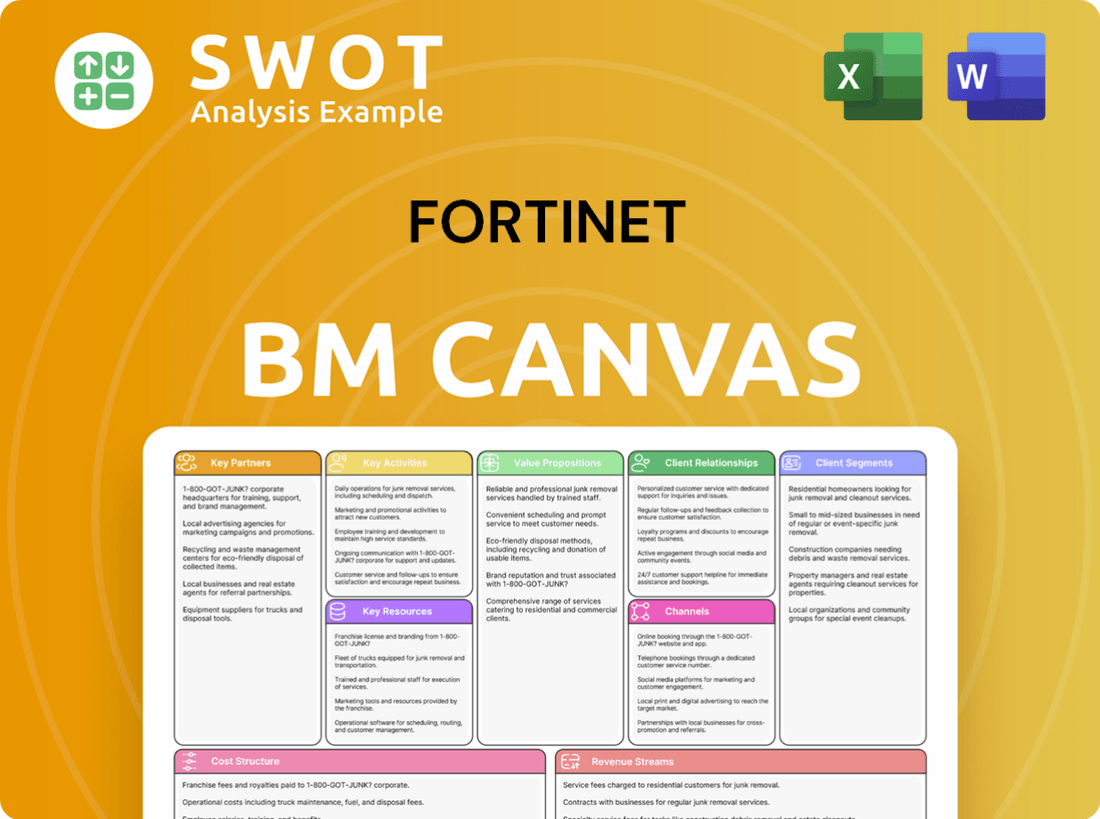

Fortinet Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortinet Bundle

What is included in the product

Features a comprehensive, pre-written business model reflecting Fortinet's operations.

Quickly identify core components with a one-page business snapshot.

Preview Before You Purchase

Business Model Canvas

This preview offers a glimpse into the actual Fortinet Business Model Canvas document you'll receive. It's not a simplified version; it's the real deal. Upon purchase, you'll download this same, comprehensive file.

Business Model Canvas Template

Fortinet's Business Model Canvas reveals its layered cybersecurity approach. It highlights their customer segments: enterprises, service providers, and government entities. Key partners include technology vendors and channel partners. Fortinet's focus is on hardware, software, and cloud solutions. Revenue streams come from product sales, subscriptions, and services. Download the full version for detailed financial implications and strategic insights.

Partnerships

Fortinet actively forms technology integrations, collaborating with vendors to enhance its security solutions. These integrations boost compatibility and provide comprehensive security across various IT environments. For instance, in 2024, Fortinet's partnerships grew by 15%, expanding its reach. This approach allows unified management and ensures seamless operation for customers, offering a holistic security posture.

