Goodyear Tire & Rubber Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodyear Tire & Rubber Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Easy-to-read matrix visually prioritizes Goodyear's business units for strategic resource allocation.

Full Transparency, Always

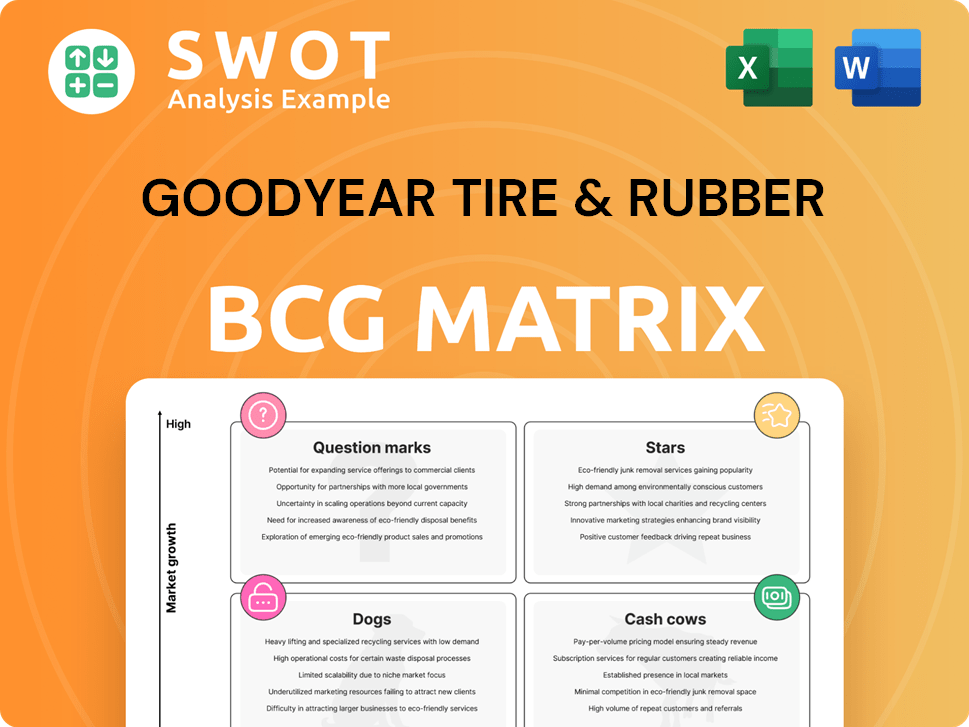

Goodyear Tire & Rubber BCG Matrix

The Goodyear Tire & Rubber BCG Matrix preview is the complete document you'll receive. This isn't a sample; it's the full, ready-to-use analysis, prepared for immediate strategic application. No hidden content, just the exact final version.

BCG Matrix Template

Goodyear's BCG Matrix offers a glimpse into its diverse product portfolio. Analyzing tires across various market segments helps understand their growth and market share. Identifying "Stars" reveals Goodyear's potential leaders, while "Cash Cows" generate vital revenue. "Dogs" highlight underperforming products needing attention, and "Question Marks" require strategic investment decisions. This overview provides a snapshot, but the full BCG Matrix report offers deep, data-rich analysis and strategic recommendations to help plan smarter and more effectively.

Stars

Goodyear's EV tire focus is a "Star" in its BCG matrix due to the EV market's rapid growth. They collaborate with EV makers, like Tesla. The ElectricDrive line addresses EV needs, with enhanced durability. In Q3 2024, Goodyear's revenue was $5.2 billion.

Goodyear's sustainable tire tech is a star in its BCG Matrix. They're investing in eco-friendly materials. For example, they use soybean oil and rice husk ash silica. This aligns with growing demand for green products. In 2024, Goodyear's revenue was about $20 billion.

Goodyear's Forward plan aims to boost margins and streamline its portfolio. This involves cutting costs and selling off assets. By late 2025, Goodyear anticipates $1.5 billion in yearly benefits. In Q3 2023, Goodyear reported a net loss of $156 million. The company is focusing on operational efficiencies.

Smart Tire Technology

Goodyear's Smart Tire Technology, particularly SightLine, is a rising star. This technology integrates tire sensors and software, enhancing vehicle systems. The collaboration with ZF Group on cubiX SightLine boosts hazard detection. Goodyear is now a vehicle tech leader.

- Goodyear's SightLine tech is expected to grow significantly by 2024.

