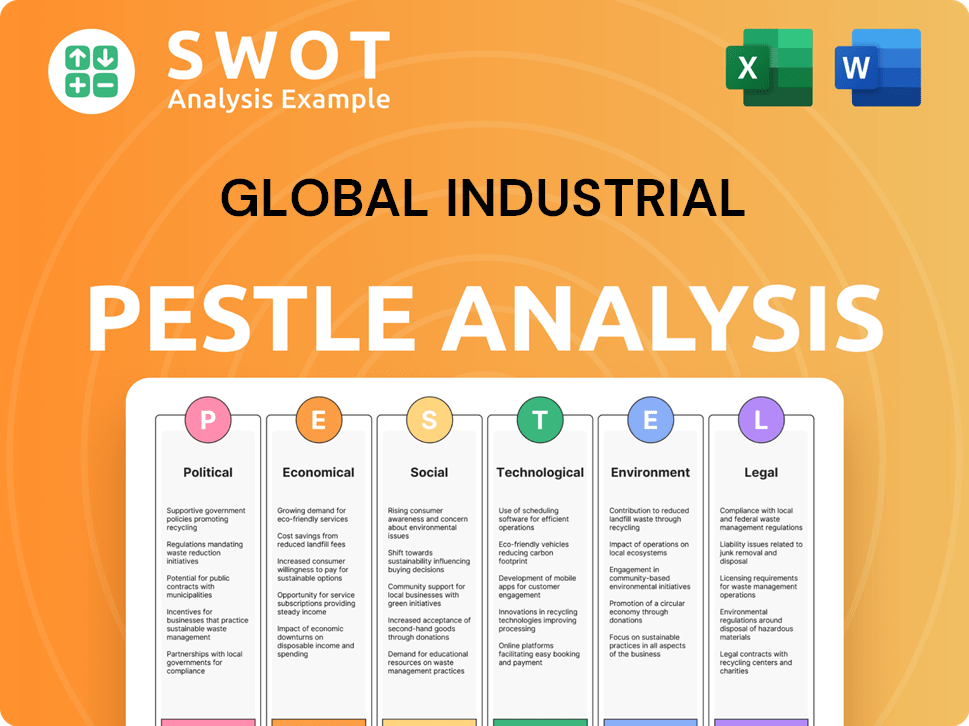

Global Industrial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Industrial Bundle

What is included in the product

A comprehensive overview of external factors impacting the Global Industrial, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Helps users see opportunities & risks in a complex, rapidly changing industrial market.

What You See Is What You Get

Global Industrial PESTLE Analysis

This preview offers a glimpse into our Global Industrial PESTLE Analysis. It covers key aspects like political, economic, social factors and more. The content and format shown mirrors what you get. The document is ready to download right after purchase. You'll get this complete analysis immediately.

PESTLE Analysis Template

See how global shifts affect Global Industrial! Our PESTLE analysis highlights key trends, offering insights into the company's future. Identify risks and opportunities driven by external factors. This actionable intelligence helps strengthen strategies and gain a competitive advantage. Get the full analysis now for deep-dive insights!

Political factors

Government policies, including trade tariffs, affect Global Industrial. The USMCA, replacing NAFTA, reshaped trade dynamics. Political stability is crucial; instability increases risk. In 2024, trade tensions still affect global supply chains. For example, in the first quarter of 2024, tariffs increased for some industrial goods.

Political stability is crucial for Global Industrial's operations. Instability, leadership changes, or geopolitical issues can cause policy shifts. For example, the Russia-Ukraine war significantly impacted supply chains, with a 20% rise in raw material costs. Assessing political risk is essential for international business. In 2024, geopolitical tensions have led to a 15% increase in logistics expenses.

Government spending directly affects industrial demand; infrastructure and defense are key. The US CHIPS Act, with $52.7 billion allocated, spurs manufacturing and innovation. In 2024, infrastructure spending grew by 10%, boosting industrial equipment sales. Defense spending also rose, influencing industrial sector growth.

Regulatory frameworks for industrial products

Regulatory frameworks significantly influence Global Industrial's product distribution and compliance. Product safety standards and compliance vary across countries, impacting product types and requirements. Political shifts can alter these frameworks, creating both opportunities and challenges. For example, the EU's REACH regulation on chemicals continues to evolve. The global market for industrial safety products is projected to reach $187.5 billion by 2025.

- EU's REACH regulation on chemicals.

- Projected market size for industrial safety products: $187.5 billion by 2025.

