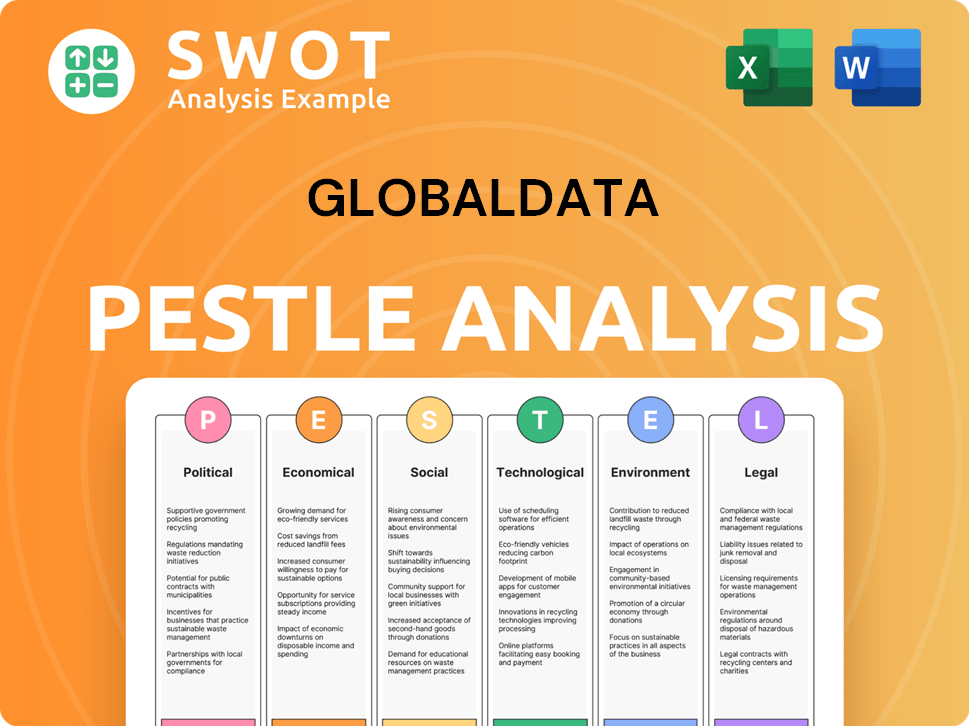

GlobalData PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GlobalData Bundle

What is included in the product

GlobalData's PESTLE analyzes external macro-environmental forces impacting businesses.

A simplified format designed to drive insightful conversations around external forces impacting strategic direction.

Preview the Actual Deliverable

GlobalData PESTLE Analysis

The GlobalData PESTLE analysis preview displays the complete document you'll receive. The content and format shown are identical to your post-purchase download. This file is ready for your use immediately. Get insights with full access after your purchase.

PESTLE Analysis Template

Uncover how external factors impact GlobalData with our detailed PESTLE Analysis. This comprehensive report examines political, economic, social, technological, legal, and environmental influences. Gain critical insights to anticipate challenges and capitalize on opportunities. Access the complete analysis now to refine your strategies and stay ahead of the curve. Download the full version for immediate strategic advantage!

Political factors

Governments worldwide are backing digital identity verification and data-driven projects. This backing involves setting up national digital identity systems and encouraging data use across sectors. For example, the EU's Digital Identity Wallet initiative aims to give citizens more control over their digital identities. In 2024, the global digital transformation market is valued at $825 billion, with expected growth. This creates a beneficial setting for data and analytics firms like GlobalData.

The regulatory frameworks for data privacy are constantly changing, which has a big impact on businesses that use a lot of data. Laws like GDPR and others around the world set rules for how data is collected, used, and stored. In 2024, the global data governance market was valued at $2.6 billion. These rules affect how companies handle data internationally.

Political stability is vital for international firms. Geopolitical risks like conflicts and trade disputes increase uncertainty. These events affect economies and consumer behavior, impacting operations. For example, the Russia-Ukraine war significantly disrupted supply chains in 2022-2023.

