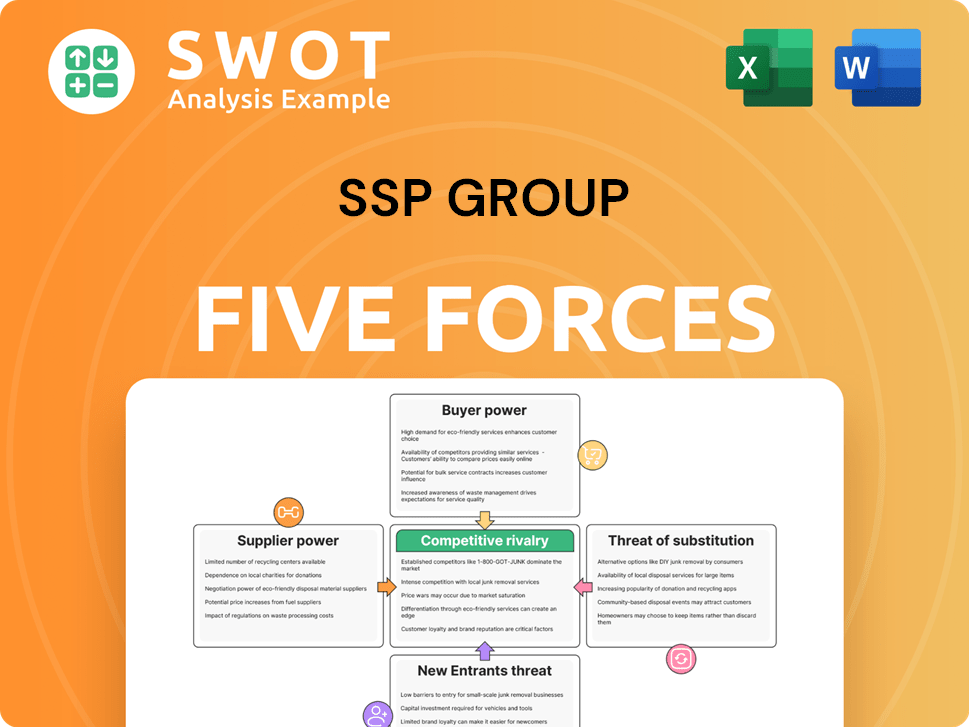

SSP Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSP Group Bundle

What is included in the product

Analyzes SSP Group's competitive landscape, examining forces like suppliers and new market entrants.

Quickly assess competitive intensity with intuitive force summaries.

What You See Is What You Get

SSP Group Porter's Five Forces Analysis

This preview showcases the complete SSP Group Porter's Five Forces analysis document. The analysis provided, detailing competitive forces, is identical to what you'll receive. Gain immediate access to the fully formatted and ready-to-use document after purchase. The information is presented professionally and prepared for your needs.

Porter's Five Forces Analysis Template

SSP Group faces moderate competitive rivalry in its airport and rail station food and beverage market, with numerous established players. Supplier power is also moderate, influenced by the availability of alternative suppliers. Buyer power is relatively low due to location-specific contracts and captive audiences. The threat of new entrants is moderate, considering high initial investment needs and existing brand recognition. Finally, the threat of substitutes is moderate, with limited readily available alternatives within transport hubs.

The complete report reveals the real forces shaping SSP Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

SSP Group depends on suppliers for its products. With few major suppliers, these entities can set prices and terms. For example, in 2024, food costs rose, affecting SSP's profit margins. Increased supplier prices could hurt SSP's financial results.

If SSP Group relies on suppliers offering unique inputs, those suppliers gain leverage. Imagine exclusive deals with top coffee bean providers. This gives the suppliers more control. SSP must cultivate robust relationships to mitigate risks.

SSP Group's reliance on specific suppliers can elevate switching costs, strengthening supplier power. High switching costs, like specialized equipment or contract terms, limit SSP's flexibility. For instance, if SSP has a 5-year contract with a key supplier, the financial impact of switching mid-term could be substantial. In 2024, contract negotiations are key to managing these costs.

Supplier forward integration potential

If suppliers can integrate forward, like opening their own restaurants, their power rises, potentially hurting SSP. This forward integration threatens SSP's profitability, urging it to negotiate less favorable terms. For example, a major coffee supplier could open competing cafes. SSP needs to watch for these moves to protect its market position and margins.

- In 2024, forward integration is a growing trend.

- Monitor for suppliers opening their own outlets.

- Assess the financial impact of supplier competition.

- Adjust contracts to mitigate supplier leverage.

SSP is a small part of supplier's business

If SSP Group is a small customer for a supplier, the supplier has greater leverage. This allows suppliers to potentially dictate prices or terms, impacting SSP's profitability. SSP might struggle to secure advantageous deals under such conditions. To mitigate this, SSP could consider diversifying its supplier network.

- Supplier concentration can elevate bargaining power.

- SSP's size relative to suppliers is crucial.

- Diversification is a key strategy for SSP.

- Negotiating power is inversely related to supplier dependence.

