FactSet Research Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FactSet Research Systems Bundle

What is included in the product

Clear descriptions & insights for Stars, Cash Cows, Question Marks, and Dogs.

Customizable FactSet BCG matrix with export-ready design for seamless drag-and-drop into presentations.

Delivered as Shown

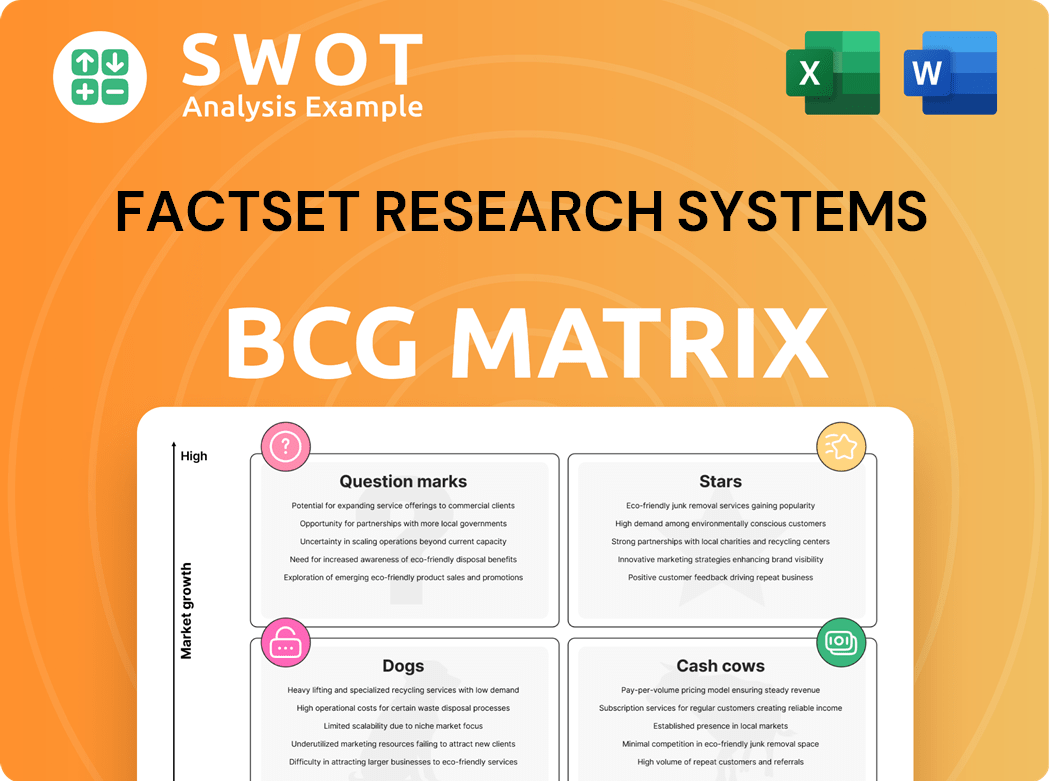

FactSet Research Systems BCG Matrix

The BCG Matrix preview displays the identical report you'll receive after purchase. This FactSet-crafted document delivers a complete, ready-to-use analysis, enabling you to make informed strategic decisions. Download the full, formatted version directly after buying; it's ready for immediate integration.

BCG Matrix Template

FactSet Research Systems' BCG Matrix offers a snapshot of its product portfolio's market position. The analysis categorizes offerings as Stars, Cash Cows, Dogs, or Question Marks. This preliminary view highlights potential areas for strategic focus. Understanding the quadrant placements is key to investment decisions. But this preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

FactSet's "Stars" category highlights its AI-powered workflow solutions. The company is embedding AI to boost client productivity. Conversational AI aids research and report creation. These innovations aim to dramatically improve client efficiency. In Q1 2024, FactSet's AI initiatives saw a 20% increase in user engagement.

FactSet has successfully broadened its reach in wealth management. User growth and strategic wins highlight this expansion, particularly in 2024. The firm's focus on this segment indicates a robust growth path. For instance, FactSet reported a 6.6% increase in organic annual subscription value in Q1 2024, driven by strong performance in Wealth Management.

FactSet strategically acquires companies to boost its offerings and expand reach. Recent buys like Irwin and LiquidityBook aim to grow Annual Subscription Value (ASV). In 2024, FactSet's revenue grew, reflecting these strategic moves. These acquisitions support FactSet's goal of offering thorough client solutions.

