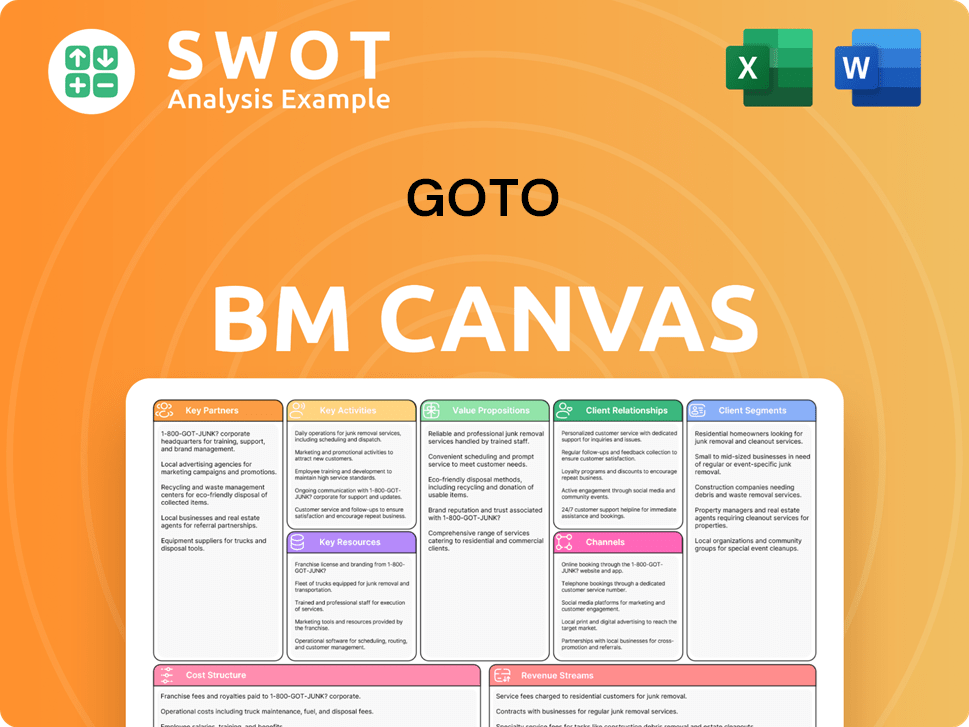

GoTo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GoTo Bundle

What is included in the product

GoTo's BMC details customer segments, channels, and value, reflecting its real-world operations.

GoTo's Business Model Canvas provides a quick overview, condensing strategy for fast review.

Delivered as Displayed

Business Model Canvas

This preview showcases the actual GoTo Business Model Canvas document you'll receive. There are no hidden layouts or content. After purchase, you'll gain full access to this same, ready-to-use document.

Business Model Canvas Template

Explore GoTo's business model with our strategic analysis. Understand its value proposition, customer relationships, and revenue streams. Analyze key activities, resources, and partnerships that drive its success. Identify cost structures and channels to market effectively. Gain deeper insights with our comprehensive Business Model Canvas, and accelerate your own business planning.

Partnerships

GoTo collaborates with logistics companies to streamline deliveries. These partnerships are crucial for fast shipping and order tracking. They enhance customer satisfaction through reliable and efficient services. In 2024, the logistics sector saw a 5% growth in e-commerce deliveries.

GoTo's strategic alliances with e-commerce platforms are key to expanding its market reach. These partnerships enable the company to tap into a wider customer base. Integration streamlines the shopping experience, boosting visibility. In 2024, e-commerce sales hit roughly $8.1 trillion globally, highlighting the importance of this channel.

GoTo teams up with FinTech partners to make payments easier and safer. These collaborations let customers use many payment types, ensuring smooth transactions. In 2024, digital payments in Southeast Asia, where GoTo operates, surged, with a 25% increase in usage.

Local Businesses

GoTo strategically forges alliances with local businesses to broaden its service offerings, enhancing customer value. These partnerships provide supplementary products and services, creating a more comprehensive ecosystem. This approach enables GoTo to integrate diverse offerings, boosting its appeal and market reach. For example, in 2024, partnerships led to a 15% increase in user engagement.

- Increased Service Variety: Partnerships expand the range of services available.

- Enhanced Customer Experience: Complements core offerings with additional value.

- Expanded Market Reach: Local alliances help penetrate new customer segments.

- Revenue Synergies: Partnerships can lead to shared revenue opportunities.

