The GEO Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The GEO Group Bundle

What is included in the product

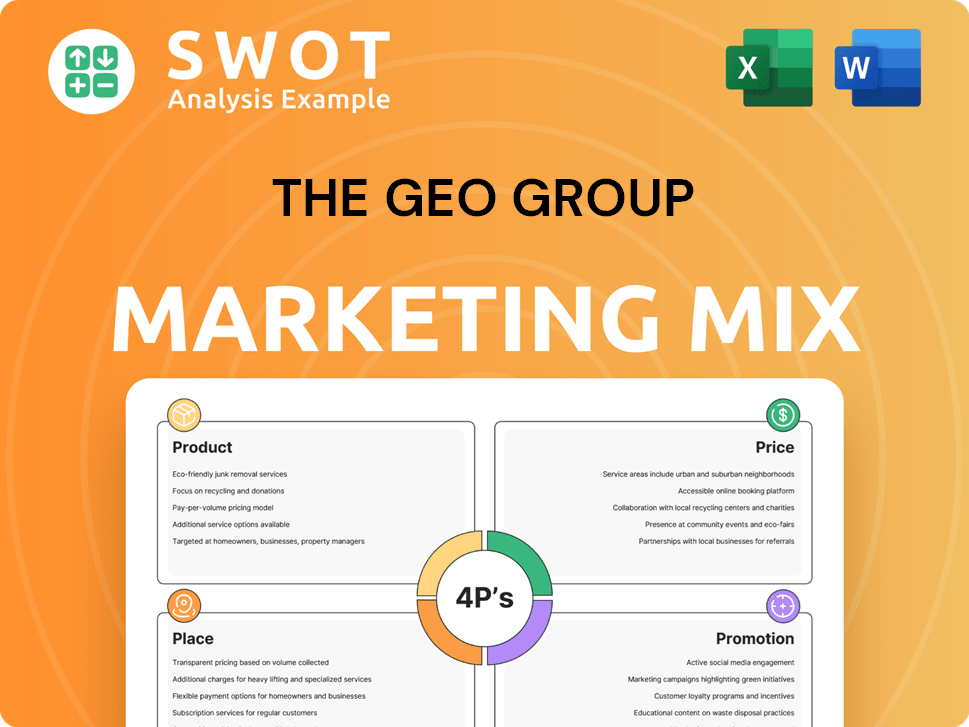

A detailed examination of The GEO Group's 4Ps. It provides a professional breakdown of its marketing strategies.

Helps anyone swiftly understand GEO Group's marketing approach for immediate application.

Preview the Actual Deliverable

The GEO Group 4P's Marketing Mix Analysis

You're seeing the actual GEO Group Marketing Mix analysis! This comprehensive document is exactly what you'll download.

4P's Marketing Mix Analysis Template

Looking at The GEO Group's strategy is intriguing. The company's product offerings are tightly focused. Analyzing their pricing models is complex. Distribution is vital to their business operations. The promotion techniques reach the target audience effectively. Uncover more details through the full 4P's analysis! Access expert research now. This will empower your marketing comprehension.

Product

The GEO Group's primary product is managing correctional and detention facilities. These facilities house individuals under contracts with government agencies. GEO's services within these centers are a key part of its product mix. In Q1 2024, GEO reported revenue of $643.8 million, demonstrating the scale of its operations.

The GEO Group's reentry centers are a key part of their service offerings. These centers help formerly incarcerated individuals reintegrate into society. They provide essential programs and support services. In 2024, GEO reported managing several reentry centers across the United States, aiming to reduce recidivism rates. These centers are part of GEO's commitment to rehabilitation.

The GEO Group's electronic monitoring and supervision services utilize technologies such as ankle bracelets and GPS trackers. These services are a key component of GEO's offerings. In 2024, GEO's revenue from electronic monitoring services was a substantial portion of their total revenue. This segment is particularly crucial for government agencies like ICE. The company's focus remains on expanding these tech-driven solutions.

Support Services within Facilities

The GEO Group's facilities go beyond just providing physical space, offering comprehensive support services. These include security, maintenance, and food services, all bundled to enhance the value proposition. This integrated approach aims to meet diverse client needs effectively. Such services are integral to the overall product offered to government clients.

- In 2023, GEO reported approximately $2.3 billion in revenue, a portion of which is attributed to these bundled services.

- The company operates over 60 facilities globally, each requiring these support services.

