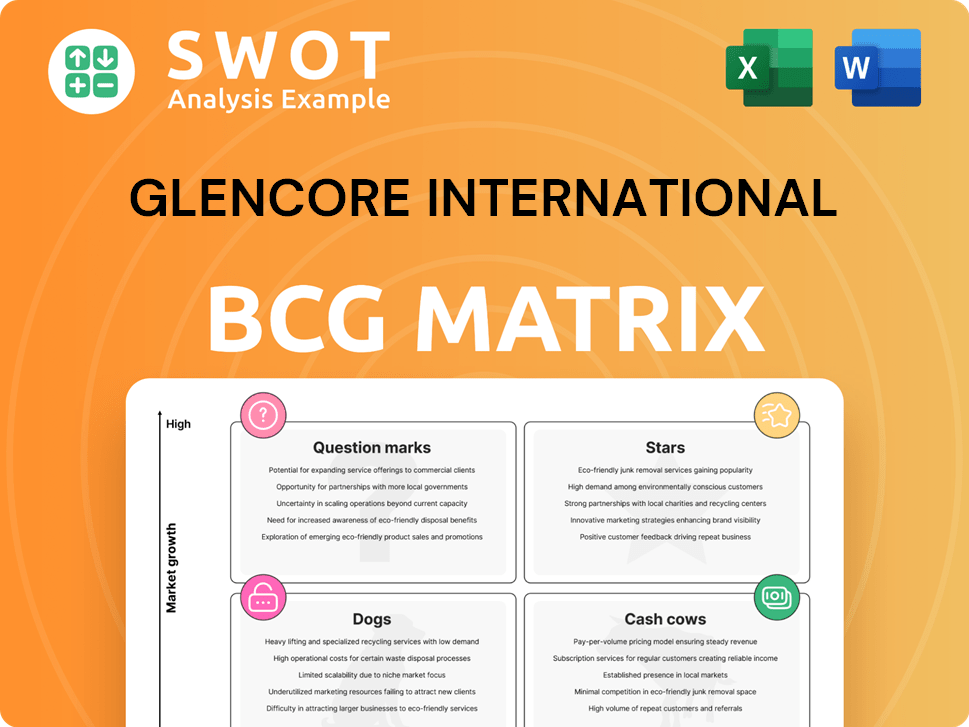

Glencore International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glencore International Bundle

What is included in the product

Glencore's BCG Matrix analysis reveals investment, holding, and divestment strategies based on market position and growth.

Printable summary optimized for A4 and mobile PDFs, delivering easily accessible strategic insights.

What You’re Viewing Is Included

Glencore International BCG Matrix

This Glencore International BCG Matrix preview mirrors the complete document you'll receive. Post-purchase, gain full access to the analysis, perfectly formatted for strategic insights. It's designed for immediate implementation within your business.

BCG Matrix Template

Glencore International's diversified portfolio presents a complex landscape for analysis. Understanding its business units' market positions is crucial. Our BCG Matrix provides a snapshot of their strategic potential. This simplified view helps identify growth drivers and resource drains. We highlight key products across all four quadrants.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Glencore's acquisition of Elk Valley Resources (EVR) in July 2024 dramatically increased its steelmaking coal production, by 165%. This strategic move capitalizes on the growing demand driven by infrastructure projects and the energy transition. Further investment in optimizing these assets could boost market dominance and profitability. Steelmaking coal's robust performance makes it a key player.

Copper is a "Star" in Glencore's portfolio, crucial for the energy transition. Despite a 6% production decrease in 2024, Glencore eyes growth. They aim to boost production to capitalize on rising demand.

Zinc shines in Glencore's portfolio, buoyed by favorable market conditions and rising prices. The ramp-up of Zhairem has significantly boosted Glencore's zinc output, a key driver of its performance. In 2024, zinc prices averaged around $2,800 per tonne, reflecting strong demand. Glencore's strategic investments in zinc smelting operations position it well for continued success.

Metals and Minerals Trading

Glencore's Metals and Minerals trading is a Star within its BCG matrix, demonstrating robust financial health. In 2023, the division reported significant revenue and adjusted EBITDA growth, driven by increased copper and zinc prices. The Marketing segment's consistent EBIT generation highlights its strategic importance, aligning with long-term objectives. Diversification and market acumen remain key for future performance.

- Revenue Growth: Significant increases in revenue, especially in copper and zinc.

- EBITDA Performance: Strong adjusted EBITDA growth.

