Fortive Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortive Bundle

What is included in the product

Comprehensive BMC tailored to Fortive's strategy, including full customer, channel & value propositions details.

High-level view of the company’s business model with editable cells.

Full Version Awaits

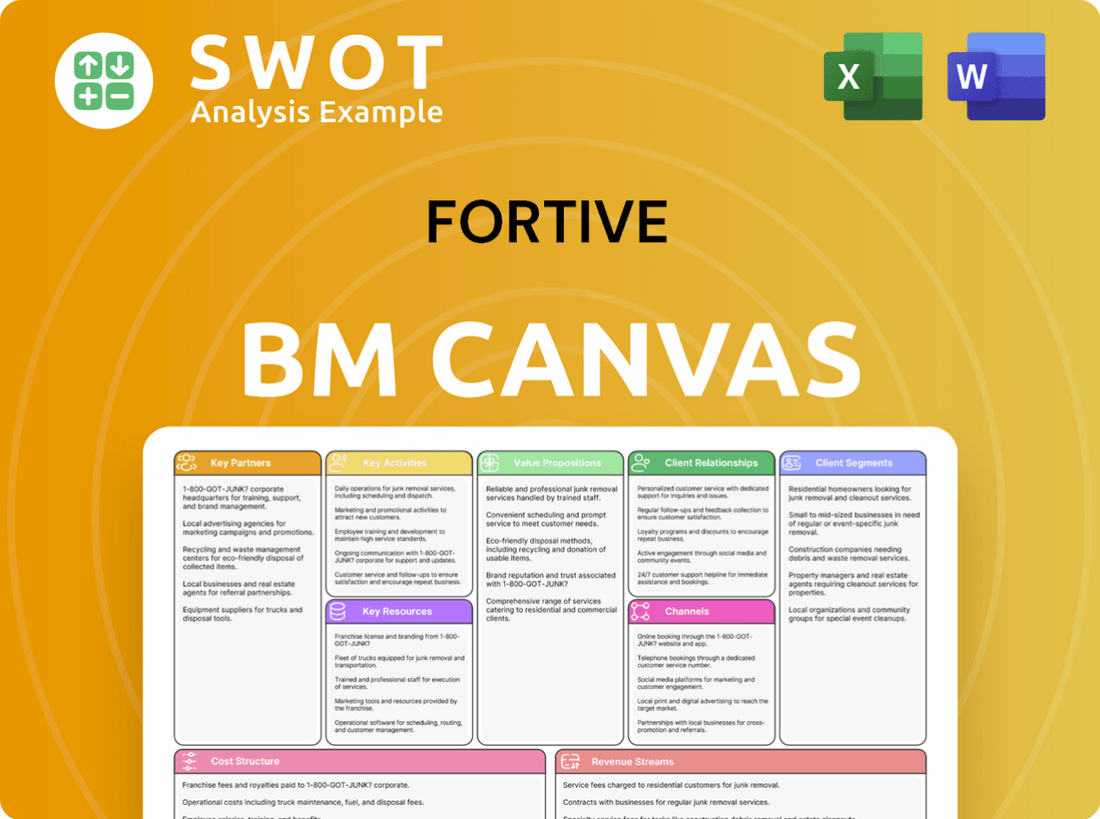

Business Model Canvas

This Business Model Canvas preview shows the exact document you'll receive after purchase. There are no differences between what you see and the final deliverable. Download the same file for immediate use and editing.

Business Model Canvas Template

Explore Fortive's strategic architecture with its Business Model Canvas. This concise overview reveals key elements like customer segments and value propositions. It showcases how Fortive generates revenue and manages costs. Gain insights into their core activities and partnerships. Understand their competitive advantages and operational efficiency. Download the full canvas for in-depth analysis and strategic inspiration.

Partnerships

Fortive's strategic acquisitions fuel growth by integrating new technologies and expanding market presence. In 2023, Fortive invested $412 million across three acquisitions, including Intelex Technologies, Gordian Group and Measurement Technologies. These acquisitions are key to enhancing Fortive's portfolio.

Fortive's success hinges on strong relationships with technology and manufacturing suppliers. These partnerships are essential for securing vital components and advanced manufacturing capabilities. Key suppliers like Siemens AG, Honeywell International, ABB Limited, and Schneider Electric play a crucial role. In 2024, Fortive's supply chain resilience was tested, highlighting the importance of these collaborations.

