General Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Electric Bundle

What is included in the product

Highlights competitive advantages and threats per quadrant

Printable summary optimized for quick team-building and decision-making.

Preview = Final Product

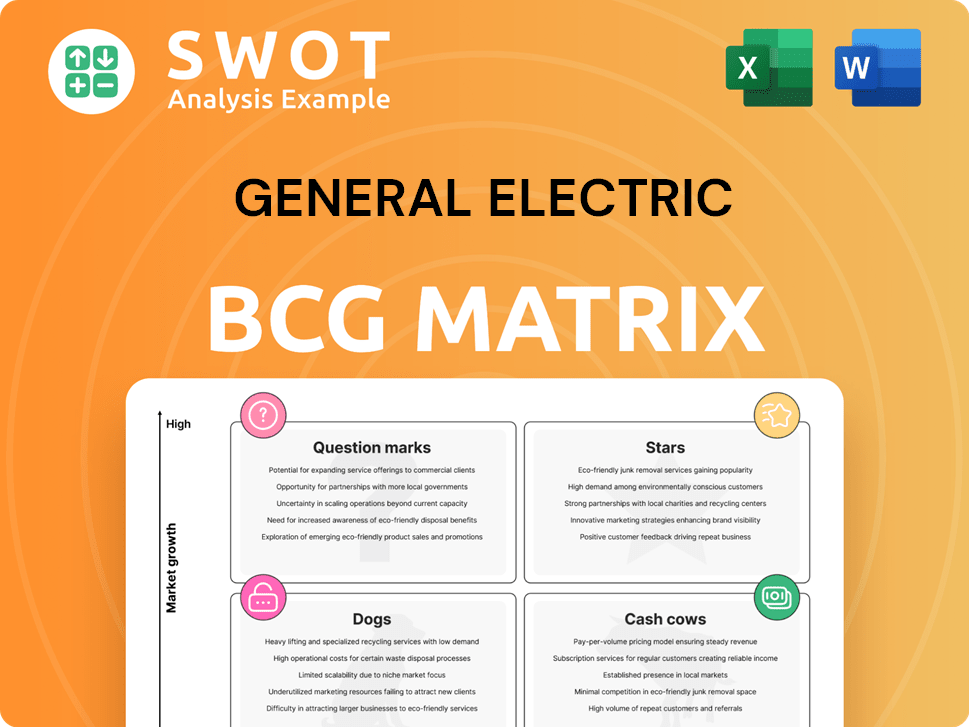

General Electric BCG Matrix

The preview shows the complete General Electric BCG Matrix report you'll receive. It's the final, ready-to-use document for strategic portfolio analysis. Download the fully formatted matrix after purchase; no alterations are required.

BCG Matrix Template

The General Electric BCG Matrix is a powerful tool for analyzing GE's diverse portfolio.

It categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth.

This framework helps determine optimal resource allocation and strategic decisions.

Understanding these positions provides insights into GE's competitive landscape.

Gain a clear picture of GE’s strategy with quadrant-by-quadrant insights and actionable recommendations.

Purchase the full BCG Matrix report for a data-driven analysis and strategic roadmap.

Stars

GE Aerospace, formerly GE Aviation, is a "Star" in the BCG matrix, excelling in the aviation sector. In 2023, the segment saw revenues of $32.6 billion, a 25% increase, with an operating profit of $6.6 billion.

This growth is fueled by strong demand for commercial engines and services, where GE Aerospace maintains a leading position. The operating margin for the aviation segment was 20.2% in 2023.

With a focus on innovation and long-term service agreements, GE Aerospace is well-positioned for continued success. They have a robust backlog, ensuring future revenue streams and market leadership.

GE Aerospace's strong financial performance and market position solidify its status as a "Star", driving overall company value. The company's future is looking bright.

GE HealthCare is a Star, excelling in medical tech. It leads in imaging, diagnostics, and digital healthcare. R&D investments, especially in AI, drive growth. For 2024, GE HealthCare's revenue was $20.1 billion. The MIM Software acquisition boosts its Star status.

In the GE BCG Matrix, the Power segment, especially Gas Power, shines as a "Star." It's experiencing growth, with GE Vernova investing to boost capacity. This segment's success is fueled by data centers and the energy transition. For Q1 2024, Gas Power orders were up 28% year-over-year, highlighting its strong performance.

Grid Solutions

GE Vernova's Grid Solutions is experiencing strong growth, driven by the need for grid upgrades and electrification. This segment supplies essential grid components, witnessing substantial order and backlog expansion, particularly in Europe and North America. Grid Solutions is actively developing its GridOS® platform, introducing new features to foster innovation and expansion. For instance, in 2024, the segment secured several large orders, reflecting its robust market position.

