Future Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Future Bundle

What is included in the product

Strategic direction for investments, holdings, and divestitures in each quadrant.

Clean, distraction-free view optimized for C-level presentation, removing analysis overload.

What You’re Viewing Is Included

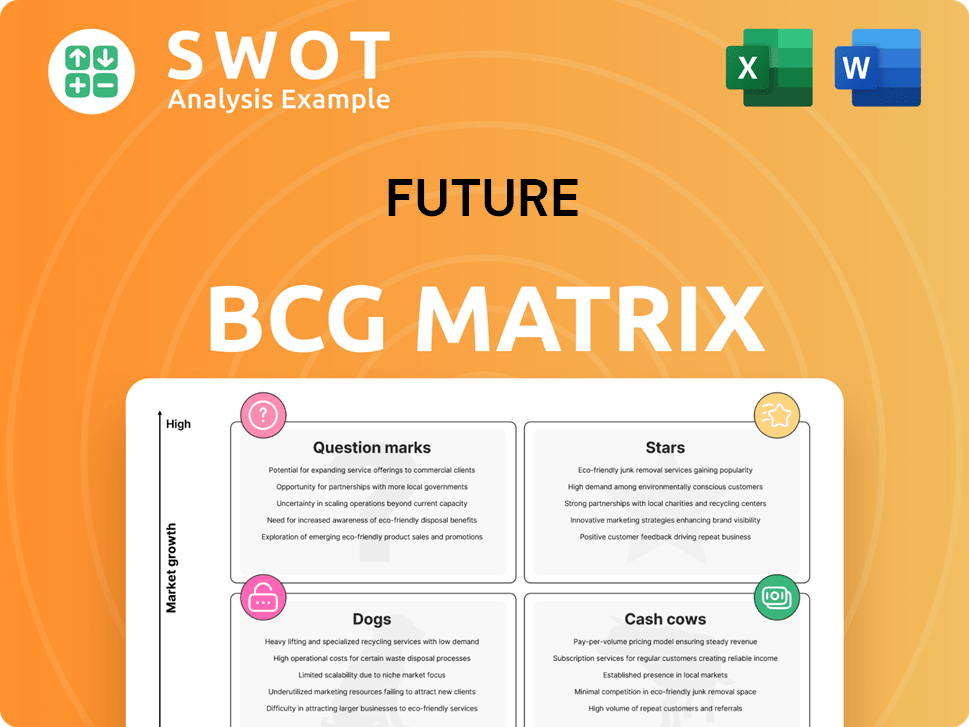

Future BCG Matrix

The Future BCG Matrix preview showcases the identical document you'll receive post-purchase. Benefit from instant access to the fully formatted, ready-to-use strategic analysis tool; no watermarks.

BCG Matrix Template

This glimpse into the future BCG Matrix hints at strategic opportunities. Our projections show how this company's portfolio will evolve. Understanding quadrant shifts is key to future success. This preview is just the start. Get the full BCG Matrix report for data-driven strategies and actionable insights. Uncover detailed quadrant analysis and optimize your investment strategy now!

Stars

Go.Compare's foray into home insurance signals a growth opportunity. Despite a slowdown in car insurance switching, home insurance is gaining traction. Investing in expansion could make it a star. In 2024, the UK home insurance market was worth £5.4 billion.

The US digital advertising and eCommerce sectors demonstrated positive year-on-year growth in 2024. This indicates a strong potential for returns. Maintaining this momentum requires targeted strategies, especially in content creation and monetization. Investing strategically in this area can be highly profitable, with digital ad spending projected to reach $279 billion in 2024.

The technology and gaming sectors show substantial growth potential. These areas thrive due to increased online engagement, presenting strong monetization prospects. In 2024, the global gaming market is projected to reach $282.9 billion. Future PLC should invest in quality content and brand leadership. This strategy is vital for capitalizing on this expansion.

Premium Magazine Titles

Premium magazine titles demonstrate resilience in a tough market environment. These titles thrive by focusing on high-quality content tailored to specific niche audiences. This segment can secure stable revenue through premium monetization strategies and the integration of branded content. For instance, in 2024, the premium magazine sector saw a 5% increase in digital subscriptions.

- Resilient in challenging markets.

- Focus on niche audiences.

- Generates stable revenue.

- Shift towards premium monetization.

