Givaudan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Givaudan Bundle

What is included in the product

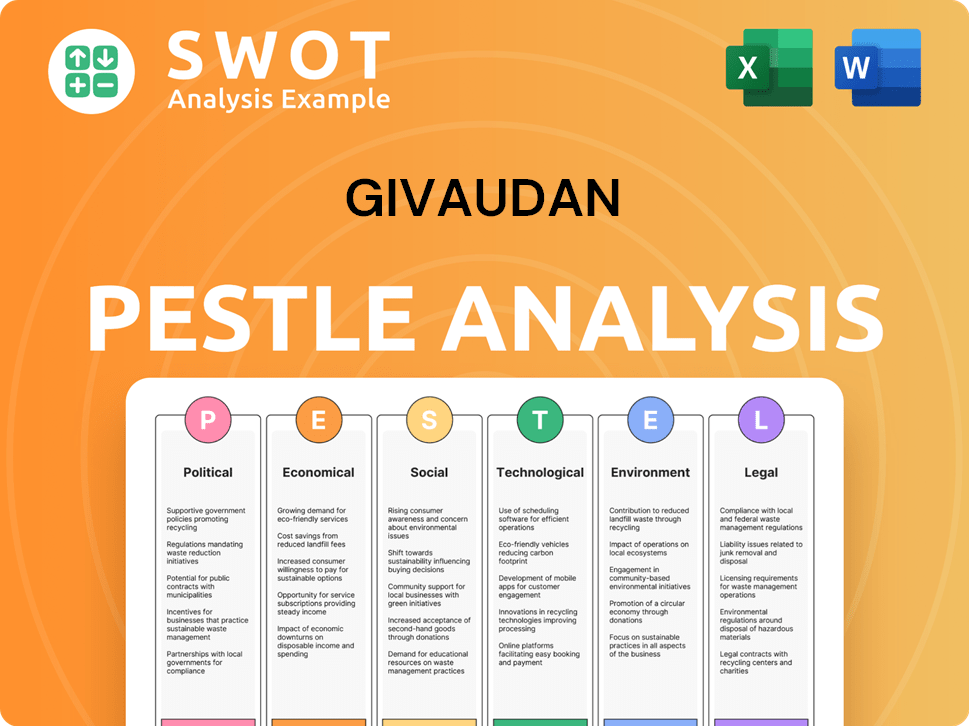

Analyzes how global macro factors impact Givaudan, covering Political, Economic, Social, Tech, Environmental, and Legal dimensions.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

Givaudan PESTLE Analysis

See the Givaudan PESTLE analysis preview? It's the full document.

The same information and formatting shown is what you get.

Buy it, and this analysis is yours instantly. No alterations.

Everything here reflects the finished product.

Enjoy your ready-to-use analysis!

PESTLE Analysis Template

Unlock a strategic advantage with our Givaudan PESTLE Analysis! Explore the company's landscape—political, economic, social, technological, legal, and environmental factors. Understand how these forces shape Givaudan's performance and future strategies. Enhance your investment decisions. Download the full analysis now!

Political factors

Givaudan, as a global player, faces risks from trade tariffs. Uncertainty in trade policies affects raw material costs and product pricing. The company has raised prices to offset increased input costs, including tariffs. In 2024, Givaudan's cost of goods sold was impacted by these factors. The company closely monitors these political factors.

Political factors significantly shape the flavor and fragrance industry through regulations. Givaudan must comply with evolving rules on chemical safety and labeling. In 2024, the EU's fragrance market was valued at approximately €10 billion. Legislative changes directly affect product development and operational costs. The company actively monitors regulatory shifts to remain compliant.

Geopolitical instability poses a significant risk to Givaudan. Ongoing conflicts and political tensions can disrupt supply chains, potentially increasing costs. For instance, the Russia-Ukraine war impacted global raw material prices in 2023. This uncertainty affects Givaudan's operations.

