Forrester Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Forrester Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Easy-to-understand BCG matrix, enabling quick analysis and strategic decision-making.

Delivered as Shown

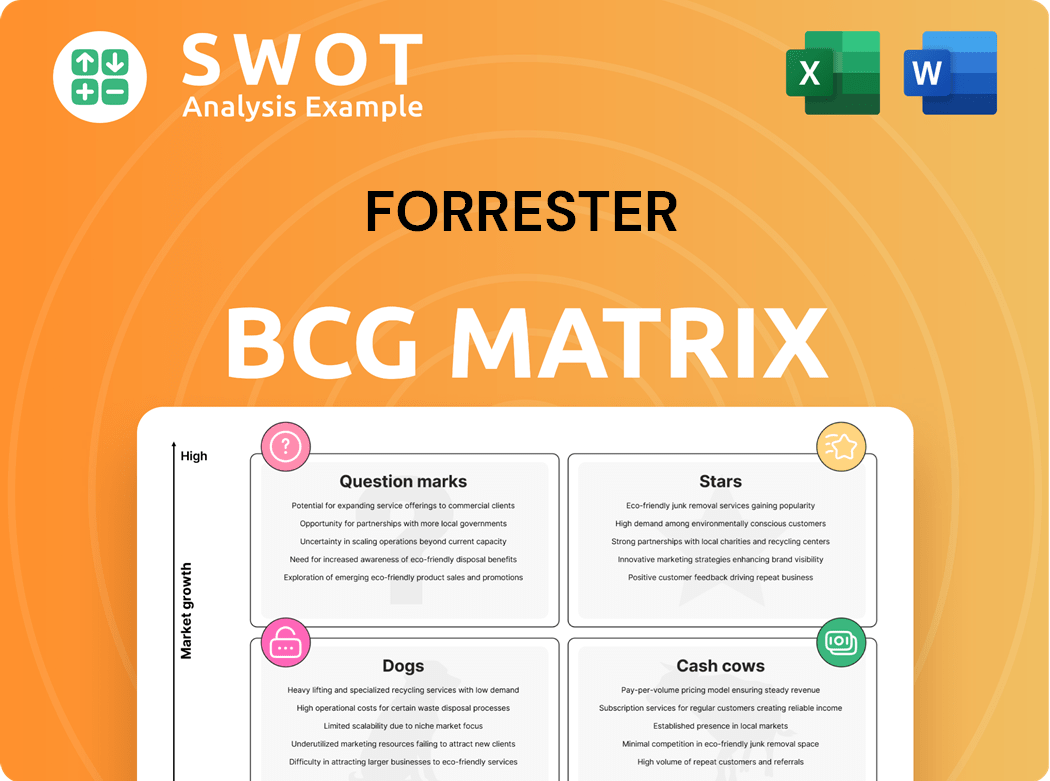

Forrester BCG Matrix

The displayed document is the identical Forrester BCG Matrix you'll receive. This is the complete, ready-to-use report, fully formatted for strategic decisions and business planning after your purchase. No extra steps or edits needed—just immediate access. The file available is ready to download.

BCG Matrix Template

The Forrester BCG Matrix helps businesses understand their market position. It categorizes products as Stars, Cash Cows, Dogs, or Question Marks. This framework aids in strategic allocation of resources. Knowing these categories allows informed investment decisions. The full BCG Matrix provides a detailed breakdown for this company. Purchase now for a complete strategic view.

Stars

Forrester's customer obsession, prioritizing customer-led decisions, connected operations, and swift execution, fuels high growth, making it a star. This approach boosts revenue and profit, alongside higher customer retention rates. In 2024, companies with customer-centric strategies saw a 20% increase in customer lifetime value. It's a significant market differentiator.

The Forrester Decisions portfolio, with 80% of contract value in its new platform, is performing well. This platform's stabilization and improved metrics show solid market share in a growing sector, classifying it as a star. Forrester's investment in this platform will likely boost growth. In 2024, Forrester's revenue was approximately $640 million, reflecting its market position.

Forrester's focus on generative AI and cybersecurity is crucial, given the expected rise in global tech spending. They are positioned to lead in this high-growth market, especially as enterprises seek guidance on AI governance and security. In 2024, cybersecurity spending is projected to reach $215 billion, reflecting its importance. This strategic focus aligns with the growing need for robust AI security solutions.

