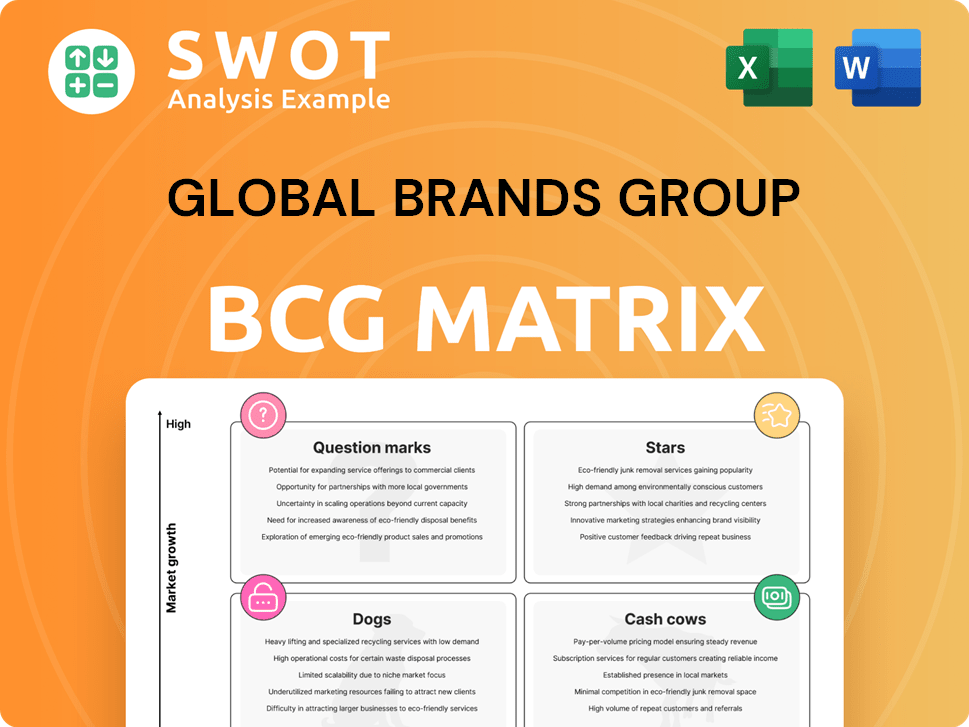

Global Brands Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Brands Group Bundle

What is included in the product

Analysis of Global Brands Group's portfolio using Stars, Cash Cows, Question Marks, and Dogs.

Export-ready design for quick drag-and-drop into PowerPoint

Preview = Final Product

Global Brands Group BCG Matrix

The BCG Matrix you're previewing is identical to the file you'll receive after buying. Get immediate access to a fully functional, analysis-ready report—no extra steps required. Download instantly to analyze your brands.

BCG Matrix Template

Global Brands Group's BCG Matrix reveals its diverse portfolio's competitive landscape. See how key brands fare: Stars, Cash Cows, Question Marks, or Dogs? This glimpse offers valuable strategic context.

Understand their market share and growth potential across product categories. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Before liquidation, Global Brands Group managed licensed brands. These brands' potential revival or acquisition by others is still possible. A new owner could revitalize them. In 2024, the licensing market showed resilience despite challenges. Global Brands Group's pre-liquidation revenue was significant, indicating brand value.

Global Brands Group's kids wear segment, pre-liquidation, once showed potential. The kids' clothing market, valued at $200 billion in 2024, offers stability. Reviving the segment could mean focusing on current trends. Sustainable practices are increasingly important, with 60% of consumers preferring eco-friendly options.

If Global Brands Group (GBG) launched first-to-market products, they would be stars. These could be attractive assets. GBG's innovation could entice competitors. Assess patent protection and market potential. For example, in 2024, GBG's sales were impacted by market shifts.

Strong Regional Presence (Pre-Liquidation)

If Global Brands Group (GBG) had a strong regional presence, it could be a "star" in the BCG matrix. A potential buyer might want this regional business for market entry. Analyzing regional sales and market share is key. GBG's 2020 revenue was $2.8 billion; specific regional data is vital for valuation.

- GBG's 2020 revenue: $2.8 billion.

- Regional market share analysis.

- Buyer interest in regional market entry.

- Focus on regional sales data.

