Experian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Experian Bundle

What is included in the product

Strategic assessment of Experian's business units using the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, to share with stakeholders and save time.

Preview = Final Product

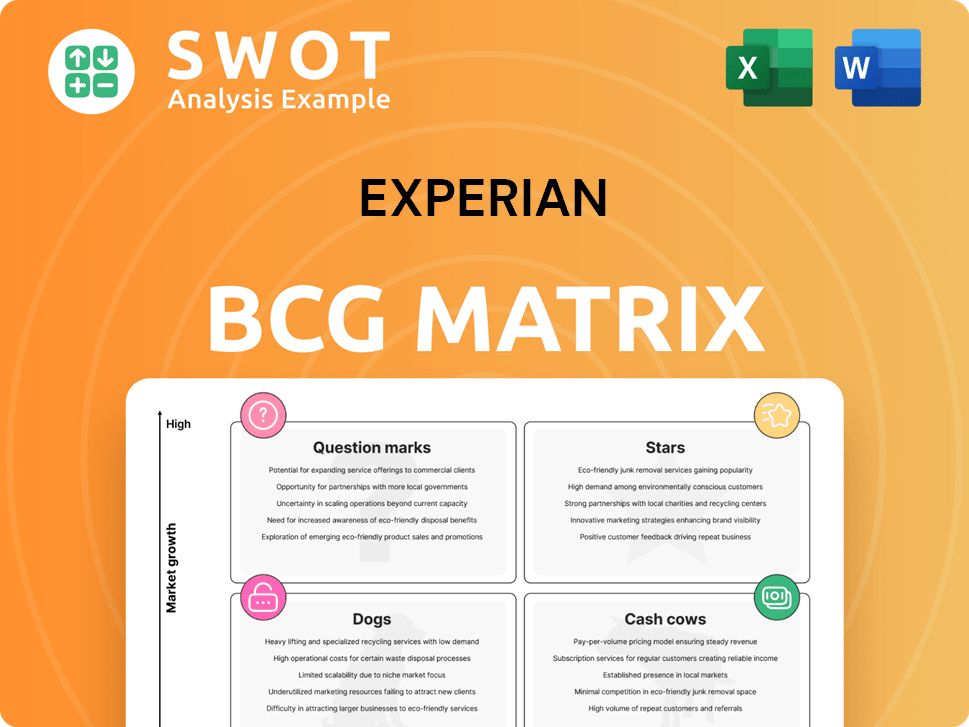

Experian BCG Matrix

The Experian BCG Matrix preview shows the final document you'll receive. It's a ready-to-use report with no watermarks or changes after purchase, designed for strategic insights.

BCG Matrix Template

Experian's BCG Matrix offers a quick snapshot of product performance.

It categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks.

This helps to understand market share and growth potential.

The matrix aids in strategic planning and resource allocation.

This preview is just a glimpse. Get the full BCG Matrix for detailed analysis.

Unlock quadrant-specific insights and actionable recommendations.

Purchase now for a ready-to-use strategic tool!

Stars

Experian excels in credit risk assessment, a market expected to surge. Cloud-based deployment and advanced solutions fuel its growth. Experian's AI and ML-enhanced software meet evolving needs. Revenue from credit services in 2024 reached $6.5 billion.

The fraud detection and prevention market is booming, fueled by the rise of cyber fraud. Experian's solutions, like AI tools and identity verification, are vital for businesses. In 2024, Experian's revenue from fraud and identity solutions grew by 10%, reflecting the market's demand. As digital transactions surge, Experian's expertise becomes increasingly valuable, with a 15% increase in demand for their services.

Experian's Ascend Platform is a strategic growth driver, providing advanced analytics and decision-making tools. It integrates diverse data and AI to offer lenders comprehensive borrower insights, enhancing customer relationships. The platform accelerates model development and deployment; in 2024, Experian's revenue grew, with its data analytics segment playing a key role.

Marketing Services (Audience Identity and Activation)

Experian's marketing services, especially audience identity and activation, are shining as Stars in the market. These solutions are crucial as businesses focus on personalized marketing and targeting specific groups. Experian's data-driven insights and identity solutions provide a complete consumer view, boosting campaign effectiveness. Revenue from Experian's marketing services grew by 11% in the first half of 2024, showing strong demand.

- Experian's marketing services revenue grew by 11% in the first half of 2024.