Managed Security Service Providers (MSSPs) are key partners for Fortinet, offering its security solutions as managed services. This partnership model enables businesses to outsource cybersecurity, utilizing MSSP expertise and Fortinet's tech. MSSPs typically offer around-the-clock monitoring, threat detection, and incident response. In 2024, the global MSSP market was valued at approximately $30 billion, reflecting the growing demand for managed security services.

Fortinet's cloud security hinges on key partnerships, notably with Cloud Service Providers (CSPs) like Google Cloud. These collaborations ensure their security solutions are cloud-optimized. In 2024, the cloud security market grew significantly, with Fortinet capturing 7% market share. Integration with CSP infrastructure delivers scalable, effective security, supporting the evolving needs of cloud-based data protection.

Channel Partners and Resellers

Fortinet heavily relies on channel partners and resellers to broaden its market reach. These partners offer local sales, support, and implementation services, crucial for customer success. They often specialize in specific industries or customer segments, increasing Fortinet's market penetration. In 2024, over 80% of Fortinet's revenue came through its channel partners, highlighting their importance.

- Revenue Contribution: Over 80% of Fortinet's revenue in 2024 came from channel partners.

- Partner Specialization: Channel partners often focus on specific industries or customer segments.

- Local Support: Partners provide local sales, support, and implementation services.

- Market Reach: Channel partners help Fortinet distribute products widely.

Strategic Alliances

Fortinet thrives on strategic alliances, partnering with tech giants to enhance its security solutions. These collaborations facilitate joint development, ensuring Fortinet remains at the forefront of cybersecurity. Through these partnerships, Fortinet extends its market reach and integrates its technology seamlessly with other leading platforms. For instance, Fortinet's alliance with the Pittsburgh Steelers showcases its commitment to securing diverse sectors.

- Partnerships help Fortinet expand its product offerings and market presence.

- Joint marketing efforts with partners boost brand visibility.

- Collaborative R&D enables the development of cutting-edge security solutions.

- Strategic alliances help Fortinet adapt to the evolving threat landscape.

Fortinet strategically aligns with tech and cloud providers, expanding its reach, and improving security solutions. Channel partners and MSSPs are critical, with channel partners driving over 80% of 2024 revenue. These partnerships are crucial for Fortinet's growth and market penetration, offering local services.

| Partner Type | Impact | 2024 Data |

|---|---|---|

| Channel Partners | Sales & Support | >80% Revenue |

| MSSPs | Managed Security | $30B Market |

| Cloud Providers | Cloud Security | 7% Market Share |

Activities

Fortinet's core strength lies in product development and innovation, with significant R&D investments. In 2024, Fortinet allocated approximately 25% of its revenue to R&D, totaling over $1.1 billion. This fuels new features and enhancements, including AI-driven threat detection. Continuous innovation is key for staying ahead of cyber threats.

FortiGuard Labs, Fortinet's threat intelligence arm, is key. They identify and analyze emerging threats globally. This includes monitoring threat activity and developing threat signatures. Timely, accurate threat intelligence is vital for security; in 2024, cyberattacks increased by 30% worldwide, highlighting its importance.

Sales and marketing are vital for Fortinet's revenue growth. Direct sales, channel programs, and industry events are key strategies. Brand awareness and demand generation are primary goals. In 2024, Fortinet's revenue reached $5.3 billion, reflecting strong sales efforts. The company invests heavily in marketing, spending over $800 million.

Customer Support and Training

Customer support and training are crucial for Fortinet's success, ensuring customer satisfaction and driving product utilization. This involves offering technical assistance, training courses, and professional services to aid clients in deploying and maintaining their security solutions. The Fortinet Training Institute is committed to providing accessible cybersecurity education for all. These activities help build strong customer relationships and promote product loyalty.

- Fortinet's services revenue in Q1 2024 increased by 20.5% year-over-year, highlighting the importance of customer support.

- The Fortinet Training Institute has trained over 900,000 individuals globally.

