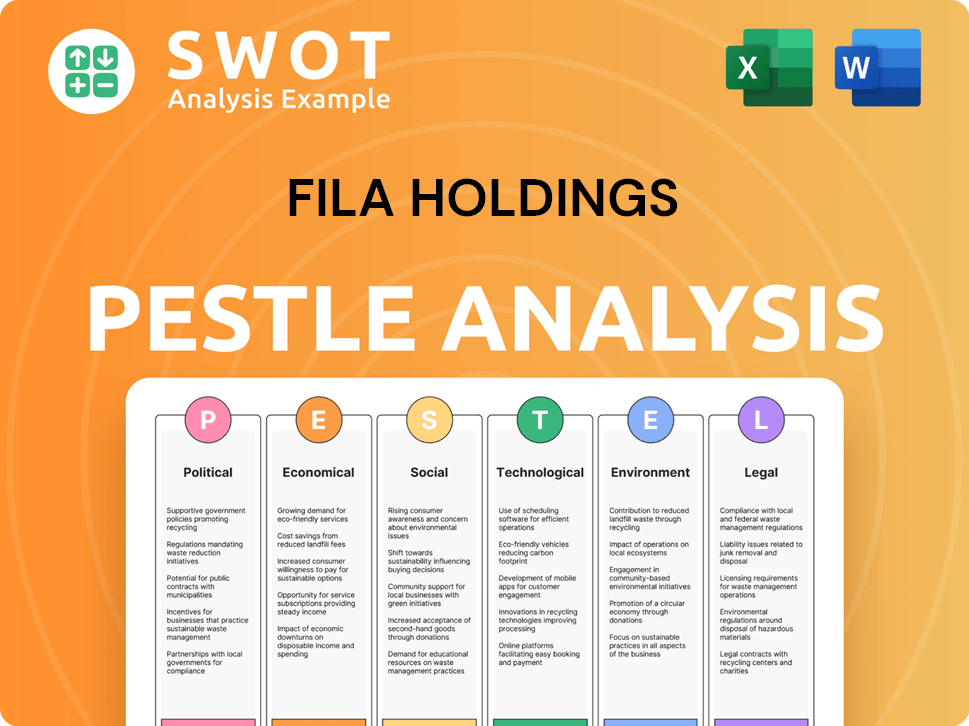

FILA Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FILA Holdings Bundle

What is included in the product

Analyzes FILA's environment via Political, Economic, Social, Technological, Environmental, and Legal factors, aiding strategic decisions.

Allows users to modify the PESTLE analysis, making it highly adaptable for different market needs.

Same Document Delivered

FILA Holdings PESTLE Analysis

Everything displayed in this FILA Holdings PESTLE analysis is part of the final product. What you see, including the assessment of Political, Economic, Social, Technological, Legal, and Environmental factors impacting FILA, is what you'll be working with after purchase. There are no alterations or surprises; it's a ready-to-use file.

PESTLE Analysis Template

Navigate the complex world of FILA Holdings with our insightful PESTLE Analysis. Uncover the political, economic, social, technological, legal, and environmental forces impacting its operations. Discover how these factors shape the company's strategy, opportunities, and challenges. Strengthen your understanding of market dynamics and inform your strategic decisions. Download the full analysis for actionable intelligence.

Political factors

Trade policies and tariffs significantly affect FILA. In 2024, rising tariffs on imported materials could increase production costs. For instance, a 10% tariff hike on textiles might cut FILA's profit margins by 2%. These changes impact the final consumer prices and FILA's global competitiveness. The company must adapt by adjusting its sourcing and pricing strategies to maintain profitability.

FILA's global operations make it vulnerable to political instability. For instance, political unrest in regions like Eastern Europe, where FILA has a market presence, could disrupt supply chains. This could lead to decreased consumer spending. Political instability can impact operations and market access, as seen with supply chain disruptions in 2022.

Government regulations significantly impact FILA. These include manufacturing standards and labor practices. Product safety and marketing regulations also play a role. Compliance adds complexity and costs. For instance, the apparel market is projected to reach $2.25 trillion by 2025, influenced by such regulations.