- ZF Group's revenue in 2023 was around $46.6 billion, signaling strong partnership potential.

- Goodyear's focus on vehicle tech aligns with the industry's shift towards advanced mobility.

- The smart tire market is projected to reach billions in the coming years.

High-Performance Tire Lines

Goodyear's "Stars" in its BCG matrix are its high-performance tire lines, bolstered by strategic moves. The company plans to launch five new product lines in the U.S. by 2025, targeting premium, high-margin segments. These include upgrades to popular lines like WeatherReady and Wrangler. Goodyear is also increasing its premium tire capacity.

- New product lines are expected to boost revenue.

- Modernization efforts aim to increase production capacity.

- Focus on premium segments drives higher profitability.

- Expansion aligns with market demand for high-performance tires.

Goodyear's premium tires are "Stars," boosted by new product lines and capacity expansions. These include upgrades like WeatherReady and Wrangler. The company plans five new U.S. product lines by 2025. This is projected to boost revenue and target high-margin segments.

| Segment | Initiative | Impact |

|---|---|---|

| Premium Tires | New Product Lines | Revenue Growth |

| Production | Capacity Increase | Higher Margins |

| Market Focus | High-Performance | Profitability |

Cash Cows

Goodyear's Americas replacement tire market is a Cash Cow in its BCG Matrix. It benefits from strong brand recognition and a wide distribution network. In 2024, the Americas replacement tire market generated substantial revenue. However, competition from low-cost imports and strategic pricing are crucial for profitability.

The EMEA consumer tire market is a cash cow for Goodyear. It's a key region, especially in the replacement segment. Winter tire sales saw strong growth. Goodyear's brand helps it adapt to local needs. In 2024, EMEA sales were about $3.2 billion.

Goodyear is a key player in commercial truck tires, serving fleets and owner-operators. They focus on fuel-efficient tires and services to maintain market share. In Q3 2024, Goodyear's Americas segment, which includes truck tires, saw net sales of $3.2 billion. Goodyear also offers rubber-related chemicals and truck services.

Original Equipment (OE) Fitments

Goodyear's OE fitments, crucial for revenue, involve partnerships with automakers. These agreements ensure a consistent income stream, despite market fluctuations. OE volumes, though cyclical, contribute to brand recognition. In 2024, OE unit volume remained flat, reflecting market dynamics.

- OE fitments provide a stable revenue base.

- Partnerships with major automakers are key.

- Brand visibility is enhanced through OE.

- OE unit volume remained flat in 2024.

Global Brand Recognition

Goodyear's strong brand recognition and global reach solidify its cash cow position. The company benefits from decades of established trust among consumers and businesses worldwide. Goodyear's diverse portfolio includes brands like Cooper, Dunlop, Kelly, Mastercraft, and Debica. These brands collectively drive consistent revenue.

- Goodyear operates in over 20 countries.

- In 2024, Goodyear's revenue reached approximately $20 billion.

- Cooper Tire acquisition enhanced Goodyear's brand portfolio.

Goodyear's diverse operations solidify its cash cow status. Solid revenue comes from established brand recognition and global distribution. Total revenue in 2024 reached around $20 billion, enhanced by strategic acquisitions.

| Segment | 2024 Revenue (approx.) | Key Drivers |

|---|---|---|

| Americas Replacement Tires | Significant | Brand strength, distribution |

| EMEA Consumer Tires | $3.2 billion | Winter tire sales, brand adaptation |

| Commercial Truck Tires | Included in Americas segment ($3.2B) | Fuel-efficient tires, services |

Dogs

Goodyear's lower-margin tire products, facing competition from imports, could be 'dogs' in its BCG matrix. In 2024, the company focused on reducing these businesses and managing channel inventory. Goodyear's Q1 2024 results showed a focus on margin improvement. The firm aims to streamline its portfolio.

Goodyear's operations in unstable regions might be "dogs" if they struggle financially. In 2024, the company faced tariff-related challenges, especially in its Canadian and Mexican supply chains. These issues can hinder growth and profitability. Addressing instability is key to improving performance. For example, in 2023, the company's net sales were $19.9 billion.

Goodyear's commodity tire market faces challenges. Regions lacking a competitive edge or brand strength may be dogs. The company saw a 3% sales drop in Q4 2024, due to volume and low-end imports. In 2024, the segment's profitability was under pressure.