- Focus on personalized marketing is driving demand for Experian's services.

- Solutions connect digital and offline identifiers for a complete consumer view.

- Experian is helping businesses target key demographics effectively.

Data Breach Services (Selectively)

Data breach services, though volatile, are a key opportunity for Experian. Cyberattacks’ rise drives demand for breach mitigation. Experian's security expertise is crucial, yet growth excluding these services can be affected.

- Experian reported a 5% organic revenue growth in fiscal year 2024, excluding data breach services.

- The global cybersecurity market is projected to reach $345.7 billion in 2024.

- Data breaches cost businesses an average of $4.45 million in 2023.

Experian's marketing services are a Star in the BCG Matrix, growing strongly due to personalized marketing demands. These services help businesses target key demographics, with revenue up 11% in the first half of 2024. Solutions connect digital and offline identifiers, providing a complete consumer view.

| Aspect | Details |

|---|---|

| Revenue Growth (H1 2024) | 11% |

| Market Focus | Personalized Marketing |

| Service Benefit | Complete Consumer View |

Cash Cows

Experian, a leading credit reporting agency, operates within a mature market. Its consumer credit reporting business is a consistent revenue generator. In 2024, Experian's revenue reached $6.6 billion. This segment's stability is a key strength.

Experian's business credit reporting mirrors its consumer services, generating consistent revenue. Businesses utilize these reports to evaluate the financial reliability of their partners. Experian's detailed business credit data offers key insights, supporting informed decisions. In 2024, Experian's business services revenue was approximately $2.8 billion, demonstrating its importance.

Experian's B2B data and analytics is a cash cow, generating substantial revenue. In fiscal year 2024, Experian's Business Services segment, which includes B2B data and analytics, saw a revenue of $3.7 billion. This segment's strong performance is driven by the increasing need for data-driven insights. The demand for these services continues to fuel revenue growth, making it a stable, high-profit area.

Consumer Services (Subscription)

Experian's subscription services are a cash cow, generating steady revenue. Consumers subscribe for credit reports, monitoring, and identity theft protection. These services are a reliable income source for Experian. Growth is fueled by product improvements and credit management awareness.

- Experian's Consumer Services revenue grew 7% in fiscal year 2024.

- Subscription revenue is a significant portion of this growth.

- Over 20 million consumers use Experian's subscription services.

- IdentityWorks and CreditWorks are key subscription products.

Automotive Data and Insights

Experian's automotive data and insights are a cash cow, offering crucial information to the automotive sector. They provide detailed data on vehicle registration trends, consumer preferences, and market share analysis. With the automotive industry's constant evolution, Experian's data remains highly sought after. This ensures consistent revenue and strong market positioning.

- Experian's automotive revenue reached $425 million in 2024, a 7% increase.

- Market share analysis services saw a 10% rise in demand.

- Consumer preference data usage increased by 8% in 2024.

- Vehicle registration trends reports are up by 6%.

Experian's cash cows, generating stable revenue, are vital. They include consumer and business credit reporting, B2B data, subscription services, and automotive data. These segments show consistent financial performance, such as $6.6 billion revenue in 2024 from consumer services.

| Segment | 2024 Revenue (USD) | Key Feature |

|---|---|---|

| Consumer Credit | $6.6 Billion | Steady credit reports |

| Business Services | $3.7 Billion | B2B data and analytics |

| Subscription Services | Significant | Credit monitoring |

| Automotive | $425 Million | Data for auto sector |

Dogs

Experian has moved some B2B units to 'exited businesses,' signaling a shift in focus. This means these areas, possibly with slow growth, don't fit Experian's main goals. Exiting these areas implies they weren't profitable enough. In 2024, Experian's strategic moves aim to boost returns.

Traditional credit risk assessment, while essential, faces growing competition from AI/ML-driven solutions. Experian's traditional offerings may become less attractive as the market embraces advanced technologies. In 2024, the global AI in credit risk market was valued at $3.2 billion, highlighting the shift. Experian must invest to stay competitive, as AI-enabled solutions gain traction.

Experian's services lacking real-time capabilities face challenges in fraud detection. With fraud losses projected at $63 billion in 2024, timely insights are crucial. Customers now expect immediate solutions to combat evolving threats. Experian must modernize its offerings to meet these demands, ensuring competitive relevance.

