Golden Agri-Resources Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Golden Agri-Resources Bundle

What is included in the product

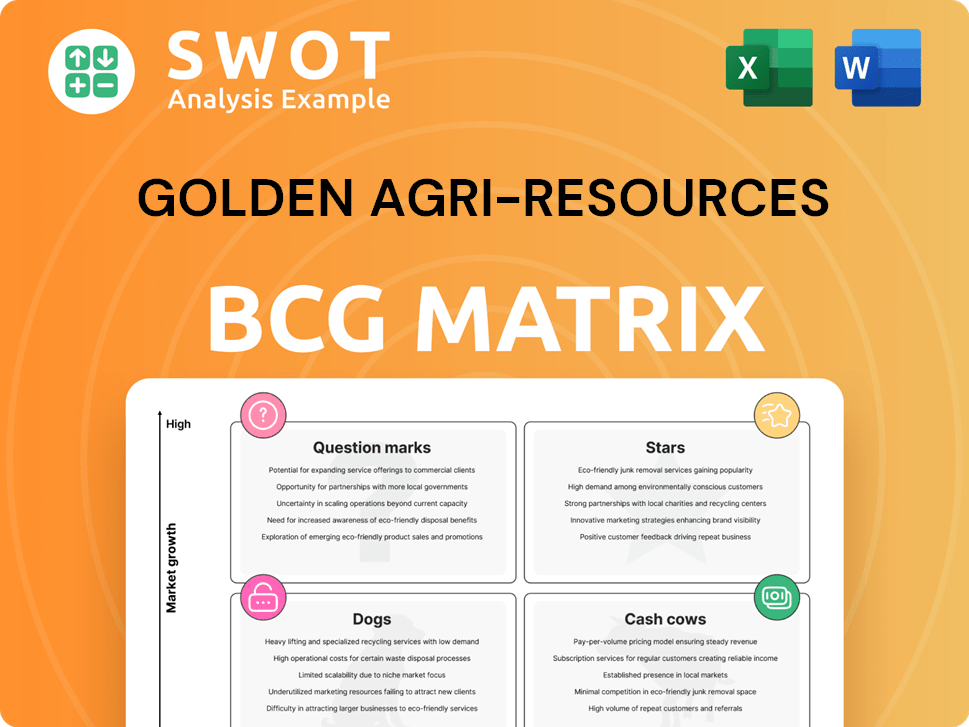

Golden Agri-Resources BCG Matrix: Strategic guidance to invest, hold, or divest units.

Export-ready design for quick drag-and-drop into PowerPoint, enabling seamless integration into presentations.

What You’re Viewing Is Included

Golden Agri-Resources BCG Matrix

The Golden Agri-Resources BCG Matrix preview is the identical file you'll receive. Get the complete strategic overview; this preview shows the full, ready-to-use document.

BCG Matrix Template

Golden Agri-Resources' BCG Matrix showcases its diverse portfolio. See how palm oil, rubber, and other products fare across market share and growth. Understand where resources are best invested to maximize returns.

This preview hints at the strategic landscape. Purchase the full BCG Matrix to unlock detailed analyses, including quadrant placements and actionable insights.

Stars

Golden Agri-Resources (GAR) upstream segment, including plantations and palm oil mills, performed strongly in 2024. It achieved a 19% increase in EBITDA, reaching US$567 million. This growth was fueled by higher CPO prices, which averaged US$1,005 per tonne, up from US$901 in 2023. GAR's leadership is reinforced by yield intensification initiatives and advanced planting materials.

In 2024, Golden Agri-Resources' downstream business, encompassing palm oil, laurics, and other products, demonstrated strong performance. The segment achieved a record sales volume of 11.5 million tonnes. This success was supported by a 12% revenue increase, reaching US$10.8 billion, reflecting its market adaptability and strategic focus on value-added products.

Golden Agri-Resources (GAR) thrives with strategic partnerships, making them stars in its BCG matrix. GAR's collaborations, like the multi-year deal with Verborg Group, are essential. This partnership makes GAR the exclusive supplier of over a million tonnes of tropical oils, boosting market access. These alliances ensure a robust, sustainable supply chain for GAR.

Sustainability Initiatives

Golden Agri-Resources (GAR) shines as a star in sustainability. GAR's commitment includes a Net Zero Emissions target by 2050. They aim to cut Scope 1 and 3 FLAG emissions by 30% and Scope 1 and 2 non-FLAG emissions by 42% by 2030. The SmartTrace system supports EU Deforestation Regulation compliance.

- Net Zero Emissions by 2050.

- 30% reduction in Scope 1 & 3 FLAG emissions by 2030.

- 42% reduction in Scope 1 & 2 non-FLAG emissions by 2030.

- SmartTrace system for EUDR compliance.