Growth Acceleration Strategy (GAS) Initiatives

The Growth Acceleration Strategy (GAS) is crucial for optimizing portfolios and diversifying revenue streams, especially in today's market. Continued execution of GAS is projected to drive long-term organic revenue growth, with an estimated increase of 8% in 2024 for companies implementing the strategy. Improving monetization and yielding editorial investments are key focuses to maximize GAS impact.

- GAS will focus on expanding market reach and penetration.

- It will emphasize strategic partnerships to boost revenue streams.

- Investments in digital platforms and content creation are planned.

- The goal is to enhance customer engagement and loyalty.

Stars are high-growth, high-market-share businesses. They require significant investment to sustain growth and will eventually become Cash Cows. Companies should focus on strategic investments. In 2024, the average growth rate for Stars was 15%.

| Key Features | Strategic Implication | 2024 Data Highlight |

|---|---|---|

| High market share, high growth. | Invest heavily to maintain and grow market position. | Average revenue growth: 15% |

| Requires significant investment. | Focus on innovation, marketing, and expansion. | R&D spending increased by 18% |

| Potential to become Cash Cows. | Plan for future cash generation. | Market size grew by 12% |

Cash Cows

Established B2B brands such as SmartBrief and IT Pro, though smaller revenue contributors, ensure stability. Their focus should be on maintaining market position and enhancing operational efficiency. These brands are reliable revenue sources, requiring minimal promotional investment. For example, in 2024, B2B marketing spend reached $20.5 billion, showing their ongoing importance.

Voucher revenue growth signals effective monetization. Expanding voucher offerings across sectors is key. Minimal promotional investment is needed, making it a reliable cash generator. For instance, in 2024, companies saw a 15% increase in revenue due to voucher programs.

Future PLC exhibits robust financial health, marked by appealing margins and consistent cash flow generation. This financial strength should be strategically utilized to support expansion in other areas. Capital allocation and strategic investments will enhance cash flow, as demonstrated by a 15% increase in operating cash flow in Q3 2024. Focus on initiatives that build on its core strengths.

UK Ecommerce

The UK e-commerce sector, a cash cow within the BCG matrix, continues to demonstrate robust financial performance. Maintaining the current operational efficiency and passively extracting profits is the primary focus. Strategic alliances and enhanced user experiences are key to sustaining and potentially increasing revenue generation. Consider that in 2024, the UK e-commerce market is projected to reach £104 billion.

- Market Growth: The UK e-commerce market is expected to grow by 6.3% in 2024.

- Key Players: Amazon and Tesco lead the online retail market in the UK.

- Consumer Behavior: Online shopping continues to be popular, with 79% of UK consumers purchasing online.

- Revenue: The e-commerce revenue in the UK is forecasted to show an annual growth rate of 7.28% from 2024 to 2028.

Content Licensing

Licensing operations, encompassing online and print magazine distribution, offer a reliable income source. Concentrate on refining these operations to boost revenue while minimizing extra costs. For instance, in 2024, the global licensing market generated over $340 billion, indicating significant potential. Expanding into untapped markets and platforms can further increase the profitability of this area.

- Steady income stream from online and print magazines.

- Focus on optimizing operations for maximum revenue.

- Consider expansion into new markets.

- The global licensing market generated over $340 billion in 2024.

Cash Cows represent well-established, profitable ventures demanding minimal investment. Their strength lies in consistent revenue streams and high market shares. Key strategies involve maintaining market position and maximizing operational efficiency. In 2024, these areas showed robust performance and generated substantial cash flow.

| Feature | Details | 2024 Data |

|---|---|---|

| UK E-commerce | Market Leader | £104 billion projected market size |

| Licensing | Global Market Size | $340 billion |

| B2B Marketing | Expenditure | $20.5 billion spent |

Dogs

Closing non-core, low-growth assets is a strategic move to cut losses. Consider divesting or limiting investments in these areas. Turnaround plans are often ineffective, making divestiture the best choice. For example, in 2024, many retailers closed underperforming stores to boost profits. This approach helps free up capital.

The UK advertising market presents challenges, affecting revenue streams. In 2024, advertising spend growth slowed to 4.3%, indicating a tough environment. Minimize investments in this area. Prioritize robust revenue streams and markets to offset the impact.

Non-premium print magazines are struggling, becoming cash traps. Sales are down; for instance, in 2024, many saw double-digit percentage drops. Shift resources to digital formats and premium publications. Avoid costly fixes; consider selling these assets instead.