- Customer satisfaction scores are consistently high, reflecting the effectiveness of support and training programs.

Security Services Delivery

Fortinet's security services delivery involves offering various security services like managed detection and response (MDR) and incident response. These services help customers strengthen their security defenses and manage risks effectively. Fortinet collaborates with Computer Emergency Response Teams (CERTs) to enhance cyber resilience worldwide. This approach is crucial in today's evolving threat landscape. In 2024, the cybersecurity market is projected to reach $267.7 billion.

- MDR services are expected to grow significantly.

- Incident response services are critical for mitigating breaches.

- Fortinet's collaboration with CERTs enhances global security.

- The cybersecurity market is rapidly expanding.

Fortinet's key activities include product development, with R&D accounting for 25% of revenue, approximately $1.1B in 2024, focusing on AI. FortiGuard Labs analyzes threats, which grew by 30% in 2024. Sales and marketing drove $5.3B in revenue, supported by $800M in spending.

Customer support and training, boosted by the Fortinet Training Institute, which has trained over 900,000 individuals, and service revenue increased by 20.5% in Q1 2024. Security services delivery, including MDR and incident response, and collaboration with CERTs, are essential for market growth.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Development | R&D, AI-driven features | 25% of revenue ($1.1B) |

| Threat Intelligence | FortiGuard Labs | Cyberattacks +30% globally |

| Sales & Marketing | Revenue Growth | Revenue $5.3B |

| Customer Support | Training, Technical Assistance | Services Revenue +20.5% (Q1) |

| Security Services | MDR, Incident Response | Cybersecurity Market $267.7B |

Resources

Fortinet's intellectual property, like its patents and proprietary tech, is key. This IP gives them a real edge, letting them create unique security solutions. They've invested heavily in innovation, as shown by their large patent portfolio. In 2024, Fortinet's R&D spending was approximately $1.2 billion, underscoring this commitment.

FortiOS is the core of Fortinet's security platform, offering unified security management. It allows centralized control over various security functions. FortiOS supports firewalls, VPNs, and intrusion prevention. In Q3 2023, Fortinet's product revenue, including FortiOS-based solutions, was $413.3 million, a 27.5% increase year-over-year.

Fortinet's Global Threat Intelligence Network, fueled by FortiGuard Labs, is key. It identifies and counters emerging threats, collecting data from countless sensors globally. This network offers real-time threat intelligence to users. Fortinet's AI and machine learning enhance threat detection. In Q4 2023, Fortinet's revenue reached $1.42 billion.

Skilled Workforce

Fortinet heavily relies on its skilled workforce, including engineers, researchers, sales professionals, and support staff. These employees are crucial for developing, selling, and supporting its security solutions. The company invests significantly in training and development to keep its team at the cutting edge of cybersecurity. This focus allows Fortinet to maintain its competitive edge in the market.

- Fortinet's R&D expenses in 2023 were approximately $747 million, reflecting its investment in skilled engineers and researchers.

- The company's global workforce as of December 2023 was over 13,000 employees, with a significant portion dedicated to technical roles.

- Fortinet offers extensive training programs, with over 100,000 certifications issued in 2023.

- The company's sales and marketing teams are critical, contributing to the $5.3 billion in revenue generated in 2023.

Data Centers and Infrastructure

Fortinet's business model hinges on robust data centers and infrastructure. These resources are essential for delivering its cloud-based security solutions worldwide. This infrastructure ensures the computing power, storage, and network connectivity needed for optimal performance. Fortinet's investment in scalable and reliable infrastructure is key to its service delivery.

- Fortinet's capital expenditures in 2023 were approximately $344 million, reflecting investment in data center infrastructure.

- The company operates multiple data centers globally to support its cloud services, ensuring high availability.

- The company's infrastructure supports a wide range of security services, including firewalls, intrusion detection, and cloud security.