Technological Innovation and Agri-science

Golden Agri-Resources (GAR) shines as a Star in its BCG matrix due to its strong focus on technological innovation and agri-science. GAR's biotechnology center develops advanced planting materials, crucial for boosting production. This approach supports increasing yields without needing more land, particularly through replanting programs. In 2024, GAR invested significantly in R&D, allocating roughly $50 million to advance its biotechnology initiatives and replanting projects.

- R&D investment in 2024: approximately $50 million.

- Focus: Development of superior planting materials.

- Goal: Increase yields without expanding land use.

- Strategy: Replanting old estates with improved materials.

Golden Agri-Resources (GAR) shines as a Star due to robust financial performance and strategic initiatives in 2024. Its upstream segment saw a 19% EBITDA increase to US$567 million, with CPO prices at US$1,005 per tonne. Downstream achieved a record 11.5 million tonnes sales volume.

| Aspect | Details |

|---|---|

| Financial Performance (2024) | Upstream EBITDA: US$567M; Downstream Revenue: US$10.8B |

| Strategic Partnerships | Exclusive supplier to Verborg Group (over 1M tonnes) |

| Sustainability | Net Zero by 2050; 30% reduction in Scope 1 & 3 by 2030 |

Cash Cows

Golden Agri-Resources (GAR) benefits from its existing palm oil plantations, a classic cash cow in its BCG matrix. GAR's 536,000 hectares, with 90% mature, deliver consistent revenue. These mature assets require minimal new investment. GAR focuses on replanting for higher yields, ensuring sustained cash flow. In 2024, GAR's CPO production reached 2.6 million tons.

Crude Palm Oil (CPO) production has been a solid revenue stream for Golden Agri-Resources. Despite a 7% year-on-year drop in total plantation output during 2024, the upstream EBITDA surged by 19% to US$567 million, driven by increased CPO prices. This showcases CPO's potential as a cash cow, especially when market conditions are advantageous.

Golden Agri-Resources (GAR) exports palm kernel shell (PKS), primarily to Japan, for sustainable energy. This generates a consistent revenue stream with minimal investment. GAR's PKS exports support Japan's energy transition goals. In 2024, PKS exports continue to be a stable contributor to revenue. This activity is a key part of their business model.

Integrated Agribusiness Model

Golden Agri-Resources (GAR) showcases a cash cow status through its integrated agribusiness model. GAR's vertical integration, spanning cultivation to distribution, provides a stable, flexible foundation. This model enables GAR to control margins across the value chain, securing a consistent revenue flow. GAR's integrated approach boosts financial resilience by managing the entire operational spectrum.

- In 2024, GAR reported a revenue of $8.9 billion.

- GAR's integrated model contributed to a gross profit of $890 million.

- The company's EBITDA reached $1.2 billion, demonstrating strong operational efficiency.

- GAR's vertically integrated operations have consistently generated positive cash flows.

Bulk and Branded Palm-Based Products

Golden Agri-Resources (GAR) capitalizes on its established bulk and branded palm-based products, generating consistent revenue streams. These products, such as cooking oil and margarine, meet essential consumer needs, ensuring stable demand. GAR's global distribution network and strong merchandising capabilities further support the steady cash flow from these items.

- In 2024, GAR reported significant revenue from its branded consumer products, indicating the cash cow status.

- Palm oil prices in 2024 remained relatively stable, supporting consistent profitability for GAR's palm-based products.

- GAR's distribution network expanded in key markets during 2024, boosting sales of its cash cow products.

Golden Agri-Resources (GAR) demonstrates its cash cow status through consistent revenue streams from mature palm oil plantations and value-added products. GAR's operational efficiency is evident, with an EBITDA of $1.2 billion in 2024. Stable demand and strong distribution networks further solidify its position.

| Key Metric (2024) | Value |

|---|---|

| Revenue | $8.9 billion |

| EBITDA | $1.2 billion |

| CPO Production | 2.6 million tons |

Dogs

Underperforming land represents a 'Dog' in Golden Agri-Resources' portfolio. This includes land with lower yields due to factors like soil degradation. Such areas may require costly improvements or be considered for sale. In 2024, the company actively monitored land productivity, aiming to improve overall efficiency. This strategy is crucial for optimizing asset value.

Inefficient processing facilities at Golden Agri-Resources, which may be outdated, fit into this category. These facilities might need substantial investments to boost efficiency. For instance, in 2024, the company allocated $150 million for upgrades. Without improvements, resources could be wasted.

Certain commodity products within Golden Agri-Resources, like bulk palm oil, might fit the "Dogs" category. These products often have low profit margins, reflecting their status as undifferentiated commodities. For example, in 2024, palm oil prices faced volatility, impacting profitability. Limited growth potential suggests these may not warrant substantial investment. Streamlining or divestiture could be considered, with the focus shifting to higher-value products.