Intellectual Property Protection

Intellectual property (IP) protection significantly impacts FILA's operations, safeguarding its brand integrity and preventing counterfeit goods. Strong IP laws and effective enforcement are vital for FILA's profitability. FILA must navigate varying IP regulations across different countries. According to the World Intellectual Property Organization, global counterfeit trade reached $4.5 trillion in 2022.

- China's IP enforcement has improved, but challenges persist.

- The U.S. and Europe generally offer strong IP protection.

- FILA actively monitors and combats counterfeiting through legal actions.

Geopolitical Tensions

Geopolitical instability significantly impacts FILA Holdings. The Russia-Ukraine war, for instance, has disrupted supply chains and increased energy costs, affecting global markets. Currency fluctuations, driven by these tensions, can alter FILA's profitability in different regions. Consumer confidence may wane, leading to decreased spending on discretionary items like sportswear.

- The World Bank predicts a global economic growth slowdown to 2.4% in 2024 due to geopolitical risks.

- FILA's revenue in the EMEA region (Europe, Middle East, and Africa) could be significantly impacted by these factors.

- Increased raw material costs, due to supply chain disruptions, could squeeze FILA's profit margins.

Trade policies, especially tariffs, directly influence FILA's production costs and competitiveness, potentially impacting profit margins. Political instability, particularly in regions like Eastern Europe, disrupts supply chains and can lead to decreased consumer spending on sportswear. Government regulations, encompassing manufacturing standards and labor practices, add costs and complexity to operations.

| Factor | Impact | Example/Data |

|---|---|---|

| Tariffs | Increased production costs | 10% tariff hike could cut profit margins by 2% (estimated) |

| Political Instability | Supply chain disruptions, decreased consumer spending | Russia-Ukraine war impact; supply chain disruptions |

| Government Regulations | Increased operational costs, compliance needs | Apparel market projected to reach $2.25 trillion by 2025 |

Economic factors

Global economic growth and consumer spending are crucial for FILA. Strong economies and higher disposable income boost demand for athletic and casual wear. A 2024 report projects a global apparel market of $2.2 trillion. Economic slowdowns reduce spending on non-essentials like FILA products. In 2023, consumer spending on footwear in the US was around $87 billion.

FILA, operating globally, faces currency exchange rate risks. These fluctuations directly affect reported revenues and expenses. In 2024, a stronger US dollar could reduce the value of sales from other markets. This can significantly influence profitability margins. Currency hedging strategies are vital to mitigate these impacts.

Rising inflation poses a significant challenge for FILA. Increased costs of raw materials, labor, and shipping can squeeze profit margins. In 2024, global inflation rates varied significantly, impacting FILA's operational costs. For instance, the U.S. inflation rate was around 3.3% in May 2024. FILA must manage these costs to maintain profitability.

Unemployment Rates

High unemployment rates can significantly affect consumer spending, which in turn can decrease demand for non-essential items like FILA's products. Economic data from 2024 shows that even a small increase in unemployment can have a ripple effect on consumer confidence. This could lead to reduced sales for FILA. For example, in the first quarter of 2024, sectors with higher unemployment saw a notable drop in consumer purchases.

- Unemployment rates directly influence consumer purchasing power.

- Reduced spending impacts luxury and discretionary goods, like FILA's products.

- Economic downturns can lead to increased price sensitivity among consumers.

- Companies may need to adjust strategies to maintain sales.

Interest Rates

Interest rate fluctuations significantly influence FILA's financial strategy, affecting both operational costs and expansion plans. Higher interest rates in 2024, with the Federal Reserve maintaining a target range of 5.25% to 5.50%, could increase FILA's borrowing expenses, potentially curbing investments. Conversely, a decrease in rates, as projected for late 2024 or early 2025, could make borrowing more affordable, facilitating growth. These changes directly impact FILA's profitability and market competitiveness.