High ASV Retention Rate

FactSet's "Stars" category, highlighted by its high Annual Subscription Value (ASV) retention rate, signifies robust customer loyalty. This high retention is a key indicator of client satisfaction and the value they derive from FactSet's offerings. A strong retention rate is essential for stable revenue streams and long-term growth. For example, in fiscal year 2023, FactSet's ASV retention rate was over 90%, showcasing its ability to retain clients.

- High retention rates demonstrate strong customer relationships.

- Loyal customers contribute to predictable revenue.

- FactSet's services are highly valued by clients.

- Retention is critical for sustainable financial performance.

Geographic Expansion in Asia Pacific

FactSet's expansion in the Asia Pacific region is a key growth driver, reflected in strong organic growth. The Asia Pacific region's quarterly organic revenue growth rate was 6.2% year-over-year. This demonstrates successful market penetration and increasing demand for FactSet's services in the area. This expansion is critical for future growth.

- Asia Pacific's organic revenue growth rate highlights market success.

- FactSet is capitalizing on the region's expanding financial market.

- The growth aligns with the company's strategic geographic priorities.

- Increased ASV (Annual Subscription Value) suggests growing adoption.

FactSet's "Stars" are high-growth, high-share areas. These include AI, wealth management, and strategic acquisitions. High ASV retention and Asia-Pacific growth drive their star status. In Q1 2024, Asia-Pacific revenue grew by 6.2%.

| Metric | Details | Data (2024) |

|---|---|---|

| AI User Engagement | Increase in usage | 20% in Q1 |

| Wealth Management Growth | Organic subscription value increase | 6.6% in Q1 |

| ASV Retention Rate | Client retention rate | Over 90% (FY2023) |

Cash Cows

FactSet's core platform is a cash cow, generating consistent revenue. It delivers integrated financial info and analytics to global investors. The platform boasts a large client base. In 2024, FactSet's revenue was $2.15 billion, highlighting its financial stability.

FactSet's subscription model offers revenue stability. This model generated $2.1 billion in revenue in fiscal year 2024. The recurring revenue stream aids in forecasting and supports client retention, which was at 89% in 2024. This drives consistent financial performance.

FactSet's strong market position stems from its dominance in financial data and analytics. The firm's unique offerings leverage extensive connected data assets and integrated AI. In 2024, FactSet's revenue reached $2.1 billion, reflecting its robust market presence. Analysts see this as a competitive advantage in the financial data sector.

Enterprise Solutions Provider

FactSet stands as a Cash Cow in its BCG Matrix, known for reliable enterprise solutions. It provides services to a diverse clientele, like asset managers and investment banks. This broad customer base helps FactSet maintain a steady revenue flow and reduce financial risks. In 2024, FactSet's revenue reached $2.15 billion, a testament to its strong market position.

- Consistent revenue growth is a key indicator.

- Diverse client base mitigates financial risks.

- FactSet's enterprise solutions are highly valued.

- Strong financial performance in 2024.

High Client and User Base

FactSet's substantial client and user base underscores its robust market position. As of November 30, 2024, they served 8,249 clients and had 218,267 users. This extensive reach fortifies FactSet's recurring revenue streams. This widespread adoption highlights the company's financial health and stability.

- Client Base: 8,249 clients as of November 30, 2024.

- User Base: 218,267 users as of November 30, 2024.

- Revenue Impact: Contributes significantly to recurring revenue.

- Market Presence: Indicates a strong and established market position.

FactSet's Cash Cow status is clear. The company's financial stability is evident, with $2.15 billion in revenue in 2024. A broad customer base and subscription model drive consistent revenue.

| Metric | Value (2024) | Impact |

|---|---|---|

| Revenue | $2.15B | Financial Stability |

| Client Retention | 89% | Recurring Revenue |

| Clients | 8,249 | Market Reach |

Dogs

FactSet is phasing out unsupported legacy solutions. This strategic move aims to cut costs and improve efficiency. It may result in some client churn, though. These legacy products are "dogs" in the BCG matrix, not driving growth. In 2024, FactSet spent $150 million on streamlining its product suite.

FactSet faces stiff competition, especially from Bloomberg and Refinitiv. These products might struggle to gain market share, thus labeled as "dogs" in the BCG matrix. Continuous innovation and differentiation are vital for FactSet to stay competitive. In 2024, Bloomberg's revenue was approximately $13 billion, highlighting the scale of competition.

Some FactSet services might show low growth in certain areas. For example, in EMEA, the Q1 2024 organic revenue growth was only 2.7%. This could mean needing more investment or a change in strategy there. Slow growth in crucial regions can drag down the company's overall results.

