Fast Retailing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fast Retailing Bundle

What is included in the product

Analysis of Fast Retailing's competitive environment, detailing threats, influence, and potential for growth.

Customize pressure levels based on new data to adapt to changing fast fashion markets.

Full Version Awaits

Fast Retailing Porter's Five Forces Analysis

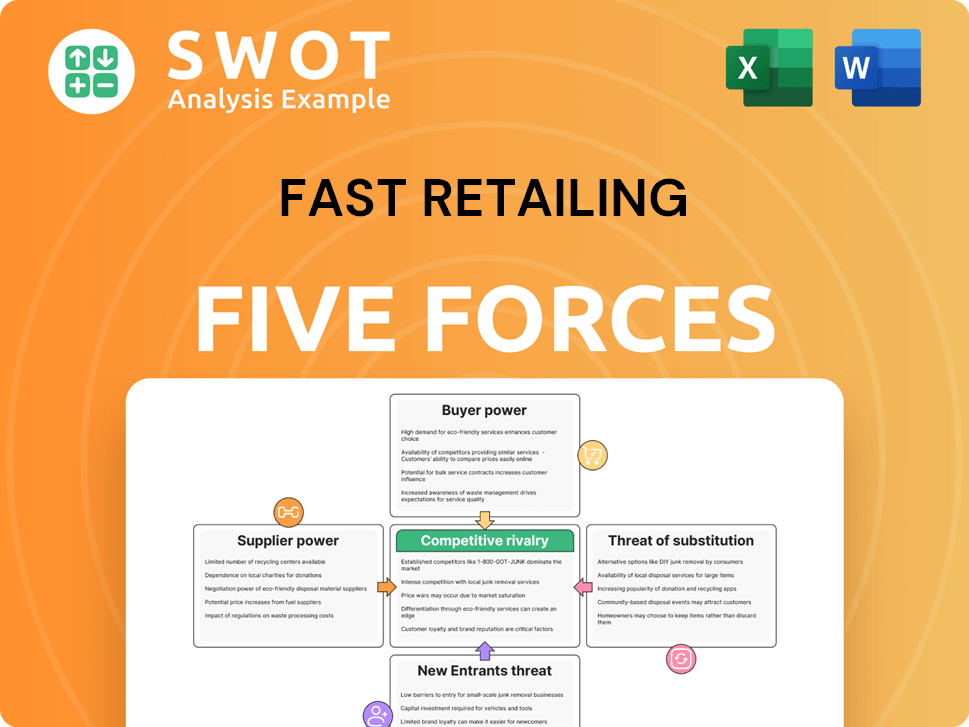

This preview details Fast Retailing's Porter's Five Forces analysis. The document examines competitive rivalry, supplier power, buyer power, threats of substitutes, and new entrants. It reveals the industry's dynamics and strategic implications. You're viewing the complete analysis; it’s what you download upon purchase.

Porter's Five Forces Analysis Template

Fast Retailing faces moderate supplier power, primarily due to its reliance on global textile manufacturers. Buyer power is significant, driven by consumer price sensitivity and readily available alternatives. The threat of new entrants is moderate, considering the capital-intensive nature and established brand presence. Substitute products, like other clothing brands, pose a considerable threat. Finally, the intensity of competitive rivalry is high within the fast-fashion industry.

Ready to move beyond the basics? Get a full strategic breakdown of Fast Retailing’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Fast Retailing maintains a diverse supplier network, which is crucial. This reduces the company's dependence on any single supplier. As of 2024, Fast Retailing sources from many countries, limiting supply chain risks. This diversification strengthens its negotiating position. Consequently, Fast Retailing can secure favorable terms.

Fast Retailing's global sourcing strategy strengthens its negotiation position with suppliers. A wide sourcing network boosts access to diverse materials and production options. This flexibility allows Fast Retailing to move production, reducing supplier influence. In 2024, Fast Retailing sourced from various countries, enhancing its bargaining power.

Fast Retailing, while not fully vertically integrated, strategically partners with suppliers. These collaborations boost innovation and secure high-quality materials. For instance, in 2024, Fast Retailing's supply chain partnerships contributed to a 10% reduction in production costs. Close relationships streamline the supply chain and offer a competitive edge. These partnerships are vital for maintaining a steady supply and controlling costs.