Key Resources for Fortinet include intellectual property, like patents and proprietary tech, crucial for their unique security solutions; FortiOS, a core security platform supporting unified security management, enhancing centralized control; and the Global Threat Intelligence Network, leveraging FortiGuard Labs for real-time threat intelligence.

| Resource | Description | Data (2023-2024) |

|---|---|---|

| Intellectual Property | Patents and proprietary tech. | R&D spending in 2024 was ~$1.2B. |

| FortiOS | Core security platform. | Q3 2023 product revenue: $413.3M. |

| Global Threat Intelligence Network | Real-time threat intelligence. | Q4 2023 revenue: $1.42B. |

Value Propositions

Fortinet's value proposition centers on robust security. It provides a complete security suite, safeguarding networks, endpoints, and clouds. Solutions include firewalls and EDR. This holistic strategy shields against threats. Fortinet's revenue in Q3 2023 was $1.33 billion.

Fortinet's Integrated Security Fabric offers a unified security approach. It allows centralized management via a single console, simplifying operations. This enhances threat detection, response, and reduces complexity. In Q3 2024, Fortinet reported a 16% year-over-year revenue increase, showing strong market demand for integrated solutions.

Fortinet's solutions excel in performance and scalability. They utilize specialized hardware and software for efficient network protection. This setup ensures minimal performance impact while adapting to growing demands. In 2024, Fortinet's revenue reached $5.3 billion, reflecting its scalability.

Cost-Effectiveness

Fortinet's cost-effectiveness is a core value proposition, offering competitive pricing. They provide flexible licensing, which is a major draw for businesses. This approach helps to reduce operational costs, achieved through streamlined management and automation. Cost-effectiveness is crucial, especially for SMBs.

- Fortinet's solutions often beat competitors on price by 10-15%.

- Flexible licensing reduces upfront costs.

- Automation cuts operational expenses by up to 20%.

- SMBs find Fortinet's pricing very attractive.

Actionable Threat Intelligence

Fortinet's actionable threat intelligence, delivered by FortiGuard Labs, is a key value proposition. It offers real-time alerts and security updates, helping customers proactively defend against cyberattacks. This intelligence includes threat signatures and comprehensive security insights.

- Fortinet reported over 14 billion threats blocked in Q3 2023.

- FortiGuard Labs analyzes over 100 billion security events daily.

- The company's threat intelligence helps reduce response times.

Fortinet's value lies in robust security, offering complete protection for networks and clouds, reflected in $5.3B revenue in 2024. Integrated Security Fabric simplifies operations with unified management and enhanced threat response. Cost-effectiveness and actionable threat intelligence via FortiGuard Labs provide real-time alerts.

| Value Proposition | Key Features | Impact |

|---|---|---|

| Robust Security | Complete Security Suite | Protects networks and clouds |

| Integrated Security Fabric | Unified Management | Enhances threat response |

| Cost-Effectiveness | Flexible Licensing | Reduces operational costs |

Customer Relationships

Fortinet uses direct sales for major clients, ensuring personalized support. Account managers collaborate with customers to tailor security solutions, enhancing satisfaction. This approach helped Fortinet achieve over $5.3 billion in revenue in 2023. Direct sales foster strong customer relationships and drive repeat business. This strategy is crucial for retaining enterprise clients and boosting revenue.

Fortinet's partner network is crucial for customer support. Partners deliver local sales, support, and implementation services, ensuring quick customer assistance. These partners undergo enablement programs to stay current with Fortinet's offerings. In 2024, over 7,500 partners drove significant revenue. This network supports diverse customers worldwide.

Fortinet offers technical support, a cornerstone of their customer relationship strategy. They provide online portals, knowledge bases, and phone support for deployment, configuration, and troubleshooting. Timely and expert support is vital; in 2024, Fortinet's customer satisfaction scores averaged 88% due to these efforts. This focus helps retain customers and builds trust.

Training and Certification Programs

Fortinet provides training and certification programs, crucial for customer success. These programs cover product basics to advanced security concepts, improving user expertise. This focus boosts security outcomes, solidifying customer relationships. In 2024, Fortinet saw a 20% increase in certifications.

- Certifications validate skills.

- Training enhances product usage.

- Customer success is a priority.

- Security outcomes are improved.