SSP Group faces supplier power due to limited options and reliance on specific providers. Rising costs, like a 7% food price increase in 2024, directly hit profit margins. Forward integration by suppliers, such as a coffee supplier opening cafes, further threatens SSP's market position.

| Aspect | Impact on SSP | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher bargaining power for suppliers | Few key suppliers controlling prices. |

| Cost Increases | Reduced profit margins | Food costs up 7%. |

| Forward Integration | Increased competition | Threat from supplier-owned outlets. |

Customers Bargaining Power

Travelers, especially in transit hubs, face limited choices and time constraints, impacting their price sensitivity. If customers are highly price-sensitive, they might choose cheaper options or pack their own food. For example, in 2024, the average meal price at airport restaurants was about 15% higher than outside. SSP needs to balance pricing with perceived value to maintain profitability.

Customers' bargaining power rises when they have many dining alternatives. SSP Group faces competition from restaurants, cafes, and stores. To stay competitive, SSP must differentiate its food and services. In 2024, the global food service market was valued at over $3 trillion, highlighting the availability of alternatives.

Customers have minimal switching costs; they can effortlessly choose another food or beverage option. This ease of switching intensifies the competition faced by SSP Group. To retain customers, SSP Group must offer superior service and value. For example, in 2024, the average customer spent $15 at a quick-service restaurant, highlighting the importance of competitive pricing and quality.

Customers are well-informed

Customers' bargaining power is significant because they have access to extensive information, especially regarding dining options at travel locations. Online reviews and travel guides enable customers to compare prices and read feedback. In 2024, the global online travel market reached approximately $756 billion, highlighting the importance of online presence. SSP Group must actively manage its online reputation to ensure positive customer feedback and maintain competitiveness.

- Online travel market size in 2024: ~$756 billion.

- Importance of online reviews and feedback.

- Need for SSP Group to manage online reputation.

- Customer ability to compare prices and options.

Customers can easily compare prices

Customers' ability to compare prices significantly boosts their bargaining power, particularly in high-traffic locations like airports and train stations. This ease of comparison forces SSP Group to offer competitive pricing to attract customers. In 2024, the global food service market was valued at approximately $3.2 trillion, highlighting the intense competition. SSP must balance competitive pricing with maintaining healthy profit margins.

- Price comparison tools are readily available.

- Multiple vendors at transport hubs.

- Competitive pricing is essential.

- Profit margin management is key.

Customer bargaining power significantly impacts SSP Group due to accessible options and price comparisons. Online reviews and price comparison tools empower travelers in choosing alternatives. In 2024, the global food service market was around $3.2T, highlighting competition.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Avg. airport meal price 15% higher |

| Alternative Availability | High | Global food service market $3.2T |

| Switching Costs | Low | Average quick-service spend $15 |

Rivalry Among Competitors

SSP Group operates in a highly competitive market, with many food and beverage providers vying for customers in travel locations. This intense rivalry can result in price wars and higher marketing costs. For instance, in 2024, the food service industry saw a 5% increase in marketing spending due to competition. SSP needs to differentiate its offerings to maintain its market share amid this rivalry.

Many food and beverage outlets, like SSP Group, provide comparable offerings such as coffee, sandwiches, and snacks. This similarity intensifies competition, as customers have more choices. To stand out, SSP needs to create distinct concepts. In 2024, the global coffee shop market was valued at $49.6 billion, showing intense rivalry.

High exit barriers, like long-term leases, keep firms in the market, increasing competition. Companies might accept lower profits to stay operational. SSP, with 2024 revenue at £3.2 billion, must assess exit plans when expanding. These barriers intensify rivalry. Consider the implications for profitability and market share.

Slow industry growth

Slow industry growth intensifies competition within SSP Group's market. This environment often triggers price wars, squeezing profit margins. SSP must strategically identify and capitalize on growth opportunities to maintain its competitive edge. For instance, the global travel market is projected to grow, but at varying rates across regions; Europe's growth rate is estimated at 3.5% in 2024.

- Europe's projected travel market growth: 3.5% in 2024.

- Intense competition leads to price pressures.

- SSP must seek out growth areas.

- Slow growth reduces profitability.

Brand competition

SSP Group navigates brand competition, both internally and externally. It manages its own brands alongside partner brands, aiming to prevent cannibalization. Effective brand positioning is vital for attracting diverse customer segments.

- SSP operates over 500 brands globally.

- Partnerships include brands like Starbucks and Burger King.

- In 2024, SSP's revenue was over £3 billion.

- Brand portfolio management is key to revenue growth.

SSP Group faces intense competition in the travel food and beverage sector, impacting profitability. Rivalry drives up marketing expenses, with the industry seeing a 5% rise in 2024. The similarity of offerings, such as coffee and snacks, increases price pressures. SSP must differentiate to maintain its market position.

| Factor | Impact | 2024 Data |

|---|---|---|

| Marketing Costs | Increased | Up 5% |

| Market Value (Coffee Shop) | High Rivalry | $49.6B |

| SSP Revenue | Competitive Pressure | £3.2B |

SSubstitutes Threaten

Convenience stores pose a threat to SSP Group by offering cheaper, quicker alternatives for travelers. These stores provide snacks and drinks at lower prices, making them attractive for budget-conscious consumers. SSP's success hinges on providing a superior experience to justify its higher prices. In 2024, the convenience store market grew, with sales of $300 billion, indicating the growing competition.