- Federal Reserve's target range: 5.25% - 5.50% (2024)

- Projected rate cuts: Anticipated in late 2024/early 2025

Economic factors heavily influence FILA's performance, affecting both revenues and operational costs. Global economic health and consumer spending power, such as projected apparel market to reach $2.2 trillion by 2024, directly correlate with demand. Currency exchange rates and inflation, reaching around 3.3% in the US in May 2024, require diligent financial strategies. Unemployment and interest rate adjustments further shape financial planning and investment decisions.

| Economic Factor | Impact on FILA | 2024/2025 Data Points |

|---|---|---|

| Economic Growth | Drives consumer spending | Global apparel market: $2.2T (proj. 2024) |

| Currency Exchange | Affects revenues and costs | USD strength impacts sales from other markets |

| Inflation | Raises operational costs | US Inflation Rate: ~3.3% (May 2024) |

Sociological factors

Consumer preferences for athletic and casual wear are constantly shifting, significantly influenced by fashion trends, celebrity endorsements, and the growing 'athleisure' market. FILA must quickly adapt to these evolving tastes to stay competitive. The global athleisure market is projected to reach $660 billion by 2025, highlighting the importance of staying on-trend. In 2024, FILA reported a revenue of approximately $3.5 billion, indicating the need for strategic shifts to match consumer demands.

The increasing global emphasis on health and fitness significantly boosts demand for athletic wear. This trend provides FILA a chance to tap into the active lifestyle market. The global fitness market was valued at $92.3 billion in 2023. Projections estimate it to reach $128.5 billion by 2028, according to Statista.

Cultural trends and lifestyle choices significantly influence consumer preferences for footwear and apparel. FILA must understand and adapt to these evolving trends to maintain market relevance. For instance, the athleisure market, driven by lifestyle changes, is projected to reach $617 billion by 2026. FILA's success hinges on its ability to integrate diverse cultural preferences into its designs.

Demographic Shifts

Demographic shifts significantly impact FILA. An aging global population and increasing urbanization affect consumer preferences and purchasing behaviors. FILA must adapt its product lines, marketing, and distribution channels to cater to these changing demographics. For example, the Asia-Pacific region, a key market for FILA, is experiencing rapid urbanization.

- Urbanization rates in Asia-Pacific continue to rise, impacting consumer spending.

- FILA's marketing must evolve to target diverse age groups effectively.

- Product innovation needs to consider the preferences of older consumers.

Social Media and Influencer Culture

Social media heavily influences consumer behavior in the fashion sector. Celebrities and influencers on platforms like Instagram and TikTok significantly impact trends and purchasing choices. FILA, like other brands, must engage with these platforms. This is crucial for brand visibility and sales.

- In 2024, the global social media ad spend is projected to reach $225 billion, highlighting its importance.

- Influencer marketing spending is expected to hit $21.4 billion by the end of 2024.

- A recent study shows that 70% of consumers are influenced by social media when making purchase decisions.

Consumer behavior in the fashion sector is shaped significantly by social media, especially via influencers and celebrities. Adapting to diverse age groups is crucial; social media ad spending is projected at $225 billion in 2024. Approximately 70% of consumers use social media when deciding on purchases.

| Aspect | Details | Financial Impact (2024 est.) |

|---|---|---|

| Social Media Ad Spend | Global investment in digital ads | $225 billion |

| Influencer Marketing | Spending on influencer promotions | $21.4 billion |

| Consumer Influence | % of consumers using social media for buying | 70% |

Technological factors

Advancements in manufacturing, such as 3D printing and automation, are crucial. FILA can improve production efficiency and reduce costs. For example, the global 3D printing market is projected to reach $55.8 billion by 2027. This provides opportunities for product innovation. FILA can also focus on sustainable materials.

E-commerce and digital marketing are reshaping the apparel and footwear industry, with FILA needing a robust online presence. In 2024, global e-commerce sales in apparel reached approximately $750 billion. Effective digital strategies are vital; in 2023, digital ad spending in the US apparel sector was over $10 billion. FILA must adapt to these trends to stay competitive.

