Fujifilm Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fujifilm Holdings Bundle

What is included in the product

Tailored analysis for Fujifilm's diverse product portfolio across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, providing a clear, accessible business overview.

Delivered as Shown

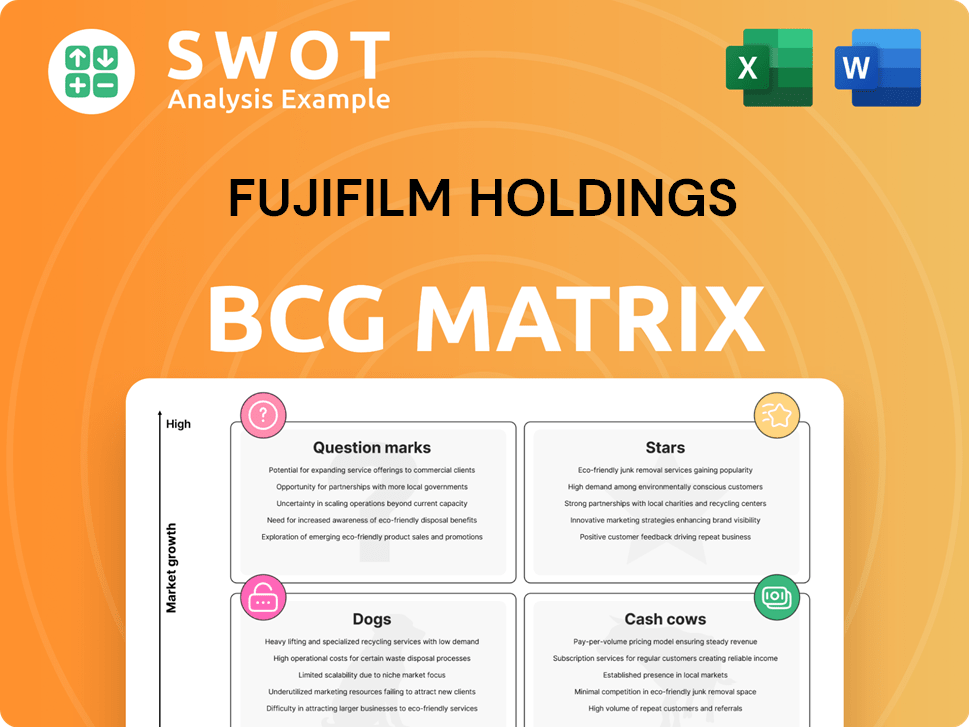

Fujifilm Holdings BCG Matrix

The Fujifilm Holdings BCG Matrix preview is identical to the purchased document. Get the full analysis immediately—no differences, ready to use. It's your complete, professional-grade strategic tool. Download and leverage this powerful resource now.

BCG Matrix Template

Fujifilm Holdings' product portfolio spans diverse sectors, from imaging to healthcare. Understanding its strategic landscape is crucial. We can briefly see potential "Stars" like innovative medical tech. "Cash Cows" might include established photographic films. Some product areas may need strategic reassessment.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Fujifilm's semiconductor materials business is booming, driven by the generative AI surge and chip production. This segment is a "Star" in their BCG matrix, signaling high growth and market share. Fujifilm is investing heavily in R&D and production capacity. In fiscal year 2023, Fujifilm's electronic materials segment saw a revenue increase.

Fujifilm's Instax instant photo systems are a Star in its BCG matrix. Instax is a major revenue driver, with record revenue expected for fiscal year 2024. This growth reflects consistent sales and new products, like the Instax Mini 99, boosting revenue. Fujifilm is expanding the Instax ecosystem with new cameras and printers. In 2023, Instax sales reached ¥250 billion.

Fujifilm's professional imaging, especially digital cameras, is booming, notably in China. New X and GFX series models drive revenue higher. In 2024, Fujifilm’s Imaging Solutions sales rose, showing strong market performance. The company is also expanding into filmmaking cameras.

Electronic Materials (OLED)

Fujifilm's electronic materials, especially OLED components, are a star in their BCG matrix. Demand for advanced materials, like anti-reflection films, is soaring due to OLED's use in smartphones and tablets. This segment significantly boosts revenue and profits within Fujifilm's electronics division. The company is capitalizing on the expanding OLED market.

- Strong demand for OLED materials.

- Revenue growth in the electronics segment.

- Focus on anti-reflection materials.

- Driven by smartphone and tablet adoption.

Bio CDMO Business

Fujifilm's Bio CDMO business, a Star in its BCG Matrix, is thriving. This growth is fueled by positive exchange rates and new facilities. Fujifilm Diosynth Biotechnologies is expanding its biomanufacturing capacity, particularly in the US and Europe. The company is actively seeking major pharma clients and growing its biomanufacturing network.