- Marketing Segment: Consistent EBIT generation within guidance.

- Strategic Focus: Diversification and market expertise are key.

Recycling Initiatives

Glencore's recycling initiatives, a Star in its BCG Matrix, are boosted by strategic investments in EU critical minerals recycling, focusing on sustainability. The company aims for 25% recycled content in battery-grade metals by 2025, demonstrating its circular economy commitment. Technological advancements are key to improving the recovery of lithium and other critical minerals for future growth.

- Glencore's 2023 full-year results showed a net debt of $10.3 billion.

- In 2024, Glencore's copper production guidance is 1.045 million tonnes.

- The company's 2023 adjusted EBITDA was $17.1 billion.

- Glencore invested $1.4 billion in recycling in 2023.

Glencore's "Stars" showcase robust growth potential. These include steelmaking coal, copper, zinc, and Metals and Minerals trading. Recycling initiatives also shine, driven by investments and sustainability goals.

| Asset | 2024 Performance | Strategic Focus |

|---|---|---|

| Steelmaking Coal | Production up by 165% | Optimize assets, market dominance |

| Copper | Production down 6% | Increase production, meet demand |

| Zinc | Prices ~$2,800/tonne | Strategic smelting investments |

| Metals & Minerals Trading | Significant revenue growth | Diversification, market expertise |

| Recycling | $1.4B invested in 2023 | 25% recycled content by 2025 |

Cash Cows

Aluminum is a cash cow for Glencore, benefiting from rising prices and providing a stable revenue stream. In 2024, aluminum prices have increased, showcasing its commodity reliability. For example, the London Metal Exchange (LME) three-month aluminum price reached $2,500 per tonne in Q4 2024. Maintaining cost efficiencies in production can boost profitability.

Glencore's lead production showed stability, with a modest increase in 2024. Although lead prices slightly decreased, consistent production ensured a steady cash flow. In 2024, Glencore produced around 1.2 million tonnes of lead. Optimizing processes and managing costs will help maintain its cash cow status.

Glencore's Marketing segment is a cash cow, consistently achieving adjusted EBIT within its guidance. This stability stems from its ability to adapt to market changes, securing a reliable revenue stream. In 2024, the Marketing segment's adjusted EBIT was $3.3 billion. Further profitability gains are expected through strategic trading.

Ferrochrome

Ferrochrome, a key part of Glencore's portfolio, demonstrated stability in 2024. This consistency positions it firmly as a reliable cash generator for the company. Efficient cost management alongside steady production ensures its continued financial contribution. Glencore can boost profitability by focusing on operational improvements.

- Ferrochrome production in 2024 remained steady, contributing to stable revenue.

- Effective cost management is crucial for maintaining profitability.

- Operational efficiency improvements can enhance financial performance.

Silver

Silver, a key by-product for Glencore, remains a cash cow despite a production dip in 2024. Rising silver prices boost its profitability, supporting its cash-generating capabilities. Glencore's focus on efficient extraction is crucial for maintaining this status. Strategic market moves can further leverage silver's value.

- 2024 silver production saw a slight decrease.

- Rising prices enhance silver's profitability.

- Efficient extraction methods are a focus.

- Market strategies aim to capitalize on trends.

Glencore's cash cows, including aluminum, lead, Marketing segment, ferrochrome, and silver, offer consistent financial stability. These assets generate significant cash flow due to stable production and rising market prices. The Marketing segment contributed significantly with adjusted EBIT of $3.3 billion in 2024.

| Cash Cow | 2024 Performance | Key Strategy |

|---|---|---|

| Aluminum | LME: $2,500/tonne | Cost efficiency |

| Lead | 1.2M tonnes produced | Optimize processes |

| Marketing | $3.3B adjusted EBIT | Strategic trading |

| Silver | Price increase | Efficient extraction |

Dogs

Glencore's nickel production faced headwinds in 2024, dropping significantly due to operational issues. The market saw a decline in nickel prices, impacting profitability. Impairment charges suggest nickel is a cash trap, underperforming financially. Strategic moves like divestiture are crucial to optimize Glencore's portfolio.

Glencore's South African coal operations are considered Dogs in its BCG Matrix due to export logistics challenges and lower prices. In 2024, impairment charges reflect underperformance, potentially tying up capital. Restructuring or divestiture may be needed. The company's coal production was 103.1 million tonnes in 2023.