Dunlop Brand (Divested)

The Dunlop brand, once part of Goodyear's portfolio, was likely categorized as a 'dog' in the BCG matrix before its divestiture. This classification stemmed from its underperformance or strategic misalignment within Goodyear's broader objectives. The sale, expected to finalize mid-2025, is projected to generate $700 million. This move aims to bolster Goodyear's financial position through debt reduction.

- Dunlop's divestiture is a strategic move to streamline Goodyear's operations.

- The $700 million from the sale will help reduce Goodyear's debt.

- Prior to the sale, Dunlop may have struggled to compete effectively.

- The closing of the deal is expected mid-2025.

Off-the-Road (OTR) Tire Business (Divested)

Goodyear's OTR tire business, before its sale, could have been classified as a 'dog' within the BCG matrix. This classification stemmed from its misalignment with Goodyear's core strategic focus. The divestiture to Yokohama Rubber was a strategic move. This shift allowed Goodyear to concentrate on its core tire businesses.

- Goodyear completed the OTR business divestiture in 2024, aligning with strategic goals.

- The deal with Yokohama Rubber was finalized for an undisclosed amount.

- Goodyear's focus shifted towards high-margin segments.

Goodyear's "dogs" often include lower-margin products facing stiff competition. In Q4 2024, sales dropped 3% due to volume and imports. Strategic divestitures like Dunlop, expected to finalize mid-2025, aimed to streamline operations and cut debt.

| Characteristic | Description | Financial Impact (2024) |

|---|---|---|

| Sales Decline | Q4 sales impacted by volume and import competition. | 3% sales drop |

| Strategic Moves | Divestitures of underperforming units. | Dunlop sale projected $700M |

| Margin Challenges | Pressure on profitability from certain segments. | Focus on margin improvement in Q1 |

Question Marks

Goodyear's push into emerging markets, such as India and Southeast Asia, is a question mark in its BCG matrix. These regions have growth potential but face strong competition and infrastructure issues. In 2024, India's tire market was valued at $3.4 billion, showing promise. Goodyear aims to seize this opportunity with reliable automotive products.

Goodyear's EV tire market share is currently modest despite its investments. The EV tire market is forecasted to reach $8.3 billion by 2033. This market is expected to grow at a CAGR of 28.01% from 2024 to 2033. Goodyear aims to increase its presence in this expanding sector.

New tire technologies, like airless and smart tires, are question marks for Goodyear. They demand substantial investment, yet market adoption remains uncertain. Goodyear plans to launch airless tires for EVs commercially by 2030. In 2024, R&D spending was approximately $400 million, focusing on innovation.

Digital Transformation Initiatives

Goodyear's digital transformation initiatives, such as boosting its online presence and leveraging data analytics, are classified as question marks within its BCG matrix. Their success hinges on effective execution and how well customers embrace these changes. In 2024, Goodyear aims to enhance its digital sales by 20%. The company is investing significantly in data analytics to improve its supply chain efficiency, aiming for a 15% reduction in costs.

- Digital sales growth target of 20% in 2024.

- 15% cost reduction through data analytics in the supply chain.

- Focus on customer experience through online platforms.

Sustainable Materials Adoption

The adoption of sustainable materials in Goodyear's tire production is a question mark in its BCG matrix. This reflects uncertainty surrounding the scalability and cost-effectiveness of these materials. Goodyear is investing in sustainable options like soybean oil and rice husk silica. The transition presents challenges, but also opportunities for innovation and market differentiation.

- Goodyear aims to have tires made entirely of sustainable materials by 2030.

- In 2024, Goodyear's revenue was approximately $20 billion.

- The company is focusing on reducing its carbon footprint.

- The cost of sustainable materials remains a key factor.

Goodyear faces uncertainties with its question marks. Investments in emerging markets like India ($3.4B tire market in 2024) and the EV sector (forecasted $8.3B by 2033) present growth potential. New tech and digital initiatives also require significant investment and customer adoption. Sustainable materials represent a key opportunity despite cost challenges; Goodyear aims for sustainable tires by 2030.

| Category | Initiative | 2024 Status |

|---|---|---|

| Emerging Markets | India Tire Market | $3.4 Billion |

| EV Market | Forecasted Value by 2033 | $8.3 Billion |

| R&D Spending | Innovation | $400 Million |

BCG Matrix Data Sources

The BCG Matrix is fueled by company financials, market analysis, and industry reports, along with expert assessments for robust strategic insights.