Flywire Payments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

What is included in the product

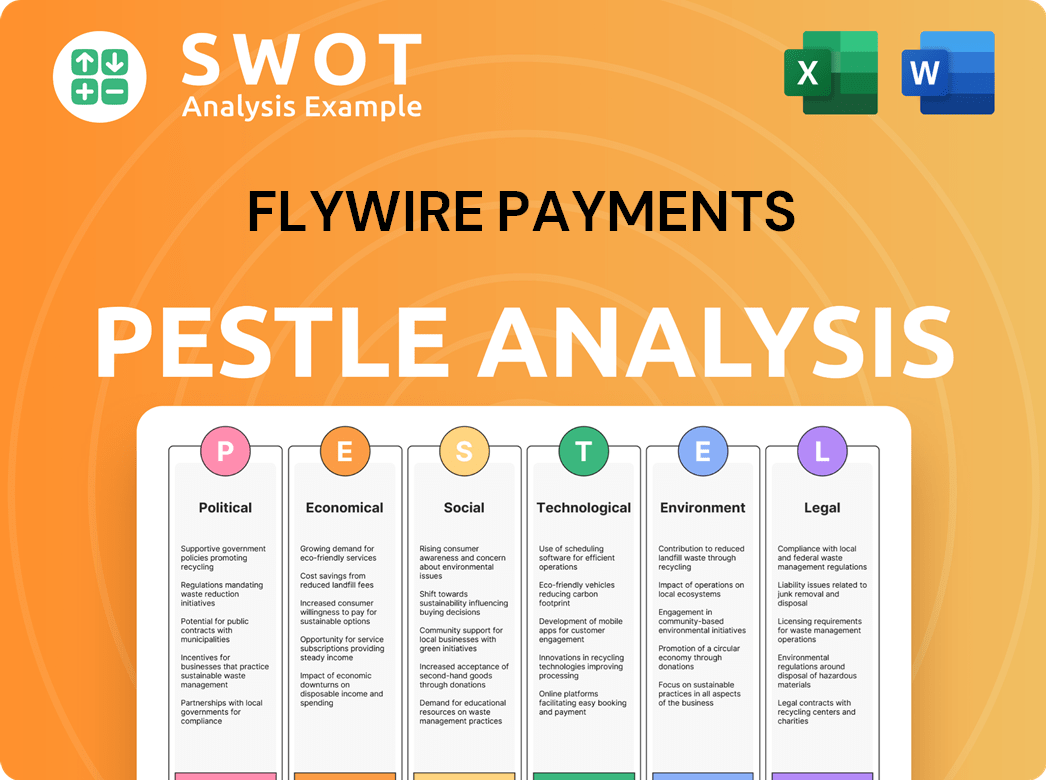

Flywire's PESTLE explores macro-environmental factors: Political, Economic, Social, Technological, Environmental, and Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

Flywire Payments PESTLE Analysis

The PESTLE analysis preview is what you get! It explores political, economic, social, technological, legal, and environmental factors affecting Flywire. The downloadable version mirrors this preview, formatted for easy use. No surprises, just the complete, ready-to-use document!

PESTLE Analysis Template

Dive into a comprehensive PESTLE analysis of Flywire Payments! Uncover how external factors influence its performance across politics, economics, social trends, technology, legalities, and environment. Our analysis delivers vital insights for strategic planning and understanding market dynamics. Access detailed breakdowns to inform your decisions.

Political factors

Flywire faces stringent government oversight; regulations like GDPR and AML/CTF compliance are crucial. Regulatory changes in financial services and consumer credit licensing can impact operations. Global regulators are intensifying scrutiny of fintechs to protect consumers. In 2024, Flywire must navigate evolving global fintech regulations.

Geopolitical instability and shifting trade policies present challenges for Flywire. Trade restrictions and tariffs can increase costs and limit market expansion. Political stability is vital for uninterrupted operations. For example, in 2024, the US-China trade tensions affected tech firms, potentially impacting Flywire's supply chain and expansion plans.

Governments globally are boosting fintech for economic growth and inclusion. This support often translates into favorable policies and initiatives. For example, in 2024, the UK launched a fintech growth plan. Such moves create chances for Flywire to partner with governments, improving digital infrastructure. These partnerships can expand services and reach.

Data Protection and Privacy Laws

Flywire must navigate the complex landscape of data protection and privacy laws worldwide. The General Data Protection Regulation (GDPR) in Europe and similar regulations globally mandate strict data handling practices. Compliance with these laws is crucial for Flywire to operate, as failure can lead to hefty fines and reputational damage. These regulations directly impact how Flywire manages and processes personal and financial data, requiring ongoing investment in compliance programs.

- GDPR fines can reach up to 4% of annual global turnover, as seen with several tech companies.

