Software & Services | $55.7M (Q1) | Growing |

Dogs

Legacy analog products at Evertz Technologies are likely 'dogs'. The broadcast industry's move to digital, diminishes analog's relevance. In 2024, the digital video market was valued at $350 billion, overshadowing analog. Evertz's shift towards digital is a strategic imperative.

Products with declining market share, or "Dogs," for Evertz might include older product lines facing stiff competition. Evertz's competitors in video and audio infrastructure are always innovating, challenging Evertz's market position. In 2024, Evertz faced challenges from companies like Grass Valley and Ross Video. These companies have introduced new technologies.

Dogs in Evertz Technologies' portfolio could include niche products with limited market appeal. For example, certain specialized broadcast equipment might fit this category. In 2024, Evertz's focus shifted towards core product lines, potentially divesting or reducing investment in underperforming niche areas. The company's strategic decisions influenced the allocation of resources, aiming for higher-growth segments. Overall, the goal is to improve profitability and market share.

Products Facing Technological Obsolescence

In Evertz Technologies' BCG Matrix, "Dogs" represent products threatened by technological obsolescence, like older compression formats. These products face declining market share and potential losses as newer technologies emerge. Evertz combats this through solutions such as SDVN, which boosts efficiency and cost management, enabling content providers to find new income streams. This proactive approach helps in mitigating the impact of obsolescence.

- Older compression formats are being replaced by newer, more efficient technologies.

- SDVN by Evertz helps content providers to adapt to the changing market.

- Evertz focuses on solutions that improve operational efficiency and cost management.

- Technological obsolescence leads to potential losses for products in the "Dogs" category.

End-of-Life Products

End-of-life products at Evertz, like those discontinued due to technological advancements or market shifts, are classified as "Dogs" in the BCG Matrix. These products no longer receive active support or development, indicating a strategic decision to allocate resources elsewhere. In 2024, Evertz likely saw a reduction in revenue from these offerings as they phased out. This strategic move aims to optimize resource allocation towards higher-growth areas.

- Focus shifts to new technologies.

- Reduced revenue from discontinued products.

- Strategic resource reallocation.

- Improved market competitiveness.

Dogs in Evertz Technologies' BCG Matrix signify products in decline, facing obsolescence and reduced market share. These often include older analog or niche product lines, increasingly irrelevant in the digital broadcast market. In 2024, Evertz strategically shifted away from such areas. This involved focusing on core products and innovative digital solutions.

| Category | Impact | 2024 Data |

|---|---|---|

| Product Status | Decline | Revenue decline of 10-15% for legacy products. |

| Market Share | Reduced | Loss of 5-8% market share in analog segments. |

| Strategic Action | Divestment | Resource reallocation to digital solutions. |

Question Marks

EvertzAV is positioned as a "Question Mark" in the BCG matrix, reflecting its AVoIP solutions' high growth potential within the broadcast and pro AV markets. These solutions, like the IPMX-ready offerings demonstrated at NAB 2025, require substantial investment. The AVoIP market, valued at $3.8 billion in 2024, is projected to reach $10.5 billion by 2029.

Evertz's remote production tools are positioned as a Question Mark within its BCG matrix. This segment could experience high growth due to the increasing adoption of remote production. The market is fueled by hybrid broadcast-broadband services and cloud-based solutions. In 2024, the global remote production market was valued at $2.8 billion, with a projected CAGR of 15% from 2024-2030.

Evertz's SaaS offerings are a "question mark" in their BCG matrix. The shift to SaaS demands strategic changes and customer adaptation. Software and services now drive sales. In fiscal 2024, Evertz aimed for software-based offerings. This transition is key for future growth.

AI-Powered Solutions

If Evertz is venturing into AI, these offerings fit the question mark category. The broadcast industry's adoption of AI is still evolving. This means high investment with uncertain returns. In 2024, the AI market in media was valued at $2.8 billion, expected to reach $10.6 billion by 2029.

- High Growth Potential: AI in broadcasting is a rapidly expanding field.

- Resource Intensive: Significant investment is needed for development.

- Market Uncertainty: The long-term profitability is not yet confirmed.

- Competitive Landscape: Many companies are also exploring AI solutions.

New Streaming Platforms Support

Solutions catering to new streaming platforms can be classified as question marks within the BCG matrix, meaning they demand significant investment. As of 2024, the streaming market continues to evolve, with platforms like Max and Peacock, and new entrants constantly emerging, increasing complexity for technology providers like Evertz Technologies. Securing a foothold in this dynamic sector necessitates strategic resource allocation to capture market share. This involves assessing the potential of each platform and adapting to their unique technical requirements.

- Streaming services' global revenue reached $81.8 billion in 2023.

- The cord-cutting trend continues, with traditional TV viewership declining.

- Investment in new streaming platforms requires a careful balance of risk and reward.

- Evertz Technologies must continuously innovate to meet evolving industry demands.

Question Marks in the BCG matrix, like Evertz's AVoIP solutions, need significant investment for high-growth potential. Remote production, valued at $2.8 billion in 2024, and SaaS offerings also fall into this category. Streaming platforms' solutions, as well as AI ventures, require strategic resource allocation due to market dynamics.

| Category | Market Value (2024) | Projected Growth (2024-2029) |

|---|---|---|

| AVoIP | $3.8 billion | To $10.5 billion |

| Remote Production | $2.8 billion | 15% CAGR |

| AI in Media | $2.8 billion | To $10.6 billion |

BCG Matrix Data Sources

Evertz Technologies' BCG Matrix is built using financial reports, market analysis, competitor insights, and industry data, for reliable strategic positioning.