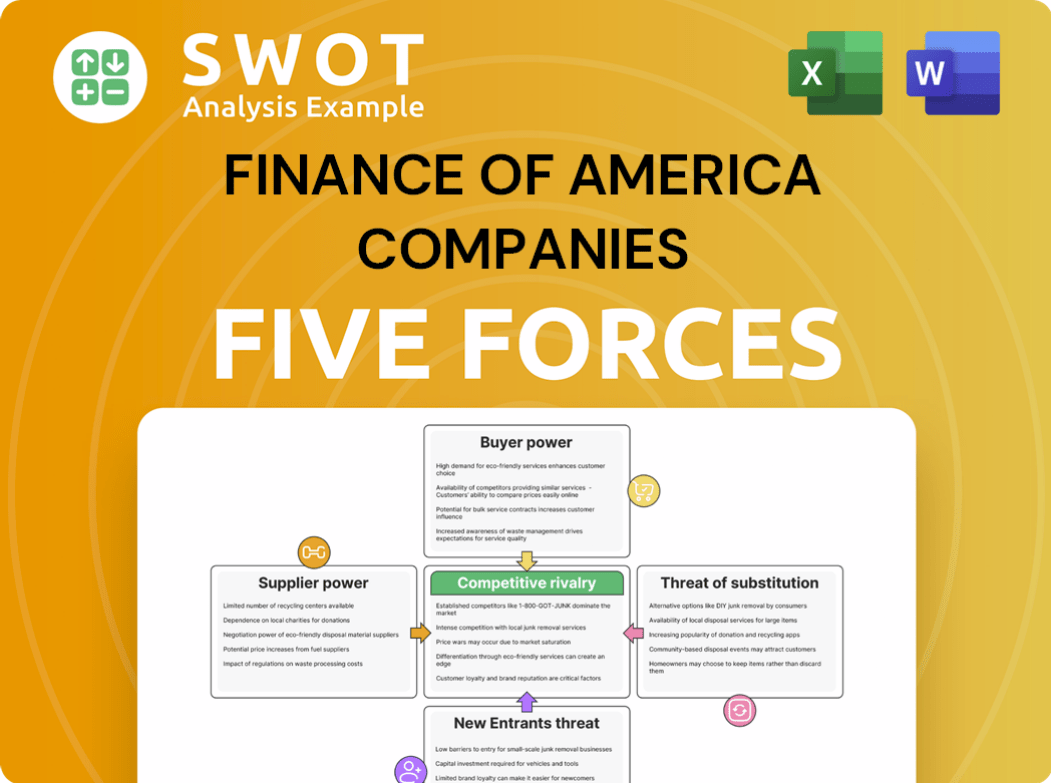

Finance Of America Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Finance Of America Companies Bundle

What is included in the product

Analyzes competitive forces impacting Finance of America, assessing supplier/buyer power & entry barriers.

Customize pressure levels based on new data or evolving market trends.

Preview Before You Purchase

Finance Of America Companies Porter's Five Forces Analysis

This preview reveals Finance of America Companies' Porter's Five Forces analysis. The factors affecting the company, like competitive rivalry, are thoroughly examined. You will receive this complete analysis—downloadable and ready to use—instantly after purchase. It covers all five forces, providing an in-depth look. This is the document you'll own: no alterations needed.

Porter's Five Forces Analysis Template

Finance of America Companies operates in a competitive mortgage lending market, facing pressure from established players and new entrants. Buyer power is moderate, influenced by interest rate sensitivity and available options. Substitute threats like alternative financing methods pose a challenge. Supplier power of capital providers and regulatory bodies is significant. Understanding these forces is critical for strategic planning.

Ready to move beyond the basics? Get a full strategic breakdown of Finance Of America Companies’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Finance of America (FOA) faces supplier concentration risks, especially with specialized tech providers. Limited alternatives for core banking tech give suppliers leverage. In 2024, FOA's tech spending was approximately $50 million. A concentrated base could mean higher costs and less favorable terms for FOA.

High switching costs, especially for critical banking software, boost supplier power. Migrating banking infrastructure is costly; this lock-in effect limits Finance of America's options. A switch could cost millions and months. This reliance gives suppliers like FIS or Temenos significant leverage in 2024.

