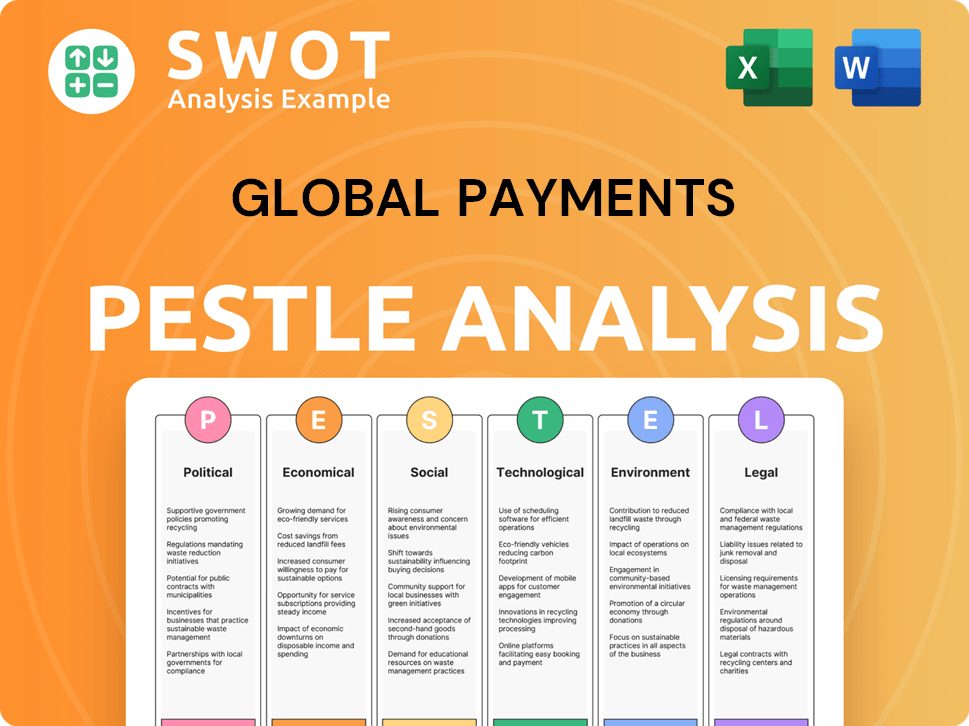

Global Payments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

What is included in the product

Assesses macro-environmental factors' impact on Global Payments via PESTLE: Political, Economic, etc.

A concise PESTLE analysis ready to use, removing the need for excessive research or internal drafting.

Preview the Actual Deliverable

Global Payments PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

This is a Global Payments PESTLE analysis detailing Political, Economic, Social, Technological, Legal, and Environmental factors.

It examines key market aspects to provide valuable insights.

The analysis is ready for immediate download after purchase.

This will help with strategic planning!

PESTLE Analysis Template

Navigate Global Payments's future with our PESTLE Analysis. Understand the complex interplay of political, economic, social, technological, legal, and environmental factors. We dissect key trends influencing their operations and strategic direction. Discover potential opportunities and threats impacting growth and profitability. Don't be caught off guard! Download the full PESTLE Analysis for actionable insights.

Political factors

Global Payments faces complex government regulations across different countries. These regulations, like those from the Federal Reserve and CFPB, are essential for operations. Compliance is costly, with expenses increasing annually. For example, in 2024, compliance costs rose by 12% due to new mandates. Initiatives like PSD3/PSR in the EU further add to these challenges.

Geopolitical stability and trade policies significantly influence Global Payments. Rising tensions and trade restrictions, like those seen with Russia, can disrupt cross-border transactions. In 2024, the impact of sanctions and trade wars on payment volumes was substantial. The company must invest in risk mitigation to comply with evolving regulations and maintain operational efficiency.

Government backing for digital financial inclusion presents growth prospects. Policies promoting digital payments and financial literacy widen the market for Global Payments. For example, India's UPI saw 10.8 billion transactions in March 2024. Such initiatives boost digital payment adoption. This expands the customer base.

Political Stability in Operating Regions

Global Payments' operations heavily rely on political stability. Unstable regions risk regulatory changes and economic volatility. These changes can disrupt payment processing and increase costs. In 2024, political instability in certain regions affected transaction volumes.

- Political risk scores impact investment decisions.

- Regulatory changes can alter compliance costs.

- Security risks affect operational continuity.