Government Support for Sustainable Practices

Governments worldwide are boosting sustainable business through incentives and regulations. Givaudan's commitment to sustainability, including emission reductions and responsible sourcing, aligns well with these trends. For instance, the EU's Green Deal, as of late 2024, sets ambitious emission reduction targets that impact companies like Givaudan. This focus can lead to financial benefits and competitive advantages for companies.

- EU's Green Deal: Aims for at least 55% reduction in emissions by 2030, influencing Givaudan's strategies.

- US Inflation Reduction Act: Provides tax credits and incentives for sustainable practices, potentially benefiting Givaudan's operations.

- China's Green Policies: Focus on green manufacturing and supply chains, which could impact Givaudan's sourcing and production.

Political Stability in Key Markets

Political stability is vital for Givaudan's operations, especially in key markets. Predictable environments support business continuity and consumer confidence. Unstable regions can disrupt supply chains and affect demand. Givaudan's expansion in high-growth markets highlights its focus on stable, promising areas. The company's 2024 financial report details its strategies.

- Givaudan reported a 5.1% sales increase in 2024.

- Emerging markets contributed significantly to this growth.

- Political stability directly impacts these markets' performance.

Givaudan navigates trade tariffs affecting costs, like in 2024. Compliance with regulations, such as EU fragrance rules (€10B market), shapes product development. The company is influenced by geopolitical instability impacting supply chains. Government sustainability drives initiatives, impacting Givaudan.

| Political Factor | Impact on Givaudan | 2024/2025 Data |

|---|---|---|

| Trade Tariffs | Affect raw material costs, pricing. | Givaudan's cost of goods sold impacted. |

| Regulations | Dictate chemical safety, labeling. | EU fragrance market at €10B. |

| Geopolitical Instability | Disrupt supply chains, increase costs. | Russia-Ukraine war impacted raw material costs in 2023. |

| Sustainability Initiatives | Offer incentives; shape practices. | EU's Green Deal targets emissions reductions. |

Economic factors

Inflationary pressures and volatile raw material costs significantly influence Givaudan's operational expenses. In 2024, the company observed a rise in input costs, particularly for essential oils and chemicals. To mitigate these impacts, Givaudan strategically adjusted its pricing. In 2024, Givaudan's price increases were around 6.2%, reflecting its efforts to offset higher input costs.

Givaudan's success heavily relies on global economic health and consumer spending patterns. Increased economic growth typically boosts demand for goods flavored or fragranced by Givaudan. In 2024, the company showed solid sales growth, a trend that extended into the first quarter of 2025. Specifically, Givaudan's sales increased by 5.6% in constant currency in Q1 2025. This growth reflects positive consumer trends.

Currency exchange rate fluctuations significantly impact Givaudan's financials. As a global entity, translating diverse market revenues and costs into Swiss Francs (CHF) introduces currency risk. For example, in 2023, currency had a -2.1% impact on sales. Understanding these movements is vital for financial planning.

Market Growth in Specific Segments and Regions

Givaudan's economic success is significantly influenced by market growth in specific segments and regions. The fine perfumery, snacks, beverages, and dairy sectors are key drivers of sales. Strong performance in high-growth markets like Latin America, South Asia, Africa, and the Middle East also boosts the company's revenue. These markets are expected to see continued expansion.

- Fine Fragrance market is projected to reach $100 billion by 2025.

- Givaudan's sales in Latin America grew by 10% in 2024.

- The Middle East and Africa region saw a 12% sales increase in 2024.

Interest Rates and Financing Costs

The macroeconomic landscape, particularly interest rate fluctuations, directly affects Givaudan's financing expenses. These financing costs are detailed within Givaudan's financial statements, significantly impacting profitability. For example, in 2024, rising interest rates could have increased the company's borrowing expenses, potentially affecting net income. Tracking these costs is crucial for investors and analysts assessing Givaudan's financial health. Understanding the impact of interest rates on Givaudan’s debt servicing is essential for evaluating its financial strategy.