- In 2024, global spending on data privacy solutions is projected to exceed $10 billion.

- The average cost of a data breach in 2024 is estimated to be around $4.5 million.

Political Risk and Fintech Operations

Fintech companies, such as Flywire, encounter elevated political risks. These risks can stem from policy shifts and regulatory changes. A study indicated that political risk doesn't always affect cash holdings directly. Navigating diverse political climates is crucial for Flywire's operations.

- Regulatory Uncertainty: Changes in payment regulations can impact operational costs.

- Policy Influence: Government policies can influence market access and competition.

- Political Instability: Unstable regions pose risks to international transactions.

Flywire must adapt to evolving global regulations and geopolitical dynamics. Governments worldwide boost fintech, creating chances for partnership, digital infrastructure enhancements, and service expansion. Political risks from policy changes require navigating various landscapes.

| Aspect | Details |

|---|---|

| Regulatory Compliance Cost | Global spending on data privacy solutions is projected to surpass $10 billion in 2024 |

| GDPR Fines | Fines can be up to 4% of global annual turnover |

| Average Cost of Data Breach | Estimated at about $4.5 million in 2024 |

Economic factors

Flywire's success hinges on global economic health. Inflation and interest rate fluctuations directly affect spending. In 2024, global inflation averaged around 5.9%, impacting payment volumes. Economic growth, projected at 3.1% globally in 2024, also shapes Flywire's revenue.

The digital payments sector is booming globally. In 2024, the market was valued at $8.06 trillion, with an expected CAGR of 16.7% from 2024 to 2030. Flywire can capitalize on this expansion, especially in cross-border transactions. The rise of e-commerce and mobile payments fuels this growth, boosting transaction volumes.

The cross-border payment market is booming, fueled by rising global trade and demand for efficient international transfers. Flywire is well-positioned to capitalize on this growth, with the market expected to reach $220.3 billion by 2025. This expansion presents excellent opportunities for Flywire to grow its transaction volume and market share.

Competition in the Payments Industry

The payments industry is intensely competitive, with traditional financial institutions and fintechs battling for market share. Flywire contends with various competitors offering alternative payment methods and embedded finance. For instance, in 2024, the global fintech market was valued at over $150 billion, showing the industry's growth. This competition impacts pricing and innovation.

- Competition drives down transaction fees.

- Fintechs offer specialized, innovative payment options.

- Established banks integrate fintech solutions.

Impact of Currency Exchange Rates

As a global payments provider, Flywire is exposed to currency exchange rate fluctuations. These fluctuations can significantly affect their revenue and profitability across different regions. Managing foreign exchange risk is crucial for Flywire's financial health, requiring strategies to mitigate potential losses. For example, in Q1 2024, the EUR/USD exchange rate saw volatility, impacting revenue translation.

- Currency volatility can increase operational costs.

- Hedging strategies help to minimize risks.

- Geographic diversification can reduce currency exposure.

- Real-time exchange rate monitoring is essential.

Global economic conditions, including inflation and interest rates, substantially influence Flywire's performance, affecting payment volumes. The digital payments market continues to expand rapidly, creating growth prospects for Flywire, with projections for substantial growth through 2030. Currency fluctuations pose financial risks; however, strategic mitigation is essential for protecting the company's revenue and profitability.

| Economic Factor | Impact on Flywire | 2024-2025 Data |

|---|---|---|

| Inflation | Affects transaction volumes and spending | Global average: ~5.9% (2024) |

| Interest Rates | Influences cost of capital, impacts spending | Variable, subject to central bank policies. |

| Economic Growth | Drives demand and overall transaction volumes | Global growth: ~3.1% (2024); forecast stable (2025). |

Sociological factors

Consumer preference for digital payments significantly impacts Flywire. Adoption of digital wallets and mobile payments, driven by global events, is increasing. In 2024, mobile payment transactions are projected to reach $7.7 trillion globally. This shift boosts demand for seamless payment solutions like Flywire's. Contactless payments are also growing, with 61% of consumers using them weekly in 2024.

Digital payment systems like Flywire can boost financial inclusion. They offer access to services for underserved groups. Flywire's diverse methods and global reach help. In 2024, 1.4 billion adults globally lacked bank accounts. Flywire aims to bridge this gap.

Social influence significantly impacts digital payment adoption. Recommendations from peers and family often drive adoption, particularly in emerging markets. Research indicates that 60% of consumers trust recommendations from friends. Data from 2024 shows a 20% increase in digital payment usage influenced by social recommendations.

Changing Lifestyle Trends

Changing lifestyles significantly influence Flywire's payment solutions. The gig economy and increased global mobility, especially in education and travel, fuel demand for effective cross-border transactions. Flywire's specialized approach aligns with these evolving needs, ensuring relevant and efficient services. For instance, international student enrollment is projected to reach 6.3 million by 2025.