Fortive strategically partners with research institutions and universities to fuel innovation. These collaborations grant access to the latest research and a pipeline of talent. Key partners include Massachusetts Institute of Technology, Stanford University, and Georgia Tech. For example, in 2024, Fortive invested $50 million in research partnerships, reflecting its commitment to technological advancement.

Joint Ventures

Fortive utilizes joint ventures to tap into specialized technology and industrial markets, pooling resources and knowledge with collaborators. This strategy allows Fortive to broaden its scope and competencies in particular sectors, while also reducing risks and capitalizing on partner strengths. In 2024, Fortive had six active joint ventures, reflecting a strategic approach to growth and innovation. The total joint venture investments amounted to $283 million, highlighting the company's commitment to collaborative ventures.

- Access to specialized technology and industrial markets

- Resource and expertise sharing

- Risk mitigation and leveraging partner strengths

- Six active joint ventures in 2024

- Total joint venture investments of $283 million

Channel Partners

Fortive leverages channel partners to expand its market presence and offer local support, especially in varied geographic locations. These partners provide crucial local market knowledge, sales assistance, and customer service, which boosts customer satisfaction. Strong channel partnerships are key for Fortive to penetrate markets effectively and offer robust customer support, as seen in 2024, with channel sales contributing significantly to overall revenue. For example, in 2024, channel partners facilitated approximately 35% of Fortive's total sales.

- Geographical Reach: Channel partners enable Fortive to access and serve diverse global markets.

- Local Expertise: Partners offer insights into local market needs and customer preferences.

- Sales and Support: They provide sales and after-sales service, improving customer experience.

- Revenue Contribution: Channel sales make up a substantial portion of Fortive's total revenue.

Key partnerships for Fortive include tech suppliers, universities, and joint ventures. These collaborations drive technological advancements and market expansion. In 2024, Fortive's partnerships supported sales and innovation.

| Partnership Type | Purpose | 2024 Data |

|---|---|---|

| Suppliers | Secure Components | Supply chain testing |

| Universities | Fuel Innovation | $50M in research |

| Joint Ventures | Specialized Markets | 6 active, $283M invested |

| Channel Partners | Market Reach | 35% sales contribution |

Activities

Fortive's core revolves around product design and manufacturing, creating professional and industrial measurement tools. This requires substantial investment in research, development, and manufacturing facilities. In 2023, Fortive allocated $735 million to capital expenditures, enhancing its design and manufacturing capabilities. This focus ensures innovation and quality in its offerings, driving its market position. The company continuously refines its processes to improve efficiency and product performance.

Technology development is crucial for Fortive, focusing on innovation and R&D to meet customer demands. This core activity involves investments and strategic acquisitions. Fortive's dedication to tech is evident in its 1,287 active patents. This focus helps maintain a competitive edge and drive future growth.

Fortive's key activities involve software engineering and digital platform development to boost product offerings. This includes cloud-based apps, data analytics, and platforms that work with hardware. In 2024, recurring revenue (ARR) growth in the IOS segment accelerated to a high single-digit rate. The company is investing heavily in digital solutions.

Strategic Acquisitions and Integration

Fortive's key activities include strategic acquisitions to fuel growth. This involves identifying, evaluating, and integrating new businesses. In 2023, Fortive completed three acquisitions, totaling $412 million. This approach expands Fortive's market presence and capabilities.

- Acquisition of Provation Software, Inc. in 2023.

- Focus on acquiring companies that complement existing business segments.

- Integration processes to leverage synergies and drive operational efficiencies.

- Due diligence to assess financial and strategic fit of potential targets.

Application of Fortive Business System (FBS)

The Fortive Business System (FBS) is central to Fortive's operations, ensuring ongoing improvement and efficiency across its diverse businesses. FBS uses lean methodologies and focuses on problem-solving to optimize processes and boost performance. In 2023, Fortive reported FBS implementation across all operating companies, driving enhancements. This system has supported Fortive's strategic goals.

- FBS drives operational excellence.

- Lean principles are key to FBS.

- Continuous improvement is a focus.

- FBS is implemented company-wide.

