Extra Space Storage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Extra Space Storage Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, offering a portable analysis of Extra Space Storage's performance.

Full Transparency, Always

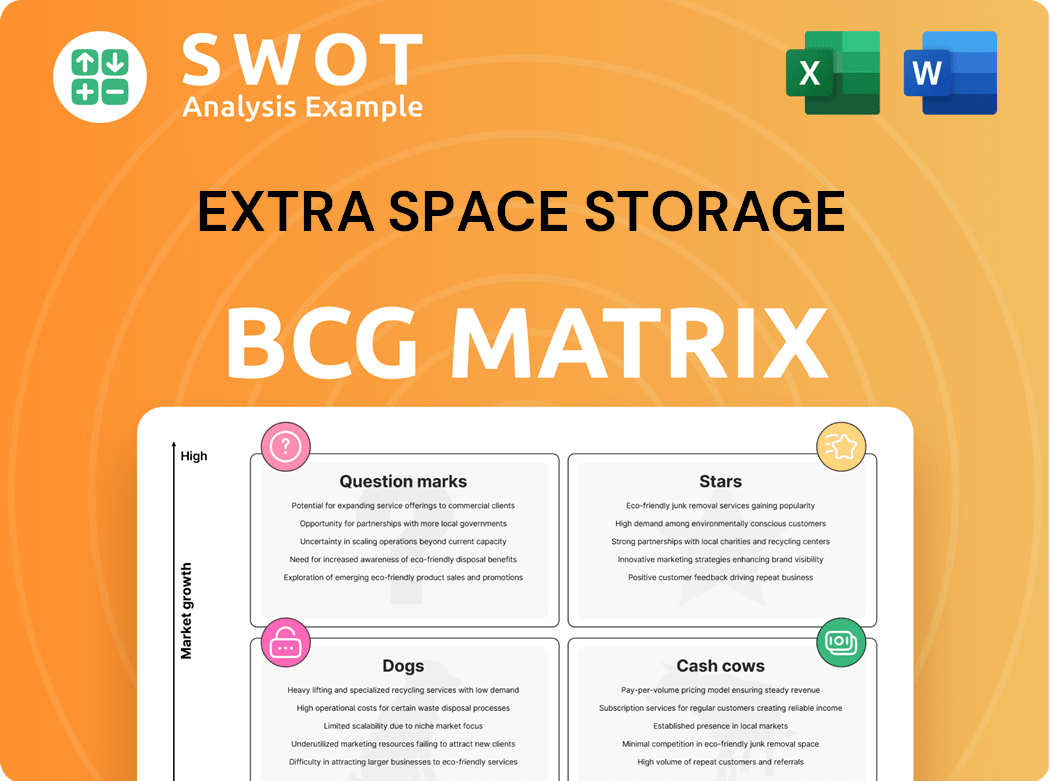

Extra Space Storage BCG Matrix

The preview you see mirrors the Extra Space Storage BCG Matrix you'll receive post-purchase. This complete, ready-to-use document offers strategic insights and is designed for clear understanding and professional application.

BCG Matrix Template

Extra Space Storage's diverse offerings require strategic allocation. This sneak peek hints at which services dominate and which need attention. Understanding the "Stars" and "Dogs" is crucial for informed decisions. The BCG Matrix illuminates growth potential and resource optimization opportunities. Discover how the company manages its portfolio for maximum impact. Purchase now for a ready-to-use strategic tool.

Stars

Extra Space Storage (EXR) is a "Star" in the BCG matrix due to its dominant position. As of Q3 2024, EXR's portfolio included ~3,600 properties. The company's brand recognition and strategic acquisitions, like the 2021 acquisition of Life Storage, support its market leadership. This strong position allows EXR to benefit from economies of scale, enhancing revenue and profitability. In Q3 2024, same-store revenue growth was 5.2%.

Extra Space Storage's strategic acquisitions, including the 2023 merger with Life Storage, are a key strength. These moves broaden its market presence and boost its share, such as a 6.3% increase in same-store revenue in Q4 2023. Integrating these assets allows for operational efficiencies and enhances performance. The Life Storage acquisition alone added over 1,000 properties to their portfolio.

Extra Space Storage's third-party management platform leads the sector. It generates management fees and offers market insights. In 2024, this segment saw significant growth, contributing to overall revenue. This business also identifies potential acquisition targets, boosting expansion.