- 2024 saw Fujifilm invest heavily in its Bio CDMO business.

- The company aims to increase its global biomanufacturing capacity.

- Fujifilm is targeting major pharmaceutical clients.

- Expansion includes facilities in both the US and Europe.

Fujifilm's Stars showcase robust growth and market dominance in key sectors. These segments, including semiconductor materials and Instax, drive significant revenue and profit. Fujifilm strategically invests in these areas, like expanding bio-manufacturing capacity. This focus on high-growth markets boosts overall performance.

| Business Segment | Key Products/Services | 2024 Revenue (Estimate) |

|---|---|---|

| Semiconductor Materials | Photoresists, CMP Slurry | Significant Growth (Driven by AI & Chip Demand) |

| Instax | Instant Cameras, Film | ¥250B+ (Sales) |

| Professional Imaging | Digital Cameras | Rising Sales in China & Globally |

| Bio CDMO | Biopharmaceutical Manufacturing | Expanding Capacity & Client Base |

Cash Cows

Fujifilm's multifunctional printers are cash cows, with stable revenue from Japan, Europe, and the U.S. In 2024, this segment generated a consistent cash flow, despite slow market growth. Fujifilm's focus on digital transformation solutions aims to boost this established business. For example, in 2023, the global market was valued at $35 billion.

Fujifilm's graphic communications segment, encompassing digital printers, is a cash cow. Sales of digital printers surged in Europe and the U.S., boosting revenue. Inkjet heads for ceramics also drive growth. This division leverages its established market position and consistent demand. Supporting infrastructure boosts efficiency and maintains strong cash flow. In fiscal year 2024, Fujifilm's graphic solutions saw revenue of ¥795.3 billion.

Fujifilm's medical systems in Japan are a cash cow, boasting a high market share. This strong position facilitates steady revenue streams for the company. Fujifilm leverages cross-selling, aiming to boost sales by 10% in fiscal year 2024, and invests in human resources, allocating ¥20 billion for talent development in 2024, to maintain its dominance.

Advanced Functional Materials (Legacy Products)

Fujifilm's advanced functional materials, some in mature markets, act as cash cows. These legacy products generate stable revenue with minimal investment. The company focuses on operational efficiency to boost cash flow. Fujifilm's imaging solutions segment saw a revenue of ¥642.6 billion in FY2024, highlighting the importance of steady earners.

- Mature markets offer stable demand for these materials.

- Fujifilm aims to streamline operations to maximize profits.

- These products require relatively low investment compared to growth areas.

- The imaging solutions segment contributes significantly to overall revenue.

Optical Devices

Fujifilm's optical devices, built on its lens tech expertise, are likely cash cows. These products, such as camera lenses, generate steady revenue. They require minimal new investment. This makes them a reliable source of funds. For 2024, Fujifilm's imaging solutions segment reported strong sales.

- Steady revenue streams from established products.

- Limited need for significant capital expenditures.

- Focus on niche markets where Fujifilm has a strong foothold.

- Contribution to overall profitability and financial stability.

Fujifilm's cash cows include multifunctional printers, graphic communications (digital printers), and medical systems in Japan. These segments generate steady revenue. The imaging solutions sector, including optical devices, is also a cash cow. They require minimal investment.

| Segment | Key Products | FY2024 Revenue (approx.) |

|---|---|---|

| Multifunctional Printers | Printers, Digital Transformation Solutions | Stable, consistent cash flow |

| Graphic Communications | Digital Printers, Inkjet Heads | ¥795.3 billion |

| Medical Systems (Japan) | Medical Equipment | High market share |

| Advanced Functional Materials | Legacy Products | Significant |

| Optical Devices | Camera Lenses | Strong Sales |

Dogs

The traditional film photography market has diminished due to digital imaging's dominance. Fujifilm's legacy in this area likely yields minimal revenue, with limited growth prospects. In 2024, Fujifilm's Imaging Solutions segment, which includes film, accounted for a small portion of overall revenue. Divestiture or resource minimization for this segment could be considered.

In 2024, Fujifilm's Medical Systems in China faced a revenue decline. This segment struggles due to market challenges and competition. The company might need to rethink its approach. Fujifilm's strategic options include re-evaluating or reducing its footprint. The segment's performance in China is a key concern.

LS Solutions, within Fujifilm's portfolio, saw a revenue decrease in 2024 due to the cell culture media market's slow recovery. This segment's performance might lag behind other healthcare areas. Fujifilm could explore turnaround strategies or consider selling LS Solutions. For example, in Q3 2024, Fujifilm's Healthcare segment faced market challenges.