Fortive's key activities include strategic acquisitions, exemplified by the 2023 purchase of Provation Software. Technology development, backed by 1,287 patents, is also vital. The Fortive Business System (FBS) drives operational excellence.

| Activity | Description | 2023 Data |

|---|---|---|

| Product Design & Manufacturing | Creates professional tools. | $735M CapEx |

| Technology Development | Focuses on innovation. | 1,287 Patents |

| Strategic Acquisitions | Fuels business growth. | 3 Acquisitions, $412M |

Resources

Fortive's success hinges on its advanced engineering and technical talent pool. This skilled workforce, including engineers and scientists, fuels innovation. Securing and keeping top talent is key for Fortive's competitive edge. As of 2024, Fortive has 25,670 employees globally, underscoring its reliance on human capital.

Fortive's competitive edge lies in its proprietary measurement and sensing technologies. These technologies are a key resource within its business model. Fortive's portfolio includes 1,287 active patents, showcasing its commitment to innovation. This technological prowess allows the company to offer high-performance solutions. Fortive's ability to leverage these technologies is crucial for its success.

Fortive's global footprint includes 43 primary manufacturing facilities, strategically located across 13 countries. These facilities are crucial for producing and distributing Fortive's diverse product portfolio. They utilize advanced manufacturing technologies. This supports efficient operations and global market reach.

Strong Brand Portfolio

Fortive's strength lies in its robust brand portfolio, featuring reputable names in its key markets. These established brands enhance customer trust and boost sales, solidifying market positions. The strategic segments boast leading brands, contributing significantly to Fortive's overall success. In 2024, Fortive's revenue was approximately $6.1 billion, reflecting the power of its brand recognition.

- Market leadership drives revenue.

- Brand recognition builds customer loyalty.

- Strategic segments support growth.

- 2024 revenue was approx. $6.1B.

Global Distribution Network

Fortive's global distribution network is crucial for its broad market reach. This network, including distributors and direct sales, serves a diverse customer base. In 2023, about 46% of Fortive's sales came from outside the U.S., highlighting its international focus. This extensive network supports sales across various geographical regions.

- Global Presence: The network's reach spans many countries.

- Sales Distribution: Channels include distributors and direct sales.

- International Revenue: Nearly half of sales are from outside the U.S.

- Market Coverage: Supports a wide range of customer locations.

Key resources for Fortive include its skilled workforce of over 25,670 employees. Proprietary technologies, backed by 1,287 patents, are crucial. A global footprint, with 43 manufacturing facilities, is also essential.

| Resource | Description | Impact |

|---|---|---|

| Talent | 25,670+ employees | Drives innovation |

| Technology | 1,287 Patents | Competitive Edge |

| Facilities | 43 Manufacturing sites | Supports global reach |

Value Propositions

Fortive's value proposition centers on high-performance solutions tailored for diverse industries. These solutions boost productivity and safety. In 2024, Fortive's revenue was approximately $6.5 billion. They offer tech for professional services.

Fortive's value proposition emphasizes technological innovation, consistently creating new products and solutions. This innovation enables Fortive to lead the competition and satisfy customer needs. Fortive is a top industrial tech company, with a strong presence in the global precision instrumentation market. In 2024, Fortive's R&D spending was approximately $500 million, reflecting its commitment to innovation.

Fortive's connected workflow solutions merge hardware, software, and services, streamlining customer processes. These solutions enhance data visibility and collaboration. Fortive offers essential tech for connected workflows. In 2024, workflow automation spending hit $12.9B. This shows the value of integrated solutions.

Global Reach and Support

Fortive's global presence ensures customers worldwide receive support. They operate in over 50 countries, offering local expertise and service. This widespread network ensures timely assistance, enhancing customer satisfaction. Fortive's 18,000 employees provide localized support.

- Global operations in over 50 countries.

- 18,000 employees worldwide.

- Localized support for timely assistance.

Customized Solutions

Fortive excels in offering customized solutions, a key value proposition. They deeply engage with clients to grasp specific needs. This approach results in tailored products and services. Fortive's focus is on solving unique customer challenges, particularly in professional service sectors.

- Custom solutions boost customer satisfaction.

- Tailored offerings foster long-term partnerships.

- Fortive's tailored approach drives revenue.

- They increase market share through customization.