Cobalt, a "dog" in Glencore's BCG matrix, saw production declines in 2024 due to lower ore grades at the Mutanda mine. This decrease, coupled with price volatility, poses challenges. In 2024, cobalt prices fluctuated significantly. Exploring strategic options for long-term viability is crucial.

Thermal Coal (Energy Coal)

Thermal coal, a key part of Glencore's portfolio, saw production decrease in 2024 due to mine closures and logistical issues. The price of thermal coal has fallen, affecting its profitability. With the shift to cleaner energy, long-term demand for thermal coal is expected to decline, making it less appealing. Glencore's thermal coal production in 2023 was 108 million tonnes.

- Production Decline: Scheduled mine closures and logistical issues reduced output in 2024.

- Price Impact: Falling thermal coal prices have decreased profitability.

- Demand Outlook: Transition to cleaner energy sources poses a long-term demand decline.

- 2023 Production: Glencore produced 108 million tonnes of thermal coal.

Koniambo Operations

Koniambo Operations, a nickel asset, is a Dog in Glencore's BCG Matrix. It underperforms significantly, leading to a $419 million impairment in 2023. Its poor performance necessitates considering divestiture or restructuring to cut financial losses. This strategic shift aims to reduce Glencore's overall financial strain.

- 2023 impairment of $419 million.

- Nickel asset underperforming.

- Divestiture or restructuring is needed.

- Strategic shift to reduce financial strain.

Glencore's zinc operations also fall into the "Dogs" category within its BCG Matrix. Zinc prices experienced volatility and faced challenges in 2024, impacting profitability. The company must assess strategic moves, like asset sales or restructuring, to address these financial strains. Glencore's zinc production was 1,073.5 kt in 2023.

| Metric | Details | 2023 Data |

|---|---|---|

| Production | Zinc Production | 1,073.5 kt |

| Price Volatility | Zinc price fluctuations | Affected profitability |

| Strategic Options | Possible moves | Asset sales/restructuring |

Question Marks

Glencore's lithium recovery faces challenges, with current rates lagging. This presents a growth opportunity within battery metals. Boosting recovery through tech could shift lithium to a star. R&D is key, especially with lithium demand soaring. For example, in 2024, lithium prices fluctuated significantly, highlighting market volatility.

Glencore's battery metals recycling is in the "Question Mark" quadrant. It faces high growth potential but has a low market share currently. In 2024, the battery recycling market was valued at $1.5 billion. Strategic investments are key for Glencore to capture this growing market. Scaling up operations and improving recovery processes are critical.

Glencore's Argentina copper assets represent a "Question Mark" in its BCG matrix. In 2023, Glencore saw promising growth in its copper resources in Argentina. This high-growth area currently has a low market share. Developing these resources could boost Glencore's copper output. Prioritizing exploration is crucial.

New Copper Growth Projects

Glencore is currently assessing organic copper growth prospects, potentially adding 1 million tonnes of production, indicating substantial expansion possibilities. These initiatives demand significant capital outlays, though the returns could be considerable in the expanding copper market. Rigorous feasibility studies and regulatory clearances are vital for the progression of these ventures. In 2024, copper prices have seen fluctuations, with an average of around $4.00 per pound.

- Potential Production: 1 Mt of copper.

- Market Context: Growing copper market.

- Capital Needs: Significant investment required.

- 2024 Copper Price: Approximately $4.00/lb.

Expansion into Recycling Technologies

Glencore's expansion into recycling technologies represents a strategic move, aligning with growing environmental regulations and market demand. This area has the potential for high growth, driven by the need for sustainable resource management. However, it requires substantial capital investments and technological expertise to succeed. The company is focusing on initiatives to enhance recovery rates and scale up operations.

- Glencore aims to capitalize on the increasing demand for recycled materials.

- Investments in R&D are crucial for improving extraction efficiency.

- The recycling sector's growth is influenced by evolving environmental policies.

- Significant capital expenditure is required for advanced recycling facilities.

Glencore's "Question Mark" copper projects require significant capital. They face high growth potential but low market share. In 2024, copper prices averaged $4.00/lb. Strategic exploration and investment are vital.

| Metric | Value |

|---|---|

| 2024 Avg. Copper Price | $4.00/lb |

| Potential Production Increase | 1 Mt copper |

| Investment Needed | Significant |

BCG Matrix Data Sources

The Glencore BCG Matrix draws on company financials, market growth data, commodity price analysis, and expert industry insights.