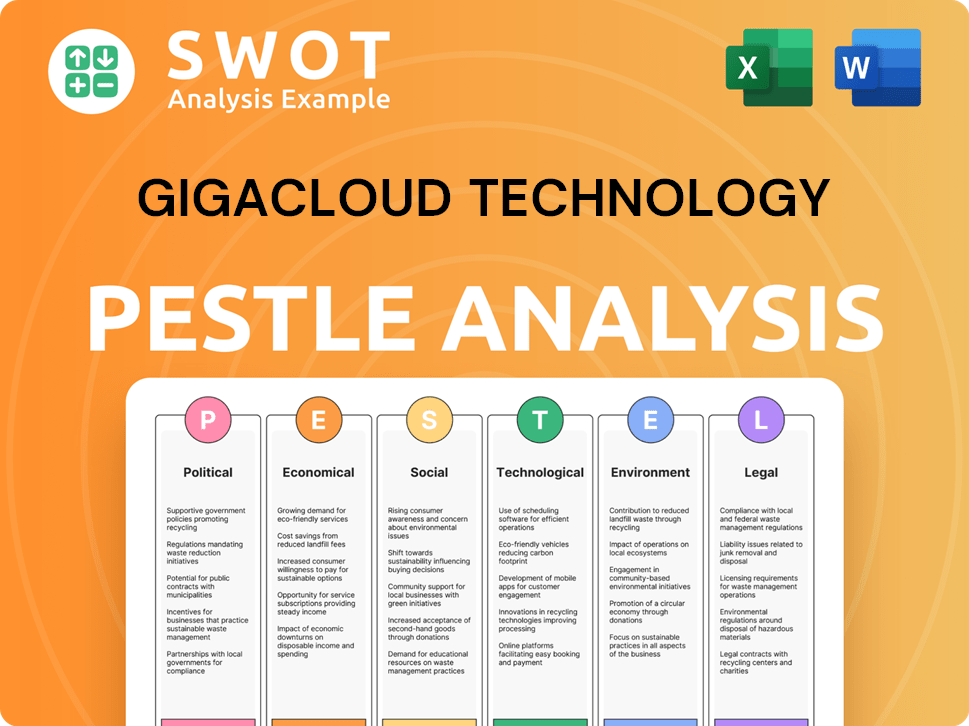

GigaCloud Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GigaCloud Technology Bundle

What is included in the product

Provides a detailed look at external factors that impact GigaCloud across Political, Economic, etc. dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Full Version Awaits

GigaCloud Technology PESTLE Analysis

The PESTLE analysis you see for GigaCloud Technology is the final document. The preview mirrors the content & format you'll download instantly.

PESTLE Analysis Template

Explore the forces shaping GigaCloud Technology's future with our in-depth PESTLE analysis.

Uncover political risks, economic opportunities, and technological advancements influencing their strategy.

We've considered social trends, legal constraints, and environmental factors impacting operations.

Our analysis is perfect for investors, analysts, and anyone needing strategic clarity.

Understand GigaCloud's market positioning better, ready to make better investment decisions.

Get a competitive edge. Download the full PESTLE analysis for immediate, actionable insights.

Political factors

GigaCloud Technology, reliant on trade, faces impacts from tariffs and trade policies. US-China tariffs can raise import costs, affecting pricing and profits. In 2024, any tariff adjustments could directly impact GigaCloud. The company strategically diversifies its supply chain to lessen trade-related risks. For example, in 2024, GigaCloud's revenue from North America was $340 million.

GigaCloud Technology's global operations make it vulnerable to geopolitical risks. Instability in regions with manufacturers or partners can disrupt supply chains. For instance, disruptions in China, where GigaCloud has significant operations, could impact its revenue. Any political shifts could affect market demand. In 2024, geopolitical tensions have already caused supply chain issues.