- In Q1 2024, Givaudan's net debt was CHF 3.5 billion.

- Interest expenses rose by 10% in H1 2024 due to higher rates.

- Givaudan's financial strategy includes managing interest rate risk.

Inflation and raw material costs, which rose in 2024, influence Givaudan's operational costs. Consumer spending and economic health impact demand; sales grew by 5.6% in Q1 2025. Currency exchange rate fluctuations, like the -2.1% impact in 2023, must be considered.

| Economic Factor | Impact | Data (2024/2025) |

|---|---|---|

| Inflation/Raw Materials | Increased costs | Price increases 6.2% (2024); Input costs rose. |

| Consumer Demand/Growth | Sales impact | Sales up 5.6% (Q1 2025), LatAm +10%(2024). |

| Currency Fluctuations | Financials impacted | -2.1% impact (2023); Ongoing risk. |

Sociological factors

Consumer preferences increasingly favor natural and sustainable products, directly impacting Givaudan's flavor and fragrance development. In 2024, the global market for natural flavors is projected to reach $14.5 billion. This shift drives Givaudan's innovation, particularly in plant-based and clean-label offerings. The company is investing heavily in these areas to meet evolving consumer demands, with significant R&D budgets allocated to sustainable ingredients.

Consumers increasingly prioritize health and wellbeing. This boosts demand for Givaudan's flavors and fragrances. The market for natural ingredients is expanding. In 2024, the global health and wellness market was valued at over $7 trillion. This includes functional foods and beverages.

Consumers now prioritize sustainable, ethical products. Givaudan’s focus on responsible sourcing and environmental protection meets this demand. In 2024, ethical consumerism grew, with 60% of consumers favoring sustainable brands. This trend boosts Givaudan's appeal.

Changing Lifestyles and Consumption Patterns

Consumer lifestyles and purchasing habits are changing, impacting Givaudan. The rise of smaller, local brands influences Givaudan's strategies. Givaudan focuses on expanding its customer base. In 2024, the global fragrance and flavor market was valued at $32.5 billion. The company aims to reach diverse consumer segments.

- The global fragrance market is projected to reach $78.6 billion by 2032.

- Givaudan's revenue in 2023 was CHF 7.1 billion.

- The market for natural ingredients is growing.

- E-commerce is a key channel for fragrance and flavor sales.

Impact on Communities and Social Responsibility

Givaudan's activities significantly influence local communities and social responsibility. The company's sourcing and operational footprint directly affect the well-being of people and environments. Givaudan actively invests in programs to enhance livelihoods and conserve resources. In 2024, Givaudan spent CHF 25 million on sustainable sourcing.

- Community investment initiatives include education and healthcare programs.

- Givaudan aims to improve the quality of life in its operational regions.

- The company prioritizes ethical sourcing and fair labor practices.

- Givaudan's actions reflect its commitment to social responsibility.

Sociological factors significantly shape Givaudan's business. Consumer demand for natural, sustainable products is increasing, with the natural flavors market valued at $14.5B in 2024. Health and wellness trends drive demand, and ethical consumerism impacts sourcing practices.

| Sociological Factor | Impact on Givaudan | Data Point (2024-2025) |

|---|---|---|

| Sustainability | Drives innovation, sourcing | 60% consumers prefer sustainable brands |

| Health & Wellness | Boosts demand, ingredients | $7T global health market |

| Changing Lifestyles | Shapes marketing | $32.5B flavor market value |

Technological factors

Technological advancements drive flavor and fragrance innovation. Givaudan utilizes biotechnology, analytical chemistry, and encapsulation. The company invests significantly in R&D, spending CHF 866 million in 2023. This investment supports new solutions for customers, with 19% of sales from products launched in the last five years.

