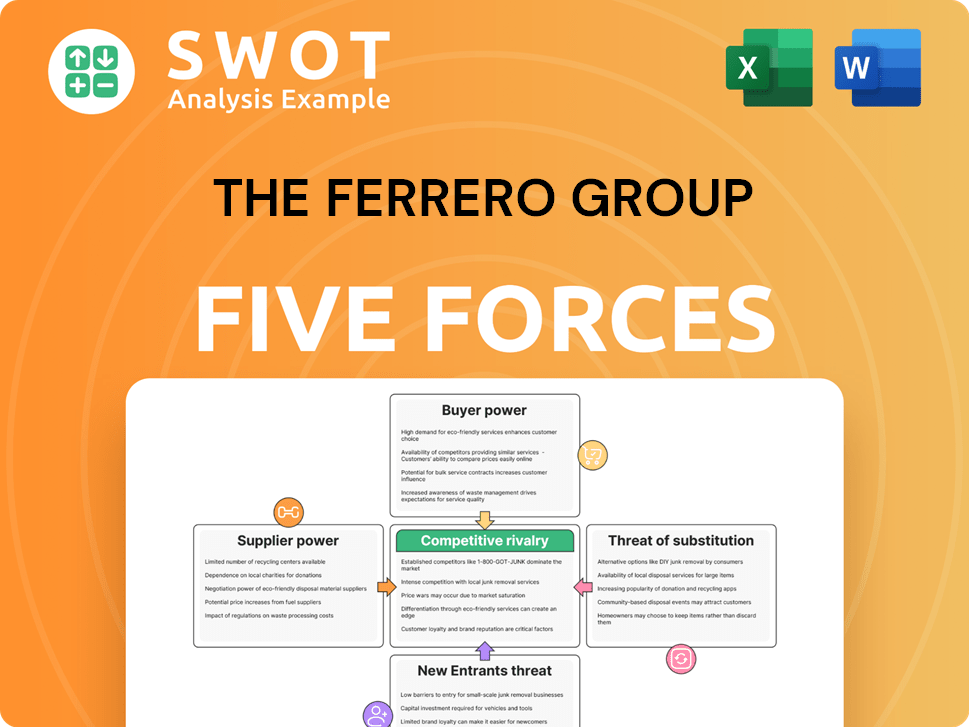

The Ferrero Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Ferrero Group Bundle

What is included in the product

Analyzes competitive forces, threats, and substitutes shaping Ferrero's market position.

Customize pressure levels based on new data or evolving market trends.

Same Document Delivered

The Ferrero Group Porter's Five Forces Analysis

This is the complete, ready-to-use analysis file. The Ferrero Group Porter's Five Forces analysis preview showcases the finished document. Examine the competitive landscape, from rivalry to substitutes, fully detailed. What you're previewing is what you get—professionally formatted and ready.

Porter's Five Forces Analysis Template

The Ferrero Group faces intense competition in the global confectionery market, battling powerful rivals and brand loyalty. Its supplier power is moderate, dependent on raw materials like cocoa and sugar. The threat of new entrants is significant due to established brands. Buyer power is high, with consumers having many choices. Substitute products, from other snacks to homemade treats, pose a continuous challenge.

Ready to move beyond the basics? Get a full strategic breakdown of The Ferrero Group’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The confectionery sector depends on a few suppliers for vital ingredients like cocoa, sugar, and hazelnuts. Ferrero sources much of its cocoa from West Africa, highlighting a concentrated supply chain. In 2023, cocoa prices hit around $2,800 per metric ton, affecting supplier bargaining power. This concentration gives suppliers leverage to influence prices.

Ferrero's strong supplier relationships, particularly with hazelnut producers, are crucial. These partnerships, especially in Turkey, secure ingredients at good prices. Ferrero's hazelnut purchases hit around 70,000 metric tons annually. This volume emphasizes their reliance on these key suppliers.

Ferrero leverages global sourcing to reduce supplier power, diversifying its supply chain. In 2022, roughly 25% of raw materials came from multiple countries. This approach mitigates risks associated with relying on a single supplier. Diversification enhances Ferrero's bargaining power.