Trade Policies and Data Flows

Trade policies significantly affect data analytics firms by either easing or hindering international data movement. Protectionist policies, like data localization, can complicate global data transfers. The EU's GDPR, for instance, mandates strict data handling, impacting data analytics. In 2024, the global data analytics market was valued at over $300 billion. These policies' implications affect market access and operational costs.

- GDPR compliance costs can reach millions for large companies.

- Data localization can add 15-25% to operational expenses.

- Trade agreements like USMCA facilitate data flows.

Government Use of Data and Analytics

Governments increasingly rely on data and analytics. They use it for policy, economic oversight, and public services. GlobalData's macroeconomic data and risk reports are useful for government bodies. This opens doors for partnerships and contracts. For example, the global big data analytics market is projected to reach $77.6 billion by 2025.

- Policy Formulation: Data aids in creating and evaluating policies.

- Economic Monitoring: Real-time data helps in tracking economic trends.

- Public Service: Data optimizes service delivery and resource allocation.

- Partnership Opportunities: GlobalData can collaborate with governmental agencies.

Political factors shape data and analytics. Government digital initiatives boost market growth; the global digital transformation market reached $825B in 2024. Data privacy regulations impact businesses. Political stability affects international firms, with geopolitical risks like the Russia-Ukraine war disrupting supply chains, as the global big data analytics market is projected to reach $77.6B by 2025.

| Political Factor | Impact | Data |

|---|---|---|

| Digital Identity | Market Growth | $825B digital transformation (2024) |

| Data Privacy | Regulatory Compliance | GDPR compliance can cost millions |

| Geopolitical Risk | Supply Chain Disruption | Russia-Ukraine war impacts |

| Government Analytics | Partnership Opportunities | Big data analytics market $77.6B (2025 est.) |

Economic factors

Global economic growth significantly impacts the market intelligence sector. In 2024, the IMF projected global growth at 3.2%. Economic stability fosters increased corporate spending on data analytics. Conversely, downturns can curb demand for these services. For 2025, forecasts suggest continued, albeit potentially slower, growth.

Inflation and central bank monetary policies significantly impact businesses. For instance, the U.S. Federal Reserve's actions, like raising interest rates, directly influence borrowing costs. In 2024, inflation in the Eurozone was around 2.4%. GlobalData provides forecasts to help clients manage these economic shifts.

Currency exchange rate volatility significantly influences GlobalData's financial outcomes. International operations expose them to currency risk, impacting revenue translation and profit margins. For example, a strong dollar could reduce the value of GlobalData's international earnings when converted. Currency fluctuations also affect the cost of cross-border acquisitions and investments. In 2024, currency volatility caused a 5% variance in reported revenues for many multinational firms.

Investment Trends and Capital Availability

Investment trends significantly impact GlobalData's potential client base. A robust investment environment, including private equity and venture capital, fuels business growth, boosting demand for market insights. In 2024, global venture capital funding reached $345 billion, reflecting investor confidence. This surge in capital availability often increases the need for due diligence and market analysis services.

- Venture capital funding in 2024: $345 billion

- Increased demand for market insights

- Strong investment climate

Industry-Specific Economic Trends

GlobalData's focus on sectors like tech, healthcare, and finance means industry-specific economic trends are crucial. These trends, including growth rates and investment flows, dictate the demand for GlobalData's specialized data. Detailed forecasts and insights allow informed decisions. Consider these 2024 examples:

- Tech spending is projected to reach $5.1 trillion in 2024.

- Healthcare IT market expected to hit $84.3 billion by 2025.

- Financial services are seeing increased demand for data analytics.

Global economic growth impacts market intelligence, with a projected 3.2% growth in 2024. Economic shifts like interest rates affect borrowing costs. Currency volatility influences GlobalData's revenues.

Investment trends, including venture capital, influence the need for market insights; in 2024, VC funding hit $345B. Demand varies with industry-specific economic trends.