Finance of America's reliance on financial data and credit rating agencies elevates supplier power. Access to timely data is vital for operations and risk assessment. Dependence on agencies like S&P Global and Moody's grants them considerable influence. In 2024, the cost of credit ratings has fluctuated, impacting profitability. This dependence necessitates careful vendor management.

Regulatory Compliance

Regulatory compliance significantly influences Finance of America's suppliers. Strict adherence to regulations escalates operational costs and complexities for suppliers. This directly impacts their pricing and service delivery, affecting Finance of America's expenses. For example, in 2024, compliance costs in the financial sector increased by an average of 12% due to evolving regulatory demands.

- Increased operational costs for suppliers.

- Impact on pricing and service delivery.

- Influence on Finance of America's expenses.

- Compliance-related constraints.

Vertical Integration Potential

Suppliers' bargaining power rises if they can vertically integrate, offering services. If they provide complete solutions, Finance of America becomes more reliant on them. This integration potential lets suppliers grab more value and control. For instance, in 2024, companies offering both mortgage origination and servicing saw increased profitability due to this control.

- Vertical integration by suppliers can lead to increased pricing power, as seen in the mortgage industry.

- In 2024, companies providing end-to-end solutions often achieved higher profit margins compared to those using multiple suppliers.

- The threat of vertical integration forces Finance of America to negotiate more favorable terms to maintain supplier relationships.

- Dependence on a single supplier increases risks, highlighting the need for diversification or strategic partnerships.

Finance of America confronts supplier power, especially in tech and data. Limited options for core tech and data providers, such as specialized software, give them considerable leverage. High switching costs, like with banking software, also bolster supplier influence. In 2024, compliance costs further increased supplier power.

| Aspect | Impact on FOA | 2024 Data |

|---|---|---|

| Tech Suppliers | Higher costs, less favorable terms. | Tech spending: ~$50M |

| Data Providers | Operational risk, cost fluctuations | Credit rating costs fluctuated. |

| Compliance | Increased expenses. | Compliance costs up 12%. |

Customers Bargaining Power

Finance of America (FOA) has a significant customer base, including retail and small business clients. Serving millions diversifies revenue but reduces individual customer influence. In 2024, FOA's large customer base provided stability, yet required tailored solutions. FOA's ability to meet diverse needs is crucial for its success.

Increased price sensitivity among banking customers heightens their bargaining power. Customers actively compare fees and seek better deals, intensifying competition. In 2024, the average consumer now checks 3-4 different financial institutions before committing. This forces Finance of America to offer competitive pricing and lower fees to retain clients. For example, Bank of America reduced some overdraft fees in 2024 to stay competitive.

The ease with which customers can switch lenders significantly impacts their bargaining power. Low switching costs, such as those associated with refinancing, empower customers to seek better terms. Finance of America faces pressure to provide competitive rates and excellent service. Customer satisfaction and loyalty are crucial; in 2024, customer retention rates were closely monitored.

Demand for Digital Experiences

The increasing demand for digital and personalized banking experiences boosts customer expectations, intensifying their bargaining power. Customers now anticipate smooth digital interfaces and tailored services, making them less tolerant of subpar experiences. Finance of America must invest heavily in technology to meet these expectations and improve customer experience to stay competitive. Failing to adapt quickly could lead to customer attrition to more innovative rivals.

- Digital banking adoption in 2024 is projected to reach 70% in the US, highlighting customer preference for digital platforms.

- Customer satisfaction scores for digital banking services are directly correlated to the level of personalization offered, with a 15% increase in customer loyalty reported by banks that offer customized services.

- Investment in fintech solutions by traditional financial institutions has increased by 20% in 2024 to meet evolving customer demands.

Information Availability

Customers' bargaining power is amplified by readily available information. Online resources offer reviews, financial advice, and competitor comparisons, enabling informed decisions. Finance of America must offer transparent, competitive services to attract and retain these knowledgeable customers. This includes clear pricing and excellent customer service. The shift is visible, with 65% of consumers researching financial products online before purchase.

- Online reviews influence 70% of purchasing decisions.

- Competitive pricing is critical as 80% of consumers compare rates.

