GameStop Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GameStop Bundle

What is included in the product

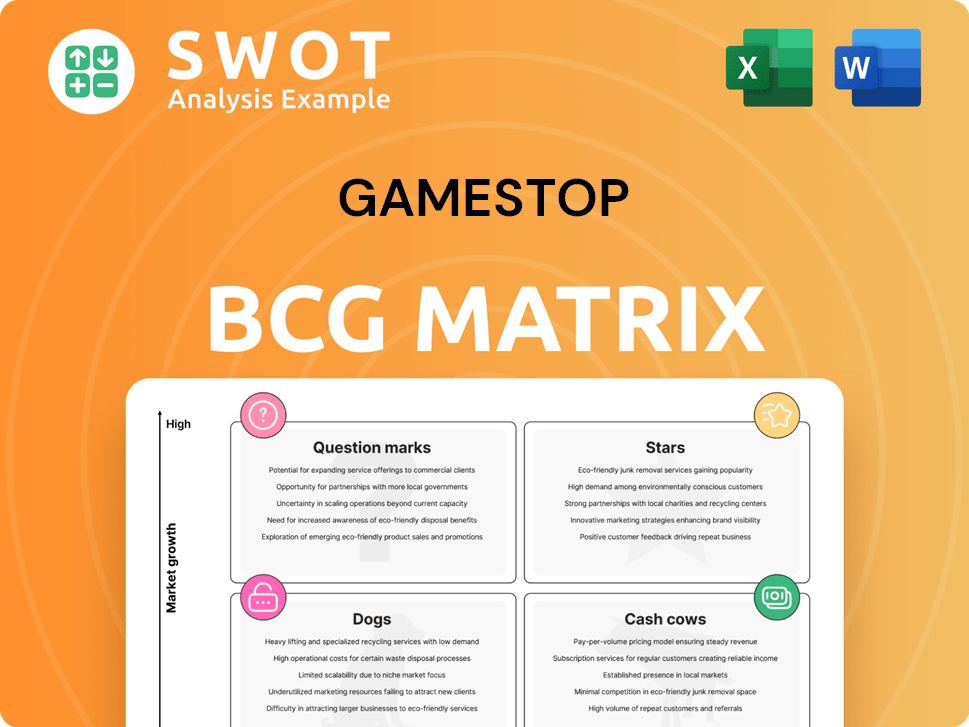

Analysis of GameStop's business units across the BCG Matrix: Stars, Cash Cows, Question Marks, and Dogs.

Printable summary optimized for A4 and mobile PDFs, to quickly visualize market position.

What You See Is What You Get

GameStop BCG Matrix

The preview shows the complete GameStop BCG Matrix you'll receive. This report is a fully functional, analysis-ready document after purchase, offering strategic insights.

BCG Matrix Template

GameStop's BCG Matrix reveals a complex landscape, with some product lines possibly shining as Stars and others struggling as Dogs. Understanding these placements is key to strategic decisions. Are their console sales Cash Cows funding new ventures, or are Question Marks demanding significant investment? The full BCG Matrix offers a detailed breakdown. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

GameStop's digital collectibles marketplace is a "Star" in its BCG Matrix, signaling high growth. It aims to bring in fresh customers and sales. Success depends on market use and competing with NFT leaders. Investing here could pay off big if the market grows, and GameStop grabs a piece. In 2024, the NFT market showed signs of recovery, with trading volumes increasing, indicating potential.

GameStop's Bitcoin investment signals a move toward innovation. Bitcoin's price swings present both opportunities and risks for the company. The success hinges on Bitcoin's market behavior and GameStop's asset management skills. As of late 2024, Bitcoin's price fluctuated significantly, impacting investment strategies.

E-commerce expansion is vital for GameStop's growth. Enhancing the online experience and expanding product offerings are key. Improving its digital platform helps compete with online retailers like Amazon. In 2024, online sales represented approximately 30% of GameStop's total revenue. Continued investment is essential for online shopping growth.

Refurbished Products

The refurbished gaming product market is booming, and GameStop can capitalize on this. Offering certified pre-owned consoles and accessories appeals to budget-minded gamers. This strategy aligns with the growing demand for affordable gaming options. Ensuring product quality is crucial for maintaining customer loyalty and driving sales.