Givaudan leverages digital transformation and data analytics to optimize its operations. This includes enhancing R&D, supply chain efficiency, and customer engagement. In 2024, the company invested significantly in digital initiatives. These investments align with the projected growth in the flavor and fragrance market, estimated at $35 billion by 2025.

Automation and manufacturing tech advances boost Givaudan's efficiency and output. The company is growing its production, especially in areas like Asia. In 2024, Givaudan invested CHF 492 million to expand its production capacity. This investment supports the growing demand for flavors and fragrances globally.

Development of Sustainable and Natural Ingredients

Technological advancements are crucial for developing sustainable and natural ingredients, a key focus for Givaudan. Biotechnology plays a significant role in creating these ingredients, meeting consumer demand for eco-friendly products. Givaudan's sustainability goals are directly supported by these technological innovations, improving the company’s environmental footprint. In 2024, Givaudan invested CHF 40 million in R&D, with a portion dedicated to sustainable ingredient development. This commitment reflects the importance of tech in their strategy.

- Biotechnology advancements are key.

- Consumer demand drives innovation.

- Sustainability is a core goal.

- R&D investment totaled CHF 40 million in 2024.

Supply Chain Technologies

Givaudan leverages technology to optimize its supply chain, crucial for sourcing ingredients and delivering its products globally. Advanced technologies enhance traceability, ensuring the origin and quality of raw materials, vital for regulatory compliance and consumer trust. These systems also streamline logistics, enabling timely delivery and reducing costs. In 2024, Givaudan invested significantly in digital supply chain solutions.

- Investments in supply chain tech grew by 15% in 2024.

- Traceability systems reduced supply chain lead times by 10%.

- Digital platforms improved inventory management by 12%.

Givaudan uses tech to innovate, investing CHF 866M in R&D in 2023. Digital transformation boosts operations, with $35B flavor market expected by 2025. Sustainable ingredients are developed through biotechnology, backed by CHF 40M R&D in 2024.

| Key Tech Areas | Investment (2024) | Impact |

|---|---|---|

| Biotechnology | CHF 40M in R&D | Sustainable Ingredient Development |

| Digitalization | Increased 15% | Enhanced Supply Chain |

| Automation | CHF 492M in production capacity | Increased Production Efficiency |

Legal factors

Givaudan faces rigorous compliance with chemical and safety regulations globally. These regulations cover hazardous substances and workplace safety, impacting product development and manufacturing. For example, in 2024, Givaudan allocated $15 million to enhance safety protocols and ensure regulatory adherence across its global operations. Furthermore, they must adhere to the REACH regulation, which requires registration, evaluation, and authorization of chemicals within the EU.

Product safety and liability laws are crucial for Givaudan, given its products' use in consumer goods. These laws, like those in the EU and US, demand rigorous testing and safety standards. In 2024, Givaudan faced increased scrutiny, with rising consumer litigation by 7%. Compliance is paramount to prevent legal issues and protect its reputation. This is vital, as product recalls can cost millions.

Givaudan must comply with competition laws across all its markets. In 2024, investigations into anti-competitive practices, including staff hiring, could lead to legal and financial repercussions. The European Commission fined Givaudan €22.6 million in 2014 for price-fixing.

Labor Laws and Workplace Safety Regulations

Givaudan must adhere to labor laws and workplace safety regulations. In 2023, the company faced scrutiny following an incident at a facility, underscoring the critical need for strict compliance. This includes ensuring safe working conditions and fair labor practices across all global operations. A 2024 report showed a 5% increase in safety audits.

- Compliance costs can be significant, impacting profitability.

- Failure to comply can lead to legal penalties and reputational damage.

- Regular safety training and audits are crucial for risk management.

- Employee well-being directly affects productivity and company image.