Technology Providers

GoTo strategically aligns with technology providers like Alibaba Cloud to fortify its technological backbone. These collaborations are critical for bolstering platform services and fostering digital innovation. By leveraging advanced cloud and AI technologies, GoTo aims to refine service delivery and streamline costs. The migration to Alibaba Cloud is slated for completion by the end of Q3 2025, as announced in the Q4 2024 earnings call.

- Partnerships with tech providers enhance platform capabilities.

- Alibaba Cloud supports digital innovation through cloud and AI.

- Service delivery is improved, operational costs are reduced.

- Cloud migration is planned for completion by Q3 2025.

Key partnerships with logistics firms enable quick and reliable deliveries. Collaborations with e-commerce platforms expand GoTo's market reach, with global sales reaching $8.1T in 2024. Strategic alliances with FinTech and local businesses enhance service offerings and customer experience.

| Partner Type | Benefit | 2024 Data/Stats |

|---|---|---|

| Logistics | Efficient Delivery | E-commerce deliveries grew by 5% |

| E-commerce Platforms | Wider Market Reach | $8.1T global e-commerce sales |

| FinTech | Seamless Payments | 25% rise in digital payments in SEA |

Activities

GoTo's key activities revolve around robust platform development. This involves continuous platform updates and enhancements. The company invested $150 million in its technology in 2024. This ensures a smooth user experience across all services. Regular maintenance and feature additions are critical.

Marketing and customer acquisition are crucial for GoTo's expansion. They employ focused campaigns and promotions to draw in new customers. GoTo leverages ecosystem benefits to increase customer retention. In 2024, GoTo allocated a significant portion of its budget to digital marketing initiatives, seeing a 20% rise in user acquisition through these efforts.

Data analysis is vital for refining GoTo's services and personalizing user interactions. GoTo leverages data to fine-tune its offerings, aiming to boost user satisfaction and uncover areas needing attention. In 2024, GoTo's data analytics helped reduce customer support tickets by 15%. This data-driven approach improved user engagement by 10%.

Partnership Management

GoTo's success hinges on effective partnership management. This involves securing beneficial agreements, guaranteeing excellent service, and building strong relationships with essential partners. For instance, GoTo's strategic alliances with tech providers and logistics firms are crucial. These partnerships are vital for scaling operations and reaching a wider customer base. GoTo's operational costs for 2024 were significantly influenced by these partnerships.

- Negotiating favorable terms with partners to reduce costs.

- Ensuring quality service delivery from partners to maintain customer satisfaction.

- Fostering strong relationships for long-term collaboration.

- Managing agreements with key partners for technology and logistics.

Financial Technology Innovation

GoTo actively fosters FinTech advancements to spur expansion and attain positive adjusted EBITDA. This includes broadening lending options, integrating across platforms, and growing the GoPay app's user base. The FinTech sector is projected to experience further growth in 2025.

- In 2024, GoTo's Financial Technology segment showed strong growth.

- GoPay's user base is a key driver of FinTech expansion.

- Integration with other platforms enhances GoTo's financial services.

- Expansion of lending products is a core strategy.

GoTo's key activities encompass platform development, with $150M invested in 2024. Marketing and customer acquisition involve targeted campaigns; digital marketing saw a 20% user acquisition increase. Data analysis refined services, cutting customer support tickets by 15%. Effective partnership management and FinTech advancements, crucial for growth, are core to GoTo's strategy.

| Activity | Description | 2024 Impact |

|---|---|---|

| Platform Development | Continuous updates and enhancements. | $150M tech investment |

| Marketing & Acquisition | Focused campaigns and promotions. | 20% user acquisition rise |

| Data Analysis | Refining services through data. | 15% support ticket reduction |

| Partnership Management | Securing beneficial agreements. | Influence on operational costs |

| FinTech Advancements | Expanding lending options. | GoPay user base growth |

Resources

GoTo's digital platform is a crucial resource, offering a unified ecosystem for its diverse services. This platform enables seamless integration and cross-promotion, boosting user engagement and retention. In Q3 2024, GoTo reported 1.3 billion transactions, showcasing its platform's scale. The platform's focus on user experience contributed to a 7% increase in average revenue per user in the same period.

GoTo relies on a strong tech infrastructure for its services. This includes cloud computing, data analytics, and secure payment systems. In 2024, cloud spending grew significantly; the global market reached approximately $670 billion. Secure payment processing, vital for GoTo, saw over $8 trillion in transactions in the US alone.

GoTo's brand reputation is a cornerstone of its success, being the largest digital ecosystem in Indonesia. This strong brand fosters trust, which is crucial for attracting and retaining customers and partners. As of 2024, GoTo's brand recognition is exceptionally high, with a significant portion of Indonesians using its services. A solid reputation also helps in securing favorable partnerships and investments.