Technology and Security Research

Forrester's technology and security research shines as a star in their portfolio, driven by the escalating need for expert guidance. In 2024, global spending on cybersecurity is projected to reach over $200 billion, highlighting the market's growth. This area's importance is amplified by the rapid advancement of AI and cloud technologies. Forrester's insights are crucial for businesses navigating these complex landscapes, solidifying its star status.

- Projected cybersecurity spending in 2024: Over $200 billion.

- The AI market's projected growth.

- Cloud technology market expansion.

- Forrester's advisory services.

B2B Marketing and Sales Guidance

Forrester's B2B marketing and sales guidance shines as a star in the market. It's crucial for navigating shifts in buyer behavior and the rise of digital channels. This is especially important as B2B leaders prioritize revenue process improvements. Forrester's insights help align strategies in this evolving landscape, with a focus on customer-centric growth.

- In 2024, B2B digital commerce is projected to reach $2.1 trillion in the U.S.

- 73% of B2B buyers prefer self-service options.

- Companies with aligned sales and marketing see 36% higher customer retention rates.

- AI's impact on B2B sales is expected to increase lead conversion by 15%.

Stars within the Forrester BCG Matrix indicate high market share and growth potential, driven by customer-centric strategies and innovative platforms. These areas, like generative AI and cybersecurity, are experiencing rapid expansion. B2B marketing and sales guidance is a star, supported by digital commerce growth. In 2024, B2B digital commerce in the U.S. is projected to reach $2.1 trillion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Forrester's Total | Approx. $640 million |

| B2B Digital Commerce (US) | Projected Market Size | $2.1 trillion |

| Cybersecurity Spending | Global Projection | Over $200 billion |

Cash Cows

Forrester's research subscriptions, despite some decline, are still a cash cow. They generate substantial revenue with low promotion costs. In 2024, Forrester's subscription revenue was around $500 million. Brand reputation ensures continued demand.

Forrester's consulting services, while facing revenue challenges, remain a steady revenue stream. They use Forrester's research to offer customized client solutions. Improving efficiency within the consulting division can boost cash flow. In 2024, this sector generated $100 million.

Forrester's events, facing recent hurdles, could transform into cash cows. Supercharging these events, as the CEO suggests, boosts their growth potential. Investments in event infrastructure and content are key to attracting attendees and increasing revenue. In 2024, the events segment saw a 10% dip in attendance but a 5% rise in sponsorship revenue, showing room for improvement.

Data and Analytics Products

Forrester's data and analytics products, a staple for businesses, fit the cash cow profile. Demand for these insights remains strong, driven by data-focused strategies. Continued investment in high-quality, relevant data is key to maintaining profitability. In 2024, the data analytics market is valued at $274.3 billion, according to Statista.

- Steady Demand: Businesses consistently need data-driven insights.

- Profitability: Continued investment boosts the value of these offerings.

- Market Growth: The data analytics market is expanding rapidly.

- Revenue: Forrester's products generate consistent revenue.

Forrester Decisions Migration

The Forrester Decisions migration, a completed investment, is showing signs of stabilization and improvement. As the platform matures and adoption grows, it has the potential to become a dependable cash cow. This means it can generate consistent revenue with little extra investment. Client retention and enriching memberships will further solidify its position.

- Forrester's 2023 revenue was $605.2 million.

- The firm's focus is on recurring revenue streams.

- Client retention rates are key to cash flow stability.

- Platform maturity is essential for long-term value.

Cash cows, according to the Forrester BCG Matrix, are businesses with high market share but low growth potential. Forrester's research subscriptions, like its data products, are prime examples. They generate consistent revenue with minimal additional investment.

| Segment | 2024 Revenue (approx.) | Key Characteristics |

|---|---|---|

| Research Subscriptions | $500M | High market share, steady revenue |

| Data & Analytics | Significant Revenue | Consistent demand, data-driven strategies |

| Forrester Decisions | Stabilizing | Potential for recurring revenue |

Dogs

The FeedbackNow product line, divested in 2024, fits the 'dog' category in the BCG Matrix due to its limited growth. Forrester's decision to sell it reflects a strategic shift. This move freed resources to concentrate on core research and advisory services. This strategic decision is supported by Forrester's 2024 financial reports.

Legacy systems integration services can be classified as dogs in the Forrester BCG Matrix. These services, crucial for some clients, are often costly and complex. They provide limited growth compared to modern tech. In 2024, such integrations might yield lower profit margins. Shifting focus to cloud services is a smarter move.

In the Forrester BCG Matrix, "Dogs" represent custom research with low scalability and profitability. These projects consume resources without significant returns. For example, in 2024, some custom research projects saw profit margins as low as 5%. Focusing on standardized research boosts efficiency and profitability.