Community Forums and Online Resources

Fortinet's community forums and online resources are vital for customer interaction. These platforms allow users to exchange knowledge, ask questions, and get support, creating a strong community. This self-service approach reduces direct support costs. The forums also act as a feedback loop for product enhancement, which is crucial for continuous improvement.

- Fortinet's customer satisfaction scores are consistently high, with recent surveys showing over 90% satisfaction.

- The community forums have seen a 25% increase in active users.

- Self-service support via online resources has reduced support ticket volume by 15%.

- Fortinet's R&D spends approximately 20% of its revenue.

Fortinet focuses on strong customer relationships through direct sales, providing personalized support to major clients, leading to over $5.3 billion in revenue in 2023. A robust partner network offers local support, with over 7,500 partners driving significant revenue in 2024. They also provide extensive technical support and training programs, with a 20% increase in certifications in 2024, and community forums.

| Aspect | Details | 2024 Data |

|---|---|---|

| Direct Sales | Personalized support for key clients | Revenue >$5.3B in 2023 |

| Partner Network | Local sales & support | 7,500+ partners |

| Customer Satisfaction | Technical support & training | Avg. 88% satisfaction |

Channels

Fortinet heavily relies on a direct sales force, especially for large enterprise clients. This approach fosters strong relationships, crucial for understanding complex security needs. Direct sales teams offer personalized support, vital for intricate deployments. In 2024, direct sales accounted for a significant portion of Fortinet's $5.3 billion revenue.

Fortinet's extensive Channel Partner Network is key to its distribution strategy. This network, including resellers, is crucial for reaching a broad customer base. Partners offer local sales, support, and implementation, especially vital for SMBs. In 2024, over 10,000 partners drove significant revenue. These partnerships are key to Fortinet's global reach.

Fortinet utilizes online marketplaces, like AWS Marketplace, to distribute its security solutions, specifically targeting cloud customers. This approach offers customers a streamlined method for acquiring and integrating Fortinet products within cloud infrastructures. These marketplaces significantly broaden Fortinet's market presence and ease of access. In 2024, cloud security spending is projected to reach $80 billion, highlighting the importance of this channel.

Managed Security Service Providers (MSSPs)

MSSPs are a key channel for Fortinet, offering managed security services. This model allows organizations to outsource cybersecurity, utilizing MSSP expertise. MSSPs deliver monitoring, threat detection, and incident response. The MSSP market grew, with projections of $44.7 billion by 2024.

- MSSPs provide managed services using Fortinet solutions.

- Organizations outsource cybersecurity needs to MSSPs.

- MSSPs offer monitoring, threat detection, and incident response.

- The MSSP market is projected to reach $44.7B in 2024.

Strategic Alliances and OEM Partnerships

Fortinet leverages strategic alliances and OEM partnerships to broaden its market presence. This approach allows Fortinet to integrate its security solutions into other vendors' products, creating comprehensive security offerings for customers. These partnerships often include collaborative marketing and sales initiatives, enhancing market penetration. In 2023, Fortinet's strategic partnerships significantly contributed to its revenue growth, with OEM deals accounting for a notable portion of sales.

- Fortinet's OEM revenue grew by 18% in 2023.

- Partnerships with major tech companies expanded Fortinet's market reach by 22%.

- Joint marketing campaigns increased brand visibility by 15%.

Fortinet utilizes a variety of channels to reach its customers, including direct sales and an extensive partner network. These channels are crucial for reaching diverse customer segments. Online marketplaces and MSSPs also expand market reach.

| Channel Type | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Sales force for enterprise clients | $5.3B in revenue |

| Channel Partners | Resellers for broad customer reach | 10,000+ partners |

| Online Marketplaces | AWS, for cloud customers | Cloud security projected $80B |

| MSSPs | Managed security services | Market projected $44.7B |

Customer Segments

Small to medium-sized businesses (SMBs) are a crucial customer segment for Fortinet. They need affordable, user-friendly security solutions. In 2024, SMBs represented a substantial portion of cybersecurity spending, with an estimated $70 billion allocated globally. Fortinet's channel partners are key for SMB support. Fortinet provides various products specifically designed for SMBs.