- GEO's contracts often specify detailed service level agreements (SLAs) for these support functions.

Offender Rehabilitation Programs

The GEO Group's rehabilitation programs are a key part of its service offerings, targeting offenders. These programs are designed to improve in-custody rehabilitation and provide support after release. The GEO Continuum of Care showcases their comprehensive approach to these services. In 2024, GEO Group reported a revenue of $2.4 billion, with a focus on expanding rehabilitation services.

- GEO Group's 2024 revenue was $2.4 billion.

- Rehabilitation programs aim to reduce recidivism rates.

- The GEO Continuum of Care is a key program.

GEO Group's core product encompasses managed correctional and detention facilities. These include comprehensive support services and various rehabilitation programs aimed at offender rehabilitation. In 2024, the company's focus was expanding services, with total revenue reported at $2.4 billion.

| Product | Description | 2024 Revenue (approx.) |

|---|---|---|

| Correctional Facilities | Management of prisons and detention centers under government contracts | $1.9 billion |

| Reentry Centers | Support services for reintegration, aiming to reduce recidivism | $200 million |

| Electronic Monitoring | Use of tech for supervision, including ankle bracelets | $300 million |

Place

GEO Group's primary 'place' is its government-contracted facilities. These include owned, leased, and managed locations. As of Q1 2024, GEO operated approximately 71 facilities. Facility locations are dictated by client needs. In 2023, GEO's revenue from U.S. government contracts was $1.8 billion.

GEO Group owns facilities, a key part of its real estate strategy. These sites are essential for providing secure services. As of 2024, they manage over 80 facilities. This ownership model impacts their operational control and financial performance.

GEO Group strategically positions its services internationally, enhancing its global reach. Their 'place' includes facilities in Australia, South Africa, and the UK. International operations generated $263.1 million in revenue in 2024, a key part of their business. This global footprint allows GEO to tap into diverse markets and opportunities.

Community-Based Locations

GEO Group's community-based locations are key to its 4Ps. These centers offer reentry services, located within communities. This placement aims to aid individuals transitioning out of custody. In 2024, these programs served approximately 40,000 individuals. This approach supports rehabilitation.

- Reentry centers focus on reducing recidivism rates.

- Community placement enhances access to support networks.

- Services include job training and counseling.

- GEO's community programs expand its reach.

Client-Determined Locations

The GEO Group's facility locations are dictated by government contracts, which outline specific geographic service needs. This approach ensures alignment with client demands, influencing the company's operational footprint. For instance, in 2024, GEO had contracts across various states, reflecting client-driven location choices, with approximately 70 facilities. These locations are integral to GEO's service delivery model.

- Location strategy is client-dependent.

- Contracts determine facility placements.

- Approximately 70 facilities in operation in 2024.

- Service delivery is location-specific.

GEO Group strategically locates facilities based on government contracts. This placement aligns with client needs, influencing the operational footprint. Community-based centers are also strategically positioned.

| Aspect | Details | 2024 Data |

|---|---|---|

| Facility Count | Number of Facilities | Approx. 70 operated |

| U.S. Gov. Revenue | Revenue from contracts | $1.8B |

| Int. Revenue | Revenue from operations | $263.1M |

Promotion

The GEO Group heavily relies on government contracting. They actively bid on projects, showcasing their expertise to secure contracts. In 2024, GEO secured approximately $2 billion in government contracts. This process is a key marketing strategy. It helps them win new business.

The GEO Group's marketing mix can highlight rehabilitation programs like the GEO Continuum of Care. This approach differentiates services, stressing reentry support. In 2024, GEO reported a 2.4% increase in revenue, partly from enhanced programs. Highlighting these efforts can attract contracts. It also improves public perception, critical for long-term success.

Promoting The GEO Group's facility management expertise is vital for attracting clients. They must highlight operational efficiency, such as reducing operating costs by 10% annually. Showcasing robust security measures, including a 98% success rate in preventing unauthorized incidents, builds trust. Demonstrating the capacity to manage large-scale operations, like handling over 70 facilities, is key.

Emphasizing Technology in Monitoring Services

For electronic monitoring services, promotion focuses on the advanced technology employed. This includes GPS tracking and surveillance tools, underscoring service effectiveness. In 2024, the global electronic monitoring market reached $4.5 billion, with a projected $6.2 billion by 2029. The GEO Group's marketing emphasizes tech superiority to attract clients.