GigaCloud Technology faces government regulations in e-commerce, cross-border trade, and logistics across the U.S., Europe, and Asia. Data protection, consumer rights, and transportation rules impact operations. Stricter regulations could raise compliance costs and pose logistical challenges. For example, EU's GDPR continues to influence data handling. In 2024, global e-commerce is projected to reach $6.3 trillion.

Political stability in target markets

GigaCloud's expansion into Southeast Asia and Europe hinges on political stability. These markets, vital for growth, demand a predictable regulatory environment. Political instability introduces risk, potentially disrupting operations and investments. For instance, in 2024, political uncertainty in some Southeast Asian nations impacted foreign direct investment.

- 2024: Political risks in Southeast Asia increased business costs by an estimated 5-10% for some companies.

- 2025 (projected): European Union's regulatory changes could impact GigaCloud's supply chain.

Government initiatives supporting B2B platforms

Government initiatives focused on digital transformation and supporting SMEs can significantly benefit GigaCloud. Policies promoting B2B platforms and efficient logistics enhance the operational landscape. For example, in 2024, several countries increased funding for digital adoption programs by up to 15%. This support aids SMEs in utilizing platforms like GigaCloud.

- Increased governmental funding for digital transformation.

- Streamlined logistics processes through policy changes.

- Support for SMEs using B2B platforms.

GigaCloud Technology is exposed to global trade policies and tariffs, mainly US-China. Geopolitical instability can disrupt its supply chains and affect revenue. The company's operations are influenced by e-commerce and data regulations. Expansion depends on stable political climates, especially in Southeast Asia and Europe.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Tariffs & Trade | Impacts import costs | US-China tariffs, projected global e-commerce to reach $6.3T |

| Geopolitics | Disrupts supply chains | Political risk increased business costs by 5-10% in some regions. |

| Regulations | Raises compliance costs | EU's GDPR continues to influence data handling. |

Economic factors

GigaCloud's success hinges on global economic stability. Economic slowdowns and inflation directly impact consumer spending, particularly in its primary markets, including the U.S., Europe, and Asia. For instance, a 2024 report shows a 3% decrease in consumer spending in Europe. This downturn could reduce demand for large parcel items. The company's financial performance is sensitive to these economic fluctuations.

GigaCloud Technology's global operations expose it to currency exchange rate risks. For instance, a stronger US dollar could reduce the value of international sales when converted. In 2024, the USD's strength against other currencies fluctuated significantly. This impacts revenue and profitability, necessitating careful hedging strategies.

Supply chain costs are a key economic factor. Logistics expenses, including ocean freight, ground delivery, and warehousing, heavily impact GigaCloud. For example, in Q1 2024, ocean freight rates saw a 15% increase due to port congestion. Fuel prices and transportation capacity also affect operating costs and gross margins.

Interest rates and access to capital

Interest rate fluctuations significantly impact GigaCloud Technology's financial strategy. Higher rates increase borrowing costs, potentially affecting investments in technology and acquisitions. Access to capital is essential for GigaCloud's expansion plans, including market growth and potential mergers. The Federal Reserve has maintained its benchmark interest rate between 5.25% and 5.50% as of May 2024, influencing borrowing conditions.

- GigaCloud's debt-to-equity ratio was 0.35 as of Q1 2024.

- The company's revenue grew by 25% in 2023, indicating a need for capital.

- Interest rate decisions by central banks globally influence GigaCloud's financial planning.

Market competition and pricing pressure

The B2B e-commerce and logistics landscape is highly competitive, with GigaCloud Technology facing rivals from various sectors. These competitors include other online marketplaces, traditional wholesalers, and established logistics companies. Such intense competition often results in pricing pressure, which can significantly impact GigaCloud's profit margins and market share. For instance, in 2024, the global B2B e-commerce market was valued at approximately $8.1 trillion, a figure that highlights the scale of the competition.

- Market competition is fierce, with B2B e-commerce valued at $8.1T in 2024.

- Pricing pressure from competitors can squeeze profit margins.

- GigaCloud competes with online marketplaces, wholesalers, and logistics providers.