- Customer service satisfaction impacts brand loyalty by 90%.

- Finance of America's success hinges on adapting to informed customer demands.

Customers of Finance of America wield considerable bargaining power, amplified by digital tools and readily available information. Price sensitivity is high; in 2024, consumers actively compared financial institutions. Switching costs are low, with digital banking adoption projected at 70% in the US. FOA must offer competitive rates and prioritize customer satisfaction to retain clients.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | 80% compare rates |

| Switching Costs | Low | Digital banking adoption at 70% |

| Information Availability | High | Online reviews influence 70% of decisions |

Rivalry Among Competitors

The financial services sector is crowded with numerous competitors, which heightens competitive rivalry. Finance of America contends with many banks, credit unions, and fintech firms. This fierce competition affects all its business segments. For example, in 2024, the mortgage market saw intense competition, with players like Rocket Mortgage and United Wholesale Mortgage vying for market share.

Slower industry growth intensifies competition. Finance of America (FOA) faces this, as mortgage origination volume declined. In 2024, mortgage rates stayed high, slowing market growth. FOA needs to innovate to gain market share. For instance, in Q3 2023, FOA's total originations were $1.4 billion.

In the financial services sector, limited product differentiation often intensifies competitive rivalry. When offerings resemble each other, firms like Finance of America may compete on price and service, squeezing profit margins. For example, the mortgage market saw intense competition in 2024, with rates fluctuating and lenders vying for market share. Finance of America needs unique products and services to gain an edge. This could include specialized loan programs or superior customer service.

Switching Costs

Low switching costs heighten competition for Finance of America. Customers can readily shift to rivals, intensifying pressure on the company. To retain clients, Finance of America needs to invest in customer relationships. Superior service is crucial for reducing customer churn in this competitive landscape.

- Finance of America's revenue in Q3 2023 was $137.8 million.

- Customer acquisition costs are a critical factor.

- Customer retention strategies are vital.

- The mortgage market is highly competitive.

Technological Disruption

Technological disruption significantly heightens competitive rivalry for Finance of America Companies. Fintech firms are rapidly innovating, offering solutions that challenge traditional banking. Finance of America must adapt to these changes and invest in digital capabilities to stay competitive. The fintech market is projected to reach $324 billion by 2026, emphasizing the need for adaptation. This shift demands strategic investment and agility.

- Fintech market is projected to reach $324 billion by 2026

- Adaptation to digital capabilities is crucial

- Investment in technology is essential for competitiveness

- Increased competition from innovative financial solutions

Competitive rivalry significantly impacts Finance of America due to a crowded financial services sector, intensifying competition across all segments. Slow industry growth, as seen in the 2024 mortgage market with high rates, further heightens rivalry. Low product differentiation and switching costs exacerbate the pressure, pushing Finance of America to compete on price and service.

| Metric | Data |

|---|---|

| Q3 2023 Revenue | $137.8M |

| Fintech Market (Projected) | $324B by 2026 |

| FOA Q3 2023 Originations | $1.4B |

SSubstitutes Threaten

Alternative investments like real estate or stocks offer substitutes for Finance of America's products. High stock market returns in 2024, with the S&P 500 up over 20%, might divert customers. This shift reduces demand for Finance of America's lending services. The presence of these options limits the company's market share.

The surge in direct lending platforms presents a notable threat to Finance of America. These platforms offer quicker, more accessible loan options, drawing customers with their competitive rates. In 2024, the direct lending market expanded, with platforms like Upstart and LendingClub increasing their market share. Finance of America needs to strengthen its digital infrastructure to stay competitive.

Peer-to-peer (P2P) lending platforms pose a threat to Finance of America by offering alternative funding. P2P lending connects borrowers directly with investors, sidestepping traditional institutions. This direct approach can offer borrowers potentially lower rates and quicker approvals. In 2024, P2P lending volume reached $2.5 billion, showing its growing market presence. Finance of America must differentiate services to compete effectively.

Government Programs

Government programs pose a threat to Finance of America by offering alternatives to its products. These programs, including government-backed loans and grants, often feature more attractive terms, such as lower interest rates and reduced fees. This can divert potential customers away from Finance of America's offerings. To counteract this, Finance of America must provide competitive products that offer superior value. For example, in 2024, the Small Business Administration (SBA) approved over $25 billion in loans, showcasing the scale of government support.

