Finnair PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Finnair Bundle

What is included in the product

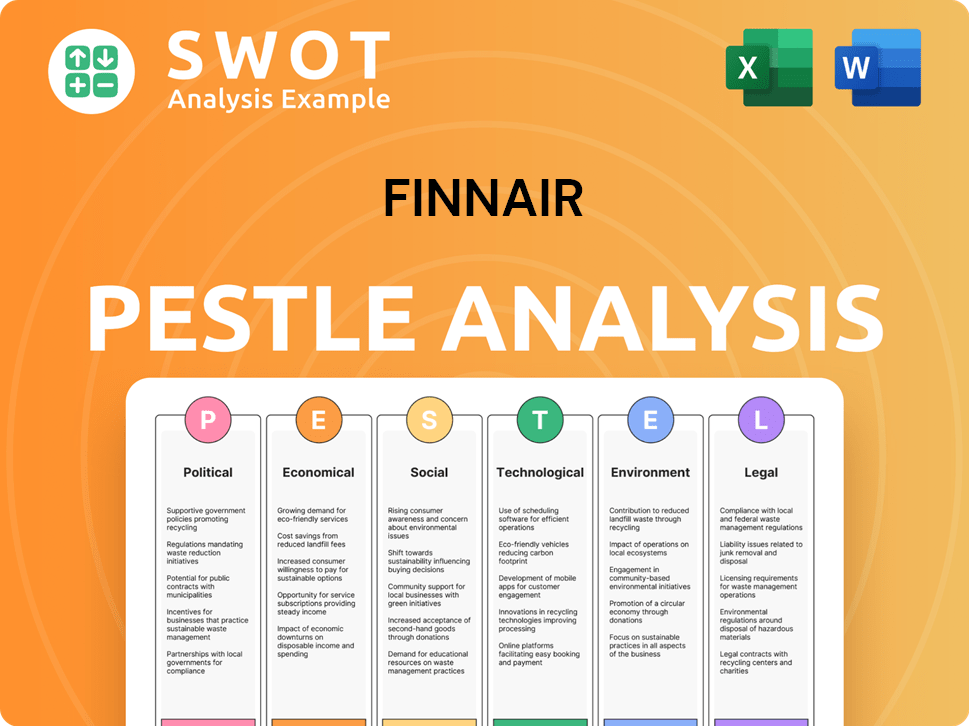

Examines the macro-environmental forces impacting Finnair across six categories: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Finnair PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Finnair PESTLE Analysis, as seen, details the political, economic, social, technological, legal, and environmental factors. The download includes all presented content and analysis. You get the ready-to-use insights immediately after purchase.

PESTLE Analysis Template

Discover the external factors impacting Finnair’s strategic direction! Our PESTLE analysis examines political, economic, social, technological, legal, and environmental forces. Explore key trends shaping their future. This insightful analysis equips you with a comprehensive overview. Make informed decisions by understanding Finnair's market context. Download the full report for detailed intelligence!

Political factors

Geopolitical instability poses considerable risks to Finnair. The ongoing closure of Russian airspace continues to disrupt routes, causing longer flight times. This situation strains profitability, with routes to Asia heavily affected. Demand for air travel and cargo is also subject to fluctuation due to global political events.

As Finland's flag carrier, Finnair is significantly influenced by government policies. In 2024, the Finnish government's aviation policies and potential state aid packages will be crucial. These decisions, including subsidies for regional routes, directly affect Finnair's profitability and strategic direction. Government support is vital in navigating economic challenges.

Finnair faces challenges from tense labor relations, including disputes with pilot unions. Industrial action has caused flight cancellations. This has negatively impacted Finnair's operating results. In Q1 2024, Finnair's comparable operating result was a loss of €100.2 million. These labor issues remain a significant concern for the airline.