In 2024, tech spending is projected to hit $5.1T and the healthcare IT market to $84.3B by 2025. These figures underline how sector-specific insights are crucial for GlobalData's business.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| Global Growth | Influences corporate spending | IMF projected 3.2% |

| Inflation/Monetary Policy | Affects borrowing costs | Eurozone ~2.4% |

| Currency Volatility | Impacts revenue & costs | 5% variance for firms |

Sociological factors

Understanding consumer behavior shifts is crucial for GlobalData's clients. Ethical and environmental factors heavily influence purchasing decisions. Consumers increasingly prioritize experiences over material goods. GlobalData's research helps businesses adapt; for example, the ethical market is projected to reach $18.3 billion in 2025, up from $15.6 billion in 2023.

Changes in labor markets, including talent availability, skill gaps, and evolving work models, impact GlobalData and its clients. The US unemployment rate was 3.9% in April 2024. Skill gaps require addressing for both internal operations and client needs. Remote work trends and workforce dynamics are key areas for analysis.

Societal pressure for corporate social responsibility and ESG is increasing. In 2024, ESG-focused assets hit $40.5 trillion. GlobalData's ESG analysis aids firms in meeting these expectations. Their reports offer data on ESG trends and impacts. This helps shape strategies and investments.

Demographic Shifts

Demographic shifts significantly influence global markets, driving changes in consumer behavior and resource allocation. Population growth, aging populations, and urbanization are key trends. GlobalData offers data to understand these impacts, aiding strategic planning.

- World population expected to reach 9.7 billion by 2050.

- Urban population projected to be 68% by 2050.

- Aging populations increase demand for healthcare and retirement services.

Access to Information and Digital Literacy

Access to information and digital literacy are reshaping data consumption. The surge in internet users globally, reaching 5.35 billion in January 2024, fuels demand for user-friendly data platforms. This impacts GlobalData's service design and delivery, requiring intuitive interfaces.

- Global internet penetration rate: 66.2% as of January 2024.

- Mobile internet users worldwide: 4.49 billion in January 2024.

Societal expectations for corporate responsibility and ESG are growing, influencing business practices. GlobalData's ESG analysis assists businesses in meeting these evolving requirements. In 2024, assets focused on ESG reached $40.5 trillion, highlighting their significance.

Demographic shifts such as population growth and aging impact market dynamics, which require strategic adjustments. The world population is anticipated to reach 9.7 billion by 2050, shaping resource allocation. Urbanization and aging trends are central to market analysis and GlobalData's data insights.

Digital literacy and information accessibility change data consumption patterns globally. In January 2024, 5.35 billion people accessed the internet. This affects how data is delivered, with user-friendly platforms being essential for effective engagement and analysis.

| Trend | Data | Implication for GlobalData |

|---|---|---|

| ESG-focused assets | $40.5 trillion (2024) | More demand for ESG data & analytics |

| Global Internet Users | 5.35 billion (Jan 2024) | Need for user-friendly data platforms |

| World Population | 9.7 billion (2050) | Changes in consumer behaviour |

Technological factors

GlobalData heavily relies on data analytics, AI, and machine learning. The company invests in AI to improve its platforms. In 2024, the AI market reached $260 billion, and is projected to hit $1.5 trillion by 2030. This helps them offer deeper market insights.

Cloud computing and advanced data infrastructure are crucial for GlobalData. They handle vast data volumes efficiently. The global cloud computing market is projected to reach $1.6 trillion by 2025, supporting scalable solutions. This infrastructure ensures quick data access and analysis for clients.

Data security and cybersecurity are top priorities given the rise in cyber threats. GlobalData and its clients face risks, necessitating investments in robust security measures. In 2024, cybercrime costs were projected to hit $9.5 trillion globally, underscoring the need for vigilance. Addressing vulnerabilities is crucial to safeguard sensitive information and maintain trust.