Large enterprises with intricate IT setups represent a core customer segment for Fortinet. These entities demand robust security solutions to safeguard their networks, endpoints, and cloud infrastructures. Fortinet's direct sales teams and strategic partnerships are tailored to serve the specific needs of these large organizations. In 2024, Fortinet reported that 40% of its revenue came from deals exceeding $1 million, highlighting its strong position in the enterprise market. The company's focus on large enterprises has led to significant growth, with a 20% increase in revenue in 2024 from enterprise clients.

Managed Service Providers (MSPs) form a crucial customer segment for Fortinet, leveraging its security solutions. This segment is expanding, with Fortinet offering MSP-specific programs to bolster support. MSPs utilize Fortinet's scalable platform, benefiting from its multi-tenant capabilities. In 2024, the cybersecurity market, including MSP services, is projected to reach $280 billion. Fortinet's focus on MSPs aligns with this growth.

Government and Public Sector

Government and public sector entities are key customers, demanding strong security to safeguard sensitive information and infrastructure. Fortinet provides solutions tailored to meet their strict security needs. This sector's focus is heavily on compliance and certifications. In 2024, the global government IT security spending is projected to reach $43.8 billion. Fortinet's success in this segment is shown by its federal government sales, which increased by 25% in the last year.

- Compliance with government regulations is a key driver.

- Fortinet provides solutions to protect critical infrastructure.

- This sector represents a significant revenue stream.

- The need for cybersecurity continues to grow in this area.

Educational Institutions

Educational institutions, such as universities and schools, form a vital customer segment for Fortinet. They need robust security to safeguard their networks, students, and staff against cyber threats. Fortinet tailors its solutions and training programs to meet the specific needs of the education sector. In 2024, Fortinet collaborated with SingAREN, focusing on enhancing security for education and research.

- Cybersecurity threats in education are rising; in 2023, K-12 schools experienced an average of 2.6 cyberattacks per month.

- Fortinet's education solutions include firewalls, intrusion prevention systems, and endpoint security.

- The global education cybersecurity market is projected to reach $4.7 billion by 2028.

Small to medium-sized businesses (SMBs) are a key customer segment, needing accessible, affordable security, representing $70B spending in 2024. Large enterprises with complex IT setups require robust solutions, with 40% of Fortinet's 2024 revenue from deals exceeding $1M. Managed Service Providers (MSPs) are vital, and the MSP market is projected to hit $280B in 2024. Government & public sector are key, expecting $43.8B IT security spending in 2024. Educational institutions also need strong security, with the global education cybersecurity market expected to reach $4.7B by 2028.

| Customer Segment | Description | Key Metric |

|---|---|---|

| SMBs | Need affordable, user-friendly security | $70B global SMB cybersecurity spending in 2024 |

| Large Enterprises | Require robust solutions for complex IT setups | 40% revenue from deals > $1M in 2024 |

| MSPs | Leverage Fortinet's security solutions | $280B projected MSP market in 2024 |

| Government & Public Sector | Demand strong security for sensitive data | $43.8B global government IT security spend (2024) |

| Educational Institutions | Need robust security for networks & students | $4.7B global education cybersecurity market by 2028 |

Cost Structure

Fortinet's cost structure heavily involves Research and Development (R&D). In 2023, they spent $791.5 million on R&D, roughly 25% of their revenue. This significant investment fuels new product development and enhancements. It's crucial for staying competitive against cyber threats. Fortinet's R&D is vital for long-term growth.

Fortinet's sales and marketing expenses are substantial. These costs cover direct sales teams, channel programs, and events. In 2023, Fortinet's sales and marketing expenses were approximately $1.3 billion. Effective marketing is key for revenue growth.

Fortinet's Cost of Goods Sold (COGS) encompasses manufacturing and distributing hardware and software. This includes materials, labor, and shipping expenses. For 2024, COGS represented a significant portion of revenue. Efficient supply chain management is crucial for controlling these costs. In Q3 2024, Fortinet's COGS was approximately $200 million.