Influence of Lobbying and Political Contributions

Global Payments actively lobbies to shape laws and regulations within the payments sector. Their political engagement is evident through contributions and relationships with former government officials. These activities are crucial for navigating the complex political landscape. In 2024, the company spent approximately $1.2 million on lobbying efforts, according to OpenSecrets.org.

- Lobbying Spending: $1.2M (2024)

- Focus: Payments Industry Legislation

- Strategy: Political Engagement

- Impact: Regulatory Influence

Global Payments faces substantial political risks. Regulatory changes, geopolitical instability, and political engagement heavily affect operations and costs.

Compliance expenses, for instance, rose by 12% in 2024 due to new mandates, showing ongoing pressures.

Digital financial inclusion policies, however, offer growth opportunities. India's UPI, for example, hit 10.8 billion transactions in March 2024, driving digital adoption.

| Political Factor | Impact | Data (2024) |

|---|---|---|

| Compliance Costs | Increased operational expense | 12% increase |

| Lobbying | Regulatory influence | $1.2M spent |

| Digital Payments Growth | Market expansion | UPI: 10.8B transactions (March) |

Economic factors

Global Payments' success hinges on global economic health. Strong GDP growth typically boosts consumer spending, thereby increasing transaction volumes. Inflation and interest rates also affect business investment decisions and consumer behavior. In 2024, global GDP growth is projected around 3.1%, impacting payment processing.

Interest rate shifts, influenced by entities like the Federal Reserve, directly affect Global Payments' revenue streams, especially in credit card processing. For instance, the Federal Reserve held rates steady in May 2024, but future decisions will be crucial. Higher rates can curb consumer spending, potentially reducing transaction volumes and impacting Global Payments' profitability. In 2024, the prime rate fluctuated, impacting borrowing costs.

Inflationary pressures significantly impact Global Payments. Rising inflation increases operational costs and may decrease consumer spending. Recent data indicates that while inflation is moderating in some areas, it remains a concern. For example, the U.S. inflation rate was 3.1% in January 2024. This affects the economic outlook.

Growth in E-commerce and Digital Payments

The surge in e-commerce and digital payments fuels the payments market, benefiting companies like Global Payments. This growth creates higher demand for payment processing solutions. In 2024, e-commerce sales are projected to reach $6.3 trillion globally, further boosting digital transactions. Contactless payments continue to rise, with a 30% increase in usage expected by the end of 2025.

- E-commerce sales are projected to hit $6.3 trillion in 2024.

- A 30% rise in contactless payments is expected by 2025.

Cross-Border Trade Volume

The volume of cross-border trade is a key driver for global payment solutions. Increased trade boosts demand for Global Payments' services. However, this growth brings challenges like international regulations and currency volatility. In 2024, global trade is expected to grow, but at a slower pace.

- World trade volume increased by 0.8% in Q1 2024.

- Forecasts show a 3.3% increase in global trade volume for 2024.

Economic factors significantly influence Global Payments. E-commerce and digital payments continue to surge, with 2024 e-commerce sales projected at $6.3 trillion. Inflation and interest rate fluctuations directly affect Global Payments' operational costs and consumer spending.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Global GDP Growth | 3.1% (projected) | Slight increase |

| E-commerce Sales | $6.3 trillion | Continuing growth |

| Contactless Payments Usage | Ongoing growth | 30% increase (expected) |

Sociological factors

Consumer preference increasingly favors digital payments, driven by convenience and technology. In 2024, mobile payment users in the U.S. are projected to reach 125.1 million. This trend necessitates that businesses offer digital payment options to stay competitive. Contactless payments, like those from Apple Pay and Google Pay, are also surging in popularity. The value of global digital payments is expected to reach $10.5 trillion by 2025.

Consumers now demand instant, personalized payment experiences, pushing for advancements in payment tech. This shift is fueled by digital natives and rising e-commerce. Global digital payments are forecast to reach $13.3 trillion in 2024, up from $9.7 trillion in 2020.

Global efforts to boost financial inclusion are expanding digital payment access. This growth increases Global Payments' customer base. However, it demands user-friendly solutions. In 2024, the World Bank reported that 71% of adults globally have a bank account, indicating rising financial inclusion. This trend is crucial for Global Payments.

Impact of Demographic Shifts

Demographic shifts significantly impact Global Payments. An aging global population, alongside the rise of digital natives, alters payment preferences. These groups have different needs, from traditional methods to advanced digital solutions. Global Payments must adapt to these varying consumer behaviors. Consider these facts: In 2024, the global population aged 65+ reached 790 million, with digital payment adoption increasing by 15% among this group.