Vending machines pose a threat as they offer convenient snacks and drinks, potentially undercutting SSP's sales. In 2024, the vending machine market was valued at approximately $24 billion globally. SSP must compete by providing superior quality and variety. Focusing on fresh, appealing options is crucial to maintain market share against this readily available alternative.

Travelers can sidestep SSP Group's offerings by bringing their own food and drinks, especially budget travelers. This poses a threat, particularly with rising inflation impacting consumer spending. In 2024, the cost-conscious approach is more prevalent. SSP must compete effectively against this "bring-your-own" trend.

Fast food chains

Fast food chains near travel hubs pose a threat to SSP Group. These chains offer convenient, affordable alternatives to SSP's restaurants. Their presence requires SSP to differentiate its offerings to maintain market share. SSP must focus on quality and unique menu items.

- McDonald's, for instance, reported $6.4 billion in U.S. sales in Q4 2023.

- SSP's revenue in 2023 was £3.0 billion.

- Fast food often has faster service than SSP's sit-down locations.

- Differentiation is key for SSP to compete effectively.

Airport lounges

Airport lounges present a threat to SSP Group by offering similar services, like food and drinks, potentially diverting customers. This is especially true for frequent flyers and business travelers who often have lounge access. SSP needs to focus on drawing in those without lounge privileges.

- In 2024, the global airport lounge market was valued at approximately $1.5 billion.

- Around 70% of business travelers have access to airport lounges.

- Lounges typically offer complimentary food and beverages, impacting SSP's revenue.

Various alternatives threaten SSP Group. Convenience stores and vending machines offer cheaper and more accessible options, competing for traveler's spend. "Bring your own" food and fast food chains also challenge SSP's market share. Airport lounges provide another area of competition for premium customers.

| Substitute | Market Size (2024) | Impact on SSP |

|---|---|---|

| Convenience Stores | $300 billion | High - Cheaper options |

| Vending Machines | $24 billion | Medium - Convenient snacks |

| "Bring Your Own" | Variable | Medium - Cost-conscious |

Entrants Threaten

Opening food and beverage outlets in airports, train stations, and motorway service areas demands substantial capital. Lease costs, construction, and equipment purchases are expensive. High capital requirements hinder new entrants. SSP Group benefits from this barrier. In 2024, average initial investments exceeded $500,000 per unit.

SSP Group benefits from strong brand recognition in the travel F&B sector. This established reputation fosters customer loyalty, a significant barrier for new competitors. In 2024, SSP's brand investments helped maintain a strong market position. SSP's success is tied to its ability to preserve brand value against rising competition.

Securing prime locations poses a significant challenge for new entrants in SSP Group's market. Limited space and long-term leases in airports, train stations, and service areas create a barrier. SSP's established relationships with landlords give them a competitive edge. In 2024, SSP reported a revenue increase, partly due to its strategic location management. Maintaining these relationships is crucial to protect their access.

Stringent regulations and security

Operating food and beverage outlets in travel locations is subject to stringent regulations and security requirements, increasing barriers to entry. New entrants face complex permitting and strict security protocols, which can be costly and time-consuming. SSP's established relationships and expertise in these areas provide a significant advantage. These regulatory hurdles protect existing players by limiting the ease with which new competitors can enter the market. In 2024, the food service industry faced increased scrutiny regarding food safety, with over 1,000 recalls in the U.S. alone, highlighting the importance of regulatory compliance.

- Stringent regulations and security requirements raise barriers to entry.

- New entrants face complex permitting processes.

- SSP's experience offers a competitive edge.

- Regulatory hurdles protect existing players.

Economies of scale

SSP Group, due to its vast size and international presence, enjoys significant economies of scale. This advantage enables SSP to secure better deals from suppliers, thus lowering operational expenses. New competitors will find it difficult to match SSP's cost structure. To maintain its competitive edge, SSP must keep leveraging its scale.

- Global Presence: SSP operates in numerous countries, enhancing its buying power.

- Supplier Negotiations: SSP can negotiate favorable terms with suppliers.

- Cost Advantage: Lower operating costs create a barrier to entry.

- Competitive Edge: SSP must continually leverage its scale to stay ahead.

New entrants face significant obstacles, starting with high capital demands; initial investments often exceed $500,000 per unit. Strong brand recognition of established players like SSP Group provides customer loyalty, creating a barrier to new competitors. Securing prime locations, essential in the travel F&B sector, also presents a hurdle due to limited space and long-term leases.

| Barrier | Impact | Data |

|---|---|---|

| Capital Costs | High initial investments | Avg. unit cost >$500K (2024) |

| Brand Recognition | Customer Loyalty | SSP brand maintained value |

| Location Access | Limited space & leases | Strategic location mgmt. |

Porter's Five Forces Analysis Data Sources

This analysis uses company reports, market data from industry research firms, and financial databases for its insights.