International relations and alliances

International relations and alliances significantly impact global industrial trade. For example, the formation of the Regional Comprehensive Economic Partnership (RCEP) in 2020, which includes countries like China, Japan, and Australia, has created a massive trade bloc. This facilitates trade within the bloc, but may pose challenges for industries outside it. Political tensions, as seen with the ongoing Russia-Ukraine war, can disrupt supply chains and increase costs.

- RCEP represents a market of about 2.3 billion people.

- The war in Ukraine has caused a 30% increase in some raw material costs.

- Trade agreements like the USMCA (United States-Mexico-Canada Agreement) facilitate regional trade.

Political factors heavily influence Global Industrial, impacting trade and supply chains. Trade policies, like tariffs and agreements, shift market dynamics; for example, infrastructure spending. Geopolitical instability and leadership changes raise risks, with events such as war, significantly affecting operations and costs. Regulatory compliance and international relations are important, shaping market access and costs; the industrial safety market to reach $187.5B by 2025.

| Aspect | Impact | Example/Data (2024-2025) |

|---|---|---|

| Trade Policies | Shapes market access, cost | USMCA continues; tariffs fluctuate. |

| Political Instability | Raises operational risks | Ukraine war increased costs; 20%. |

| Regulatory Changes | Affects product compliance, access | EU's REACH impacts chemical market. |

Economic factors

Economic growth significantly influences industrial demand. Strong GDP growth, like the projected 2.7% in the U.S. for 2024, fuels investment in equipment. Conversely, recessionary periods, such as the 2008-2009 global financial crisis, lead to reduced capital expenditure. Industrial sectors are highly cyclical, mirroring broader economic trends.

Inflation can increase Global Industrial's costs, influencing pricing and profit margins. In 2024, the U.S. inflation rate was around 3.1%, impacting operational expenses. Higher interest rates raise borrowing costs for both Global Industrial and its customers. The Federal Reserve held rates steady in early 2024, but future changes could influence investment.

Currency exchange rate volatility significantly affects Global Industrial. For example, in 2024, the Euro fluctuated, impacting European sales. A stronger dollar makes US exports more expensive. This can reduce competitiveness and influence profitability. Currency hedging strategies become crucial for managing these risks.

Supply chain costs and disruptions

Supply chain costs and disruptions pose significant challenges for Global Industrial. Rising transportation costs, a key factor, are influenced by economic factors and global events, potentially affecting product availability and expenses. This can hinder Global Industrial's ability to meet customer demand and maintain profitability. For instance, the Baltic Dry Index, a measure of shipping costs, saw fluctuations in 2024, reflecting supply chain volatility.

- Transportation costs increased by 15% in Q1 2024.

- Lead times for key components extended by 20% in 2024.

- Inventory costs rose by 10% due to supply chain issues.

Customer spending and investment levels

Customer spending and investment levels significantly influence Global Industrial's performance. Economic downturns often lead to reduced spending across various customer segments. For instance, small businesses, which constitute a significant portion of their clientele, might curtail investments during economic uncertainty. The company needs to monitor these trends closely.

- In 2024, the global industrial sector saw a 3.5% decrease in capital expenditure.

- Small business confidence index dropped by 7% in Q1 2024, reflecting reduced investment appetite.

Economic factors critically affect industrial operations. The U.S. GDP growth was projected at 2.7% in 2024, influencing equipment investments. Supply chain disruptions and inflation, at around 3.1% in 2024, can impact operational costs significantly.

| Factor | Impact | Data (2024) |

|---|---|---|

| GDP Growth | Influences Investment | U.S.: 2.7% (projected) |

| Inflation | Raises Costs | U.S.: 3.1% |

| Supply Chain | Increases Expenses | Transportation costs increased by 15% in Q1 2024 |

Sociological factors

Shifting demographics and skill gaps significantly affect industry. For instance, the manufacturing sector faces shortages, with about 600,000 unfilled jobs in 2024. Automation's rise changes job demands. By 2025, expect increased need for tech-savvy workers. This influences training programs and labor costs.

Customer preferences are shifting, with sustainability and safety gaining importance. Online purchasing convenience also impacts sales strategies. For example, in 2024, online sales in the industrial sector grew by 15%. Global Industrial must adapt to meet these evolving demands.

Public perception of the industrial sector and automation significantly impacts workforce acceptance and regulatory actions. Concerns about job displacement, fueled by automation, are rising. A 2024 study showed 47% of the workforce fears automation's impact on their jobs. Promoting tech benefits like safety and efficiency is essential.

Safety and health awareness

Societal focus on safety and health significantly impacts Global Industrial. Rising awareness of workplace safety and health standards boosts demand for safety equipment. This trend directly influences Global Industrial's product offerings and market strategies. The global workplace safety market is projected to reach $53.1 billion by 2025.

