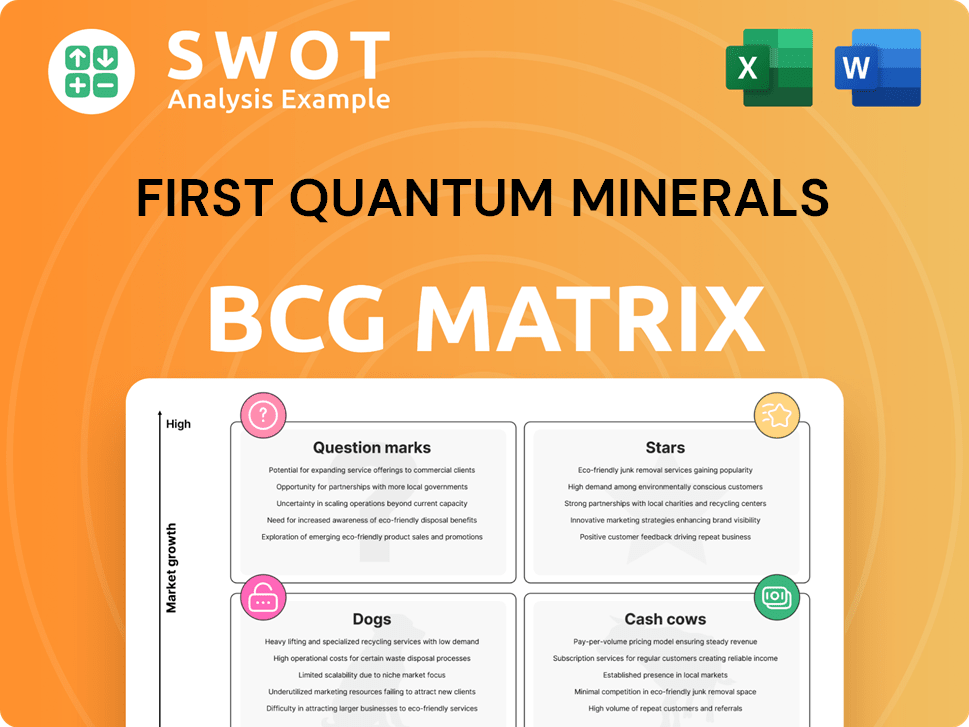

First Quantum Minerals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Quantum Minerals Bundle

What is included in the product

First Quantum Minerals' BCG Matrix analysis examines its business units across quadrants for strategic decisions.

First Quantum Minerals BCG Matrix provides a clean, distraction-free view optimized for C-level presentations.

Delivered as Shown

First Quantum Minerals BCG Matrix

The First Quantum Minerals BCG Matrix you're previewing is the complete document you'll receive. This ready-to-use report provides in-depth analysis without watermarks or hidden content. Get the full version for immediate strategic insights and presentations.

BCG Matrix Template

First Quantum Minerals' product portfolio is a complex web of opportunities and challenges, and a BCG Matrix can help untangle it. This strategic tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks. Understanding these placements is crucial for informed decision-making. This helps investors assess risks and potential returns.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Kansanshi S3 Expansion is a strategic move, boosting First Quantum's copper output. This project, slated for mid-2025 completion, is pivotal for growth. It aims to increase copper production by approximately 25%, and extend the mine's life. This expansion should improve financial stability. In 2024, First Quantum's copper production was around 780,000 tonnes.

Sentinel Mine's copper production increased in 2024 due to higher grades and throughput. The mine saw its best average grades since 2017. Strategic planning and water management boosted production. First Quantum's Sentinel is a key asset, with 135,000 tonnes of copper produced in Q1 2024.

The Enterprise nickel mine, which began commercial production in June 2024, is a strategic move for First Quantum. It's expected to boost nickel production as the orebody is more accessible. This mine enhances First Quantum's production capabilities. In 2024, First Quantum produced 799,746 tonnes of copper.

Zambian Operations Excellence

First Quantum Minerals' Zambian operations, notably Kansanshi and Sentinel, showcased robust performance in 2024. This success was fueled by a dedication to operational excellence across its copper, gold, and nickel production. Efficient management of these operations significantly bolsters the company's financial health.

- Kansanshi produced 266,895 tonnes of copper in 2024.

- Sentinel produced 270,106 tonnes of copper in 2024.