Outdated Office Solutions

In Fujifilm's BCG Matrix, "Dogs" represent business units with low market share in a slow-growth industry. Outdated office solutions, like certain legacy document systems, fit this category. These products likely face declining demand due to digital alternatives. Fujifilm may need to reduce investment or exit these markets. For example, in 2024, Fujifilm's office solutions revenue decreased by 5% year-over-year.

- Declining Demand: Older office tech faces digital transformation challenges.

- Minimal Revenue: These products may generate little income.

- Resource Intensive: Maintaining them requires significant resources.

- Strategic Action: Fujifilm must consider phasing out or repurposing.

Low-Margin Products

In Fujifilm's BCG matrix, low-margin products with small market shares are considered "dogs." These products drain resources without providing substantial returns. Fujifilm should assess these dogs to optimize its portfolio. In 2024, Fujifilm's Imaging Solutions segment, with products like instant cameras, faced intense competition, potentially fitting this category.

- Low profit margins characterize these products.

- Limited market share is another key feature.

- Dogs consume resources without giving much back.

- Fujifilm should consider streamlining its portfolio.

Dogs in Fujifilm's BCG matrix include low-growth, low-share businesses. These units often see declining revenues with minimal profit. Fujifilm may opt to reduce investment or exit these markets. In 2024, several segments faced these challenges.

| Feature | Impact | 2024 Example |

|---|---|---|

| Low Growth | Reduced Revenue | Office Solutions down 5% |

| Low Market Share | Limited Profit | Imaging Solutions competition |

| Resource Drain | Negative Impact | Outdated systems |

Question Marks

Fujifilm is strategically investing in AI-driven detection systems for endoscopic imaging, marking a significant move into a high-growth area. Despite the technology's promising future, its current market share is likely modest. Fujifilm will need substantial investments to compete effectively, particularly against entrenched competitors. The FDA approval of CAD Eye is a positive advancement, boosting Fujifilm's position in the market. In 2024, the global medical imaging market was valued at approximately $29.8 billion.

Fujifilm views regenerative medicine as a promising, high-growth area, aligning with its focus on healthcare. While the market is expanding, Fujifilm's current position is still developing. To compete, Fujifilm will likely need significant investments and strategic alliances. This is a long-term venture. In 2024, the global regenerative medicine market was valued at approximately $20 billion.

Fujifilm is actively creating novel semiconductor materials to keep pace with industry demands. These innovations show significant growth potential, yet their current market share might be limited. Fujifilm's focus should be on strategic marketing and sales efforts. This approach can boost adoption, mirroring how Fujifilm invested ¥87.8 billion in R&D in FY2024.

Digital Healthcare Solutions

Fujifilm is venturing into digital healthcare, a "Question Mark" in its BCG Matrix. This includes medical informatics and remote monitoring. The digital healthcare market is booming, but Fujifilm's current market share is still evolving. Strategic alliances and focused marketing are crucial for growth. Fujifilm's healthcare segment brought in ¥949.7 billion in revenue for fiscal year 2024.

- Market growth in digital health is projected to reach $600 billion by 2027.

- Fujifilm's healthcare segment accounts for roughly 30% of overall revenue.

- Strategic partnerships are essential to increase market penetration.

- Investments in R&D are vital to stay competitive.

Biomaterials

Fujifilm's foray into biomaterials, targeting medical applications, signifies a high-growth, yet potentially low-market-share venture. This area requires strategic investments and partnerships to gain traction. Fujifilm's focus on innovative materials aligns with the growing demand in healthcare. The company's strategy involves expanding its footprint in regenerative medicine and drug delivery. Fujifilm aims to capitalize on the increasing biomaterials market.

- Biomaterials market expected to reach $146.9 billion by 2028.

- Fujifilm invests in advanced materials for medical devices.

- Strategic collaborations are key for market expansion.

- Focus on regenerative medicine and drug delivery systems.

Fujifilm's ventures in digital healthcare and biomaterials, classified as "Question Marks," present high-growth potential but uncertain market shares. They require significant investments and strategic partnerships to compete effectively. Fujifilm's healthcare segment, contributing nearly 30% of total revenue in 2024, is critical.

| Area | Market Status | Fujifilm's Strategy |

|---|---|---|

| Digital Healthcare | High Growth; Evolving Market Share | Strategic Alliances, Focused Marketing |

| Biomaterials | High Growth; Low Market Share | Strategic Investments, Partnerships |

| 2024 Healthcare Revenue | ¥949.7 Billion | Expanding footprint in regenerative medicine |

BCG Matrix Data Sources

Fujifilm's BCG Matrix uses annual reports, market analysis, and financial publications for data. We leverage industry benchmarks and expert insights too.