Fortive's value proposition includes advanced tech tailored for various industries, boosting productivity and safety. They innovate consistently with new products, leading the competition, and meeting customer needs. Connected workflow solutions streamline processes with hardware, software, and services, enhancing data visibility and collaboration.

| Value Proposition Element | Details | 2024 Data |

|---|---|---|

| Tech Solutions | High-performance products, professional services. | Revenue approx. $6.5B |

| Innovation | New products, solutions to meet customer needs. | R&D spending approx. $500M |

| Connected Workflows | Integrated hardware, software, and services. | Workflow automation spending $12.9B |

Customer Relationships

Fortive utilizes a direct sales force to connect with major clients, understand their needs, and offer its products. This approach strengthens customer relationships, crucial for its business model. In Q4 2023, Fortive saw core revenue growth, especially in Intelligent Operating Solutions. This direct engagement strategy is key to enhancing its performance in key segments like Advanced Healthcare Solutions.

Fortive's technical support is crucial, offering assistance for product setup, training, and issue resolution. This support is essential for maximizing the utility of Fortive's offerings. In 2024, 22% of Fortive's staff, totaling 5,648 employees, were dedicated to technical support roles. This investment underscores Fortive's commitment to customer success and product usability.

Fortive supports customers through online resources, including product documentation, training, and FAQs. These resources boost satisfaction and minimize direct support needs. In 2024, Fortive's digital initiatives saw a 15% increase in customer self-service usage. Fortive's technology solutions cater to various professional service sectors.

Customer Training Programs

Fortive offers customer training programs to enhance the use and maintenance of its professional service solutions. These programs boost customer proficiency, ensuring they fully leverage their investments. Fortive's commitment to customer education is crucial, especially for its technology solutions. This approach strengthens customer relationships and drives long-term value.

- Training programs help customers achieve operational efficiency.

- These programs often include hands-on sessions and online modules.

- Customer training is a key element of Fortive's service offerings.

- The company's customer satisfaction scores are consistently high.

Dedicated Account Management

Fortive's dedicated account management is crucial, especially for key customers. These managers act as the main contact, fostering strong relationships and ensuring customer satisfaction. This approach supports Fortive's core revenue growth, particularly in Intelligent Operating Solutions and Advanced Healthcare Solutions. In 2024, Fortive's revenue was approximately $6.2 billion, with significant contributions from these strategic segments.

- Account managers build lasting customer relationships.

- Focus on strategic segment performance.

- Supports overall revenue growth.

- Revenue in 2024 was around $6.2B.

Fortive builds strong customer relationships via direct sales, technical support, and online resources. Customer training programs and dedicated account management further enhance these connections. This customer-centric approach supports consistent revenue growth, which was approximately $6.2 billion in 2024.

| Customer Touchpoint | Description | Impact |

|---|---|---|

| Direct Sales | Direct engagement to understand and offer products. | Strengthens relationships & drives revenue. |

| Technical Support | Assistance with setup, training, and issue resolution. | Enhances product utility and customer satisfaction. |

| Online Resources | Product documentation, training, and FAQs. | Boosts customer self-service & reduces direct support needs. |

Channels

Fortive's direct sales teams engage directly with customers, crucial for complex solutions. This approach strengthens client relationships, offering personalized support. In Q1 2024, Intelligent Operating Solutions saw revenue growth, reflecting direct sales effectiveness. Fortive emphasizes core revenue growth and strategic segment performance.

Fortive leverages distributor networks to expand its market reach, especially in varied geographical areas. These partners offer crucial local market knowledge and support, aiding customer engagement. In 2024, Fortive's distribution strategy supported its $6.6 billion revenue. This approach is vital for delivering connected workflow solutions.

Fortive utilizes an online marketplace, streamlining product access for customers. This platform offers detailed product specs, technical support, and customer service options. Fortive’s tech solutions cater to various professional service sectors, driving operational efficiency. In 2024, online sales accounted for a significant portion of Fortive's revenue, reflecting the marketplace's importance.

Value-Added Resellers (VARs)

Fortive leverages Value-Added Resellers (VARs) to enhance its market presence, especially in niche areas. These VARs customize and integrate Fortive's solutions, offering specialized services. This approach expands Fortive's reach in connected workflow solutions. Fortive's VAR strategy helps to improve customer satisfaction, which in turn could increase the company's revenue.

- VARs provide crucial services like training and support, increasing customer adoption of Fortive's products.

- This reseller network supports Fortive’s revenue growth, contributing to the company's financial performance.

- Fortive's VAR model is a key part of its strategy to provide essential technologies across various end-markets.

Original Equipment Manufacturers (OEMs)

Fortive's Original Equipment Manufacturers (OEMs) channel is crucial. They integrate Fortive's tech into their products. This offers broad customer access, boosting recurring revenue. Fortive delivers vital tech for connected workflows. This spans diverse, appealing end-markets.