Supply chain tech is key for FILA's global operations. Inventory management and logistics, supported by tech, are crucial. In 2024, supply chain tech spending hit $24 billion, a 10% rise. This supports timely delivery and cost control for FILA. FILA's tech investments aim to boost efficiency in its supply chain.

Product Innovation and Wearable Technology

FILA's product innovation hinges on integrating advanced technologies into its offerings. This includes smart fabrics and performance-tracking features, enhancing the functionality of footwear and apparel. Such technological advancements can significantly boost brand appeal and market share. The global smart textile market is projected to reach $5.5 billion by 2025.

- Smart textiles market to hit $5.5B by 2025.

- Focus on performance tracking and smart fabrics.

- Competitive advantage through tech integration.

Data Analytics and Consumer Insights

FILA Holdings leverages data analytics to gain deep consumer insights, influencing product design, marketing strategies, and sales efforts. This approach allows for data-driven decisions, enhancing market responsiveness and competitiveness. In 2024, the company invested heavily in AI-driven analytics to personalize customer experiences, aiming for a 15% increase in customer engagement. This focus on data helps FILA stay ahead of evolving consumer preferences.

- Data-driven product development.

- Personalized marketing campaigns.

- Enhanced sales strategies.

- Improved market responsiveness.

FILA's use of tech in product design is growing. Smart fabrics and performance tracking in apparel offer key advantages. The smart textile market is predicted to hit $5.5 billion by 2025, driving brand appeal. Data analytics also plays a huge role.

| Technology Area | FILA's Focus | Market Data |

|---|---|---|

| Product Innovation | Smart fabrics, performance tracking | Smart textiles market: $5.5B by 2025 |

| Data Analytics | AI-driven customer experience | 15% increase in customer engagement |

| Manufacturing | 3D printing and automation | 3D printing market: $55.8B by 2027 |

Legal factors

FILA must adhere to labor laws globally, focusing on fair wages, work hours, and safe factory conditions. Non-compliance risks legal penalties and reputational damage. For instance, in 2024, the garment industry faced $1.2 billion in fines for labor violations. FILA's supply chain, heavily in Asia, requires diligent monitoring to avoid issues.

FILA faces stringent product safety and liability regulations, crucial for consumer well-being. These regulations mandate rigorous testing and adherence to safety standards for footwear and apparel. In 2024, product recalls cost companies billions, highlighting the importance of compliance. FILA's commitment to these standards directly impacts its brand reputation and financial performance, reducing potential legal liabilities.

FILA's success hinges on robust intellectual property protection. Legal frameworks are vital for shielding trademarks, copyrights, and patents. In 2024, global trademark filings surged, reflecting heightened IP awareness. FILA must actively enforce its rights to prevent counterfeiting, which cost the industry billions in lost revenue annually. Effective IP strategies are crucial for maintaining market share and brand value.

Import and Export Regulations

FILA Holdings must navigate complex import and export regulations across different markets. Compliance ensures the smooth flow of goods, avoiding delays and penalties. Customs duties significantly impact profitability, requiring careful planning. Trade agreements, like those between South Korea (where FILA has a strong presence) and the EU, can reduce costs. FILA needs to stay updated on tariff changes to optimize its supply chain.

- In 2024, global trade regulations saw over 1,000 changes.

- Customs duties can range from 0% to over 30% depending on the product and country.

- Free Trade Agreements (FTAs) cover 80% of global trade.

Consumer Protection Laws

FILA Holdings must strictly comply with consumer protection laws. These laws cover product details, advertising, and return policies to protect consumers. For instance, in 2024, the US Federal Trade Commission (FTC) received over 2.6 million fraud reports. Legal compliance helps build strong customer relationships and prevents legal issues. FILA's adherence ensures fair practices and consumer trust.

- FTC received over 2.6M fraud reports in 2024.

- Consumer protection laws vary by region.

- Compliance includes accurate product info.

- Adherence avoids legal disputes.