Cost Leadership Focus

Uniqlo's cost leadership strategy impacts supplier bargaining power. Fast Retailing's stringent cost management demands competitive pricing from suppliers. This pressure is intensified by the company's operational efficiency and large order volumes. In 2024, Fast Retailing's revenue reached approximately $26.8 billion, highlighting its significant purchasing power.

- Competitive Pricing: Suppliers must offer low prices.

- Operational Efficiency: Fast Retailing's efficiency boosts its influence.

- Large Order Volumes: Fast Retailing's purchasing power is substantial.

- Revenue in 2024: Around $26.8 billion emphasizes its market strength.

Ethical Sourcing Standards

Fast Retailing's ethical sourcing and sustainability commitments impact supplier relationships. Suppliers must comply with strict standards, which may raise their operational costs. This approach can also attract suppliers who prioritize ethical conduct and long-term collaborations. In 2024, Fast Retailing reported that 98% of its strategic suppliers had signed its Code of Conduct. This demonstrates a strong emphasis on ethical practices.

- Compliance Costs: Suppliers face expenses related to meeting ethical standards.

- Attractiveness: Ethical practices can attract suppliers valuing long-term partnerships.

- Code of Conduct: Fast Retailing's Code of Conduct is a key element.

- Supplier Adherence: High percentage of strategic suppliers adhere to the code.

Fast Retailing’s diverse sourcing network and cost leadership enhance its bargaining power with suppliers. Its global sourcing and strategic partnerships allow for flexibility and competitive pricing. In 2024, the company's revenue of $26.8 billion underscores its significant influence in negotiations.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Sourcing Strategy | Reduces supplier dependence. | Sourced from many countries. |

| Cost Leadership | Demands competitive pricing. | Revenue ~$26.8B. |

| Ethical Sourcing | Influences supplier relationships. | 98% suppliers signed Code of Conduct. |

Customers Bargaining Power

Fast Retailing's customers, especially those of Uniqlo, demonstrate significant price sensitivity. The company's value-based pricing, which offers affordable, quality apparel, appeals to a wide audience. This sensitivity gives customers leverage, enabling them to choose competitors if prices increase. In 2024, Uniqlo's focus on accessible pricing played a key role in its global sales growth.

Uniqlo's strong brand loyalty reduces customer bargaining power. This loyalty comes from functional clothing and a consistent brand experience. In 2024, Uniqlo's global sales increased. Brand loyalty helps maintain pricing, even with competition. This is due to its loyal customer base.

Uniqlo's extensive product availability, spanning physical stores and online platforms, boosts customer convenience and choice. This ease of access allows customers to readily compare prices and styles, amplifying their bargaining power. The company's effective omnichannel strategy, highlighted by a strong online presence, further strengthens customer influence. In 2024, Fast Retailing's e-commerce sales were a significant part of total revenue, reflecting the impact of digital accessibility on customer dynamics.

Fashion Trends

Customers wield significant power in the fashion industry, driven by fluctuating trends and a plethora of brand choices. Fast Retailing, like its competitors, faces the challenge of keeping its offerings appealing and fresh to retain customer loyalty. Failing to meet evolving consumer preferences can lead to a swift shift in customer allegiance to other brands. In 2024, the global apparel market reached approximately $1.7 trillion, highlighting the competitive landscape.

- Fashion's rapid cycles demand constant innovation.

- Customer loyalty is tested by diverse brand options.

- Fast Retailing must stay ahead of trends to succeed.

- Market size reflects the high stakes of consumer choice.

Transparency and Sustainability

Customers are increasingly focused on transparency and sustainability in the fashion industry. Fast Retailing's commitment to these areas can enhance brand loyalty. This approach can make customers less price-sensitive, supporting the company's pricing strategies. In 2023, Fast Retailing reported a 10.2% increase in revenue, reflecting strong customer engagement.

- Fast Retailing's revenue increased by 10.2% in 2023.

- Sustainability efforts boost customer loyalty.

- Loyal customers are less price-sensitive.

- Transparency builds trust.