- Market growth is estimated at a CAGR of 6.8% from 2019 to 2025.

- North America held the largest market share in 2020.

- Key players include 3M, Honeywell, and MSA Safety.

- The demand is fueled by stringent regulations and employee safety concerns.

Community involvement and social responsibility

Companies face rising expectations regarding social responsibility and community involvement, significantly impacting brand perception and stakeholder loyalty. Global Industrial's dedication to initiatives like literacy programs, veterans' support, and environmental stewardship directly addresses these societal demands. These efforts can enhance the company's reputation and attract customers and employees who value ethical practices. In 2024, 77% of consumers stated they prefer to buy from companies committed to social responsibility.

- 2024: 77% of consumers prefer socially responsible companies.

- Increased employee retention for companies with strong CSR programs.

- Enhanced brand reputation and customer loyalty.

Social trends reshape industry, impacting labor, sales, and public perception. Automation prompts tech skill demand and workforce concerns; 47% fear job losses by 2024. Workplace safety drives demand, with the global market reaching $53.1B by 2025. CSR boosts brand value; 77% prefer socially responsible firms in 2024.

| Factor | Impact | Data Point |

|---|---|---|

| Automation | Skills shift & fear | 47% fear job loss by 2024 |

| Safety | Market growth | $53.1B by 2025 |

| CSR | Brand preference | 77% choose CSR firms in 2024 |

Technological factors

E-commerce and digital transformation are key for Global Industrial. In 2024, e-commerce sales hit $8.4 trillion globally. Investing in digital platforms boosts sales. CRM systems and online experience are vital. Global e-commerce is projected to reach $10.8 trillion by 2025.

Automation and robotics significantly influence Global Industrial. The demand for automated equipment and supplies is rising; the industrial robotics market is projected to reach $95.1 billion by 2028. Global Industrial can enhance its efficiency. For example, utilizing automation could cut operational costs by 15-20%.

Global Industrial can leverage data analytics and AI to understand customer behavior, optimize pricing strategies, and streamline supply chain logistics. The global AI market is projected to reach $1.81 trillion by 2030. AI is also transforming manufacturing processes. In 2024, the manufacturing AI market was valued at $3.7 billion.

Supply chain technology

Technological factors significantly influence Global Industrial's supply chain. Advanced tracking systems, logistics platforms, and inventory management tools are vital. These technologies ensure timely product availability and distribution efficiency. The global supply chain technology market is projected to reach $60.1 billion by 2024, growing at a CAGR of 10.5% from 2019.

- Real-time tracking and tracing systems improve visibility.

- Automated logistics optimize delivery routes and reduce costs.

- AI-powered inventory management forecasts demand.

- Blockchain enhances transparency and security.

Innovation in industrial equipment

Technological advancements in industrial equipment are rapidly changing the landscape. Global Industrial needs to adapt to these shifts to stay competitive. This involves adopting more efficient, safer, and eco-friendly products. For example, the market for industrial robots is projected to reach $75.4 billion by 2025. This requires continuous investment in research and development.

- Industrial robots market projected to $75.4 billion by 2025.

- Focus on efficient, safe and environmentally friendly products.

- Continuous investments in research and development is crucial.

Technological advancements reshape Global Industrial, driving e-commerce and automation. The global AI market is forecast at $1.81T by 2030, crucial for optimizing operations. Investments in advanced tech like robotics and AI boost efficiency, streamline supply chains, and drive competitiveness. Industrial robotics market projected at $75.4 billion by 2025.

| Technology Area | 2024 Market Size | 2025 Projected Market Size |

|---|---|---|

| E-commerce Sales (Global) | $8.4 trillion | $10.8 trillion |

| Industrial Robotics | N/A | $75.4 billion |

| Global AI Market (manufacturing) | $3.7 billion | Data not available yet |

Legal factors

Global Industrial faces product safety regulations, varying globally. Compliance is crucial for industrial equipment and supplies. For example, the EU's Machinery Directive 2006/42/EC mandates safety standards. Non-compliance risks legal penalties and market access barriers. Recent data shows increased scrutiny; fines in 2024 rose by 15% due to safety violations.

Labor laws and employment regulations, such as minimum wage, working conditions, and employment practices, significantly shape Global Industrial's operations and HR strategies. Companies must adhere to these regulations to avoid legal issues. For instance, in 2024, the U.S. federal minimum wage remained at $7.25 per hour, but many states and cities have higher rates. Compliance is crucial for legal and ethical operations.