Technology Integration

Extra Space Storage excels in technology integration, enhancing customer experience and operational efficiency. They utilize AI, online booking, and digital security. These tech advancements attract more customers and streamline operations. In 2024, the company invested heavily in these areas. This strategy is crucial for maintaining a competitive edge.

- AI-powered solutions for customer service and facility management.

- Online booking platforms for easy and convenient storage unit rentals.

- Digital security features to protect customer belongings.

- Increased spending on technology to improve efficiency and customer experience.

Strong Financial Performance

Extra Space Storage shines with robust financials, marked by steady revenue increases and robust Funds From Operations (FFO). This financial prowess enables strategic investments and shareholder value enhancement. The company's fiscal health fortifies its ability to withstand economic challenges and seize market opportunities. In 2024, Extra Space Storage reported a revenue of approximately $2.4 billion, showcasing its financial strength.

- Revenue Growth: Consistent upward trend.

- FFO Strength: Solid and reliable.

- Strategic Investments: Supported by financial stability.

- Market Opportunity: Well-positioned to capitalize.

Extra Space Storage (EXR) exemplifies a "Star" in the BCG matrix due to its strong market presence and financial performance. EXR leverages strategic acquisitions and technology integration to enhance its competitive edge. In 2024, the company reported approximately $2.4 billion in revenue, reflecting its solid financial standing.

| Key Metrics | 2024 Data | Strategic Impact |

|---|---|---|

| Revenue | ~$2.4B | Supports growth, investment |

| Same-Store Revenue Growth (Q3 2024) | 5.2% | Indicates strong market position |

| Acquisitions (Life Storage) | Added 1,000+ properties | Expands market share |

Cash Cows

Extra Space Storage's established properties, a crucial "Cash Cow" in its BCG Matrix, form a stable base. These properties, located in mature markets, yield consistent cash flow. In 2024, these assets contributed significantly to the company's revenue. They also require minimal capital expenditure, boosting profitability.

Extra Space Storage excels with high occupancy, boosting rental revenue. This directly enhances cash flow, a key cash cow trait. In 2024, they reported around 95% occupancy. This is thanks to strong revenue management and brand recognition.

The self-storage sector, including Extra Space Storage, sees customer loyalty due to the hassle of moving belongings. Extra Space Storage emphasizes customer service and accessible locations to maintain customer retention. This customer loyalty generates consistent recurring revenue, as shown by their high occupancy rates. In 2024, Extra Space Storage reported an occupancy rate of approximately 94.8% illustrating the strength of their customer base.

Ancillary Services

Extra Space Storage boosts revenue through ancillary services like tenant insurance and moving supplies, enhancing profitability. These services act as crucial cash cows, especially during market fluctuations. In 2024, these offerings contributed significantly to overall revenue. This strategy helps stabilize returns as the market changes.

- Tenant insurance and moving supplies are key revenue drivers.

- Ancillary services help stabilize returns.

- Extra Space Storage benefits from added profitability.

- These services are part of the company's cash cow strategy.

Efficient Operations

Extra Space Storage excels in efficient operations, a key factor for its cash cow status. They use their size and tech to streamline processes and manage costs effectively. These efficiencies boost cash flow and strengthen their market position. In 2024, they reported a 15.6% increase in same-store revenue.

- Optimized Pricing: Dynamic pricing models.

- Expense Management: Focus on cost control.

- Process Streamlining: Tech-driven efficiency.

- Competitive Advantage: Enhanced cash flow.

Extra Space Storage's "Cash Cows" include established, high-occupancy properties in mature markets that generate stable cash flow. Their customer loyalty and recurring revenue, supported by ancillary services, are key. In 2024, they showed around 94.8% occupancy.

| Aspect | Details | 2024 Data |

|---|---|---|

| Occupancy Rate | Percentage of occupied storage units. | ~94.8% |

| Revenue Growth | Increase in same-store revenue. | 15.6% |

| Key Services | Tenant insurance, moving supplies. | Contributed to profitability. |

Dogs

Some Extra Space Storage locations may be "Dogs" due to lower occupancy or high costs. These stores might struggle against new competition. In 2024, Extra Space Storage's same-store revenue growth was around 2.4%, indicating some locations may lag. Divestiture could be an option if improvement investments fail.

Oversupply in self-storage markets like Orlando and Dallas can hurt Extra Space Storage. New construction leads to lower rental rates and occupancy. In 2024, markets with heavy supply saw rent declines. This impacts financial performance in those specific regions.