Customer bargaining power at Fast Retailing is complex, shaped by price sensitivity and brand loyalty. Accessible pricing and widespread availability impact this dynamic. The competitive fashion market, with its trends, affects customer choices. Fast Retailing's 2024 sales demonstrate this interplay.

| Factor | Impact on Bargaining Power | 2024 Data/Example |

|---|---|---|

| Price Sensitivity | High, customers can switch brands. | Uniqlo's accessible pricing strategy in 2024 aimed at retaining customers. |

| Brand Loyalty | Lowers bargaining power. | Uniqlo's loyal customer base supported stable pricing in 2024. |

| Product Availability | Increases customer choice & power. | E-commerce contributed significantly to 2024 revenue, enhancing customer choices. |

Rivalry Among Competitors

The fast fashion arena, including giants like Zara and H&M, is fiercely competitive. Fast Retailing, the parent company of Uniqlo, faces constant pressure to innovate. In 2024, Fast Retailing's revenue was ¥3.06 trillion, illustrating the scale of the competition. Pricing and marketing are key battlegrounds.

Fast Retailing's global ambitions significantly fuel competitive rivalry. The company's foray into diverse markets, like the US, pits it against formidable players. Success hinges on tailoring offerings to local preferences; this demands substantial investment. For instance, Uniqlo's 2023 revenue in North America was ¥187.1 billion, highlighting the stakes.

The surge in e-commerce has intensified competition. Online retailers, such as Shein and Temu, are major threats. Fast Retailing needs robust online platforms. In 2024, online sales grew, emphasizing digital investment. Fast Retailing's digital marketing is crucial for survival.

Innovation and Technology

Technological innovation significantly shapes competitive dynamics in the apparel industry. Uniqlo's success hinges on proprietary technologies like HEATTECH and AIRism, giving it a distinct advantage. Fast Retailing allocates substantial resources to R&D to maintain its edge. This continuous investment allows them to introduce new fabrics and designs, setting them apart. Staying ahead requires ongoing efforts in innovation.

- Fast Retailing's R&D expenses in fiscal year 2023 were ¥3.8 billion.

- Uniqlo's HEATTECH and AIRism technologies are key differentiators.

- Technological advancements in fabrics and garment design drive competition.

- Investment in R&D is crucial for maintaining a competitive advantage.

Sustainability Concerns

Sustainability concerns are intensifying competitive rivalry in the apparel industry. Consumers increasingly favor eco-conscious brands, pushing companies to adopt green practices. Fast Retailing's sustainability efforts, such as using recycled materials and reducing emissions, could set it apart. This focus is vital as the market for sustainable fashion is expected to reach $9.81 billion by 2025.

- Increased consumer demand for sustainable products.

- Pressure on brands to improve supply chain transparency.

- Fast Retailing's initiatives as a differentiator.

- Market growth forecast for sustainable fashion.

Competitive rivalry in fast fashion, including Fast Retailing, is intense. Continuous innovation, such as Uniqlo's HEATTECH, is crucial for maintaining a competitive advantage. The company's R&D spending in 2023 was ¥3.8 billion, emphasizing its commitment to staying ahead.

| Aspect | Details |

|---|---|

| Market Size | Fast fashion market is highly competitive. |

| R&D Spending (2023) | ¥3.8 billion |

| Revenue (2024) | Fast Retailing: ¥3.06 trillion |

SSubstitutes Threaten

Generic apparel poses a threat to Fast Retailing. These budget-friendly options offer lower prices, potentially appealing to value-conscious consumers. Uniqlo's brand and innovative designs face competition from these alternatives. In 2024, the global fast fashion market was valued at $106.4 billion, highlighting the scale of this threat.

The secondhand market presents a significant substitution threat to Fast Retailing. Consumers increasingly opt for pre-owned clothing, seeking value and variety. In 2024, the global secondhand apparel market reached $210 billion, showcasing its substantial growth. Fast Retailing must embrace sustainability to compete.

Rental services pose a threat to Fast Retailing by offering an alternative to buying new clothes. These services appeal to consumers looking for variety and lower costs. The clothing rental market was valued at $1.26 billion in 2023. Fast Retailing could explore rental models to compete and retain customers.

DIY Fashion

The DIY fashion movement, including upcycling, poses a growing threat to Fast Retailing. Consumers are turning to create their own clothes, impacting demand for new apparel. This shift highlights a preference for customization and sustainable practices, potentially affecting Fast Retailing's market share. In 2024, the secondhand clothing market is estimated to reach $218 billion, showing the scale of this substitution.

- Increased interest in creating and modifying clothing.

- Shift towards sustainable and customized fashion.