Development of Data Integration and Management Tools

The evolution of data integration and management tools is pivotal for GlobalData. These advancements enable the seamless merging of diverse datasets, offering a consolidated information view. This enhances the utility and value of GlobalData's products, improving data accessibility and analytical capabilities. The market for data integration tools is projected to reach $25.3 billion by 2024.

- Data fabric solutions are expected to grow, with a market size of $4.4 billion in 2024.

- Improvements in data quality tools are also crucial, with the market valued at $1.5 billion in 2024.

Emerging Technologies (IoT, AR/VR)

The rise of IoT and AR/VR reshapes data landscapes, fostering data-driven innovation. GlobalData tracks these shifts closely. The global IoT market is projected to reach $2.4 trillion by 2029. AR/VR spending is expected to hit $72.8 billion in 2024. New applications emerge, enhancing data analysis.

- IoT market expected to reach $2.4T by 2029.

- AR/VR spending projected at $72.8B in 2024.

GlobalData leverages AI and data analytics, with the AI market hitting $260B in 2024, expected to grow to $1.5T by 2030. Cloud computing, projected at $1.6T by 2025, and robust data infrastructure support their operations. Data security is crucial as cybercrime costs hit $9.5T in 2024, and data integration tools market is set at $25.3B. The evolution of IoT and AR/VR technologies significantly influence data-driven innovation. The global IoT market is anticipated to reach $2.4T by 2029, while AR/VR spending is projected to reach $72.8B in 2024. Data fabric solutions and data quality tools are set to impact GlobalData's technological framework, growing to $4.4 billion and $1.5 billion respectively.

| Technology Area | Market Size/Spending (2024) | Projected Market/Spending (End of forecast) |

|---|---|---|

| AI Market | $260 Billion | $1.5 Trillion by 2030 |

| Cloud Computing | - | $1.6 Trillion by 2025 |

| Cybercrime Costs | $9.5 Trillion | - |

| Data Integration Tools | $25.3 Billion | - |

| IoT Market | - | $2.4 Trillion by 2029 |

| AR/VR Spending | $72.8 Billion | - |

| Data Fabric Solutions | $4.4 Billion | - |

| Data Quality Tools | $1.5 Billion | - |

Legal factors

Data privacy regulations like GDPR and CCPA are critical legal factors. Companies must comply with these rules on data collection, processing, and storage. Non-compliance can lead to hefty fines; for instance, GDPR fines can reach up to 4% of global annual turnover. The global data privacy market is projected to reach $19.6 billion by 2025.

Intellectual property laws are vital for GlobalData. These laws safeguard databases and proprietary research methods. Protecting its data from misuse is key. In 2024, global IP revenue hit $7.5 trillion, showing its significance.

GlobalData relies heavily on contract law and licensing agreements to define its business relationships. These legal frameworks dictate the terms of service with clients and the usage rights of data from providers. In 2024, the company likely updated its standard contracts to reflect evolving data privacy regulations, such as GDPR and CCPA, to ensure compliance. This is crucial for maintaining trust and avoiding legal issues.

Competition Law and Antitrust Regulations

GlobalData must navigate competition laws and antitrust regulations, which significantly affect its market standing, including mergers and collaborations. Adherence to these laws is crucial to prevent legal issues and restrictions on expansion. Regulatory bodies globally, like the European Commission and the U.S. Department of Justice, actively scrutinize market activities. For instance, in 2024, the EU imposed substantial fines on companies for antitrust violations, demonstrating the high stakes.

- EU fines for antitrust violations can reach up to 10% of a company's global turnover.

- The U.S. Federal Trade Commission (FTC) and Department of Justice (DOJ) have increased scrutiny of tech acquisitions.

- GlobalData's acquisitions and partnerships must undergo thorough regulatory review to ensure compliance.

- Failure to comply can result in significant financial penalties and operational restrictions.

Industry-Specific Regulations

Industry-specific regulations significantly affect GlobalData's operations. These regulations, particularly in healthcare, financial services, and telecommunications, dictate data usage and compliance. For example, the healthcare sector must comply with HIPAA in the US, which impacts data handling. Financial services face regulations like GDPR and CCPA, influencing data privacy. Telecommunications are subject to regulations like the FCC's rules.