Some Extra Space Storage properties might need redevelopment to stay competitive. These projects can be expensive and affect cash flow initially. The company regularly evaluates properties for redevelopment possibilities. In 2024, Extra Space Storage allocated $150 million for same-store revenue growth initiatives, including redevelopments. They aim to boost operating income through these efforts.

High Operating Expenses

Some Extra Space Storage locations, particularly those in prime real estate areas, grapple with elevated operating expenses. These expenses stem from property taxes, insurance, and ongoing maintenance needs. High costs directly impact the profitability of these specific stores, potentially diminishing their cash flow. For instance, in 2024, property tax increases were a challenge for many storage facilities.

- Increased property taxes in major markets affect profitability.

- Insurance and maintenance also contribute to elevated costs.

- Higher expenses lead to lower cash flow for individual stores.

- Operating costs vary significantly by location.

Limited Growth Potential

Some Extra Space Storage properties face limited growth. Market saturation or demographics restrict significant revenue boosts. These units, while stable, are cash traps. In 2024, the self-storage industry's growth slowed, indicating potential saturation in certain areas. Businesses have money tied up even though they bring back almost nothing in return.

- Market saturation limits revenue growth.

- Stable cash flow with minimal increases.

- Properties considered cash traps.

- Industry slowed growth in 2024.

Dogs in Extra Space Storage's portfolio face challenges like slow growth and high costs. These properties may suffer from oversupply or market saturation, impacting financial performance. In 2024, same-store revenue growth was around 2.4%, signaling potential issues in some locations.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Low Occupancy | Reduced revenue | Same-store revenue growth at 2.4% |

| High Expenses | Lower Profitability | Property taxes increased |

| Market Saturation | Limited Growth | Industry growth slowed |

Question Marks

Extra Space Storage's foray into new markets lands it in the "Question Mark" quadrant of the BCG Matrix. These expansions, like those in 2024, carry inherent risks due to unknown demand and competition. Significant capital, as seen in their strategic acquisitions, is often needed for marketing and infrastructure development. The goal is to increase market adoption of their storage solutions.

Extra Space Storage's foray into innovative solutions, like climate-controlled units, faces market uncertainty. These ventures require strong marketing to boost adoption. If these don't quickly capture market share, they could become "dogs". In Q3 2024, Extra Space Storage's revenue was $835.8 million. This is a critical factor to consider.

Extra Space Storage's joint ventures carry inherent risks tied to partner dynamics and possible goal clashes. Successful ventures hinge on strong alignment and effective teamwork. In 2024, the company allocated $66 million to redevelopment projects. These investments highlight the commitment to growth, despite the partnership dependencies. The outcome is subject to the partners' collaboration.

Technology Investments

Extra Space Storage's technology investments, while promising, fall into the question mark quadrant of the BCG matrix, given the inherent risks. Despite the potential for enhanced efficiency and customer experience, there's a chance these initiatives won't yield anticipated financial returns. For 2024, the company allocated approximately $40 million to technology upgrades, including those mentioned. However, the success hinges on effective implementation and customer acceptance.

- 2024 Tech Investment: $40M

- Website Natural Language Search: Aiming for improved user experience.

- AI-Powered Chatbots: Focus on customer service enhancement.

- Intelligent Virtual Agents: Goal is to streamline call center operations.

Bridge Loan Program

Extra Space Storage's bridge loan program provides financing to third-party self-storage owners, representing a 'Question Mark' in its BCG matrix. This segment involves risks, including potential loan defaults that could affect the company's financial health. Despite these risks, the business unit is experiencing rapid growth, positioning it for potential future gains. It has the opportunity to evolve into a 'Star' within a high-growth market, if successful.

- Bridge loans provide short-term financing.

- Defaults could hurt financials.

- High growth potential exists.

- Could become a 'Star'.

Extra Space Storage's "Question Marks" include new markets and ventures, each with varying degrees of risk and reward. Successful initiatives like climate-controlled units depend heavily on market adoption, and the company invested $40M in technology. Bridge loans, while high-growth, carry default risks. Extra Space Storage’s revenue was $835.8 million in Q3 2024.

| Category | Risk | Opportunity |

|---|---|---|

| New Markets | Unknown demand, competition | Market share gain |

| Tech Investments | Implementation issues | Efficiency, customer experience |

| Bridge Loans | Loan defaults | Rapid growth, future gains |

BCG Matrix Data Sources

Our BCG Matrix relies on SEC filings, market research reports, and competitor performance data, for strategic and comprehensive coverage.