- Grid Solutions is a Star in the GE BCG Matrix.

- Significant growth in orders and backlog, especially in Europe and North America.

- The business is scaling GridOS® and adding new features.

- Grid Solutions is experiencing strong growth.

Renewable Energy

GE Vernova's Renewable Energy segment, especially in offshore wind, is poised to be a Star. The market's focus on clean energy boosts its potential. GE is investing in R&D, including 3D printing for turbines. This strengthens efficiency and reduces expenses.

- In 2024, global renewable energy capacity additions are projected to reach a record high.

- GE Vernova's offshore wind business is expected to grow substantially.

- R&D spending in renewable energy technologies is increasing.

- 3D printing could lower wind turbine costs by 10-15%.

GE's Renewable Energy segment, particularly offshore wind, has "Star" potential, driven by the clean energy market. R&D investments, like 3D printing, boost efficiency, potentially reducing costs. Global renewable energy capacity additions are hitting record highs. In 2024, offshore wind is expected to see substantial growth.

| Aspect | Details | 2024 Data/Projection |

|---|---|---|

| Market Growth | Renewable Energy | Record high capacity additions |

| Offshore Wind | GE Vernova Segment | Expected substantial growth |

| R&D Impact | 3D printing | Potential 10-15% cost reduction |

Cash Cows

GE Aerospace's Commercial Engine Services (CES) is a cash cow, fueled by its aftermarket dominance. Long-term service contracts provide stable, high-margin revenue. The installed base of engines assures continuous service income. In 2024, CES revenue was substantial, with operating margins exceeding industry averages. This steady performance makes it a reliable cash generator.

GE Vernova's Power segment, a cash cow, relies on established power generation infrastructure. This generates consistent revenue from existing equipment and services. In 2024, GE Power's revenue was substantial, reflecting its strong cash-generating ability. This financial performance solidifies its position within the BCG matrix.

GE HealthCare's imaging segment is a cash cow, fueled by a substantial installed base and consistent demand. This segment consistently generates significant revenue, benefiting from GE HealthCare's strong brand. In 2024, the imaging segment is expected to contribute significantly to the company's overall revenue. GE HealthCare's imaging portfolio is a reliable cash source.

Defense & Propulsion Technologies

GE Aerospace's Defense & Propulsion Technologies (DPT) is a "Cash Cow" for General Electric. It consistently generates profits and stable revenue, largely due to long-term U.S. military contracts. The segment's strong book-to-bill ratio indicates its ability to secure future contracts. DPT's focus on next-generation investments ensures continued relevance and profitability.

- In 2024, GE Aerospace's Defense segment revenue was approximately $8 billion.

- The segment benefits from multi-year contracts, providing predictable cash flow.

- DPT invests significantly in advanced technologies, such as hypersonic propulsion.

- The book-to-bill ratio for the Defense segment remains above 1, showcasing strong contract wins.

Electrification Infrastructure

GE Vernova's Electrification business is a cash cow, consistently generating revenue from essential transmission infrastructure. It operates in over 100 countries, providing critical grid components like transformers and switchgears. This segment holds a significant share of the global transmission equipment market. This solid market presence makes Electrification a reliable source of cash for GE.

- In 2024, the global transmission equipment market was valued at approximately $50 billion.

- GE Vernova's Electrification segment contributed significantly to GE's overall revenue.

- The segment's stable revenue stream is supported by long-term contracts and recurring service agreements.

- Electrification's global footprint ensures diversification and reduces risk.

Cash cows are established businesses generating consistent profits with low investment needs. GE Aerospace's CES and DPT, and GE HealthCare's imaging exemplify this. These segments benefit from strong market positions and stable demand, ensuring predictable cash flows.

| Segment | 2024 Revenue (Approx.) | Key Characteristics |

|---|---|---|

| GE Aerospace (CES) | Significant | Aftermarket dominance, long-term contracts. |

| GE Aerospace (DPT) | $8B | U.S. military contracts, book-to-bill ratio > 1. |

| GE HealthCare (Imaging) | Significant | Installed base, brand strength. |

Dogs

General Electric's (GE) discontinued lighting business perfectly fits the "Dog" category in the BCG matrix. This segment held a low market share within a low-growth market. GE's strategic move to exit this business aligns with its aim to reduce investment in underperforming areas. In 2024, GE continues to restructure, focusing on high-growth sectors. The lighting market saw a decline, with LED adoption and competition increasing.

Onshore wind, a "Dog" in GE's BCG matrix, shows potential but struggles. Revenue declined in 2024, even with EBITDA loss improvements. This segment needs strategic overhauls. GE aims to boost financial performance, facing market dynamics. In Q1 2024, revenue was $1.3B, down 12% YoY.