Products with Declining Margins

Products facing declining margins due to rising costs or intense competition often become "dogs" in the BCG matrix. These items may not be profitable enough to warrant continued investment. Businesses must carefully assess cost management and pricing strategies to improve profitability. For instance, in 2024, the consumer discretionary sector saw margin compression due to inflation and shifting consumer behavior.

- Margin decline can be caused by increased production costs or lower selling prices.

- These products struggle to generate sufficient profits.

- Businesses must evaluate cost-cutting measures and pricing strategies.

- The consumer discretionary sector faced margin pressures in 2024.

Underperforming Sell-Side Segment

The sell-side segment of FactSet Research Systems, categorized as a "Dog" in the BCG Matrix, has lagged behind the buy-side in terms of organic growth. As of February 28, 2024, the buy-side's organic annual growth rate was 6.3%, while the sell-side's was 3.8%. This segment faces challenges that need strategic attention. FactSet must identify and address these specific issues to improve performance.

- Lower Growth: The sell-side segment has shown lower organic ASV growth.

- Buy-Side Comparison: The buy-side segment consistently outperforms the sell-side.

- Strategic Focus: FactSet needs targeted strategies to improve performance in this segment.

- Understanding Challenges: FactSet must understand the challenges and opportunities within this segment.

FactSet's "Dogs" struggle with low growth, intense competition, and declining margins.

These underperforming products require strategic attention to improve profitability and market share.

The sell-side segment, an example, underperformed the buy-side in 2024, highlighting challenges.

| Category | Key Issues | 2024 Impact/Data |

|---|---|---|

| Low Growth | Slow revenue increase | EMEA Q1 organic growth: 2.7% |

| Competition | Market share challenges | Bloomberg revenue (approx.): $13B |

| Margin Decline | Rising costs, lower prices | Consumer discretionary sector margin pressure in 2024 |

Question Marks

FactSet's conversational AI, launching in early 2025, is a high-potential, new venture. This integration aims to assist users with text-heavy tasks like reports and memos. Its success hinges on user adoption and demonstrable benefits. In 2024, FactSet's revenue grew, showing its capacity for innovation. The effective integration of AI could further boost user engagement and market share.

FactSet's DaaS is a recent venture, its market reception still developing. It offers data collection, management, and integration for financial institutions' data teams. Its success hinges on client need satisfaction and market competitiveness. In 2024, the DaaS market was valued at approximately $2.5 billion, showing growth potential.

FactSet's Enterprise AI Building Blocks, for technologists building bots or AI workflows, represent a new growth area. Success hinges on usability and value for developers. FactSet must market these tools effectively. The global AI market is projected to reach $200 billion by 2025.

Pitch Creator and Logo Intern Solutions

FactSet's Pitch Creator and Logo Intern, designed for junior bankers, are recent additions with market penetration still developing. The Pitch Creator automates pitch book tasks like chart creation and slide development, aiming to save time. These solutions must prove their worth to encourage broader usage within the financial sector. Currently, FactSet's revenue grew by 8.9% in the last fiscal year.

- Pitch Creator automates pitch book tasks.

- Logo Intern streamlines design processes.

- Market adoption is still developing.

- FactSet's revenue growth was 8.9% in the last fiscal year.

Expansion into Private Equity and Venture Capital

FactSet is broadening its reach to include more private equity and venture capital firms, a strategic move representing a significant growth opportunity. This expansion requires FactSet to adapt its offerings to meet the specific, often specialized, needs of these clients. The success of this venture hinges on FactSet's ability to attract and retain these new clients by providing tailored solutions. FactSet must focus on providing data and analytics that cater to the unique demands of these firms.

- FactSet's revenue for fiscal year 2024 was $2.15 billion.

- FactSet's client count as of August 31, 2024, was 8,062.

- The private equity market is expected to grow, presenting a larger customer base.

- FactSet's expansion into this area could increase its market share.

FactSet's ventures, like Pitch Creator, are Question Marks. Their market impact is still developing, needing focused growth strategies. Despite FactSet's revenue of $2.15B in 2024, these new tools face uncertain market positions.

| Product | Status | Consideration |

|---|---|---|

| Pitch Creator/Logo Intern | Market Development | Enhance user adoption |

| Enterprise AI Building Blocks | New Growth Area | Focus on usability |

| DaaS | Recent Venture | Meet client needs |

BCG Matrix Data Sources

FactSet's BCG Matrix utilizes comprehensive market data, financial filings, competitive intelligence, and expert assessments for impactful strategic positioning.