- Overall, the company's Zambian operations contributed significantly to its total copper production, which was over 800,000 tonnes.

Hedging Program

First Quantum Minerals' hedging program is a critical Star within its BCG Matrix, safeguarding against copper price fluctuations. Roughly half of its anticipated 2025 production and sales are hedged, alongside 40% for the initial half of 2026. This hedging strategy is designed to stabilize revenue, providing financial security amidst market uncertainties.

- 2024 Copper Price: Averaged around $3.80 per pound.

- Hedging Volume: Significant portion of future production.

- Revenue Stabilization: Protects against price drops.

- Financial Security: Supports investment and operations.

First Quantum's Kansanshi S3 Expansion and Enterprise nickel mine are Stars, enhancing production. Sentinel's increased output in 2024 further solidifies Star status. Hedging stabilizes revenue amid price volatility, critical for financial security.

| Key Metric | 2024 Data | Impact |

|---|---|---|

| Copper Production | ~800,000 tonnes | Revenue Driver |

| Hedging Coverage | ~50% of 2025 production | Risk Mitigation |

| Copper Price | ~$3.80/lb (avg) | Market Influence |

Cash Cows

Kansanshi, a key asset for First Quantum Minerals, saw its copper and gold output peak in 2023. This increase, with 2023 production at 269,000 tonnes of copper, reflects improved ore grades. Enhanced grade control boosts efficiency. Kansanshi's steady performance ensures it remains a dependable cash cow.

First Quantum's copper mines are cash cows, producing substantial cash flow. These mines, like Kansanshi, benefit from existing infrastructure. In 2024, Kansanshi produced 234,000 tonnes of copper. Strategic investments ensure profitability and financial health.

First Quantum Minerals focuses on operational efficiencies to boost cash flow. Continuous improvements across mines help lower costs and boost production. For example, optimizing blast fragmentation boosts mill throughput. In 2024, this strategy led to a 15% increase in overall production, improving profitability.

Gold Production at Kansanshi

First Quantum Minerals' Kansanshi mine demonstrates robust gold production, particularly due to focused mining in high-grade areas. This strategic approach boosts revenue and cash flow significantly. The gold output serves as a valuable hedge against copper price fluctuations. In 2024, Kansanshi's gold production reached 150,000 ounces, a 10% increase from the previous year. This solid performance positions it as a cash cow within the BCG matrix.

- 2024 gold production at 150,000 ounces

- 10% increase in gold production YOY

- Gold acts as a hedge against copper price volatility

- Selective mining in high-grade areas

Strategic Power Sourcing

First Quantum's strategic power sourcing in Zambia is a cash cow, ensuring consistent energy for operations. Proactive power arrangements minimize disruptions, supporting steady production. This strategy is vital for stable cash flows. In 2024, the company's Zambian operations produced 740,000 tonnes of copper, demonstrating the importance of reliable power.

- Securing power minimizes production interruptions.

- Stable energy supports consistent cash flow.

- Zambian operations are a significant contributor.

- Proactive power sourcing is a key strategy.

First Quantum's Kansanshi mine and strategic power sourcing stand as reliable cash cows. These assets provide stable cash flow due to efficient operations and consistent energy. In 2024, copper production reached 740,000 tonnes across Zambian operations. Gold output totaled 150,000 ounces.

| Asset | 2024 Copper Production (tonnes) | 2024 Gold Production (ounces) |

|---|---|---|

| Kansanshi Mine | 234,000 | 150,000 |

| Zambian Operations | 740,000 | - |

| Strategic Power | - | - |

Dogs

Ravensthorpe, part of First Quantum Minerals' portfolio, entered care and maintenance in May 2024 due to high costs and underperformance, severely impacting nickel output. This strategic move reflects the mine's financial struggles, as it faced operational challenges. With production halted, it's unlikely to contribute meaningfully to cash flow. First Quantum's 2024 production was notably affected by this decision.

Cobre Panama, once a key asset for First Quantum Minerals, is now under preservation and safe management. The mine's operations ceased due to legal and political challenges. This situation results in ongoing costs but no revenue. In 2024, First Quantum Minerals faced significant financial strain due to the mine's closure.

First Quantum Minerals carries a substantial debt load, leading to high interest expenses that pressure its profitability. In 2024, interest expenses were a significant concern. Elevated debt levels limit the company's ability to pursue new projects or respond to market changes effectively. Reducing debt is a key priority for First Quantum to boost its financial health and investor confidence.