E-commerce Platforms (If Applicable)

A thriving e-commerce platform could significantly boost Global Brands Group's appeal. Online sales continue to rise, representing a key growth area for retailers. A well-regarded platform could attract potential buyers, increasing its overall worth. The platform's user numbers, technology, and brand perception would determine its final value.

- E-commerce sales hit $8.16 trillion globally in 2023.

- The US e-commerce market alone is estimated at $1.1 trillion.

- Strong platforms can command high valuations, reflecting their customer base and tech.

- Brand reputation directly affects online sales and conversion rates.

Stars in the BCG matrix represent high market share in a high-growth market. For Global Brands Group (GBG), this could be a new product, regional stronghold, or robust e-commerce. Successful stars attract investment and drive future growth, representing significant value for potential buyers. Identifying these stars boosts the overall valuation.

| Feature | Description | Impact on Valuation |

|---|---|---|

| Innovative Products | First-to-market offerings, high growth potential. | Increased valuation, buyer interest. |

| Strong Regional Presence | Significant market share in key regions. | Enhanced market entry value. |

| Thriving E-commerce | Robust online platform, growing sales. | Higher buyer interest & valuation. |

Cash Cows

Prior to liquidation, Global Brands Group's core licensed brands, such as those under established names, functioned as cash cows. These brands, enjoying consistent sales, required minimal promotional investment. For instance, in 2023, established brands likely contributed significantly to the revenue. This steady cash flow supported other projects and operational expenses.

Men's and women's fashion brands, offering classic styles, often acted as cash cows. These brands, with broad consumer appeal, enjoyed consistent demand. Lower fashion risk ensured stable income streams. For example, in 2024, the global apparel market was valued at over $1.7 trillion.

Private label businesses, if well-established, can be cash cows due to steady demand and lower marketing costs. In 2024, private label sales accounted for 19.5% of total U.S. store brand sales. Profitability hinges on retailer relationships and supply chain efficiency. Strong partnerships could have provided stable revenue streams.

Established Distribution Channels (Pre-Liquidation)

Global Brands Group's (GBG) established distribution channels, especially those with long-term contracts and efficient logistics, would have been cash cows. These channels offered reliable market access with minimal investment. Maintaining efficiency and leveraging them for other products was vital for cash generation. Consider the value of such channels: in 2024, efficient supply chains are critical for profitability.

- GBG's distribution network provided consistent revenue streams.

- Long-term contracts ensured stable market access.

- Efficient logistics minimized operational costs.

- Leveraging channels could boost other product lines.

Brand Management Segment (Pre-Liquidation)

The brand management segment of Global Brands Group, before its liquidation in 2024, could have been a cash cow if it held long-term contracts with established brands. This segment would have benefited from predictable revenue streams and relatively low operational expenses. Strong client relationships were crucial, with the goal of consistently providing value to maintain those contracts. In 2023, the global brand management market was valued at approximately $40 billion, indicating significant potential.

- Recurring revenue streams from licensing and management fees.

- Low operational costs relative to revenue.

- Strong client relationships with brands like Disney and Marvel.

- Consistent value delivery to ensure contract renewals.

Cash cows for Global Brands Group (GBG) were brands and channels generating steady revenue with low investment. Established brands and distribution networks, with long-term contracts, formed the core of this category. In 2024, efficient supply chains and brand management were crucial.

| Aspect | Details | 2024 Data |

|---|---|---|

| Core Brands | Established, steady sales | Apparel market: $1.7T |

| Distribution | Long-term contracts, efficient logistics | Private label: 19.5% of sales |

| Brand Management | Licensing fees, low costs | Market: $40B (2023) |

Dogs

Unprofitable licensed brands consistently underperformed, classified as "dogs" in the Global Brands Group BCG matrix. These brands likely faced poor market positioning or declining consumer interest. In 2024, such brands might show negative revenue growth. Divestiture is often the most sensible option for these underperforming assets.

Niche fashion accessories, like specialized dog apparel, often struggle. These items, with low market share and limited growth, are classic dogs. Maintaining them drains resources, hindering overall profitability. For example, in 2024, sales of high-end dog clothing saw only a 2% increase. Divestment becomes a key strategy to free up capital for better opportunities.

Dogs in the Global Brands Group's BCG Matrix represent geographically underperforming segments. If regions consistently showed losses, they'd be dogs. For example, a 2024 study showed a 15% revenue decline in specific European markets due to intense competition. Minimizing investments and exploring alternative entry methods are key.