Supplier Sustainability Standards

Suppliers now face rising demands to meet sustainability standards, which complicates supply chains. Consumers increasingly prefer sustainable and ethical sourcing, impacting purchasing choices. Ferrero is assessing its sustainability goals across critical areas, including packaging, to stay current and reflect different stages of sustainability across its brands. This strategic focus is crucial for maintaining a competitive edge.

- Ferrero's 2023 Sustainability Report highlights their commitment to sustainable sourcing, including cocoa and hazelnuts.

- In 2023, Ferrero invested over $100 million in sustainability initiatives.

- Ferrero aims to have 100% sustainably sourced cocoa by 2025.

- Packaging sustainability is a key focus, with targets for recyclable and reusable materials.

Impact of Cocoa Prices

The Ferrero Group faces challenges from suppliers due to rising cocoa prices, significantly impacting production costs. Climate change and supply chain disruptions drive these price increases, affecting negotiations. Stable and sustainable cocoa supply is crucial for the industry, requiring careful management.

- Cocoa prices surged in 2024, with futures reaching multi-year highs.

- Ferrero, as a major chocolate manufacturer, is highly exposed to these price fluctuations.

- Supply chain disruptions, like those impacting West African cocoa farms, have worsened the situation.

- The company has implemented strategies to mitigate supplier power, including long-term contracts and sustainability initiatives.

Ferrero's supplier bargaining power is influenced by cocoa, sugar, and hazelnut suppliers. Cocoa prices in 2024 rose sharply due to supply chain disruptions. Ferrero's sustainability initiatives and global sourcing strategies help mitigate supplier influence.

| Ingredient | 2024 Price Trend | Ferrero Strategy |

|---|---|---|

| Cocoa | Increased sharply | Sustainable sourcing, long-term contracts |

| Hazelnuts | Stable, high demand | Strategic partnerships, volume buying |

| Sugar | Variable | Diversified sourcing |

Customers Bargaining Power

Ferrero enjoys strong brand loyalty, which limits customer bargaining power. Iconic brands like Nutella and Kinder dominate their respective markets. Nutella boasts a significant market share, exceeding 20% globally in the spreadable market. This strong brand presence reduces consumer incentives to switch to alternatives.

Increasing health consciousness among consumers is a significant factor. Demand for healthier options is on the rise. Ferrero's high sugar content might deter health-conscious customers. In 2024, the global health and wellness market is valued at over $7 trillion. This gives consumers more power to demand healthier alternatives.

Customers wield significant bargaining power due to the availability of numerous substitutes in the confectionery market. Ferrero Rocher competes with a vast array of products satisfying the desire for sweets, including chocolates and candies. For instance, in 2024, the global chocolate market was valued at approximately $130 billion, indicating substantial competition. Moreover, consumers can opt for alternative gifts, such as flowers or experiences, further amplifying their choices. The wide range of options elevates customer influence.

Price Sensitivity Varies by Product Category

Customer bargaining power is significantly influenced by price sensitivity, which differs across product categories. Ferrero, known for premium branding, faces fluctuating consumer spending tied to economic stability. In 2024, the global chocolate market saw varied consumer behaviors. During economic downturns, consumers might shift towards more affordable chocolate options.

- Premium chocolate sales may decline during recessions.

- Economic factors affect consumer choices.

- Ferrero's brand positioning is crucial.

- Price competition intensifies in tough times.

Retailer Influence on Pricing

Retailers wield considerable power in the confectionery market, influencing pricing strategies for companies like Ferrero. Their control over shelf space and distribution channels significantly impacts product visibility and sales volumes. Major retailers, such as Walmart and Kroger, often dictate terms, affecting profit margins. This bargaining power is a key aspect of Porter's Five Forces.

- Walmart's U.S. confectionery sales in 2024 reached approximately $3.5 billion.

- Kroger's confectionery sales in 2024 were around $2.8 billion.

- Ferrero's revenue in 2024 was estimated at €17 billion.