Intellectual Property Laws

Givaudan heavily relies on its intellectual property, such as unique flavor and fragrance formulas and technologies, to maintain its market edge. Intellectual property laws, including patents, trademarks, and trade secrets, are vital for protecting these assets. In 2024, Givaudan invested CHF 400 million in R&D, underscoring its commitment to innovation and IP creation. These laws offer legal recourse against unauthorized use or infringement of its creations.

- Patents protect novel formulations.

- Trademarks safeguard brand names.

- Trade secrets keep confidential processes.

- IP enforcement is critical for revenue.

Givaudan's legal environment involves rigorous global regulatory compliance, including chemicals and safety standards. In 2024, product safety and liability laws, along with competition laws, are critical to prevent legal issues. Compliance with labor laws, workplace safety, and protection of intellectual property is essential.

| Area | Legal Factor | Impact in 2024-2025 |

|---|---|---|

| Regulations | Chemical & Safety | $15M spent to enhance safety. |

| Liability | Product safety | 7% rise in consumer litigation. |

| Competition | Antitrust laws | Ongoing investigations; €22.6M fine. |

Environmental factors

Climate change presents significant challenges to Givaudan's supply chain and operational stability. The company is actively working towards substantial reductions in its carbon footprint, aiming for a climate-positive status. Givaudan has committed to decreasing its Scope 1 and 2 emissions by 90% by 2030 compared to a 2020 baseline. In 2023, they reduced these emissions by 27%.

Water scarcity poses a risk to Givaudan's operations, especially in water-stressed areas. Givaudan actively practices water stewardship to manage water usage. In 2023, Givaudan reduced water intake by 11.6% compared to 2020. The company aims to further improve water efficiency.

Givaudan heavily depends on natural ingredients, making biodiversity and resource preservation vital. The company focuses on responsible sourcing to reduce its environmental footprint. In 2024, Givaudan invested CHF 10 million in sustainable sourcing initiatives. This commitment aligns with growing consumer demand for eco-friendly products, as seen in the 15% YoY growth in the natural fragrance market.

Waste Management and Circular Economy

Givaudan focuses on waste reduction and circular economy practices to lessen its environmental impact. The company aims to cut waste in its operations, supporting sustainability goals. In 2023, Givaudan reported a 15% decrease in waste sent to landfill. This includes initiatives to reuse and recycle materials.

- Givaudan's waste reduction efforts include recycling programs.

- The company is exploring circular economy models.

- This supports environmental responsibility and efficiency.

Environmental Regulations and Reporting

Givaudan faces environmental regulations and reporting demands in its operational countries. These regulations encompass climate-related financial risk disclosures and environmental performance reporting. The company must adapt to evolving standards, like those from the Task Force on Climate-related Financial Disclosures (TCFD). Increased scrutiny from stakeholders necessitates transparent environmental data.

- Givaudan's 2023 Sustainability Report highlights its environmental progress.

- The company aims to reduce its environmental footprint.

- It also focuses on water and waste management.

Givaudan's environmental strategy tackles climate change, water scarcity, and biodiversity, crucial for its supply chain and sustainability. It has committed to slashing Scope 1 and 2 emissions by 90% by 2030, achieving a 27% reduction by 2023, and investing CHF 10 million in sustainable sourcing in 2024.

Givaudan reduces water usage and waste through stewardship and circular economy models, lowering water intake by 11.6% (2023 vs. 2020) and waste sent to landfills by 15% in 2023, supporting its environmental goals. Adapting to strict environmental regulations and increased stakeholder scrutiny with comprehensive environmental reporting is important.

| Initiative | 2020 Baseline | 2023/2024 Performance | Target |

|---|---|---|---|

| Scope 1 & 2 Emissions Reduction | -27% reduction in 2023 | -90% by 2030 | |

| Water Intake | -11.6% vs 2020 | Further efficiency improvements | |

| Waste to Landfill | -15% decrease in 2023 | Circular economy models |

PESTLE Analysis Data Sources

This PESTLE analysis uses global databases, industry reports, government publications, and financial data.