- Highlighting GPS tracking and surveillance technologies.

- Emphasizing the effectiveness and capabilities of monitoring.

- Focusing on tech advantages to gain market share.

- Use of data to showcase service reliability.

Building Relationships with Government Agencies

The GEO Group's promotion strategy heavily relies on building and maintaining solid relationships with government agencies. This is crucial for securing and renewing contracts, which form the core of their revenue. Consistent communication and demonstrating reliability are vital to ensure trust and long-term partnerships. Understanding the evolving needs of government clients allows GEO to tailor its services effectively.

- In 2024, GEO Group secured $2.2 billion in revenue from government contracts.

- Over 80% of GEO's revenue comes from government contracts.

- GEO's lobbying spending in 2024 was approximately $1 million.

The GEO Group's promotion targets government agencies to secure contracts and foster long-term relationships. Highlighting GPS and surveillance tech is key for their electronic monitoring services. Data demonstrating service effectiveness builds trust.

Promotion strategies include emphasizing advanced tech in electronic monitoring, showcasing cost reduction by 10%, and robust security with a 98% success rate. GEO also highlights reentry support programs. Strategic efforts resulted in $2.2 billion in revenue from government contracts in 2024.

Key to promotion is building and maintaining government relationships, with over 80% of GEO's revenue tied to these contracts. The company spent $1 million on lobbying in 2024. This ensures ongoing support.

| Aspect | Details | Data (2024) |

|---|---|---|

| Government Contracts | Key Revenue Source | $2.2 Billion |

| Lobbying Spending | Influence with Agencies | $1 Million |

| Electronic Monitoring Market | Global Size | $4.5 Billion (2024) |

Price

GEO Group's pricing is set via negotiated contracts, mainly with government entities. These contracts are usually long-term, dictating service terms and conditions. In 2024, GEO's revenue was approximately $2.3 billion, significantly influenced by these contracts. Contract renewals and terms directly impact GEO's financial performance and future outlook. The pricing reflects the specific needs and risks associated with each agreement.

Fixed-price contracts offer The GEO Group a stable, predictable revenue flow. These contracts, locked in for a set period, help forecast financial performance. In 2024, roughly 80% of GEO's revenue came from fixed-price contracts, bolstering financial planning. This stability is crucial for investor confidence and operational budgeting.

Pricing at GEO Group includes per diem rates, a daily fee per person housed or monitored. These rates adjust based on occupancy levels and program involvement. In Q1 2024, average daily rate was $84.75 for U.S. Corrections and $72.90 for GEO Care. Fluctuations depend on contract terms and services provided.

Consideration of Operating Costs

Pricing strategies for The GEO Group must carefully consider operating costs. These costs include facility management, service provision, and technology upkeep, all impacting contract profitability. In Q1 2024, GEO reported operating expenses of $600.7 million. Maintaining cost-effectiveness is key for sustainable financial performance.

- Operating expenses significantly affect profitability.

- Facility management and service provision are major cost drivers.

- Technology maintenance is an ongoing operational expense.

- Cost control is crucial for maximizing contract profitability.

Value Proposition to Government Clients

The GEO Group's pricing strategy for government clients centers on the value it delivers. This includes secure facilities and tailored services, often presented as cost-effective solutions compared to government-operated options. GEO's contracts with governmental entities are a significant revenue stream, reflecting the competitive pricing in the correctional and detention services market. In 2024, GEO Group's revenue reached approximately $2.2 billion, with a substantial portion derived from government contracts.

- Cost Savings: GEO often highlights potential cost savings versus government-run facilities.

- Service Specialization: Offers specialized services like mental health or rehabilitation programs.

- Secure Environments: Provides secure and controlled environments for inmates.

The GEO Group's pricing is heavily contract-based, primarily with government agencies. Fixed-price contracts comprised approximately 80% of GEO's revenue in 2024, ensuring revenue stability. Per diem rates and cost considerations, like facility management, influence contract profitability and financial performance, and in Q1 2024 operating expenses were $600.7 million.

| Pricing Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Contract-Based | Negotiated agreements with governments. | Revenue of $2.2 billion in 2024. |

| Fixed-Price Contracts | Long-term contracts offer predictable revenue. | Around 80% of revenue stability |

| Per Diem Rates | Daily fees per person based on occupancy. | Q1 2024 average daily rate, $84.75 U.S. Corrections. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis of The GEO Group utilizes SEC filings, investor relations data, and news archives.