Economic factors significantly impact GigaCloud Technology's financial performance. Consumer spending in key markets like Europe decreased by 3% in 2024, affecting demand. Currency exchange rate risks and fluctuating interest rates (5.25%-5.50% in May 2024) also pose challenges.

| Factor | Impact | Data |

|---|---|---|

| Consumer Spending | Affects Demand | Europe's 3% decrease (2024) |

| Currency Exchange | Impacts Revenue | USD fluctuations |

| Interest Rates | Influences Costs | 5.25%-5.50% (May 2024) |

Sociological factors

GigaCloud's B2B marketplace success hinges on consumer demand for large items. Consumer preferences significantly impact product demand on the platform. For instance, in 2024, home goods spending in the U.S. reached $1.2 trillion, reflecting strong consumer interest. Shifts in trends, like the rise of minimalist or eco-friendly furniture, directly affect the products sought by GigaCloud's resellers.

E-commerce adoption is surging worldwide, creating a favorable environment for GigaCloud. Global e-commerce sales reached $6.3 trillion in 2023 and are expected to hit $8.1 trillion by 2026. This shift online boosts demand for B2B platforms and logistics, key to GigaCloud's success. In 2024, B2B e-commerce is projected to account for 20% of all global e-commerce transactions.

GigaCloud's logistics and tech depend on skilled workers. Labor availability affects efficiency and growth. High demand for tech skills could raise labor costs. In 2024, logistics sector employment grew by 3.7%, indicating strong demand. The company's success hinges on adapting to these workforce trends.

Cultural differences in business practices

GigaCloud Technology, operating in Asia, the U.S., and Europe, faces diverse cultural norms. These differences affect business practices, requiring adaptation for strong relationships. For example, in 2024, cultural nuances impacted negotiation times. Successful partnerships depend on understanding and respecting these variances. This impacts supplier relations and market strategies.

- Negotiation times can vary significantly: In some Asian cultures, building trust might extend initial deal timelines by weeks compared to the U.S. or Europe.

- Communication styles: Directness in communication varies; what's considered assertive in the U.S. may be seen as aggressive in some Asian cultures.

- Decision-making processes: Some cultures favor consensus-based decisions, leading to slower approvals compared to more individualistic decision-making processes.

- Gift-giving and etiquette: Cultural norms around gift-giving and business etiquette can vary greatly, influencing relationship-building.

Urbanization and population shifts

Urbanization and population shifts are key. They impact demand for large parcel merchandise and logistics complexity. Urban growth boosts the need for efficient last-mile delivery, which GigaCloud's platform supports. In 2024, urban populations globally are expected to reach over 5.7 billion, increasing demand. This trend drives the need for scalable solutions.

- Urban population growth fuels demand.

- Last-mile delivery solutions are in demand.

- GigaCloud's platform offers scalable solutions.

Sociological factors greatly impact GigaCloud's operations and market dynamics. Cultural differences across Asia, the U.S., and Europe necessitate tailored business approaches; negotiation styles vary widely. Urbanization drives demand for efficient last-mile delivery services, affecting GigaCloud's logistics strategy.

| Factor | Impact | Data (2024) |

|---|---|---|

| Cultural Differences | Adaptation in business practices. | Negotiation times vary (Asia vs. US/Europe) |

| Urbanization | Increased demand for last-mile solutions. | Urban pop. >5.7B, driving logistics demand |

| E-commerce Growth | B2B platforms benefit from rising adoption. | B2B e-commerce projected at 20% of all e-commerce transactions. |

Technological factors

GigaCloud Technology's B2B marketplace success hinges on its tech platform. In 2024, the company allocated $15 million to platform enhancements. User experience and search improvements are key, with transaction tools becoming more streamlined. Staying competitive needs continuous tech investments, reflecting its 20% YoY tech spending increase.

GigaCloud Technology heavily relies on technology for logistics. In 2024, the company invested significantly in warehouse automation, increasing efficiency by 15%. Inventory tracking systems and route optimization have led to a 10% reduction in delivery times. These enhancements directly contribute to improved customer service and cost savings.