- Gig economy growth boosts demand for cross-border payments.

- Increased international travel and education drive transaction needs.

- Flywire's focus meets evolving lifestyle demands.

- Projected 6.3M international students by 2025.

Psychological Impact of Digital Payments

Digital payments significantly influence consumer behavior, often making spending feel less impactful than using cash. This "pain of paying" is reduced, potentially leading to increased spending. Flywire can leverage this by optimizing user interfaces to create a seamless payment experience, encouraging higher transaction volumes. Research indicates a 15-20% increase in spending when using digital payments versus cash, according to recent studies.

- Perceived Value: Digital payments can alter how consumers perceive the value of purchases.

- Impulse Buying: Reduced friction encourages impulse purchases.

- Budgeting Challenges: Easier spending may complicate budgeting.

- Emotional Connection: Cash can have more emotional connection.

Sociological factors greatly shape Flywire's performance, influenced by consumer payment trends. Digital payments are rising, with mobile transactions hitting $7.7 trillion in 2024, favoring user-friendly solutions. Financial inclusion, a priority, leverages Flywire’s services to assist underserved communities, considering the 1.4 billion unbanked adults worldwide.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Digital Payments | Increased Usage | 61% weekly use of contactless payments, $7.7T mobile transactions |

| Social Influence | Adoption Rates | 20% increase due to recommendations |

| Gig Economy | Demand | Growth in cross-border transactions |

Technological factors

Advancements in payment tech, like real-time payments and AI, are changing the game. Flywire must use these tools to boost platform speed, security, and efficiency. Real-time payments are predicted to reach $185.1 billion by 2027. Using AI can improve fraud detection by 40%.

Artificial intelligence (AI) and machine learning (ML) are transforming payments, crucial for fraud detection and automation. Flywire leverages AI to boost efficiency and security. The global AI in payments market is projected to reach $22.6 billion by 2025. Flywire's adoption of AI could significantly reduce transaction times and fraud rates.

Blockchain and digital currencies are reshaping global finance. By 2024, the market for blockchain in payments could reach $27.6 billion. This includes increased speed, security, and efficiency in transactions. Flywire could leverage these to streamline B2B and cross-border payments.

Embedded Finance and API Integration

Embedded finance is a booming trend, with payment functions integrated into software. Flywire leverages APIs to connect with ERP systems, ensuring smooth client payment experiences. This technological integration streamlines financial processes. The embedded finance market is projected to reach $138 billion by 2026.

- Flywire's API integrations enhance user experience.

- Seamless payments increase customer satisfaction.

- Technology is key to Flywire's growth.

Cybersecurity Threats

Cybersecurity is a crucial technological factor for Flywire, given its reliance on digital platforms for financial transactions. The company needs to implement strong security measures to combat cyberattacks and maintain customer trust. In 2024, the global cybersecurity market was valued at over $200 billion, with projections to exceed $300 billion by 2027. This growth highlights the increasing importance of cybersecurity.

- Data breaches cost companies an average of $4.45 million in 2023.

- The financial services sector is a primary target for cyberattacks.

- Flywire must comply with stringent data protection regulations.

Flywire must adopt new tech to stay competitive, like AI and real-time payments. AI's market value in payments is projected to hit $22.6 billion by 2025. They should use blockchain and digital currencies, too, to streamline B2B payments.

| Tech Trend | Impact on Flywire | Financial Data |

|---|---|---|

| Real-time Payments | Enhance transaction speed and efficiency | $185.1B market by 2027 |

| AI in Payments | Improve fraud detection & automation | $22.6B market by 2025 |

| Blockchain in Payments | Increase transaction security and efficiency | $27.6B market by 2024 |

Legal factors

Flywire must navigate intricate financial regulations across its global footprint. These regulations cover licensing, operational protocols, and reporting duties. Failure to comply can result in hefty penalties or operational restrictions. In 2024, the regulatory landscape saw increased scrutiny of fintech firms. Flywire must stay current to avoid legal issues.

Flywire must comply with data privacy laws like GDPR. These laws dictate how data is handled, necessitating strong security measures. In 2024, data breaches cost companies an average of $4.45 million. Flywire's security must prevent breaches, which is crucial given the sensitive financial data it processes, impacting its reputation and financial stability.

Flywire is heavily regulated by Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. These regulations require Flywire to implement stringent Know Your Customer (KYC) protocols. In 2024, FinCEN imposed penalties totaling over $1 billion for AML violations. Flywire must monitor transactions to prevent illicit activities.

Consumer Protection Laws

Consumer protection laws significantly influence Flywire's operations, ensuring fair practices in financial transactions. These regulations mandate clear pricing, transparent terms, and effective dispute resolution processes. Flywire must comply with various consumer protection acts globally, such as the Consumer Financial Protection Bureau (CFPB) regulations in the U.S. and similar laws in the EU. For 2024, the CFPB reported over 10,000 consumer complaints related to payment processing services. This compliance adds to the company's operational costs, demanding robust legal and compliance teams.