High Carbon Footprint Activities

Activities with a high carbon footprint that clash with Golden Agri-Resources' (GAR) sustainability goals are "Dogs." These activities may suffer under increasing regulatory and reputational risks. For instance, GAR's palm oil operations face scrutiny due to deforestation concerns, potentially impacting its market value. Transitioning to more sustainable practices or divesting from these activities is crucial for long-term viability.

- GAR's 2023 Sustainability Report highlights efforts to reduce deforestation.

- Regulatory pressure includes EU Deforestation Regulation, impacting palm oil imports.

- Reputational risks involve consumer boycotts and investor concerns.

- Divestment could involve selling high-carbon-footprint assets.

Non-Strategic Business Units

Non-strategic business units within Golden Agri-Resources (GAR) that underperform or deviate from its core strategy are often categorized as "Dogs" in the BCG matrix. These units may consume resources without generating substantial returns, potentially hindering overall profitability. GAR might consider restructuring or selling off these units to concentrate on its key strengths. In 2024, GAR's focus remained on its core palm oil business.

- Divestiture of non-core assets can free up capital.

- Restructuring may improve efficiency.

- Focus on core competencies can boost performance.

- Strategic alignment is crucial for success.

Underperforming assets, such as land with low yields and inefficient facilities, are categorized as "Dogs." These assets may have low profit margins and face regulatory and reputational risks, as seen with GAR's palm oil operations.

In 2024, Golden Agri-Resources allocated $150 million for upgrades to improve efficiency. Streamlining or divesting from these underperforming areas is vital for boosting profitability and strategic alignment.

Non-strategic business units and products like bulk palm oil can also be considered "Dogs," particularly if they don't align with sustainability goals.

| Category | Description | GAR's Response (2024) |

|---|---|---|

| Underperforming Land | Low yields, soil degradation | Monitored productivity, potential sale |

| Inefficient Facilities | Outdated processing | $150M allocated for upgrades |

| Low-Margin Products | Bulk palm oil, volatility | Streamlining, divestiture considered |

Question Marks

Golden Agri-Resources (GAR) is venturing into bioenergy, specifically biomass and biofuel derived from palm oil. These initiatives currently have a low market share but show high growth potential. GAR's export of Palm Kernel Shells (PKS) to Japan is a key step, with potential for expansion. In 2024, the bioenergy sector is expected to grow by 8%.

Golden Agri-Resources (GAR) has specialty palm-based products like oleochemicals in a growing market. They currently hold a smaller market share. GAR is aiming to boost its value-added products. This segment needs more R&D investment for a competitive edge. In 2024, the oleochemicals market was valued at over $30 billion, with GAR seeking to capture a larger slice.

GoNutri, GAR's sustainable animal feed supplements, faces challenges. It has low market share despite a growing market, especially in North America. A partnership with ED&F Man aims for expansion. Substantial investment is crucial for marketing and distribution. Success could turn GoNutri into a high-growth product. In 2024, the global animal feed market was valued at approximately $470 billion.

Traceable and Certified Sustainable Palm Oil

Golden Agri-Resources (GAR) is navigating the evolving landscape of sustainable palm oil. While GAR's SmartTrace system and NDPE commitment are steps in the right direction, the demand for fully traceable and certified sustainable palm oil is still ramping up. There's potential for this segment to shine, especially with rising consumer awareness and supportive regulations. However, market acceptance and premium pricing remain key challenges.

- GAR's 2024 sustainability report likely shows progress in traceability.

- Market demand for sustainable palm oil is projected to increase.

- Premium pricing for certified palm oil remains a key goal for GAR.

- Consumer awareness is a critical driver for this segment.

New Geographic Markets

Golden Agri-Resources' (GAR) push into new geographic markets aligns with the "Question Mark" quadrant of the BCG Matrix. These markets, often in emerging economies, promise high growth but come with uncertainty.

GAR currently holds a low market share in these regions, necessitating strategic investment. Success hinges on thorough market research and establishing distribution channels.

Strategic partnerships are crucial to navigate local complexities and regulations. GAR's ability to adapt and execute effectively will determine its success.

These new markets could significantly boost GAR's future revenue and profitability if managed well. The company must carefully manage risks.

- GAR's revenue in 2023 was approximately $8.6 billion.

- Emerging markets offer potential for significant revenue growth.

- Market share in new regions is currently low, requiring investment.

- Expansion involves risks related to market entry and competition.

Golden Agri-Resources' "Question Marks" involve high-growth, low-share ventures. These include bioenergy, oleochemicals, and expansion into new markets. Success demands strategic investment and effective market execution. GAR must navigate risks to boost revenue and profitability. In 2024, GAR's revenue was about $8.6 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Bioenergy Growth | High potential, low market share | 8% growth expected |

| Oleochemicals | Growing market, smaller share | Market over $30B |

| New Markets | Emerging economies | Revenue growth potential |

BCG Matrix Data Sources

The BCG Matrix leverages company financials, market research, and expert analysis for reliable insights.