Data analytics and AI offer GigaCloud Technology opportunities to understand market trends and customer behavior. AI could enhance platform and logistics, though past claims have been questioned. In 2024, the global AI market reached $230 billion, with projected growth. GigaCloud can leverage AI for operational efficiency, potentially impacting its revenue.

Cybersecurity and data protection

Cybersecurity is paramount for GigaCloud Technology due to its handling of extensive transaction data. Protecting user data and the platform from cyber threats is crucial for trust and business continuity. Cybersecurity breaches can lead to significant financial and reputational damage. According to recent reports, the global cybersecurity market is projected to reach $345.7 billion by 2025.

- Data breaches can cost companies millions, impacting stock prices and customer loyalty.

- Implementing robust security measures is an ongoing investment.

- GigaCloud must comply with data protection regulations.

Integration with third-party systems

GigaCloud Technology's platform thrives on its ability to connect with different third-party systems. This includes manufacturers, resellers, and logistics companies, ensuring smooth operations. As of Q1 2024, about 75% of GigaCloud's revenue came from transactions facilitated through these integrated systems. This seamless integration is vital for scalability and efficiency.

- 75% of revenue from integrated systems (Q1 2024).

- Enhanced operational efficiency through automation.

- Improved scalability to accommodate growth.

GigaCloud's tech investments target platform improvements, spending $15 million in 2024. Logistics enhancements like warehouse automation increased efficiency by 15%. Data analytics & AI can boost operational efficiency amid the $230B global AI market in 2024.

Cybersecurity, vital for data protection, aligns with a projected $345.7B cybersecurity market by 2025. Integrating with third-party systems facilitated 75% of Q1 2024 revenue. Continuous tech upgrades are essential for staying competitive.

| Area | 2024 Data | Impact |

|---|---|---|

| Platform Investment | $15M allocated | Improved UX, streamlined tools |

| Logistics Automation | 15% efficiency gain | Reduced delivery times by 10% |

| AI Market | $230B global | Enhanced operational efficiencies |

| Cybersecurity Market | Projected $345.7B by 2025 | Data protection, business continuity |

| System Integration Revenue | 75% of Q1 2024 revenue | Scalability and efficiency |

Legal factors

GigaCloud Technology faces data protection regulations like GDPR and CCPA, impacting its global operations. These rules mandate secure handling of personal data, affecting data storage and processing. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover. As of 2024, GigaCloud must ensure compliance to avoid penalties.

E-commerce regulations, crucial for GigaCloud, include consumer protection, online transaction rules, and platform liability. Compliance is essential; non-compliance can lead to legal issues. The global e-commerce market is projected to reach $8.1 trillion in 2024, growing to $10.5 trillion by 2027. GigaCloud must adhere to these to build trust and operate legally.

GigaCloud Technology's logistics must comply with diverse transportation and shipping regulations globally. These regulations, differing by region, impact vehicle standards and driver qualifications. Customs procedures and cargo handling are also subject to these rules. For instance, in 2024, the company handled over $700 million in cross-border transactions, highlighting the importance of regulatory compliance.

Product safety and compliance standards

GigaCloud Technology must ensure large parcel merchandise complies with product safety standards in target markets. This is crucial for legal compliance and consumer protection. The company may need to verify product certifications and labeling. Non-compliance could lead to penalties and reputational damage. In 2024, product safety violations resulted in over $50 million in fines for e-commerce platforms.

- Compliance with standards is essential for legal and consumer protection.

- GigaCloud may need to verify product certifications.

- Non-compliance can lead to fines.

- Product safety violations cost e-commerce platforms millions.

Securities regulations and litigation

As a publicly traded entity, GigaCloud Technology must adhere to stringent securities regulations. The company's compliance with these rules is crucial for maintaining investor trust and avoiding legal repercussions. GigaCloud has encountered securities class action lawsuits. These lawsuits emphasize the need for precise financial disclosures and strict adherence to securities laws.

