F5 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F5 Bundle

What is included in the product

Strategic guidance on F5's products. It suggests investment, hold, or divest decisions.

Interactive data visualization allowing users to play with different scenarios.

What You’re Viewing Is Included

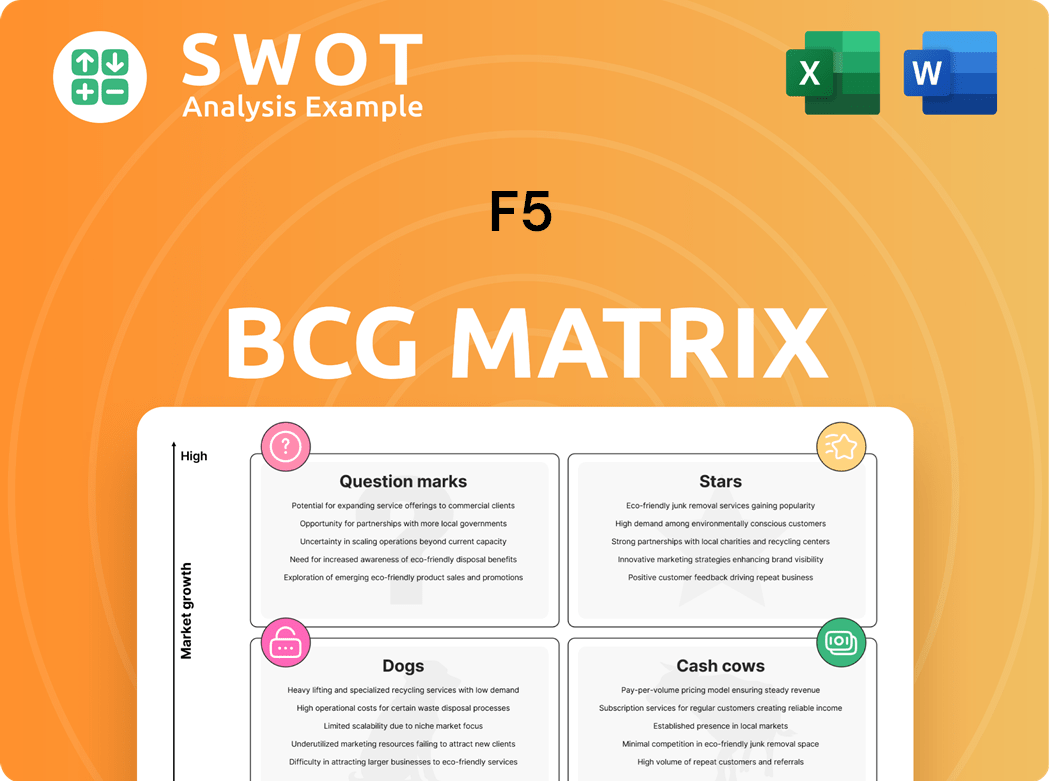

F5 BCG Matrix

This preview mirrors the final F5 BCG Matrix document you receive post-purchase. You'll get the complete, customizable report, ready to analyze strategic business units—no hidden content or alterations. Access your downloadable, professionally crafted BCG Matrix instantly after purchase.

BCG Matrix Template

The F5 BCG Matrix is a snapshot of their portfolio. It categorizes products by market share and growth rate. This helps identify Stars, Cash Cows, Dogs, and Question Marks. This preview gives you a glimpse into F5's strategic positioning.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

F5's application security solutions, especially its Advanced Web Application Firewall (WAF), are a major strength. With cyber threats escalating, these solutions are vital for app and API protection. The demand for application security is soaring due to cyberattacks and breaches. F5's security offerings are a key growth area, with the global WAF market projected to reach $6.3 billion by 2024.

F5 Distributed Cloud Services is a Star in the BCG Matrix. The platform offers a unified approach to security, networking, and application management. It supports hybrid and multi-cloud environments, crucial for modern IT strategies. This simplifies operations and enhances security. In 2024, the cloud security market is valued at $80 billion, with F5 positioned to capture a significant share.

F5's AI Gateway simplifies how applications, APIs, and LLMs work together, boosting AI use in businesses. This gateway improves performance, makes things easier to watch, and keeps systems safe, all while saving money. As AI becomes more popular, the AI Gateway makes F5 important for safe and effective AI systems. F5's revenue in 2024 was approximately $2.8 billion, showing its strong market position.