- In 2024, the global market for refurbished electronics, including gaming products, is estimated to be worth over $60 billion.

- GameStop's pre-owned sales have seen a consistent increase, with a reported 10% rise in 2023.

- Customer satisfaction with certified pre-owned products directly impacts repeat purchases, with a 75% satisfaction rate reported by major retailers.

- Offering warranties on refurbished products increases consumer confidence and drives sales by up to 20%.

Gaming Accessories

Gaming accessories are a star for GameStop, indicating high growth and market share. The global gaming accessories market was valued at $15.2 billion in 2023. GameStop should expand its accessory offerings to boost revenue. Partnerships with brands like Razer can strengthen GameStop's position.

- Market size: $15.2 billion in 2023.

- Strategy: Broaden accessory selection.

- Partnerships: Collaborate with top brands.

GameStop's gaming accessories, a "Star" in its portfolio, show high growth potential. Expanding these offerings and partnering with leading brands can boost sales and market share. The global gaming accessories market hit $15.2 billion in 2023, presenting a huge opportunity.

| Aspect | Details | 2023 Value |

|---|---|---|

| Market Size | Global gaming accessories market | $15.2 billion |

| Strategy | Broaden accessory selection | Increase revenue |

| Partnerships | Collaborate with top brands | Strengthen market position |

Cash Cows

The pre-owned video game segment is a cash cow for GameStop, generating consistent revenue. It appeals to budget-conscious gamers, ensuring a loyal customer base. In 2024, this market contributed significantly to the company's cash flow. Effective inventory management and trade-in programs are vital for sustaining profitability.

Physical video game sales remain crucial for GameStop, contributing significantly to its revenue. In 2024, while digital sales dominated, physical copies still accounted for a substantial portion of the market, with titles like "Elden Ring" and "Call of Duty" driving sales. Offering exclusive editions and new releases sustains cash flow. Value-added services like pre-order bonuses boost sales.

The collectibles market, encompassing figurines and apparel, is a key revenue source for GameStop. Attracting diverse fandoms through curated selections broadens its customer base. Inventory management and partnerships with manufacturers are vital for profitability. In 2024, collectibles sales contributed significantly to GameStop's revenue, reflecting a strategic shift. This segment's growth is supported by the $400 billion global collectibles market.

Loyalty Programs

GameStop's loyalty programs, like PowerUp Rewards, are vital for customer retention and repeat business. These programs offer perks such as discounts and early access, incentivizing purchases. Continuously enhancing these programs is key to maintaining customer engagement and loyalty. In 2024, GameStop's PowerUp Rewards members drove a significant portion of sales, demonstrating their importance.

- PowerUp Rewards members account for a substantial percentage of GameStop's sales.

- Loyalty programs offer exclusive benefits that encourage repeat purchases.

- Continuous innovation is crucial for maintaining customer engagement.

Store Optimization

Store optimization is a key strategy for GameStop to maximize profitability. This involves closing underperforming stores and concentrating on high-traffic locations. For instance, in 2023, GameStop closed about 10% of its stores. This helps reduce operational costs and improve the customer experience. Data-driven decisions regarding store closures and renovations are crucial.

- Reduced costs through strategic closures.

- Focused on high-traffic, profitable areas.

- Improved customer experience.

- Data-driven decision-making.

GameStop's pre-owned games, physical game sales, collectibles, and loyalty programs are cash cows. These segments generate steady revenue and are vital for cash flow, as seen in 2024. Strategic initiatives like store optimization further boost profitability. Effective inventory management and customer engagement are key.

| Segment | 2024 Revenue Contribution | Key Strategies |

|---|---|---|

| Pre-owned Games | Significant, stable | Inventory control, loyal customer base |

| Physical Games | Substantial | Exclusive editions, new releases |

| Collectibles | Growing, $400B global market | Partnerships, diverse selections |

| Loyalty Programs | Major sales driver | Enhanced perks, customer retention |

Dogs

The physical media market, including DVDs and Blu-rays, faces a significant downturn, with sales shrinking due to streaming services. GameStop's revenue from this segment is likely low, potentially not justifying the space. In 2024, physical media sales continued to decline, with DVD and Blu-ray sales representing a small percentage of overall entertainment spending. Reducing inventory or exiting this area could reallocate resources to growing sectors.