- 2024 revenue from industrial technology was $3.3 billion.

- OEMs contribute significantly to the overall revenue.

- Fortive's focus is on workflow solutions for OEMs.

- This channel supports long-term growth.

Fortive's channels strategy includes direct sales, distributor networks, and online marketplaces. They use Value-Added Resellers (VARs) to enhance market presence and improve customer satisfaction. The OEM channel integrates tech, boosting recurring revenue. In 2024, revenue from industrial tech was $3.3B.

| Channel Type | Description | Impact |

|---|---|---|

| Direct Sales | Direct engagement with customers | Strengthens relationships |

| Distributor Networks | Expanding market reach | Supports revenue growth |

| Online Marketplace | Streamlines product access | Increases sales volume |

Customer Segments

Fortive's healthcare provider segment focuses on enhancing patient care and operational efficiency. This includes hospitals and clinics, offering solutions for streamlined workflows. The Advanced Healthcare Solutions (AHS) segment represented 22% of Fortive's revenue over the last year. Fortive's products help healthcare providers meet regulatory needs.

Fortive's customer base includes industrial manufacturers, offering solutions for productivity, quality, and safety. These manufacturers span aerospace, automotive, and electronics. In 2024, the industrial sector contributed significantly to Fortive's sales. For instance, in Q3 2024, the Professional Instrumentation segment, which serves this sector, saw strong growth. This segment accounted for approximately 40% of total revenue in 2024.

Fortive's customer segments include government and defense, a key area. They provide solutions for aerospace, defense, and security. Precision Technologies focuses on test and measurement, sensors, and defense. In 2024, defense spending continues to rise, creating opportunities.

Utilities and Energy

Fortive's utilities and energy customer segment benefits from solutions designed to boost efficiency, safety, and reliability. These solutions are crucial for power generation, transmission, and distribution. The Precision Technologies segment focuses on test and measurement, specialty sensors, and aerospace & defense. This strategic realignment allows Fortive to better serve the evolving needs of these sectors.

- In 2024, the global smart grid market is valued at approximately $35 billion.

- Fortive's Precision Technologies segment generated $2.7 billion in revenue in 2023.

- The energy sector is seeing increased investment in grid modernization.

- Utilities are prioritizing digital solutions for operational improvements.

Research and Development

Fortive's customer segment includes research and development entities. These organizations, such as universities and corporate labs, require Fortive's advanced tools. Fortive's offerings support innovation in professional service sectors. This segment leverages Fortive's technology for measurement and analysis.

- Revenue from professional instrumentation in 2023 was approximately $3.7 billion.

- Fortive's R&D spending in 2023 was around $400 million.

- The company serves thousands of R&D customers worldwide.

- Key products include test and measurement equipment.

Fortive serves healthcare providers to improve patient care, with the AHS segment accounting for 22% of revenue in 2024. Industrial manufacturers, like those in aerospace and automotive, make up a key segment, and the Professional Instrumentation segment grew strongly in Q3 2024. Government and defense are served by precision technologies. The smart grid market in 2024 is valued at approximately $35 billion.

| Customer Segment | Description | Revenue Contribution (2024) |

|---|---|---|

| Healthcare Providers | Hospitals, clinics; streamlines workflows. | AHS Segment: 22% |

| Industrial Manufacturers | Aerospace, automotive, electronics; focus on productivity, safety. | Professional Instrumentation: 40% (approx.) |

| Government & Defense | Aerospace, defense, security. | N/A |

| Utilities & Energy | Power generation, transmission, and distribution. | N/A |

| R&D Entities | Universities, corporate labs; advanced tools. | Professional Instrumentation: $3.7B (2023) |

Cost Structure

Fortive's cost structure includes substantial Research and Development (R&D) investments. These investments fuel the creation of new products and solutions. R&D expenses cover salaries, equipment, and facility costs. In 2022, Fortive's R&D spending was $687 million, which was 6.4% of total revenue.

Fortive's manufacturing and production costs cover raw materials, labor, equipment, and facility expenses. These costs are vital for producing its diverse products and solutions. In 2023, Fortive allocated $735 million towards capital expenditures, enhancing its manufacturing and design capabilities. This investment underscores Fortive's commitment to operational efficiency and innovation. These efforts help maintain competitiveness within the market.