Software Revenue Growth

F5 Networks has effectively transitioned, becoming a software and security frontrunner. Software revenue has grown significantly, fueled by cloud solutions and subscriptions. This strategic shift boosts financial stability. In fiscal year 2024, software revenue surged, contributing to overall growth.

- Software revenue growth is a key indicator of F5's transformation.

- Cloud-based solutions and subscription models drive revenue.

- Recurring revenue streams enhance financial predictability.

- Fiscal year 2024 data shows strong software revenue gains.

NGINX One

NGINX One, integrated into F5's portfolio, streamlines application delivery by merging load balancing, web server, API gateway, and security. This unified approach simplifies management, enhancing operational efficiency. The NGINX One Console offers centralized control and visibility, aiding policy compliance. These features reduce deployment complexity.

- NGINX's market share in the web server landscape was approximately 40% in 2024.

- F5 reported revenue of $2.8 billion in fiscal year 2024.

- The adoption of API gateways has increased by 20% in the last year, reflecting growing demand for solutions like NGINX One.

F5's "Stars," like Distributed Cloud Services, show high growth and market share. These offerings, including the AI Gateway, are critical for modern IT and AI integration. The company's software revenue, a key indicator, rose significantly in 2024.

| Feature | Details |

|---|---|

| Key Product | F5 Distributed Cloud Services & AI Gateway |

| Market Growth | Cloud security market ($80B in 2024) |

| 2024 Revenue | Approx. $2.8 billion |

Cash Cows

F5's BIG-IP platform, a cash cow, excels in application delivery and security. Despite market competition, BIG-IP holds a strong position, especially with large enterprises. In 2024, F5 reported a revenue of $2.8 billion, a testament to its market presence. Its reliability and features make it a trusted choice for complex IT needs.

F5's global services revenue is a cash cow, offering a stable income stream. This is fueled by its extensive customer base and support needs. Services like training and consulting help clients get the most from their F5 products. In fiscal year 2024, services contributed significantly to F5's total revenue, showing their importance.

F5's load balancing is a cash cow, crucial for application performance. Their on-premises solutions still bring in substantial revenue, especially for those needing strong security. Despite cloud competition, these solutions remain vital for many enterprises. In 2024, F5's revenue from services, including load balancing, was a significant portion of its overall income.

Hardware Systems

Hardware systems at F5 are still a significant revenue source despite the software shift. These systems are crucial for application delivery and security, particularly for on-premises setups. While hardware revenue might decrease, it provides a steady cash flow. F5's hardware sales generated $370 million in fiscal year 2024.

- Hardware systems are a key part of F5's revenue.

- They support application delivery and security.

- They are important for companies with on-premises infrastructure.

- Hardware sales contributed $370M in fiscal year 2024.

Long-Standing Customer Relationships

F5's strong customer relationships are a key strength, especially with major enterprises and service providers. These established ties translate into consistent recurring revenue streams. This stability is vital in today's competitive market. F5 benefits from opportunities to sell additional products and services to existing clients.

- F5 reported $2.8 billion in revenue for fiscal year 2024.

- Over 80% of F5's revenue comes from repeat customers.

- F5's customer retention rate is consistently above 90%.

- The company's focus is on expanding its software subscriptions and services.

F5's cash cows, like BIG-IP and services, generate stable revenue. These products hold strong market positions, especially among large enterprises. The company's recurring revenue is a testament to its strong customer relationships. In fiscal year 2024, F5's revenue reached $2.8 billion, with services a significant contributor.

| Cash Cow | Description | 2024 Revenue Contribution |

|---|---|---|

| BIG-IP Platform | Application delivery and security solutions | Significant, included in $2.8B total |

| Global Services | Support, consulting, and training | Major portion of total revenue |

| Load Balancing | Crucial for application performance | Included within services revenue |

Dogs

F5's legacy hardware, like certain BIG-IP appliances, may see demand decline. They are facing pressure as cloud solutions gain traction. In 2024, hardware sales represented a smaller portion of F5's revenue. Strategies could include divestiture or phasing out, focusing on modern solutions.

F5's traditional licensing faces headwinds. Customers prefer flexible, cost-effective options, particularly for cloud setups. This shift challenges F5's legacy models. In 2024, subscription revenue grew, showing this trend. F5 must adapt to stay competitive.