GE's legacy transportation, a 'Dog' in the BCG Matrix, struggles with growth. The segment faces competition and market challenges. GE has been selling transportation assets, signaling a strategic shift. In 2024, GE continues to reduce its footprint in this area. This includes businesses like Wabtec, which was spun-off in 2019.

GE Capital (Legacy)

GE Capital, a former powerhouse, now operates in the Dogs quadrant of the BCG Matrix. This segment has faced significant headwinds, leading to restructuring efforts. The performance of GE Capital has been influenced by economic factors and regulatory shifts. GE has actively decreased its involvement in financial services.

- In 2023, GE's financial services revenue was a small fraction of its total, reflecting the reduced focus.

- GE has been selling off assets within GE Capital to streamline operations.

- Regulatory changes, like those affecting financial institutions, have impacted GE Capital's operations.

- The strategic shift away from financial services is part of GE's broader restructuring.

Offshore Wind (Challenged)

Offshore wind is a "Dog" for GE Vernova, despite being a growth market. The company has struggled with blade issues and project delays, hurting its performance. GE is striving to improve execution in this challenging segment. In 2024, GE Vernova's renewable energy revenue decreased by 17% due to these issues.

- Blade failures and delays have negatively impacted GE Vernova's offshore wind projects.

- The segment faces execution challenges, affecting its financial results.

- GE is actively working to rectify these problems and boost its market position.

- GE Vernova's renewable energy revenue fell by 17% in 2024.

Several GE segments fall into the "Dog" category of the BCG Matrix, indicating low market share in slow-growing markets. These include legacy businesses and areas facing significant challenges. GE actively divests or restructures these underperforming units. A key metric is Q1 2024, where GE Vernova's renewable energy revenue dropped by 17%.

| Segment | Status | 2024 Performance |

|---|---|---|

| Onshore Wind | Dog | Q1 Revenue down 12% YoY |

| Offshore Wind | Dog | Revenue down 17% YoY |

| GE Capital | Dog | Reduced focus |

Question Marks

GE's digital solutions are classified as 'Question Marks' in the BCG Matrix, indicating high growth potential but low market share. The company is actively investing in digital initiatives across its segments. GE's industrial IoT platform is a key area for growth, although it requires substantial investment to increase market share. In 2024, GE reported increased digital revenue, but its overall market share in this space is still developing.

GE Grid Solutions' foray into advanced battery storage positions it as a 'Question Mark' in the BCG Matrix. This sector demands considerable investment due to its high growth potential. GE aims for a significant market share, eyeing a $30 billion energy storage market by 2026. In 2024, the global battery energy storage systems market was valued at $10.5 billion.

GE Vernova's BWRX-300 SMR is a 'Question Mark' in the BCG matrix. Nuclear power's role in energy transition is promising but faces challenges. GE Vernova's investment is significant, yet success isn't guaranteed. The SMR market could reach $60 billion by 2030.

Electric Vehicle Charging Infrastructure

GE's foray into EV charging is a "Question Mark" in its BCG Matrix. The EV charging market is expanding, with projections estimating a global market value of $160 billion by 2030. GE is eyeing investments in this sector, which requires strategic allocation of resources.

- Market Growth: The EV charging market is expected to grow significantly.

- Investment Strategy: GE needs focused investments to compete effectively.

- Technology Focus: GE is targeting specific technologies within EV charging.

- Financial Data: The EV charging market is projected to reach $160 billion by 2030.

Renewable Energy (Offshore Wind Projects)

GE Renewable Energy's offshore wind projects are classified as 'Question Marks' in the BCG matrix. This is due to the substantial investments needed for growth and the inherent market uncertainties. The offshore wind segment is still developing, with significant project pipelines globally. These projects have the potential for high market share and growth, but face challenges.

- GE's offshore wind projects are in various stages of development worldwide.

- The segment requires considerable investment to achieve its full potential.

- There are inherent market uncertainties that the projects face.

- Offshore wind has high growth potential.

GE's digital solutions, battery storage, SMR, EV charging, and offshore wind projects are "Question Marks" in the BCG Matrix. These segments require substantial investment despite high growth potential. GE aims to increase market share in these areas, facing market uncertainties. The EV charging market is projected to hit $160B by 2030.

| Segment | BCG Status | Key Challenge |

|---|---|---|

| Digital Solutions | Question Mark | Gaining market share |

| Battery Storage | Question Mark | Securing investment |

| SMR | Question Mark | Overcoming market uncertainties |

| EV Charging | Question Mark | Strategic resource allocation |

| Offshore Wind | Question Mark | Market uncertainties |

BCG Matrix Data Sources

The GE BCG Matrix leverages diverse sources such as financial reports, market share data, industry analyses, and growth projections for well-supported strategic decisions.