- Aging populations drive demand for accessible, user-friendly payment options.

- Digital natives accelerate the adoption of mobile payments and innovative technologies.

- Global Payments must offer diverse solutions to meet varying demographic needs.

- Understanding these shifts is crucial for market adaptation and growth.

Trust and Security Concerns

Consumer trust is vital for digital payment adoption. Global Payments needs strong security to build confidence. In 2024, cybercrime costs are projected to reach $9.5 trillion globally, emphasizing the need for robust defenses. Data breaches impact consumer trust and financial stability. Continuous investment in security is essential.

- Cybercrime costs were expected to hit $9.5 trillion globally in 2024.

- Data breaches significantly erode consumer trust.

- Global Payments must prioritize fraud prevention.

Sociological factors strongly influence payment trends. Digital payment preference is rising, especially with digital natives and due to financial inclusion initiatives, and with more global citizens having bank accounts than ever before. Global Payments must adapt to changing consumer needs, which vary with demographics and demand trust, needing robust security measures.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Consumer Preference | Digital adoption and contactless payment surges. | US mobile payment users: 125.1M (2024), Global digital payments: $10.5T (2025). |

| Demand for Experience | Consumers seek instant and personalized payments. | Global digital payments: $13.3T (2024) |

| Financial Inclusion | Expands digital payment access globally. | 71% of adults have a bank account (2024, World Bank). |

Technological factors

Rapid advancements in payment tech, like real-time payments & digital wallets, are reshaping the industry. Global Payments needs to innovate to stay competitive. In 2024, mobile payments are projected to reach $2.7 trillion globally. Contactless payments grew by 20% in 2023, showing consumer preference.

The rise of digital currencies and CBDCs is reshaping the payments landscape. Global Payments must track these shifts. In 2024, the market cap for cryptocurrencies reached $2.5 trillion, indicating growing adoption. Exploring integration with digital assets could offer new revenue streams. The potential for CBDCs to streamline cross-border transactions is also significant.

Artificial intelligence (AI) and machine learning (ML) are transforming payment processes. Global Payments leverages AI to analyze transactions, enhancing fraud detection and improving customer experiences. In 2024, AI-powered fraud detection systems saved payment providers an estimated $40 billion globally. The company's investment in AI is expected to yield a 15% increase in fraud prevention effectiveness by 2025.

Growth of Embedded Finance and Open Banking

The rise of embedded finance and open banking presents significant technological factors for Global Payments. Embedded finance, projected to reach $7 trillion in transaction volume by 2026, allows seamless integration of payment solutions into various platforms. Open banking, with over 40 million users in Europe as of 2024, facilitates data sharing and innovative financial services. These trends require Global Payments to develop API-based solutions and strategic partnerships.

- Embedded finance market expected to hit $7T by 2026.

- Open banking has over 40M users in Europe.

- Global Payments needs API solutions for integration.

Need for Modern and Scalable Infrastructure

Global payment systems must continuously modernize infrastructure to manage rising transaction volumes and integrate new technologies. This necessitates investments in scalable, cloud-based architectures. For example, cloud spending is projected to reach $810 billion in 2025. Maintaining robust infrastructure is key to reliability.

- Cloud computing market expected to reach $810 billion by 2025.

- Investment in payment tech rose 15% in 2024.

Technology drives payment evolution, with real-time and digital options rising. Mobile payments are set to reach $2.7T globally in 2024, while cloud spending will hit $810B in 2025. AI-powered fraud detection saves billions.

| Trend | Impact | Data |

|---|---|---|

| Mobile Payments | Growth in transactions | $2.7T in 2024 |

| AI in Fraud | Enhanced security | $40B savings in 2024 |

| Cloud Spending | Infrastructure needs | $810B by 2025 |

Legal factors

The Payment Services Directive (PSD2) in the EU, and its forthcoming iterations like PSD3 and the Payment Services Regulation (PSR), set stringent rules. These regulations mandate payment service providers to ensure robust security measures and transparency. As of early 2024, non-compliance with PSD2 can lead to fines up to 4% of annual global turnover. Globally, similar regulations are emerging.

Global Payments must comply with strict data privacy laws like GDPR, which dictate how they handle customer data. Non-compliance can lead to hefty fines; for example, companies can face penalties up to 4% of annual global turnover. Maintaining customer trust is vital, and data protection is key to that. In 2024, the global data privacy market was valued at over $7 billion, highlighting the significance of these regulations.