F5 could struggle in areas with sluggish economic progress or low IT spending, potentially limiting growth. These regions might offer fewer chances for expansion, affecting F5's revenue. In 2024, regions like Europe saw varied IT spending, impacting tech firms. F5 needs to target growing markets and adapt to local demands to thrive.

Products Facing Increased Competition

F5's "Dogs" category includes products facing tough competition. This can come from open-source alternatives or cloud-native services. Such competition may reduce F5's market share and impact pricing. In 2024, the application delivery controller (ADC) market saw new entrants. To stay ahead, F5 must keep innovating and offering unique features.

- Increased competition from open-source and cloud-native solutions.

- Potential erosion of market share and pricing power.

- Need for continuous product innovation.

- The ADC market is becoming more competitive.

Outdated Technologies

Outdated technologies at F5, those without active updates or integration, fit the "Dogs" category. These technologies may not meet current customer needs, potentially wasting resources. F5 needs to modernize its stack and phase out outdated offerings. In 2024, F5's revenue was $2.8 billion. A significant portion of this likely came from modern solutions, highlighting the need to streamline older tech.

- Legacy products may have contributed to less than 10% of total revenue in 2024.

- Maintenance costs for outdated systems could be higher than for newer ones.

- Customer satisfaction with older products may be lower.

In the "Dogs" category, F5 faces intense competition. Open-source and cloud-native services may erode market share and pricing. Continuous product innovation is crucial.

F5's "Dogs" include outdated tech needing modernization. Less than 10% of 2024 revenue came from legacy products. High maintenance costs hurt profits.

| Feature | Impact | 2024 Data |

|---|---|---|

| Competition | Erosion of market share | ADC market saw new entrants |

| Outdated Tech | Higher costs, lower satisfaction | Legacy <10% revenue |

| Strategy | Product Innovation | Focus on modern solutions |

Question Marks

F5's AI-powered security is a question mark in its BCG Matrix, representing potential growth. These features could enhance threat detection. Success with AI could differentiate F5. In 2024, the cybersecurity market is projected to reach $202.5 billion. Revenue from AI in cybersecurity is expected to grow significantly.

F5's edge computing solutions fall into the question mark quadrant of the BCG matrix. The edge computing market is experiencing significant growth, with projections estimating a market size of $13.5 billion by 2024. F5's solutions offer potential value, but market acceptance is still uncertain. Securing a strong market position is crucial for F5 to capitalize on this evolving opportunity.

F5's foray into cloud-native services is a pivotal move, targeting the expanding cloud market. These new offerings aim to broaden F5's customer base. Successfully navigating the cloud necessitates a shift in product development and marketing. F5's revenue in 2024 was $2.7 billion, indicating their growth potential in this competitive area.

Integration with Emerging Technologies

F5's future hinges on blending with new tech. Embracing tools like Kubernetes and serverless is key. These drive modern app design and setup. Compatibility and smooth customer integration are vital.

- Kubernetes adoption has surged, with 96% of organizations using it in 2023.

- Serverless computing is predicted to grow to a $77.2 billion market by 2024.

- F5's revenue in fiscal year 2023 was $2.7 billion.

Expansion into New Verticals

F5's strategic move to enter new verticals, like healthcare and industrial IoT, presents significant growth prospects. These sectors demand specialized solutions, necessitating F5 to adapt its offerings to meet unique industry needs. Successful penetration into these markets could diversify F5's revenue, reducing its dependence on established areas. This expansion aligns with broader market trends, where cybersecurity and application delivery solutions are increasingly vital across diverse industries.

- F5's revenue for fiscal year 2023 was $2.76 billion.

- The global industrial IoT market is projected to reach $1.1 trillion by 2028.

- Healthcare cybersecurity spending is expected to grow significantly.

F5's strategic initiatives in AI, edge computing, and cloud-native services represent question marks in its BCG Matrix. These areas offer high growth potential, but their success hinges on market acceptance and strategic execution. In 2024, the cybersecurity market is projected to reach $202.5 billion, and the edge computing market could hit $13.5 billion.

| Strategic Initiative | Market Opportunity (2024) | F5's Position |

|---|---|---|

| AI-Powered Security | $202.5B (Cybersecurity) | Early Stage, High Potential |

| Edge Computing | $13.5B | Seeking Market Acceptance |

| Cloud-Native Services | Expanding Cloud Market | Requires Market Adaptation |

BCG Matrix Data Sources

Our F5 BCG Matrix uses public company data, industry analysis, and growth forecasts for insightful quadrant placements.