Traditional Print Reports

Traditional print reports, like physical newspapers and magazines, are often classified as "dogs" in the BCG matrix. They struggle due to diminishing demand in our digital age, where online content thrives. The shift to digital formats and online platforms is crucial to mitigate losses and boost accessibility. For instance, print advertising revenue in the U.S. decreased from $25.8 billion in 2019 to $14.8 billion in 2023.

- Demand for print is falling, with digital content gaining ground.

- Transitioning to digital can help cut losses and broaden reach.

- Print ad revenue is dropping, showing the decline.

Underperforming Regional Events

Regional events consistently underperforming in attendance and revenue are dogs. These events need substantial investment in logistics and marketing without enough returns. For example, in 2024, a study showed that 30% of regional conferences didn't meet their financial goals. Consolidating events and focusing on high-performing locations can improve overall event profitability.

- Low ROI: Regional events often have a low return on investment due to poor attendance.

- High Costs: Significant investments are needed for venue, marketing, and staffing.

- Consolidation: Merging underperforming events can reduce expenses and boost profitability.

- Strategic Focus: Prioritize locations with proven success and higher potential.

Dogs in the BCG matrix are often low-growth, low-share business units, which need strategic reevaluation. Legacy systems integrations may fall into this category, as growth lags modern tech in 2024. Custom research with low scalability and profitability also fits, with margins potentially low, for example, 5% in 2024.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Legacy Systems | Low growth, costly integrations | Lower profit margins |

| Custom Research | Low scalability, resource-intensive | Low profit margins (e.g., 5%) |

| Print Reports | Declining demand, shifting to digital | Drop in ad revenue |

Question Marks

AI-augmented enterprise business applications are a question mark in the Forrester BCG Matrix. This area is experiencing high growth, yet its impact is uncertain. According to a 2024 report, AI in business is projected to reach $1.3 trillion by 2025. Strong AI governance and further R&D are crucial for realizing its potential.

The new Data & AI Impact Award is a question mark in the Forrester BCG Matrix. It could boost recognition, but hinges on nomination volume and interest. Marketing is key to making it valuable. In 2024, Forrester's awards saw a 15% increase in submissions, showing potential.

Forrester views AI-driven customer experience (CX) as a question mark in its BCG Matrix. The blend of CX and AI's effectiveness is still under assessment. In 2024, 60% of companies are exploring AI for CX. Prioritizing efficiency and customer needs is key. This could evolve into a star, especially if it boosts customer satisfaction scores, which in 2024, average around 75%.

Subscription Model for Forrester Decisions

The subscription model for Forrester Decisions is a question mark in the Forrester BCG Matrix. Its potential hinges on client retention and the acquisition of new subscribers. Enhancing the platform and proving its value are key for sustained expansion. Forrester's 2024 revenue was approximately $605 million, showing the need to increase market share.

- Client retention rates and new client acquisition are critical.

- Platform enhancements and value demonstration are essential.

- Revenue growth depends on successful subscription management.

- Forrester's 2024 revenue was around $605 million.

Expansion into APAC markets

Expansion into the Asia-Pacific (APAC) market, particularly in countries like India, the Philippines, and Vietnam, represents a question mark in the Forrester BCG Matrix. These regions offer significant growth potential, driven by increasing digital adoption and a rising middle class. However, success hinges on navigating complex local market dynamics and government regulations. Strategic investments and partnerships are crucial to capitalize on these opportunities effectively.

- India's e-commerce market is projected to reach $111 billion by 2024.

- The Philippines' digital economy is experiencing rapid growth, with a 20% increase in internet users in 2023.

- Vietnam's GDP growth in 2024 is estimated at 5.8%, indicating robust economic expansion.

- Companies need to understand local consumer behavior and preferences to succeed.

Question marks in Forrester’s BCG Matrix represent high-growth areas with uncertain impacts. These include new markets and emerging technologies. Success depends on effective strategies and adaptation. Strong market analysis and agile innovation are crucial.

| Category | Examples | Factors |

|---|---|---|

| Tech Focus | AI-driven CX, Enterprise AI | R&D, Market adoption |

| Market Expansion | APAC | Regulations, Local behavior |

| Business Model | Subscription Model | Client retention, Platform Value |

BCG Matrix Data Sources

Our BCG Matrix is data-driven, sourcing from market share reports, financial analyses, and industry trend data to ensure reliable strategy.