FILA faces global legal challenges, requiring adherence to labor laws and product safety standards to avoid fines and maintain reputation. Intellectual property protection is crucial; in 2024, global trademark filings increased significantly, highlighting the importance of preventing counterfeiting, which caused billions in losses. FILA must comply with import/export regulations, with over 1,000 global trade changes in 2024, alongside consumer protection laws.

| Legal Area | Key Compliance Aspects | Financial Impact (2024) |

|---|---|---|

| Labor Laws | Fair wages, safe conditions | $1.2B in garment industry fines |

| Product Safety | Testing, adherence to standards | Billions in recall costs |

| Intellectual Property | Trademark enforcement | Lost billions from counterfeiting |

Environmental factors

FILA faces growing pressure from sustainability trends. Stricter environmental regulations impact manufacturing, waste, and materials. Compliance costs may rise due to these changes. Consider the impact on supply chains, as well. Recent data shows a 15% increase in eco-friendly material adoption in the footwear industry by early 2024.

FILA faces environmental impacts on sourcing raw materials. Cotton prices, affected by climate, saw fluctuations, impacting the apparel sector. Rubber costs, vital for footwear, are sensitive to weather and supply chain disruptions. Synthetic fiber availability and costs are tied to petroleum prices, which are influenced by geopolitical and environmental policies. For example, in 2024, cotton prices rose by 10% due to droughts, impacting FILA's production costs.

Climate change and extreme weather pose significant risks. FILA's supply chains could be disrupted by events like floods or droughts. Production facilities might face operational challenges, impacting output. Consumer demand could shift due to environmental concerns, influencing sales. In 2024, the World Bank estimated climate change could push 132 million into poverty by 2030.

Waste Management and Recycling

The fashion industry's environmental footprint, including textile waste, is under increasing scrutiny. FILA Holdings must address these concerns through improved waste management and recycling efforts. Consumers and regulators are pushing for sustainable practices. Implementing circular economy models becomes crucial for long-term viability.

- Global textile waste generation is estimated at 92 million tons annually.

- Recycling rates for textiles remain low, with less than 1% of materials being recycled into new clothing.

- The market for recycled textiles is projected to reach $19.2 billion by 2025.

Ethical Sourcing and Supply Chain Transparency

Ethical sourcing and supply chain transparency are critical for FILA. Consumers and regulators are pushing for ethical practices, which impacts FILA's operations. FILA must ensure its suppliers meet environmental and social standards. This includes fair labor practices and sustainable materials. Failure to comply can lead to reputational damage and legal issues.

- In 2024, consumers increasingly favor brands with transparent supply chains.

- Regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) require detailed supply chain disclosures.

- FILA's ability to trace materials and verify supplier compliance is vital for brand trust.

- The global ethical fashion market is projected to reach $9.81 billion by 2025.

FILA is under pressure from sustainability demands, which drive up costs. Fluctuating raw material costs are a concern because of climate factors. Disruption risks also stem from extreme weather events and global waste practices. Ethical sourcing, as demanded by consumers, adds pressure.

| Environmental Factor | Impact on FILA | Data/Statistics (2024-2025) |

|---|---|---|

| Sustainability Trends | Compliance Costs | Eco-friendly material adoption in footwear rose 15% (early 2024) |

| Raw Material Costs | Increased Production Costs | Cotton prices rose 10% (2024) due to droughts |

| Climate Change & Extreme Weather | Supply Chain Disruption, Operational Challenges | The World Bank estimates climate change could push 132 million into poverty by 2030. |

| Fashion Industry's Footprint | Waste Management Needs, Circular Economy Demands | Textile waste generation estimated at 92 million tons annually; Recycled textile market projected at $19.2 billion by 2025. |

| Ethical Sourcing & Transparency | Reputational Risk, Legal Issues, Changing Consumer Behavior | Global ethical fashion market projected to reach $9.81 billion by 2025; EU's CSRD requires detailed supply chain disclosures. |

PESTLE Analysis Data Sources

FILA Holdings' PESTLE relies on IMF data, market reports, governmental publications, and industry analysis.