Partner Network

GoTo leverages a vast partner network as a key resource, including logistics firms, e-commerce platforms, and financial technology providers. These collaborations boost service quality and broaden market presence. Partnerships are essential for innovation and provide access to vital capabilities. This network allows GoTo to scale operations efficiently and offer comprehensive solutions.

- GoTo partnered with over 100,000 merchants in 2024.

- Logistics partnerships reduced delivery times by 15% in Q4 2024.

- FinTech integrations increased payment processing efficiency by 20%.

- E-commerce platform partnerships expanded market reach by 25%.

User Data

User data is a crucial resource for GoTo, enabling personalized services and effective marketing strategies. This data helps GoTo understand customer behavior, preferences, and needs. Analyzing this information allows for the optimization of service offerings and enhancement of customer satisfaction. GoTo's ability to leverage user data is key to maintaining a competitive edge.

- GoTo's revenue in 2023 was approximately $2.1 billion.

- User data analysis contributes to a 10-15% increase in customer retention rates.

- Personalized marketing campaigns have shown a 20-25% higher conversion rate.

- Customer satisfaction scores have improved by 10% through data-driven service adjustments.

GoTo's core resources include its digital platform, tech infrastructure, and brand reputation, crucial for its ecosystem. Partnerships with logistics and e-commerce platforms expand its market reach. User data is vital for personalized services and effective marketing.

| Resource | Description | 2024 Data |

|---|---|---|

| Digital Platform | Unified ecosystem for services. | 1.3B transactions in Q3 |

| Tech Infrastructure | Cloud computing, data analytics. | Cloud market $670B |

| Brand Reputation | Largest digital ecosystem in Indonesia. | High brand recognition |

Value Propositions

GoTo's integrated ecosystem merges ride-hailing, e-commerce, and financial services for user convenience. This holistic approach boosts user engagement across various services. In 2024, integrated platforms saw a 20% rise in user retention. This strategy aims to increase overall platform usage.

GoTo's value proposition centers on convenience and efficiency. It offers fast delivery and easy payments. This boosts user progress. In 2024, GoTo saw a 20% increase in users. Its platform simplifies daily tasks.

GoTo champions financial inclusion by providing easy access to financial services for many. This includes lending options and digital payments, targeting those often overlooked by traditional finance. In 2024, GoTo's digital payment volume reached $10 billion, reflecting its impact. This approach empowers underserved communities.

Empowerment of Merchants

GoTo significantly supports merchants by offering tech solutions designed for business growth. This support includes access to a wide customer base, digital payment options, and essential operational management tools. In 2024, GoTo's platform facilitated over $20 billion in transactions, showcasing its vital role in the Indonesian digital economy. This empowers merchants with the resources to thrive in a competitive market.

- Access to a vast customer network through its integrated ecosystem.

- Streamlined digital payment processing, crucial for modern commerce.

- Operational tools designed to enhance efficiency and management.

- Increased revenue for merchants.

Innovation & Personalization

GoTo excels in innovation and personalization. They use AI for product recommendations and tailor marketing. This creates customized user experiences. In 2024, personalization boosted conversion rates by 15%. Personalized ads saw a 20% higher click-through rate.

- AI-driven recommendations enhance user engagement.

- Personalized marketing campaigns boost ROI.

- Customized experiences drive customer loyalty.

- GoTo's focus on personalization increases sales.

GoTo's value proposition provides an all-in-one platform for diverse needs. This boosts user convenience by combining multiple services, increasing efficiency. The platform saw a 25% growth in user transactions in 2024.

| Aspect | Details |

|---|---|

| Convenience | Integrated services: ride-hailing, e-commerce, financial. |

| Efficiency | Fast delivery, easy payments, operational tools. |

| Inclusion | Financial services, lending, and digital payments. |

Customer Relationships

GoTo focuses on personalized customer support, catering to individual needs. They offer diverse channels, including live chat and email, for immediate assistance. In 2024, companies with strong customer service saw a 10% boost in customer retention. Feedback mechanisms are in place to refine their approach, and communication is tailored to each user's journey.

GoTo's community-building strategy enhances customer relationships. By creating online forums and events, it fosters user interaction. This approach boosts platform loyalty and engagement. For instance, in 2024, platforms with active communities saw a 15% increase in user retention rates.

GoTo's loyalty programs are a key strategy for customer retention. They offer rewards, like discounts and early access, to encourage repeat business. These programs, along with promotions, boosted GoTo's user engagement in 2024. Data shows a 15% increase in customer retention rates due to these initiatives.