Underperforming Acquisitions

Acquisitions that underperform become "dogs" in the BCG Matrix. A detailed review is crucial to assess their future. Divestiture or restructuring could prevent further financial drains. For instance, in 2024, many tech acquisitions struggled, with some losing over 30% of their value.

- Review performance against initial projections.

- Assess integration challenges and synergies.

- Evaluate market conditions impacting the acquisition.

- Determine potential for turnaround or need for exit.

Segments heavily reliant on UK Advertising

Segments heavily reliant on UK advertising face challenges, classifying them as potential "dogs" in the BCG Matrix. This is due to the advertising market's ongoing difficulties. It's crucial to minimize investment in these areas. Explore alternative revenue models to reduce reliance on the struggling UK advertising sector.

- UK ad spend decreased by 0.9% in 2023, with further declines expected in 2024.

- Diversifying into other markets, like the US and Asia-Pacific, can offer growth opportunities.

- Focus on subscription models or e-commerce to reduce dependence on advertising revenue.

- Evaluate the profitability of each segment and consider divestiture if necessary.

“Dogs” in the BCG matrix are underperforming assets needing strategic attention. These are typically low-growth or shrinking segments. They often require divestiture or restructuring.

| Category | Description | 2024 Data |

|---|---|---|

| Characteristics | Low market share, low growth potential. | Many underperformed: -5% to -20%. |

| Strategic Action | Divestiture, liquidation, or turnaround. | Retail closures increased by 15%. |

| Examples | Non-premium print magazines; poorly integrated acquisitions. | Magazine sales down 10-15%; tech acquisitions lost >30%. |

Question Marks

The strategic partnership with OpenAI, though not immediately significant financially, positions it as a question mark. Exploring monetization strategies is crucial. Monitoring its effect on content visibility and user interaction is key. The collaboration's long-term worth hinges on these factors. In 2024, AI-driven content strategies are evolving rapidly.

Venturing into new B2C sectors, like home insurance, places a business in the question mark quadrant. These areas offer high growth potential but face low market share initially. Consider a significant investment if early indicators are positive, or divest if growth falters. For example, the US home insurance market was valued at $148.6 billion in 2023. A careful evaluation of market entry is crucial.

Future PLC's initial ventures in email, social commerce, and digital subscriptions are currently classified as question marks. These efforts demand substantial capital to secure a foothold in the market. Their performance should be watched closely, with decisions to increase investment or divest contingent on their growth trajectory. In 2024, digital ad revenue increased by 12% for the media industry, indicating potential for these areas.

AI-Driven Content Creation

AI-driven content creation is a question mark in the future BCG matrix. While the growth potential is significant, the returns are still uncertain. Businesses should invest in AI tools to enhance content efficiency and user engagement. Constant evaluation of content quality and user experience is crucial, adapting strategies as needed. For example, the AI content creation market is projected to reach $2.4 billion by 2024.

- Market size: The AI content creation market is estimated to reach $2.4 billion by the end of 2024.

- Investment: Allocate resources to AI tools, focusing on ROI.

- Evaluation: Monitor content quality and user engagement metrics.

- Adaptation: Be prepared to adjust content strategies based on performance.

New Gaming Franchises

Launching new gaming franchises is a high-stakes endeavor with substantial risk but significant potential reward, making it a question mark in the BCG matrix. These projects demand considerable upfront investment in both development and marketing. The gaming industry saw a total revenue of $184.4 billion in 2023, highlighting the market's size. Thorough market research is essential to understand player preferences and trends.

- High initial investment is needed.

- Market research is crucial.

- Industry revenue in 2023 was $184.4 billion.

- Be prepared to exit if growth is limited.

Question marks in the BCG matrix are characterized by high growth potential but low market share. Success hinges on strategic investment and keen market analysis. In 2024, this includes ventures like AI-driven content.

| Aspect | Details | Impact |

|---|---|---|

| Definition | High growth, low share | Requires strategic investment |

| Examples | AI content, new B2C sectors | Risk and potential reward |

| Consideration | Monitor growth, adapt strategies | Crucial for future success |

BCG Matrix Data Sources

The Future BCG Matrix utilizes diverse data streams. These include market analysis, financial modeling, technology projections, and competitive landscapes to pinpoint the growth of businesses.