- CFPB data indicates a rising trend in consumer complaints about payment services in 2024.

- Flywire must adapt to evolving consumer protection laws internationally.

- Compliance costs include legal fees and technology investments.

- Failure to comply can lead to significant penalties and reputational damage.

Cross-Border Transaction Regulations

Cross-border transaction regulations are crucial for Flywire's global payments. These regulations vary widely, impacting how Flywire operates internationally. Compliance is essential for smooth transactions across borders, as regulatory changes can quickly affect business. In 2024, the global cross-border payments market was valued at approximately $156 trillion.

- Compliance costs can range from 3-7% of transaction value.

- Regulatory changes in 2024 included updates in the EU's PSD2.

- Flywire must adhere to the laws of over 140 countries.

- The U.S. sees over $100B in cross-border education payments annually.

Legal factors significantly influence Flywire’s operations. The company must adhere to many laws across various jurisdictions. Penalties for non-compliance are steep; it must continually adapt. These costs are substantial; they include fees and tech.

| Legal Area | Impact on Flywire | 2024/2025 Data |

|---|---|---|

| Data Privacy | Compliance to avoid breaches | Average cost of breaches in 2024: $4.45M |

| AML/CTF | KYC compliance; transaction monitoring | FinCEN imposed penalties in 2024: Over $1B |

| Consumer Protection | Fair practices in finance transactions | CFPB complaints about payment services: over 10,000 (2024) |

Environmental factors

Digital infrastructure, crucial for Flywire, has environmental impacts. Data centers, essential for processing payments, consume significant energy. Globally, data centers' energy use could reach 1,000 TWh by 2025. Flywire's operations contribute to this footprint through data storage and processing.

The payments industry is increasingly focused on environmental sustainability. This involves reducing the environmental impact of transactions. Companies explore energy-efficient tech and support green initiatives. For example, in 2024, the push for eco-friendly payment options grew. Flywire may adopt these practices.

The shift towards paperless transactions is gaining momentum, with digital payments reducing paper waste and environmental impact. Flywire's platform supports this trend, aligning with sustainability goals. In 2024, digital payments accounted for over 70% of global transactions, a rise from 60% in 2022. This reduces the carbon footprint.

Client and Consumer Demand for Sustainable Practices

Growing environmental awareness is pushing clients and consumers to favor sustainable businesses. Flywire might need to show its environmental commitment to meet these expectations. This includes reducing its carbon footprint and supporting eco-friendly practices. Failure to adapt could affect its reputation and market position. In 2024, 68% of consumers preferred sustainable brands.

- Consumer demand for sustainable products is up 73% since 2020.

- Companies with strong ESG (Environmental, Social, and Governance) scores often see higher valuations.

Environmental, Social, and Governance (ESG) Considerations

Environmental factors, particularly in the context of Environmental, Social, and Governance (ESG) criteria, are increasingly vital for businesses. Flywire's commitment to environmental stewardship can significantly influence its reputation and appeal to investors and partners. Companies with strong ESG profiles often experience better financial performance. For example, sustainable funds saw inflows of $21.4 billion in Q1 2024, indicating growing investor interest.

- Flywire's environmental impact includes its carbon footprint from operations and the environmental practices of its vendors.

- Regulatory pressures, such as climate-related financial disclosure requirements, can affect Flywire.

- Flywire can enhance its ESG profile through sustainable practices and transparent reporting.

- Strong ESG performance can lead to increased investor confidence and access to capital.

Flywire's operations impact the environment through energy consumption by data centers and digital transactions.

Sustainability in the payments sector is rising, with eco-friendly practices gaining traction, and paperless transactions are promoted by them, as shown by 70% global use in 2024.

Consumer preference for sustainable businesses, indicated by a 68% preference in 2024, compels Flywire to show environmental responsibility; a good ESG profile often results in higher financial performance. Flywire should reduce its carbon footprint to boost ESG.

| Environmental Aspect | Impact | 2024 Data/Facts |

|---|---|---|

| Data Centers | High energy use; carbon footprint. | Data centers use around 1,000 TWh globally in 2025. |

| Paperless Transactions | Reduced waste; lower environmental impact. | Digital payments over 70% of transactions, up from 60% in 2022. |

| Consumer & Investor Demand | Influence brand reputation and funding. | Sustainable funds attracted $21.4B in Q1 2024. 68% consumers prefer green brands. |

PESTLE Analysis Data Sources

The Flywire PESTLE Analysis relies on financial reports, economic forecasts, legal updates, and market research from leading institutions. These insights are enriched with payment industry data and public sector sources.