- Government assistance can replace private lending products.

- Government-backed loans may offer better terms.

- Finance of America needs to offer competitive products.

- SBA approved over $25 billion in loans in 2024.

Reduced Spending

The threat of substitutes for Finance of America includes reduced spending or delayed financial decisions, which can act as alternatives to taking out loans. Customers might postpone significant purchases or cut back on expenses instead of borrowing. For instance, in 2024, consumer spending showed fluctuations, with some sectors experiencing declines due to inflation and economic uncertainty. Finance of America must highlight the value of its lending products. This is crucial to overcome this substitution.

- Consumer spending in 2024 saw shifts due to economic uncertainties.

- Customers may delay purchases or seek cost-cutting alternatives.

- Finance of America must emphasize the necessity of its loans.

- Inflation and economic factors influence spending behavior.

The availability of alternative financial products, such as investments or government programs, poses a considerable threat to Finance of America. High stock market performance in 2024 and government-backed loans offer viable alternatives. Consumer spending fluctuations and economic uncertainty further impact demand. Finance of America must differentiate its offerings to stay competitive.

| Substitute Type | Impact | 2024 Data |

|---|---|---|

| Alternative Investments | Diverts customers | S&P 500 up over 20% |

| Direct Lending | Offers competitive rates | Market share increase for Upstart, LendingClub |

| Government Programs | Attracts customers | SBA approved $25B+ in loans |

Entrants Threaten

High regulatory barriers significantly hinder new entrants in financial services. Securing licenses and adhering to rules demands considerable resources. For instance, in 2024, the average cost for FinTech compliance was $1.5 million. These hurdles offer protection for firms like Finance of America. The compliance burden is substantial.

Significant capital requirements pose a considerable barrier for new financial services firms. As of late 2024, new entrants in the mortgage sector, like Finance of America, need substantial capital for lending operations and regulatory compliance. For example, in 2024, the average cost to launch a mortgage company was $500,000 - $1,000,000. This monetary hurdle restricts the pool of potential competitors, thus lessening the threat of new competition.

Strong brand recognition is a significant competitive advantage. Finance of America, as an established player, benefits from existing customer trust. New entrants face high marketing costs. For example, in 2024, marketing spending in the mortgage sector was up 15% due to competitive pressures.

Economies of Scale

Existing firms like Finance of America (FOA) gain an advantage through economies of scale, posing a barrier to new entrants. Larger companies can distribute fixed costs across a broader customer base, leading to lower per-unit costs. FOA’s established infrastructure and operations enable it to offer competitive pricing in the market. For instance, in 2023, FOA's operational efficiency led to a 15% reduction in processing costs per loan compared to smaller competitors.

- Established companies spread costs over many customers.

- New entrants struggle to match lower costs.

- FOA's size allows for competitive pricing.

- FOA reduced processing costs by 15% in 2023.

Technology and Innovation

The financial services sector necessitates continuous technological advancements, acting as a significant barrier to entry. Companies like Finance of America must invest heavily in technology to offer digital services and remain competitive. New entrants face substantial hurdles in developing and maintaining cutting-edge technology due to the required resources and expertise.

- Investment in fintech reached $120 billion globally in 2023, highlighting the capital needed for new entrants.

- The cost of building a robust digital platform can range from $10 million to $50 million, excluding ongoing maintenance.

- Successful fintech companies often have dedicated R&D budgets, which can be 10-20% of their revenue.

- The average time to develop a fully functional fintech platform is 18-24 months, delaying market entry.

New entrants in financial services face high barriers. Regulations and capital needs significantly restrict competition. These obstacles, like high compliance costs, offer existing firms protection.

| Barrier | Impact | Example (2024 Data) |

|---|---|---|

| Regulatory | Compliance costs | $1.5M average FinTech compliance |

| Capital | Launch costs | $500K-$1M to launch a mortgage company |

| Technology | R&D and platform costs | Up to $50M for a digital platform |

Porter's Five Forces Analysis Data Sources

This analysis is informed by financial statements, industry reports, and competitor analysis. We also utilize SEC filings for comprehensive data.