- GigaCloud's stock price experienced volatility in 2024, influenced by market conditions and legal challenges.

- Legal fees related to securities litigation can be substantial, impacting profitability.

- Accurate and timely financial reporting is essential for compliance.

Data protection laws like GDPR and CCPA require secure personal data handling, impacting GigaCloud’s global operations; in 2024, non-compliance could result in fines of up to 4% of annual global turnover.

Compliance with e-commerce regulations is critical, given that the e-commerce market is projected to reach $8.1 trillion in 2024 and $10.5 trillion by 2027, including rules about consumer protection.

Logistics regulations, customs, and cargo handling significantly impact operations; the company managed over $700 million in cross-border transactions in 2024, demonstrating the need for legal compliance.

| Legal Area | Regulation Type | 2024 Impact |

|---|---|---|

| Data Protection | GDPR, CCPA | Fines up to 4% of turnover |

| E-commerce | Consumer Protection | $8.1T market size |

| Logistics | Transportation | $700M+ cross-border |

Environmental factors

GigaCloud's business model, which involves shipping large items, is significantly affected by transportation emissions. The logistics sector accounts for a substantial portion of global carbon emissions. In 2024, the transportation sector in the United States produced 28% of total greenhouse gas emissions. Pressure is mounting on logistics firms to adopt eco-friendly practices. This includes optimizing routes, using alternative fuels, and investing in green technologies to reduce their carbon footprint.

GigaCloud's packaging for bulky items creates substantial waste. Growing environmental awareness boosts demand for eco-friendly packaging. In 2024, the global sustainable packaging market was valued at $287.6 billion. Increased recycling efforts within its supply chain are vital. The market is projected to reach $435.3 billion by 2029.

Manufacturers utilizing GigaCloud's platform, especially those in Asia, must adhere to environmental regulations. These rules can significantly influence production costs. For example, China's environmental inspections have led to factory closures and increased compliance expenses. The global green technology and sustainability market size was valued at $36.6 billion in 2024 and is projected to reach $57.5 billion by 2029.

Climate change impacts on logistics

Climate change poses risks to GigaCloud's logistics. Extreme weather, like floods and storms, can disrupt shipping. Rising sea levels may impact port operations, raising costs. These changes could affect GigaCloud's supply chain. The World Bank estimates climate change could cost $170 billion annually in infrastructure damage by 2030.

- Disrupted Shipping: Extreme weather causes delays.

- Increased Costs: Potential port issues from rising seas.

- Supply Chain Risk: Overall reliability affected.

- Financial Impact: Billions in damage by 2030.

Customer and investor focus on ESG

GigaCloud Technology faces growing scrutiny regarding its environmental, social, and governance (ESG) performance. Customers and investors increasingly prioritize ESG factors in their decisions. In 2024, ESG-focused assets under management reached approximately $40.5 trillion globally, reflecting this trend. GigaCloud must showcase its environmental sustainability efforts to satisfy stakeholders.

- ESG assets under management hit $40.5T globally in 2024.

- Stakeholders increasingly demand ESG transparency.

Environmental factors significantly influence GigaCloud's operations, from transportation to packaging and manufacturing compliance. The transportation sector generated 28% of U.S. greenhouse gas emissions in 2024, highlighting the pressure for eco-friendly practices. Global sustainable packaging market was valued at $287.6B in 2024, expecting to reach $435.3B by 2029.

| Aspect | Impact | Data |

|---|---|---|

| Transportation Emissions | High Carbon Footprint | 28% U.S. emissions from transport (2024) |

| Packaging Waste | Environmental Concerns | Sustainable packaging market: $287.6B (2024) |

| Regulatory Compliance | Increased Costs | Green tech market: $36.6B (2024), rising to $57.5B (2029) |

PESTLE Analysis Data Sources

Our analysis relies on governmental, economic and industry reports. These data points cover global tech trends and macroeconomic indicators.