International Trade Relations and Tariffs

International trade relations and tariffs are crucial for Finnair. Trade wars and tariff increases raise operational risks. These can destabilize the economic environment and impact travel demand. For instance, in 2024, airline industry experts anticipated potential disruptions from new trade policies.

- Trade disputes can lead to higher fuel costs.

- Tariffs may affect the cost of aircraft parts.

- Fluctuations in currency exchange rates are possible.

- Demand for travel might decline due to economic uncertainty.

Regulatory Environment

The aviation industry is heavily regulated, especially within the EU, impacting Finnair. Regulatory changes, particularly concerning environmental standards, like the EU's Emissions Trading System (ETS), can add to operating costs. Safety regulations and market access rules also influence Finnair’s operations and profitability. For instance, in 2023, the EU ETS price averaged around €80 per ton of CO2. This increases operational expenses.

- EU ETS: €80/ton CO2 (2023 average)

- Safety regulations compliance costs

- Market access restrictions

- Environmental standards influence

Political factors profoundly shape Finnair's operational landscape. Geopolitical instability, like the Ukraine war, alters routes, raising costs; 2024 Q1 saw a €100.2M loss. Government policies, including subsidies, directly affect profitability and strategic direction. Regulatory frameworks, such as EU ETS, raise operational expenses; average price in 2023 was around €80 per ton of CO2.

| Factor | Impact | Data |

|---|---|---|

| Geopolitical Risks | Route Disruptions, Cost Increases | Q1 2024 Loss: €100.2M |

| Government Policies | Subsidy Influence, Strategic Direction | Finnish aviation policy impacts |

| EU Regulations | Increased Operational Costs | EU ETS €80/ton (2023 average) |

Economic factors

Inflation and rising interest rates significantly affect Finnair. Higher rates can curb travel demand and increase borrowing costs. These factors create uncertainty, potentially impacting profitability. In Q1 2024, Eurozone inflation was around 2.4%, influencing Finnair's operational strategies.

Fuel price volatility directly affects Finnair's financial health. In late 2024, lower jet fuel prices boosted profitability. Conversely, rising fuel costs can squeeze margins. For instance, a 10% increase in fuel expenses could decrease operating profit by millions.

The global air travel market is projected to experience continued growth, presenting a favorable economic environment for Finnair. This expansion is supported by rising disposable incomes and increasing international travel. However, potential economic downturns and trade disputes introduce uncertainty, which could negatively impact passenger demand. For instance, in 2024, global air passenger traffic increased by 11.1% compared to 2023, according to IATA.

Operating Costs

Finnair faces ongoing challenges from escalating operating costs. These pressures stem from factors such as increasing salaries, higher navigation and landing fees, aircraft maintenance expenses, and the impact of emissions trading. For instance, in 2023, Finnair's operating expenses were significantly impacted by these factors. Such cost increases can negatively affect the airline's financial performance.

- Rising salaries and wages:

- Increased navigation and landing charges:

- Aircraft maintenance expenses:

- Costs related to emissions trading:

Revenue and Profitability

Finnair is focused on regaining profitability. The airline anticipates its revenue to be within a specific range for 2025. Several elements challenge its profitability goals, such as rising operational expenses and the effects of strikes. For 2024, Finnair's revenue was approximately €2.6 billion. They aim to improve their financial standing by 2025.

- 2024 Revenue: Approximately €2.6 billion.

- Profitability Target: Return to profit.

- Challenges: Rising costs, industrial action.

Economic factors significantly shape Finnair's performance. Inflation, interest rates, and fuel prices are key external influencers, impacting costs and demand. The global air travel market's growth offers opportunities despite economic uncertainties. These factors require strategic adaptation.

| Factor | Impact | Data |

|---|---|---|

| Inflation/Interest Rates | Influence travel demand, increase borrowing costs | Eurozone inflation (Q1 2024): 2.4% |

| Fuel Prices | Affect profit margins directly | 10% fuel cost rise: millions in operating profit loss |

| Air Travel Market | Supports growth; faces economic challenges | Global passenger traffic growth (2024 vs 2023): 11.1% |

Sociological factors

Consumer preferences are evolving, impacting air travel. Changing expectations and purchasing patterns, fueled by demographic shifts, shape demand. Notably, environmental awareness influences passenger choices. For instance, in 2024, sustainable travel options grew by 15% among eco-conscious travelers. This shift is significant for Finnair.