- HIPAA compliance in healthcare data management.

- GDPR and CCPA impact on data privacy in financial services.

- FCC regulations affecting data use in telecommunications.

- Compliance costs impacting operational budgets.

Legal factors significantly shape GlobalData's operations.

Compliance with data privacy laws like GDPR and CCPA is vital; GDPR fines can be up to 4% of global turnover.

Intellectual property laws, which saw global revenue of $7.5 trillion in 2024, also protect its proprietary data. GlobalData must also navigate competition laws, and antitrust regulations which are actively scrutinized by EU and US regulatory bodies.

| Legal Area | Impact | 2024 Data/Forecasts |

|---|---|---|

| Data Privacy | GDPR/CCPA compliance, fines | Data privacy market projected to $19.6B by 2025. |

| Intellectual Property | Protection of databases | Global IP revenue at $7.5T. |

| Competition Law | Antitrust scrutiny and regulations | EU fines up to 10% of turnover for violations. |

Environmental factors

Climate change and sustainability are major concerns for businesses. GlobalData offers insights into ESG and environmental topics. In 2024, ESG assets reached $40 trillion globally. Companies face pressure to adopt sustainable practices. Investors increasingly prioritize environmental factors in their decisions.

Environmental regulations significantly impact GlobalData's clients. Policies on carbon emissions and waste management shape industries. In 2024, the global market for environmental technologies reached $1.1 trillion. GlobalData analyzes these policies within its reporting.

Natural resource availability, crucial for sectors like energy and agriculture, significantly affects supply chains and costs. GlobalData's PESTLE analysis incorporates these environmental factors. For instance, the World Bank reported that in 2024, natural resources accounted for 20% of global GDP, impacting business strategies. Scarcity and management decisions are key.

Pollution and Waste Management

Growing worries about pollution and the need for better waste management are reshaping industries and regulations. GlobalData's ESG framework highlights pollution as a major environmental issue. The global waste management market is projected to reach $2.6 trillion by 2028. These changes are impacting how companies operate and how investors assess them.

- Waste generation increased by 20% worldwide between 2016 and 2024.

- The EU aims to recycle 65% of municipal waste by 2035.

- China plans to reduce plastic waste by 30% by 2025.

Biodiversity and Ecosystem Health

Business activities significantly impact biodiversity and ecosystem health, a growing concern for regulators and stakeholders. GlobalData's framework integrates biodiversity as a key environmental factor. The World Economic Forum highlights that over half the world's GDP is moderately or highly dependent on nature. The UN estimates biodiversity loss costs the global economy about $479 billion annually.

- Increased scrutiny on corporate environmental impacts.

- Rising demand for sustainable business practices.

- Financial risks associated with biodiversity loss.

- Opportunities for businesses to innovate in conservation.

Environmental factors deeply impact businesses, with climate change and sustainability at the forefront. In 2024, the environmental technologies market hit $1.1 trillion. Waste generation rose, affecting industries and regulations globally.

Biodiversity loss costs the global economy about $479 billion annually, stressing the importance of sustainable practices. Scarcity of natural resources and environmental regulations directly shape industries.

GlobalData integrates these factors into PESTLE analyses, informing strategies for financial decisions and market analysis.

| Environmental Aspect | Data/Fact (2024-2025) | Impact on Business |

|---|---|---|

| ESG Assets | Reached $40 trillion globally | Investor priorities shifting to environmental considerations. |

| Waste Management Market | Projected to reach $2.6 trillion by 2028 | Opportunities in waste solutions, challenges with waste regulations. |

| Biodiversity Loss Cost | Approximately $479 billion annually | Financial risks for companies with environmental impacts. |

PESTLE Analysis Data Sources

GlobalData's PESTLE uses governmental, institutional data, plus industry reports for accuracy. Analysis draws on economic databases, policy updates, tech forecasts for relevance.