Data Breach Services (Potentially)

Data breach services, while potentially lucrative, present volatility. Revenue swings are common, tied to breach frequency and severity. Experian must carefully manage this segment to avoid dragging down overall performance. In 2024, data breaches cost businesses an average of $4.45 million.

- Volatility makes data breach services a potential Dog.

- Revenue depends on breach frequency and severity.

- Experian must manage carefully to avoid underperformance.

- Average data breach cost in 2024 was $4.45 million.

Regions with Low Market Penetration

Experian's "Dogs" category includes regions with low market penetration or intense competition. These areas often demand substantial investment for growth. Consider Experian's presence in emerging markets, where it might face strong local competitors. Returns need careful assessment before allocating resources. In 2024, Experian's revenue growth in certain international markets was less than 5%.

- Low market penetration often requires significant investment.

- Competition from local players can hinder growth.

- Careful evaluation of potential returns is crucial.

- Example: Experian's underperforming international divisions.

Experian's Dogs face challenges like low market share or fierce competition. These divisions often require substantial investment but offer weak returns. Consider international operations where revenue growth was under 5% in 2024. High data breach costs also create potential problems.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Market Position | Low growth, potential losses | <5% revenue growth in some markets |

| Competition | Difficult to gain market share | Intense competition in emerging markets |

| Investment Needs | High capital required | Requires significant spending to compete |

Question Marks

Experian recognizes substantial growth prospects in underpenetrated markets, especially within the Asia Pacific region. These areas are witnessing a surge in credit lending, driven by digital advancements and supportive government policies. Experian's strategic focus is on expanding its reach in these high-growth markets. However, it requires substantial investment and localized strategies. In 2024, Experian's revenue from Asia Pacific grew by 12%, reflecting its commitment to this region.

Experian is betting big on Generative AI, launching products like Experian Assistant. These tools aim to revolutionize data and analytics for businesses. The market for these GenAI solutions is still developing. In 2024, Experian's revenue was over $6.6 billion, with significant investment in innovation.

Experian is actively integrating consumer-permissioned and alternative data to refine its credit risk models. This includes data from sources like utility payments and rental history, offering a more inclusive view of consumer creditworthiness. In 2024, the utilization of such data saw a 15% increase in identifying creditworthy individuals previously excluded. Yet, challenges persist in data standardization and privacy compliance.

Integrated Global Platform for Identity and Fraud

Experian is developing an integrated global platform for identity and fraud, focusing on automated, secure, and scalable solutions. This platform is designed to be a significant revenue driver and competitive edge for Experian. However, creating this platform involves substantial investment and coordination across various business segments and regions. In 2023, Experian's revenue from fraud and identity solutions was a substantial part of its overall revenue, showcasing the platform's importance.

- The global fraud detection and prevention market is expected to reach $64.1 billion by 2028.

- Experian invested $1.6 billion in research and development in 2023.

- The platform aims to reduce fraud losses, which totaled $40 billion in 2023.

Health Expansion (New Market Segments)

Experian is exploring health business expansion into new market segments. This strategy includes creating new products, services, or acquiring companies. Success depends on understanding healthcare and stakeholder needs. In 2024, the healthcare market saw significant shifts due to technological advancements and changing consumer expectations.

- Experian's moves aim to capture growth in the evolving healthcare landscape.

- The healthcare market's value in 2024 is estimated to be over $4 trillion in the U.S. alone.

- Acquisitions would allow Experian to broaden its healthcare offerings quickly.

- New segments could include telehealth and personalized medicine.

Question Marks represent ventures in high-growth markets but with uncertain returns. Experian's investments in GenAI and new platforms fit this category. These initiatives require significant capital and carry risks. Experian must monitor performance closely and adapt strategies.

| Characteristic | Description | Financial Implication |

|---|---|---|

| Market Growth | High growth potential, e.g., GenAI solutions | Requires significant investment. |

| Market Share | Low, possibly new market entrants. | Uncertainty in market position and revenue. |

| Investment | Substantial spending on R&D and new ventures. | Potential for high returns but also high risk. |

| Strategy | Requires careful monitoring, flexibility and innovation. | Decisions depend on market response and ROI. |

BCG Matrix Data Sources

Experian's BCG Matrix relies on financial reports, market analysis, industry benchmarks, and expert opinions to provide actionable strategic insights.