Public health crises and safety concerns, such as pandemics, heavily affect air travel. The COVID-19 pandemic caused a dramatic drop, but leisure travel has rebounded. Corporate travel's recovery is slower. Finnair's 2023 passenger numbers are around 11.8 million, up from 2022's 8.8 million.

Finland's labor market is currently experiencing tension, with ongoing disputes affecting Finnair. Strikes and industrial actions, particularly with pilot unions, disrupt flight schedules. In 2024, labor disputes led to flight cancellations and operational challenges. For example, in Q1 2024, Finnair reported a 10% decrease in available seat kilometers due to labor issues. The situation impacts both operational efficiency and financial performance.

Social Cohesion and Connectivity

Finnair significantly bolsters social cohesion and connectivity. As a national carrier, it ensures access to internal markets across Finland. In 2024, Finnair transported over 11 million passengers, reflecting its role in connecting communities. This supports regional development and economic activity.

- Finnair's network facilitates family visits and business travel within Finland.

- It promotes cultural exchange and tourism, strengthening social ties.

- The airline supports essential services, such as medical transport to remote areas.

Customer Satisfaction and Experience

Customer satisfaction is key for Finnair, particularly in a competitive market. Addressing disruptions and improving the overall customer experience are ongoing priorities. Finnair invests in better disruption management to minimize negative impacts. Understanding and adapting to evolving customer needs is also crucial. In 2024, Finnair's customer satisfaction score was 7.8 out of 10.

- Customer satisfaction is crucial for brand loyalty.

- Disruption management includes proactive communication.

- Finnair is investing in personalized experiences.

- Understanding customer feedback is an ongoing process.

Evolving consumer habits impact air travel, with a 15% growth in sustainable options in 2024. Public health and safety significantly affect passenger volume and Finnair's operational planning. The airline boosts social cohesion through transport and connectivity, with 11+ million passengers carried in 2024.

| Sociological Factor | Impact on Finnair | Data/Example (2024) |

|---|---|---|

| Changing Consumer Preferences | Influence Demand | 15% growth in sustainable travel choices |

| Public Health Crises | Affect Travel Volume | 11+ million passengers |

| Social Cohesion | Connectivity & Development | 11+ million passengers |

Technological factors

Finnair actively invests in advanced aircraft technologies to enhance fuel efficiency and reduce its environmental impact. The airline's fleet modernization strategy includes acquiring new aircraft like the Airbus A350 XWB, known for its fuel efficiency and reduced emissions. This approach aligns with the company's sustainability targets and aims to improve its operational cost structure. In 2024, Finnair's average fuel consumption was about 3.6 liters per 100 passenger kilometers. By 2025, the company expects to further reduce its carbon footprint through continuous fleet upgrades.

Finnair's technological landscape is evolving, prioritizing digital transformation and data analytics. Investments in data platforms aim to optimize operations and boost customer experiences. For example, in 2024, the airline allocated over €50 million to enhance its digital infrastructure. This includes improving its data analytics capabilities to personalize services.

Finnair's adoption of New Distribution Capability (NDC) is transforming its distribution strategy. NDC enables more personalized offers directly to customers. Finnair is actively implementing NDC and removing booking surcharges for NDC bookings. As of late 2024, this strategy aims to increase direct sales and enhance customer experience, with initial data showing positive impacts on engagement.