Sales and marketing expenses cover salaries, advertising, and promotional materials, vital for lead generation, sales closure, and brand building. Fortive prioritizes revenue growth, focusing on Intelligent Operating Solutions and Advanced Healthcare Solutions segments. In 2024, Fortive's marketing spend is expected to be around $300 million. This investment supports its market position.

Acquisition and Integration

Fortive's cost structure includes acquisition and integration expenses, crucial for its growth strategy. These costs cover due diligence, legal fees, and integrating new businesses. In 2023, Fortive spent $412 million on three strategic acquisitions. This investment reflects Fortive's commitment to expanding its portfolio and market presence.

- Acquisition costs include due diligence and legal fees.

- Integration expenses involve merging new businesses.

- Fortive completed 3 acquisitions in 2023.

- The total acquisition value in 2023 was $412 million.

Technology Infrastructure

Fortive dedicates resources to its technology infrastructure, essential for its diverse operations. This encompasses IT systems, software, and data centers, forming the backbone of its services. Costs include hardware, software licenses, and the salaries of IT staff. Fortive's tech solutions support professional sectors, driving efficiency.

- In 2024, Fortive's IT spending is estimated at $500 million.

- Data center operations account for roughly 10% of the IT budget.

- Software licensing expenses are projected at $75 million.

- IT personnel costs are around $150 million annually.

Fortive's cost structure is multifaceted, encompassing R&D, manufacturing, sales, marketing, acquisitions, IT, and infrastructure. In 2022, R&D spending was $687 million. Acquisition and integration costs in 2023 totaled $412 million.

| Cost Category | Description | 2024 Estimated Spend |

|---|---|---|

| R&D | New product development | $700 million |

| Manufacturing | Production costs | $735 million (CapEx) |

| Sales & Marketing | Advertising, promotions | $300 million |

Revenue Streams

Fortive's revenue streams significantly rely on product sales, acting as a cornerstone for its financial performance. This includes measurement tools, software, and equipment sales. In 2023, the company's total revenue was $9.02 billion, demonstrating the importance of product sales. This revenue stream is vital for Fortive's overall financial health and growth.

Fortive's service revenue stems from product installation, maintenance, and repairs. This includes both contract-based and on-demand services. In 2024, service revenue contributed significantly to Fortive's total revenue. Fortive's technology solutions support professional service sectors. Service revenue is a key part of Fortive's business model.

Fortive's software subscriptions offer recurring revenue from platforms and applications. This model includes cloud-based and on-premise licenses. In 2024, the IOS segment saw recurring revenue (ARR) growing at a high single-digit rate. This growth highlights the importance of subscription models. It ensures a steady income stream for the company.

Consumables

Fortive's consumables revenue stream involves selling items like medical supplies and replacement parts, ensuring recurring income. This segment shows consistent growth, contributing significantly to overall financial performance. In 2024, the healthcare consumables sector saw mid-teens growth, partially balancing reduced capital expenditure. This highlights consumables' importance for sustained revenue.

- Recurring revenue from consumables ensures financial stability.

- Mid-teens growth in healthcare consumables in 2024.

- Replacement parts sales add to the revenue.

- The consumables segment contributes to overall growth.

Training and Consulting

Fortive's revenue streams include training and consulting services, crucial for customer support and market positioning. This encompasses product training, application support, and process optimization consulting. These services enhance customer utilization of Fortive's technology solutions. This is particularly important in professional service sectors.

- Training and consulting services are a key component of Fortive's revenue model.

- These services enhance customer utilization of Fortive's technology solutions.

- They provide product training, application support, and process optimization consulting.

- Fortive provides technology solutions for professional service sectors.

Fortive's revenue streams span product sales, services, and software subscriptions. Product sales generated $9.02 billion in 2023, showing their significance. Recurring revenue from software and consumables like medical supplies is also essential.

| Revenue Stream | Description | 2024 Highlights |

|---|---|---|

| Product Sales | Measurement tools, software, and equipment. | Key part of $9B total. |

| Service Revenue | Installation, maintenance, and repairs. | Significant contribution to total revenue. |

| Software Subscriptions | Cloud-based and on-premise licenses. | IOS ARR grew at a high single-digit rate. |

Business Model Canvas Data Sources

Fortive's canvas uses financial statements, market reports, and competitor analysis for data accuracy. We ensure relevant and precise strategic insights.