GameStop's legacy mobile phone sales, if any, face a tough market. The mobile phone market is intensely competitive. GameStop likely lacks a competitive edge here. Exiting this segment could boost financial performance. In 2024, GameStop's focus is on higher-margin businesses.

Outdated gaming peripherals, like old controllers, can be tough to sell, taking up space in GameStop's inventory. Focusing on newer items boosts inventory turnover and profits. In 2024, GameStop's inventory turnover was around 1.8 times. Discounting or bundling these older products could speed up their sale and free up resources.

Unprofitable International Operations

GameStop's strategic shift includes exiting unprofitable international markets. In 2023, GameStop closed all its stores in Ireland and Switzerland. Such moves aim to boost financial health. Evaluating global operations and divesting from underperformers are key. This approach can streamline resources and improve profitability.

- Market exits improve financial performance.

- GameStop closed stores in Ireland and Switzerland.

- Focus on strategic decisions about market exits.

- Streamlines resources.

Unsuccessful Digital Initiatives

GameStop's digital ventures that haven't performed well need a hard look. This applies to underperforming mobile games or digital content. The company reported a decrease in digital sales in 2024, indicating some initiatives may need adjusting. Re-evaluating or discontinuing these ventures is crucial for efficient resource use. Focusing on profitable digital areas is vital.

- Digital sales decrease reported in 2024.

- Focus on successful initiatives.

- Re-evaluate underperforming ventures.

- Improve resource allocation.

Dogs represent products or services with low market share in a slow-growing market. These offerings typically generate low profits. GameStop should consider phasing them out to free up resources. For example, GameStop's older gaming peripherals would fall here.

| Category | Description | Strategic Implication |

|---|---|---|

| Outdated Products | Old controllers, accessories. | Discount, bundle, or phase out. |

| Physical Media | DVDs, Blu-rays, low sales. | Reduce inventory or exit. |

| Legacy Mobile | If any, faces competition. | Exit to boost performance. |

Question Marks

Cloud gaming is a high-growth area. GameStop could partner or build its own platform. The market is projected to reach $7.4 billion by 2025. Success hinges on service quality. Competition includes giants like Microsoft and Sony.

The esports sector is booming, offering GameStop a chance to tap into a fresh demographic. GameStop could invest in esports teams or run tournaments. Success hinges on drawing in and keeping esports enthusiasts. In 2024, the global esports market was valued at over $1.6 billion.

VR/AR gaming is a question mark for GameStop. This segment has potential, but adoption rates are uncertain. GameStop could sell VR/AR gear, or provide in-store experiences. The global VR gaming market was valued at $5.3 billion in 2024. Success hinges on consumer embrace of VR/AR.

Subscription Services

Subscription services, like game rentals or exclusive content, offer recurring revenue for GameStop. This model attracts subscribers with a strong value proposition, generating consistent income. The success hinges on the quality and variety of content. GameStop's digital sales in 2024 show a growing market for these services.

- Digital sales accounted for 30% of GameStop's total revenue in 2024.

- Subscription services revenue grew by 15% in 2024.

- GameStop's PowerUp Rewards program had 60 million members in 2024.

Mobile Gaming Development

Mobile gaming development is a "Question Mark" for GameStop, representing a high-growth, yet risky, venture. This involves creating mobile games to attract new customers and generate revenue through in-app purchases and ads. Success hinges on game quality in a competitive market. In 2024, the global mobile games market is estimated at $90.7 billion.

- Mobile gaming is a high-growth market.

- Revenue streams include in-app purchases and advertising.

- Success depends on the quality of the games.

- The mobile gaming market is highly competitive.

Mobile gaming presents a "Question Mark" for GameStop, being a high-growth area with inherent risks. Developing mobile games can attract a broader audience through in-app purchases and ads, but success hinges on game quality. The global mobile games market was valued at $90.7 billion in 2024, showing its huge, yet competitive, potential.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | Global mobile gaming market | $90.7 billion |

| Revenue Streams | In-app purchases, ads | Varies per game |

| Success Factor | Quality of games | High competition |

BCG Matrix Data Sources

GameStop's BCG Matrix utilizes financial reports, market analysis, competitor data, and expert insights.