Sustainable Aviation Fuel (SAF) Technology

Sustainable Aviation Fuel (SAF) technology is pivotal for reducing aviation's environmental impact. Finnair is navigating the EU's SAF distribution mandates, incurring extra expenses. The airline actively collaborates on SAF development to secure future fuel supplies. The SAF market is expected to grow significantly, with production increasing. Finnair's initiatives include partnerships like the one with Neste, aiming for SAF use.

- EU SAF Mandate: Requires a minimum SAF blend, starting at 2% in 2025, increasing over time.

- Neste Partnership: Finnair utilizes Neste's SAF, which can reduce emissions by up to 80% compared to conventional jet fuel.

- SAF Cost: SAF currently costs more than conventional jet fuel, impacting airlines' operational expenses.

- Industry Goal: The aviation industry aims for net-zero carbon emissions by 2050, heavily reliant on SAF.

Exploration of Electric Aviation

Finnair is actively investigating electric aviation, primarily for shorter routes, as part of its future strategy. The airline participates in collaborative projects aimed at advancing electric flying technologies within the Nordic region. This strategic move aligns with the global trend toward sustainable aviation, with potential cost savings and reduced emissions. Electric aircraft could significantly reduce operational expenses on shorter flights. The electric aviation market is projected to reach $21.8 billion by 2032.

- Finnair aims to reduce its carbon footprint.

- Electric aircraft could lower operational costs.

- The company is committed to sustainability.

- Electric aviation market is growing.

Finnair is modernizing its fleet, including the Airbus A350, to boost fuel efficiency and reduce emissions; its 2024 fuel consumption was around 3.6 liters/100 passenger kilometers. Digital transformation, with €50M invested in 2024, prioritizes data analytics. Finnair implements New Distribution Capability, with its adoption improving sales and customer experiences.

| Technology Aspect | Initiative | Impact/Data (2024-2025) |

|---|---|---|

| Fleet Modernization | Acquiring fuel-efficient aircraft (A350) | Fuel efficiency, reduced emissions; approx. 3.6 L/100km. |

| Digital Transformation | Investing in data analytics, digital infrastructure | Optimized operations, improved CX; €50M invested in 2024 |

| New Distribution Capability | Implementing NDC, removing surcharges | Enhanced sales, improved CX; positive initial engagement. |

Legal factors

Finnair is subject to stringent aviation regulations globally. These rules dictate safety standards, operational procedures, and security protocols. Compliance is essential for operating flights and avoiding penalties. In 2024, the EU aviation safety agency (EASA) reported 15% rise in safety inspections.

Finnair faces stricter environmental rules, including the EU Emissions Trading System. These regulations increase expenses and require sustainable aviation fuel. In 2024, the EU ETS cost airlines significantly. Sustainable aviation fuel mandates will also raise operating costs.

Finnair's operations are significantly shaped by labor laws and collective bargaining agreements, particularly with employee unions. These agreements dictate working conditions, compensation, and benefits, potentially leading to labor disputes or strikes. In 2024, airline industry labor negotiations saw increased activity, and Finnair is no exception. Any disruptions can impact flight schedules and profitability. For example, in 2024, labor costs accounted for approximately 30% of Finnair's operational expenses.

International Agreements and Treaties

Finnair's global reach relies heavily on international agreements and treaties. These agreements dictate air traffic rights, routes, and operational standards. For example, the EU-US Open Skies agreement significantly impacts Finnair's transatlantic flights. As of 2024, about 80% of Finnair's revenue comes from international routes. Changes in these treaties can directly affect Finnair's ability to operate and compete globally.

- EU-US Open Skies agreement.

- 80% of Finnair's revenue from international routes.

- Bilateral air service agreements.

Data Protection and Privacy Laws

Finnair, like all airlines, must adhere to stringent data protection and privacy laws due to the vast amount of customer data they manage. The General Data Protection Regulation (GDPR) in Europe and similar regulations globally mandate how personal data is collected, processed, and protected. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of a company's annual global turnover. Compliance costs can also significantly impact operational budgets.