Customer bargaining power is moderate due to brand loyalty, yet health trends and substitutes matter. The global chocolate market was worth ~$130B in 2024, offering alternatives. Price sensitivity and retailer influence further affect Ferrero.

| Factor | Impact | Data (2024) |

|---|---|---|

| Brand Loyalty | Reduces Power | Nutella's market share >20% |

| Health Trends | Increases Power | Health market: >$7T |

| Substitutes | Increases Power | Chocolate market: $130B |

Rivalry Among Competitors

Ferrero confronts fierce competition from major rivals such as Mars, Hershey, and Nestlé. These companies continually innovate, launching new products and broadening their offerings. In 2024, Mars' revenue hit $47 billion. To succeed, Ferrero needs unique products and marketing.

Consumer preferences are shifting, with health and wellness gaining importance. Ferrero must adjust its offerings to align with these trends. The company needs to monitor evolving consumer demands, especially the rise of health-focused options, to maintain market relevance. In 2024, the global health and wellness market is projected to reach $7 trillion.

Ferrero faces competition from global players like Lindt and local brands. This rivalry can squeeze Ferrero's market share. The premium chocolate market is highly competitive. In 2024, the global chocolate market was valued at approximately $130 billion, with intense competition among brands. Ferrero Rocher competes with other luxury chocolate brands.

Low Brand Loyalty and Switching Costs

Low brand loyalty and minimal switching costs amplify competitive rivalry within Ferrero's market. With numerous competitors and intense market saturation, the pressure is substantial. Consumers readily change brands, fostering a highly competitive environment. In 2024, the global confectionery market, where Ferrero significantly participates, saw intense price wars and promotional activities, reflecting this rivalry. This environment forces continuous innovation and pricing strategies.

- High market saturation leads to increased competition.

- Consumers' willingness to switch brands intensifies rivalry.

- Price wars and promotions are common strategies.

- Continuous innovation in products is essential.

Market Share Domination by Major Players

The chocolate industry is highly competitive, with major players like Mondelez controlling significant market share. This leads to intense rivalry among companies. Customers face insignificant switching costs, further intensifying competition. Ferrero must contend with rivals in chocolate and related sectors aiming for premium positioning.

- Mondelez's 2023 net revenues reached approximately $36 billion, showcasing its market dominance.

- The global chocolate market was valued at around $140 billion in 2024.

- Ferrero's 2023 revenue was approximately $17 billion.

Ferrero competes fiercely in a saturated market, facing giants like Mars and Mondelez. Consumer brand switching is common, intensifying the rivalry. Price wars and continuous innovation are prevalent strategies. In 2024, the chocolate market was valued at around $140 billion.

| Key Competitor | 2024 Revenue (approx.) | Market Strategy |

|---|---|---|

| Mars | $47 billion | Product innovation, marketing |

| Mondelez | $36 billion (2023) | Market dominance, premium positioning |

| Ferrero | $17 billion (2023) | Focus on premium chocolates, Nutella |

SSubstitutes Threaten

The threat of substitutes for Ferrero Rocher is moderate to high due to the premium, experiential value it offers. Any confectionery, like Godiva or Lindt, aiming for a similar sensory experience acts as a substitute. In 2024, the global chocolate market was valued at approximately $130 billion, showing ample room for competitors. This intensifies the threat, especially with evolving consumer tastes.

Ferrero faces the threat of substitutes due to the wide array of products that can serve as premium gifts. Items like luxury chocolates, expensive flower bouquets, or high-end spirits compete for the same gifting occasions. In 2024, the global luxury goods market, which includes these alternatives, was valued at approximately $350 billion, underscoring the scale of competition. Any product perceived as a premium gift poses a substitute threat to Ferrero Rocher.

Health-conscious consumers increasingly prefer healthier snacks. This shift impacts Ferrero's chocolate sales, with options like baked goods and fruits gaining traction. The demand for sugar-free and plant-based products is rising. In 2024, the global health and wellness market reached $7 trillion, highlighting the growing threat. Ferrero must adapt to stay competitive.

Impact of GLP-1 Weight Loss Drugs

GLP-1 weight loss drugs pose a threat to Ferrero's confectionery business by potentially shifting consumer preferences towards healthier options. The growing health and wellness trend further exacerbates this risk, as consumers become more conscious of sugar intake and weight management. This could lead to decreased demand for Ferrero's indulgent products, impacting sales and profitability. The global weight loss drugs market, valued at $3.4 billion in 2023, is projected to reach $7.3 billion by 2028, signaling a significant shift in consumer behavior.