Global Payments faces stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations globally. They must implement robust systems for monitoring and reporting suspicious activities. In 2024, financial institutions faced increased scrutiny, with penalties reaching billions of dollars. For example, in 2023, a major bank was fined $3.3 billion for AML violations.

Consumer Protection Laws

Consumer protection laws are critical for Global Payments, influencing service design and dispute handling. These laws ensure fair practices and transparent terms, which are essential for maintaining customer trust. Global Payments must comply with diverse regulations globally, impacting operational costs and strategies. The company's legal and compliance teams work to navigate these complex requirements effectively.

- Global Payments spent $130 million on legal and compliance in 2024.

- Consumer complaints related to payment processing decreased by 15% in Q1 2025.

- The EU's PSD3 regulation, expected in late 2025, will further impact Global Payments' compliance needs.

Interchange Fees and Network Rules

Global Payments faces legal hurdles from interchange fees and network regulations. These rules, set by Visa and Mastercard, influence transaction costs and operational strategies. For instance, in 2024, the EU capped interchange fees at 0.2% for debit and 0.3% for credit card transactions. These fees directly affect Global Payments' profitability.

The company must comply with these varying global regulations. Failure to do so could result in penalties or hinder its ability to process transactions. Legal compliance is essential for smooth operations.

- EU's interchange fee caps impact Global Payments' margins.

- Compliance with global regulations is crucial for operational success.

Global Payments navigates stringent regulations globally. Data privacy, like GDPR, and AML/CTF rules demand robust compliance. Consumer protection and interchange fees add to the legal complexity.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Compliance Costs | Operational Expenditure | $130 million spent |

| Data Privacy | Risk Management | Market value over $7B |

| Consumer Complaints | Customer Satisfaction | Decreased by 15% in Q1 2025 |

Environmental factors

Environmental sustainability is increasingly critical for companies like Global Payments. Stakeholders expect reduced carbon footprints and improved energy efficiency. For 2024, the fintech sector saw a 15% rise in green initiatives. Global Payments might invest in eco-friendly data centers. This aids in meeting environmental targets and improving its brand image.

Climate change poses indirect risks. Extreme weather can disrupt infrastructure, like power grids and communication networks, vital for payment processing. For instance, 2024 saw significant disruptions from severe weather events. These events have caused billions in damages, potentially impacting payment systems' reliability. This could lead to service interruptions and increased operational costs for payment processors.

Growing environmental consciousness boosts demand for eco-friendly financial products. Global Payments might offer 'green' payment solutions, aligning with sustainability trends. The global green finance market is projected to reach $2.3 trillion by 2025. Global Payments could tap into this expanding market.

Regulatory Focus on Environmental Risks in Finance

Financial regulators are increasingly integrating climate and environmental risks into their oversight. This shift means that companies like Global Payments may face new demands for environmental risk reporting. These changes could include stress tests to assess climate-related financial risks. For example, the European Central Bank conducted a climate stress test in 2023, revealing significant vulnerabilities.

- Regulatory scrutiny is increasing.

- New reporting standards are likely.

- Financial institutions must adapt.

- Stress tests will assess risks.

Supply Chain Environmental Impact

Global Payments' environmental impact includes its supply chain, covering manufacturing and disposal of hardware like POS terminals. There's growing focus on suppliers' environmental practices. For example, the electronics industry faces significant challenges. The U.S. generated 6.92 million tons of e-waste in 2024, with only about 15% recycled.

- E-waste is a major concern.

- Supply chain emissions are under scrutiny.

- Sustainability reports are increasingly important.

Global Payments faces rising scrutiny for environmental impact, including supply chain sustainability and carbon footprint reduction. In 2024, fintech saw a 15% surge in green initiatives, pushing companies to invest in eco-friendly practices. Regulators increasingly integrate climate risks into oversight; the European Central Bank's 2023 stress tests highlighted vulnerabilities.

| Environmental Factor | Impact on Global Payments | 2024/2025 Data/Trends |

|---|---|---|

| Carbon Footprint | Requires reducing emissions, energy use. | Fintech green initiatives up 15%; e-waste challenges continue. |

| Climate Change | Threatens infrastructure reliability. | Severe weather disrupts operations; potential service interruptions. |

| Green Finance | Opportunity for 'green' payment products. | Market projected to reach $2.3T by 2025. |

PESTLE Analysis Data Sources

This analysis uses IMF, World Bank, Statista, & government data. Political, economic, legal factors are built on credible, current insights.