- GDPR fines can be up to 4% of global turnover.

- Airlines must protect passenger data.

- Data breaches can severely damage reputation.

Finnair navigates a complex web of aviation regulations, with 15% rise in safety inspections by EASA reported in 2024, which mandates compliance to maintain operations.

Environmental rules, like the EU Emissions Trading System (ETS) and sustainable aviation fuel mandates, are raising costs; labor laws, collective bargaining (approx. 30% of operating expenses) are impactful, potentially causing disruption.

International treaties and data protection laws, such as the GDPR, influence global operations, with GDPR fines potentially reaching 4% of turnover, shaping Finnair’s operational and strategic approaches in 2024/2025.

| Aspect | Description | 2024/2025 Impact |

|---|---|---|

| Aviation Regulations | Safety, operational, security standards | EASA inspections up 15%; ensures safe flights and avoid penalties |

| Environmental Rules | EU ETS, Sustainable fuel | Increase operational costs due to SAF mandates and carbon pricing; reduce emissions |

| Labor Laws | Collective bargaining agreements | Affects costs, operations; labor disputes & strikes impact flights and profitability. |

Environmental factors

Climate change poses a significant hurdle for airlines. Finnair aims to slash net carbon emissions by 50% by 2025 and achieve carbon neutrality by 2045. This necessitates considerable financial investment. For example, in 2023, Finnair's total CO2 emissions were approximately 1.6 million tonnes.

Finnair faces challenges with Sustainable Aviation Fuel (SAF). SAF use is crucial for emission cuts, yet it's expensive. SAF costs are 3-5 times higher than conventional jet fuel. Production in 2024 was 0.05% of global jet fuel demand. Limited supply and high costs impact profitability.

Finnair recognizes aviation's environmental footprint, focusing on reducing emissions. They aim to minimize their climate impact. This includes fleet updates and operational improvements. Finnair's sustainability report for 2023 showed a 10% reduction in CO2 emissions per passenger kilometer compared to 2019.

Noise Pollution

Noise pollution poses an environmental challenge for Finnair, especially near airports. Regulations and community pressure can impact operations, influencing flight schedules and aircraft types. The European Union's "Fit for 55" package includes measures affecting aviation's environmental footprint. For instance, the EU's Emissions Trading System (ETS) covers aviation, which indirectly addresses noise as it influences the types of aircraft used.

- EU ETS covers aviation.

- Noise regulations affect flight schedules.

- Community pressure influences airline operations.

Waste Management and Recycling

Waste management and recycling are critical environmental factors for airlines like Finnair. The airline faces waste from in-flight services and operational activities. Finnair is actively working on waste reduction strategies, including adjusting catering to minimize food waste. In 2024, the airline aimed to increase recycling rates across its operations to align with sustainability goals. This is reflected in their annual sustainability reports and targets.

- Finnair's recycling rate is expected to increase by 10% by the end of 2025.

- The airline is investing in new waste management technologies to improve efficiency.

- Finnair is working with suppliers to reduce packaging waste.

Environmental factors are pivotal for Finnair's strategies. Climate change targets necessitate huge investments; Finnair aims for 50% emission cuts by 2025. Noise regulations and community pressure shape operations, with the EU's ETS also playing a role. Waste management, aiming for a 10% recycling increase by 2025, impacts the airline.

| Factor | Impact | Finnair's Response |

|---|---|---|

| Climate Change | High costs & emission regulations. | Aiming for 50% CO2 cut by 2025. Investing in SAF & new fleet. |

| SAF | Expensive, limited supply. | Strategic partnerships, long-term contracts, emission-reduction investment |

| Noise Pollution | Operational restrictions. | Fleet upgrades & operational adjustments to reduce community impact. |

PESTLE Analysis Data Sources

Our Finnair PESTLE analysis is built upon industry reports, governmental data, financial analysis, and leading publications.