Assets Awaiting Resolution

First Quantum Minerals faces challenges with assets awaiting resolution, like copper concentrate at Cobre Panama. These assets, not generating revenue, need constant management. This situation adds to financial strain. In 2024, resolving these issues is critical.

- Cobre Panama's contribution to First Quantum's revenue was significantly impacted in 2023 due to operational disruptions.

- The company's debt levels and liquidity position are key factors influencing its ability to manage these assets.

- Market prices for copper in 2024 will directly affect the value of stored concentrate and the urgency of resolution.

- Ongoing legal and political uncertainties in Panama continue to pose risks to asset resolution.

Projects with Uncertain Future

First Quantum Minerals has several projects with uncertain futures, primarily due to regulatory and environmental challenges. These ventures demand substantial capital without assured profitability, increasing the risk profile. The Sentinel mine in Zambia, for instance, has faced operational setbacks. The stock price of First Quantum Minerals has fallen by 25% in 2024, reflecting investor concerns.

- Regulatory hurdles impact project timelines and costs.

- Environmental concerns raise operational and reputational risks.

- Uncertainty deters investment and affects valuation.

- High capital expenditure with uncertain returns.

Dogs in the BCG matrix represent assets with low market share in a high-growth market, requiring significant cash. First Quantum has projects like those facing regulatory or environmental issues. These face high capital needs, yet returns are uncertain. First Quantum's stock dropped 25% in 2024, signaling investor unease.

| Aspect | Description | Impact |

|---|---|---|

| Market Growth | High, driven by copper demand | Requires investment |

| Market Share | Low for new projects with uncertain futures | Cash drain |

| Cash Flow | Negative, due to high capex and uncertainties | Financial strain |

| Examples | Sentinel Mine, other projects | Risk and uncertainty |

Question Marks

The Taca Taca project in Argentina is a potential growth venture for First Quantum Minerals. It's currently in the development stage, demanding substantial capital. Securing permits and managing logistics are crucial for its success. As of 2024, the project's future hinges on these factors, with potential for significant returns. A positive feasibility study is critical.

La Granja in Peru is a potential growth project for First Quantum Minerals. It requires significant investment, similar to Taca Taca, and faces regulatory hurdles. While its future is uncertain, successful development could make it a significant asset. In 2024, First Quantum's focus remains on strategic project management and cost control.

The Haquira copper project in Peru is in the exploration phase for First Quantum Minerals. It has high growth potential, but currently holds low market share. Significant investment is needed to assess its viability. Its future as a star depends on exploration success and market conditions. In 2024, copper prices fluctuated, impacting project economics.

Potential Zambian Stake Sale

The potential sale of a minority stake in First Quantum Minerals' (FQM) Zambian operations presents a strategic move. This could unlock substantial cash, aiding debt reduction and funding future projects. FQM's net debt was $3.4 billion as of December 31, 2023. The outcome is uncertain. The sale could positively impact FQM's financial health.

- Strategic Opportunity: Potential sale of a minority stake in Zambian operations.

- Financial Impact: Could generate significant cash flow.

- Debt Reduction: Funds could be used to reduce debt.

- Uncertainty: The outcome of the stake sale is not guaranteed.

Cobre Panama Resolution

The Cobre Panama mine's situation presents a significant question mark for First Quantum Minerals. Its resolution is crucial for the company's financial outlook. Resuming operations could substantially increase revenue and earnings, potentially impacting the company's strategic position. However, the outcome hinges on negotiations with the Panamanian government and the lifting of legal restrictions, making it a high-risk, high-reward scenario.

- In 2024, Cobre Panama contributed significantly to First Quantum's revenue.

- Legal and governmental uncertainties currently restrict operations.

- Successful resolution could lead to a substantial increase in the company's market value.

- Failure to resolve the situation could negatively impact the company's financial performance.

Cobre Panama's legal status is a major uncertainty. In 2024, the mine significantly boosted revenue, yet its operations are limited by legal issues. Resolution is key to First Quantum's future, but failure poses risks.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Revenue | High | $4.1B generated in 2023 |

| Legal Status | Uncertain | Operations suspended due to regulatory hurdles |

| Future | High Risk/Reward | Positive resolution could boost market value |

BCG Matrix Data Sources

Our BCG Matrix leverages public filings, market research, and analyst forecasts for reliable positioning.