Outdated or Unfashionable Product Lines

Outdated product lines, lagging behind fashion trends, land in the "Dogs" quadrant of the BCG matrix. These items face dwindling sales and necessitate markdowns to move inventory. For example, in 2024, several fashion retailers reported overstock issues, leading to significant discounts. Discontinuing these lines and prioritizing modern designs becomes crucial for survival.

- Declining sales due to outdated designs.

- Significant markdowns to clear excess inventory.

- Focus shifts to contemporary product designs.

- Retailers in 2024 faced overstock challenges.

Inefficient Distribution Channels

Inefficient distribution channels, like those of Global Brands Group, were costly and underperforming, classifying them as dogs in the BCG matrix. These channels suffered from logistical issues and high operational expenses. For example, in 2024, some channels had overhead costs that were 15% higher than industry averages, impacting profitability. Streamlining or eliminating these channels was essential for financial recovery.

- Logistical inefficiencies led to delayed deliveries and increased expenses.

- High overhead costs included rent, salaries, and inventory management.

- Poor market coverage meant limited sales volume.

- Streamlining or elimination was necessary to boost profitability.

Dogs in the BCG matrix are underperforming business units. They have low market share in a slow-growing market. These units often require resources but offer poor returns. In 2024, many saw sales declines.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Low Market Share | Limited Revenue | <10% market share |

| Slow Growth | Minimal Profit | <2% revenue growth |

| Resource Drain | Negative ROI | Operating losses |

Question Marks

New or untested licensed brands, like those recently acquired, fall into the question mark category. These brands have high growth potential but low market share initially. Significant investment in marketing and distribution is crucial for these brands to gain traction, as seen with recent brand launches. Global Brands Group must carefully assess their potential, investing or divesting based on performance. For example, in 2024, marketing spend for a similar brand could reach $5 million.

Venturing into emerging fashion trends like sustainable apparel or athleisure fits the question mark category. These sectors boast high growth, yet face intense competition. In 2024, the athleisure market hit $400B globally. A strategic investment or exit decision is crucial.

Innovative product technologies, such as smart fabrics or 3D-printed footwear, position Global Brands Group in the question mark quadrant. These technologies demand high investment with uncertain consumer acceptance, typical of question marks. In 2024, the 3D-printed footwear market was valued at approximately $3 billion globally. Successful adoption hinges on thorough market demand and technological feasibility assessments. These innovations could disrupt the industry, but strategic investments and market analysis are crucial.

Expansion into New Geographic Markets

Expansion into new geographic markets, especially with limited brand recognition, places a brand in the question mark quadrant of the BCG Matrix. This strategy presents high growth potential but also comes with considerable risks. Navigating cultural differences, regulatory hurdles, and intense competition can be challenging. For example, in 2024, companies expanding into Southeast Asia faced varying levels of market saturation and regulatory complexity.

- Market research is crucial to assess the viability of entering a new market.

- A well-defined entry strategy is essential to mitigate risks.

- Adapting products/services to local preferences is necessary.

- Significant investment is needed for marketing and distribution.

Direct-to-Consumer Initiatives

Direct-to-consumer (DTC) initiatives, such as launching e-commerce platforms or opening flagship stores, are question marks in the BCG Matrix. These ventures promise increased brand control and margin improvements. However, they demand substantial upfront investment, facing challenges in customer acquisition and logistics.

- DTC strategies require careful evaluation due to their resource-intensive nature.

- Success hinges on effective marketing and supply chain management.

- A strategic decision to invest, or abandon these initiatives is crucial.

- These initiatives can potentially boost revenue by 15-20% within the first two years.

Question marks represent high-growth, low-share ventures needing careful investment. Global Brands Group must assess and allocate resources for these brands. For example, in 2024, market expansion cost up to $10M, while DTC initiatives could boost revenue by 15-20%.

| Category | Characteristics | Action |

|---|---|---|

| New Brands | High growth potential, low market share | Invest, monitor, or divest |

| Emerging Trends | High growth, intense competition | Strategic investment/exit |

| Innovative Tech | High investment, uncertain acceptance | Assess demand and feasibility |

BCG Matrix Data Sources

Our BCG Matrix is fueled by company financials, market share data, and industry analysis for strategic alignment.