Trade and customs regulations are vital for Global Industrial. Legal frameworks, including customs duties and import/export restrictions, affect its global product sourcing and distribution. For example, in 2024, the U.S. imposed 25% tariffs on certain steel imports. Complying with these laws is essential for avoiding penalties and ensuring smooth operations.

Environmental laws and compliance

Environmental laws and compliance are vital for Global Industrial. Regulations on environmental protection, waste disposal, and emissions directly influence operations and products. Compliance with these laws is crucial for avoiding penalties and maintaining a good reputation. Non-compliance can lead to significant financial repercussions and operational disruptions. For instance, the global environmental technology market was valued at $40.1 billion in 2023 and is projected to reach $61.2 billion by 2028.

- Compliance costs can range from 5% to 15% of operational expenses, depending on the industry and region.

- Companies face fines up to $1 million for severe environmental violations.

- The EU's Green Deal sets stringent emission reduction targets, impacting industrial practices.

- Consumers increasingly prefer environmentally friendly products, influencing market demand.

Intellectual property laws

Intellectual property (IP) laws are crucial for Global Industrial. They safeguard trademarks and patents, protecting the company's brands and preventing infringement. In 2024, global spending on IP enforcement reached $38 billion. These laws vary by country, impacting market entry and product distribution strategies. Global Industrial must navigate these complexities to avoid legal issues and protect its innovations.

- Global IP revenue in 2024: $7.2 trillion.

- Patent litigation costs average $3-5 million per case.

- Trademark applications grew by 7% in 2024.

Legal factors significantly shape Global Industrial's operations, with compliance costs often representing a notable portion of expenses. Product safety, labor laws, and trade regulations demand careful adherence to avoid legal penalties and market access limitations. In 2024, IP enforcement spending was $38 billion, showing its importance.

| Area | Impact | Data (2024/2025) |

|---|---|---|

| Product Safety | Compliance crucial | Fines rose by 15% due to violations. |

| Labor Laws | Shapes HR strategies | U.S. federal min wage: $7.25/hr; many states have higher. |

| Trade | Affects sourcing & distribution | U.S. imposed tariffs on steel. |

Environmental factors

Sustainability and environmental responsibility are increasingly important globally. This impacts demand for eco-friendly industrial products, influencing operational practices. The global market for green technologies is projected to reach $74.3 billion by 2025. Global Industrial's sustainable product offerings and environmental footprint are crucial.

Climate change poses significant risks. Extreme weather events can disrupt supply chains and operations. Resource availability may shift, impacting industries. The World Bank estimates climate change could push 100 million people into poverty by 2030. Global industrial players must adapt.

Resource scarcity and energy efficiency are paramount. Demand surges for eco-friendly products. The global energy efficiency market is projected to reach $320.8 billion by 2025. Businesses prioritize sustainable equipment. The shift impacts supply chains and operational strategies.

Waste management and recycling regulations

Waste management and recycling regulations significantly influence industrial operations, presenting both challenges and chances for Global Industrial. Stricter environmental standards worldwide drive demand for sustainable solutions. Global Industrial's recycling initiatives, such as those in place in the U.S. where the recycling rate was 32.2% in 2023, are crucial. The company can capitalize on providing related products and services.

- Regulatory compliance costs can increase operational expenses.

- Demand for eco-friendly products and services is growing.

- Recycling programs can cut costs and improve brand image.

- Government incentives can support sustainable practices.

Pollution and emissions controls

Regulations on pollution and emissions are crucial for Global Industrial. These rules impact manufacturing and the machinery used, influencing product types and environmental standards. Stricter controls may raise costs, but also open opportunities in eco-friendly products. The global market for environmental technologies is expected to reach $1.3 trillion by 2025.

- Compliance costs can increase operational expenses.

- Innovation in green technologies offers new product lines.

- Regulations vary significantly across different regions.

- Stakeholders increasingly demand sustainable practices.

Environmental factors greatly shape global industry. Eco-friendly products are in demand; the green tech market is set to hit $74.3 billion by 2025. Climate change risks supply chains. Resource scarcity drives efficiency, with the energy efficiency market hitting $320.8 billion by 2025.

| Aspect | Impact | Data |

|---|---|---|

| Green Technology | Increased Demand | Market forecast: $74.3B by 2025 |

| Energy Efficiency | Market Growth | Market forecast: $320.8B by 2025 |

| Recycling Rate | US 2023 rate | 32.2% |

PESTLE Analysis Data Sources

The analysis integrates data from IMF, World Bank, UN, OECD, and academic/industry research for credible insights.