- 2023: Global weight loss drugs market valued at $3.4 billion.

- 2028 (projected): Market to reach $7.3 billion.

Seasonal and Nostalgic Products

Seasonal and nostalgic products pose a threat as they provide alternative confectionery choices. The market's innovation in flavors and formats continuously expands consumer options. Ferrero must compete with these diverse offerings to maintain its market position. This includes items like themed chocolates or limited-edition treats.

- Ferrero's Kinder Joy sales in the U.S. surged by 22.9% in 2024, indicating strong consumer demand for novelty products.

- The global confectionery market is projected to reach $270 billion by the end of 2024, showcasing the vast range of substitutes.

- Seasonal chocolate sales, particularly around holidays, account for about 30% of total confectionery sales, highlighting the impact of substitutes.

Ferrero faces moderate to high threat from substitutes. The $270B global confectionery market in 2024 offers vast alternatives. Seasonal items and premium gifts, like luxury goods valued at $350B, compete. Health trends and weight loss drugs also shift consumer preferences.

| Substitute Type | Market Size/Impact | Ferrero's Response |

|---|---|---|

| Luxury Chocolates/Gifts | $350B (Luxury Goods) | Product innovation, premium positioning. |

| Healthier Snacks | $7T (Health/Wellness) | Diversification, healthier options. |

| Weight Loss Drugs | $7.3B (Projected 2028) | Monitor trends, adapt offerings. |

Entrants Threaten

High capital investment acts as a major barrier for new confectionery entrants. Setting up production facilities and acquiring equipment can cost new entrants between €10 million and €50 million. Established firms like Ferrero, with 2022 revenues of about €14.2 billion, have a significant advantage. This financial hurdle makes it challenging for new businesses to compete effectively.

Established brand loyalty significantly deters new entrants. Ferrero's robust brand portfolio, featuring Nutella and Kinder, fortifies its market position. Nutella's commanding over 20% share in the global spreadable market exemplifies this. New competitors struggle to overcome consumers' preference for Ferrero's established brands.

New entrants face regulatory hurdles. Food safety laws, like HACCP in the EU, demand compliance. These processes may cost up to €1 million. Labeling laws also require accurate nutritional data and allergen warnings.

Economies of Scale

Ferrero's established economies of scale pose a significant barrier to new entrants. The company's massive production volume, exceeding 1.5 million tons per year, allows for cost efficiencies. New competitors often struggle with initial per-unit costs, potentially 20-30% higher. This cost advantage stems from optimized supply chains and large-scale production.

- Production capacity over 1.5 million tons annually.

- Potential 20-30% higher per-unit costs for new entrants.

- Enhanced supply chain efficiency.

- Established brand recognition and market share.

Distribution Channel Access

New confectionery businesses face hurdles in accessing distribution channels. Major retailers often control shelf space, making it tough for newcomers to get their products seen. The confectionery market requires specific expertise and knowledge, creating another barrier. Ferrero, with its established distribution, presents a formidable challenge to new entrants. Gaining shelf space in supermarkets is critical for success, and Ferrero's existing relationships give it an advantage.

- Ferrero's strong brand recognition aids in securing distribution deals.

- New entrants struggle against established supply chain networks.

- Retailers may favor brands with proven sales performance.

- Distribution is crucial for reaching consumers in the confectionery market.

The confectionery market presents significant barriers for new entrants, with high capital investment, brand loyalty, and regulatory hurdles. Ferrero's economies of scale and established distribution networks further deter competition. These factors make it challenging for new businesses to gain market share.

| Barrier | Impact | Example (Ferrero) |

|---|---|---|

| Capital Investment | High initial costs | Production facilities (€10-50M) |

| Brand Loyalty | Established consumer preference | Nutella's 20%+ market share |

| Economies of Scale | Cost advantages | Production of over 1.5M tons annually |

Porter's Five Forces Analysis Data Sources

Our analysis leverages public financial reports, market share data from research firms, and industry-specific reports to assess Ferrero's competitive landscape. We also consider trade publications and news articles.