- Potential impact on Fast Retailing's sales and market share.

- Growth of the secondhand clothing market.

Private Label Brands

The threat of substitutes for Fast Retailing comes from private label brands, especially in the apparel industry. These brands, sold by retailers like H&M and Zara, provide similar fashion styles at lower prices. Retailers use their customer base and distribution networks to their advantage. To compete, Fast Retailing must focus on product innovation and strengthening its brand.

- In 2024, the global apparel market was valued at approximately $1.7 trillion.

- Private label brands account for a significant and growing portion of apparel sales.

- Fast Retailing's revenue for fiscal year 2024 was approximately $26.8 billion.

- Uniqlo, a Fast Retailing brand, must continually update its product offerings to stay competitive.

The threat of substitutes significantly impacts Fast Retailing's market position. Secondhand markets and DIY fashion represent growing alternatives, reflecting consumer preferences for sustainability and customization. These trends, combined with private label brands, challenge Fast Retailing's sales. In 2024, the global apparel market was valued at $1.7 trillion.

| Substitute Type | Market Size (2024) | Implication for Fast Retailing |

|---|---|---|

| Secondhand Apparel | $218 billion | Increased competition, need for sustainable practices |

| DIY Fashion | Growing, difficult to quantify | Impact on demand for new apparel, focus on customization |

| Private Label Brands | Significant market share | Pressure on pricing, need for innovation & brand strength |

Entrants Threaten

The ease of entry into online retail is a notable threat. New online fashion retailers can rapidly capture market share. Fast Retailing must continuously adapt its online strategy. In 2024, online sales represented a significant portion of total retail sales. Fast Retailing's digital sales grew, but competition remains fierce.

Direct-to-consumer (DTC) brands pose a growing threat, reshaping the fashion industry landscape. These brands, like Allbirds and Everlane, sidestep traditional retail, connecting directly with consumers. Fast Retailing must fortify brand loyalty and customer engagement to compete effectively. In 2024, DTC sales are projected to reach $175 billion, highlighting the need for Fast Retailing to adapt.

New entrants targeting niche markets, like sustainable fashion, pose a threat. These firms address specific consumer demands. Fast Retailing must be adaptable to evolving trends. For instance, the global sustainable fashion market was valued at $9.81 billion in 2023. This market is projected to reach $15.74 billion by 2028.

Global Brands

Global brands pose a threat to Fast Retailing. Companies like H&M and Zara, with established reputations, could enter Fast Retailing's markets. These entrants possess significant resources. Fast Retailing must use its strengths effectively. For example, in 2024, H&M's revenue was approximately $21.7 billion.

- Increased Competition: New entrants intensify market competition.

- Resource Advantage: Global brands often have greater financial and marketing resources.

- Brand Recognition: Established brands bring pre-existing customer loyalty.

- Market Adaptation: Fast Retailing must adapt to local market preferences.

Capital Intensity

Capital intensity poses a significant barrier for new entrants into the retail market. While online platforms offer a relatively low-cost entry point, building a substantial physical retail presence demands considerable capital. Fast Retailing, with its vast global network, benefits from this, making it harder for smaller, resource-constrained competitors to challenge its market position.

- Fast Retailing operates over 3,600 stores globally as of 2024.

- The cost of establishing a single physical store can range from hundreds of thousands to millions of dollars.

- Established brands often have better access to capital and can negotiate more favorable terms with suppliers.

- Fast Retailing's market capitalization was approximately $80 billion in late 2024, providing financial stability.

New entrants intensify competition within the retail sector. Global brands pose a threat due to their financial and marketing resources. Fast Retailing must adapt to market dynamics.

| Aspect | Details | Impact on Fast Retailing |

|---|---|---|

| Competition | Increased from online retailers and DTC brands. | Requires continuous adaptation of online strategy and brand loyalty. |

| Resources | Global brands have significant financial and marketing resources. | Fast Retailing must leverage its strengths, such as a $80B market cap in 2024. |

| Market Entry Barriers | Capital-intensive physical retail, cost of a store may reach millions of dollars. | Fast Retailing's global network of over 3,600 stores provides competitive advantage. |

Porter's Five Forces Analysis Data Sources

The Fast Retailing analysis leverages financial reports, market research, and industry databases. We incorporate competitor analysis and trade publications for strategic insights.