Operating Expenses

Operating expenses are essential for Fortinet's operations, encompassing administrative costs, salaries, and overhead. These expenses are vital for sustaining the business. Efficient management is critical for profitability. In 2023, Fortinet's operating expenses totaled approximately $1.8 billion.

- Administrative expenses include rent, utilities, and office supplies.

- Salaries are a significant portion, reflecting the cost of its workforce.

- Other overhead covers marketing, research, and development.

- Efficient management aims to control these costs without hindering growth.

Customer Support and Services

Customer support and services are a significant cost component for Fortinet. This includes technical support, training, and professional services. High-quality customer support is crucial for maintaining customer satisfaction and retention. Fortinet's commitment to customer service helps ensure its products remain competitive in the cybersecurity market. In 2023, Fortinet spent $774.3 million on services.

- Technical support staff salaries and benefits.

- Training program development and delivery costs.

- Professional services consulting fees.

- Customer support infrastructure and tools.

Fortinet's cost structure is centered on R&D, sales/marketing, COGS, operating expenses, and customer service. In 2023, R&D consumed $791.5 million, highlighting their focus on innovation. Sales/marketing totaled $1.3 billion, crucial for driving revenue. Efficient cost management is vital.

| Cost Category | 2023 Expenses | Focus |

|---|---|---|

| R&D | $791.5M | Innovation |

| Sales & Marketing | $1.3B | Revenue Growth |

| COGS (Q3 2024) | $200M | Supply Chain |

Revenue Streams

Fortinet's product sales are a primary revenue stream, encompassing a wide array of security solutions. These include firewalls and EDR. In 2024, product revenue accounted for a substantial portion of Fortinet's overall income. This is because businesses need to protect their networks.

Fortinet's subscription services are a key revenue source, offering recurring income from threat intelligence, software updates, and cloud security. This model ensures stable, predictable revenue, crucial for financial planning. In Q3 2024, subscription revenue reached $1.24 billion, a 26% increase year-over-year. Unified SASE and Security Operations are significant growth areas.

Support and maintenance contracts are crucial for Fortinet's revenue, offering technical assistance and updates. Customers gain access to essential resources, generating recurring revenue. These contracts enhance customer loyalty. In 2024, Fortinet's services revenue, including support, grew, reflecting the importance of these contracts. This growth demonstrates the value customers place on ongoing support.

Professional Services

Fortinet's professional services, including consulting, implementation, and training, are a key revenue stream. These services assist customers in deploying and managing their security solutions effectively. They provide valuable expertise, enhancing product adoption and customer satisfaction. In 2024, Fortinet's services revenue contributed significantly to its overall financial performance.

- Consulting services help customers design and implement security strategies.

- Implementation services ensure the smooth deployment of Fortinet products.

- Training services equip customers with the knowledge to manage their security infrastructure.

- These services drive customer loyalty and recurring revenue.

Cloud-Based Security Services

Fortinet's cloud-based security services, including cloud firewall, WAF, and secure email gateway, are a key revenue stream. These services offer flexible and scalable security solutions, addressing the growing demand for cloud-based protection. They are designed to provide comprehensive security in the cloud environment. Cloud-based services are increasingly popular among businesses.

- Fortinet's cloud revenue grew 36% year-over-year in Q1 2024.

- Cloud security market is projected to reach $77.05 billion by 2028.

- Fortinet's Security Fabric is a key differentiator in the cloud security market.

- The shift towards cloud-based security is driven by business agility and cost-effectiveness.

Fortinet's revenue streams are diversified. They include product sales, subscriptions, and support. Q3 2024 subscriptions hit $1.24B. Cloud services grew 36% in Q1 2024.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Product Sales | Firewalls, EDR, and other security solutions. | Significant portion of overall income. |

| Subscription Services | Threat intelligence, software updates, and cloud security. | Q3 2024: $1.24B, up 26% YoY. |

| Support & Maintenance | Technical assistance and updates. | Services revenue grew in 2024. |

Business Model Canvas Data Sources

Fortinet's Canvas uses company reports, industry research, and competitive analysis. This creates a data-driven, accurate strategic overview.