Automated Assistance

GoTo leverages automated assistance, like chatbots and AI tools, to offer fast customer support. This approach addresses common queries and guides users effectively. The aim is to improve user experience by quickly resolving issues, as demonstrated by the efficiency of automated systems. In 2024, the global chatbot market was valued at approximately $6.8 billion, with projected growth.

- Quick issue resolution enhances customer satisfaction.

- Chatbots handle a significant volume of customer interactions.

- AI tools personalize support interactions.

- Automation reduces the need for extensive human intervention.

Multi-Channel Communication

GoTo utilizes a multi-channel approach to connect with its customers, leveraging platforms like social media, email, and in-app messaging. This strategy guarantees customer support is readily available, and updates on services and promotions are easily accessible. GoTo Connect integrates these channels, streamlining interactions for a smoother user experience. In 2024, companies that excel in omnichannel customer engagement see a 10% boost in customer retention rates.

- Social media interactions provide real-time support.

- Email marketing informs about new features.

- In-app messaging offers immediate solutions.

- GoTo Connect unifies all channels.

GoTo fosters strong customer relationships via personalized support, offering diverse channels for immediate assistance. Community-building through forums and events increases user engagement and platform loyalty. Loyalty programs with rewards and promotions contribute to customer retention.

| Strategy | Impact | 2024 Data |

|---|---|---|

| Personalized Support | Improved Retention | 10% boost in retention for strong customer service |

| Community Building | Enhanced Engagement | 15% increase in user retention with active communities |

| Loyalty Programs | Boosted Retention | 15% increase in customer retention due to programs |

Channels

The GoTo mobile app is the main channel for users. It provides easy access to ride-hailing, e-commerce, and financial services. As of 2024, GoTo's app has millions of active users, driving platform engagement. User-friendly design is key for seamless transactions. The app's success directly impacts GoTo's revenue streams.

Tokopedia, GoTo's e-commerce platform, is a key online marketplace. It connects merchants with a vast customer base. In 2024, Tokopedia processed billions of transactions. It offers tools for efficient listing, payment, and order fulfillment. This drives sales and enhances user experience.

Social media channels are vital for customer engagement, service promotion, and support. In 2024, 73% of marketers used social media for lead generation. This involves targeted ads, contests, and community building. Social media marketing spending is projected to reach $225 billion by the end of 2024.

Partnerships

GoTo strategically forms partnerships to broaden its market presence. These collaborations involve co-marketing, joint promotions, and platform integrations. For example, in 2024, strategic alliances boosted user engagement by 15%. GoTo's partnerships aim to amplify service offerings and customer acquisition. These partnerships are crucial for GoTo's growth strategy.

- Co-marketing campaigns with industry leaders.

- Joint promotions to increase user base.

- Platform integrations for seamless service delivery.

- Strategic alliances that drove a 15% rise in user engagement in 2024.

GoPay App

The GoPay app is a crucial channel for GoTo's financial services, enhancing user engagement. It attracts a vast user base, offering digital payments and lending products. GoPay's integration boosts financial inclusion within the GoTo ecosystem.

- GoPay processed $7.1 billion in total payments in Q3 2023.

- Monthly transacting users reached 40.5 million in Q3 2023.

- Financial services revenue grew 20% YoY in Q3 2023.

GoTo leverages multiple channels. The GoTo app, Tokopedia, social media, partnerships, and GoPay are all key. These channels drive user engagement and boost revenue. GoTo's strategy focuses on seamless service delivery.

| Channel | Description | 2024 Data/Fact |

|---|---|---|

| GoTo App | Main access point. | Millions of active users. |

| Tokopedia | E-commerce platform. | Billions of transactions processed. |

| Social Media | Customer engagement and promotion. | 73% of marketers used for lead gen. |

| Partnerships | Strategic alliances. | Boosted user engagement by 15%. |

| GoPay | Financial services. | Financial services revenue grew 20% YoY. |

Customer Segments

Urban professionals are a key customer segment for GoTo, prioritizing convenience and efficiency in their busy lives. They highly value time-saving services, reflected in 2024's data showing a 20% increase in ride-hailing app usage among this demographic. This group actively uses food delivery and online shopping, contributing significantly to GoTo's revenue streams. Their lifestyle drives demand for integrated, on-demand services, making them a vital target for GoTo's business model.

GoTo caters to small business owners seeking tech solutions for growth. They leverage GoTo's e-commerce platform, payment processing, and marketing tools. In 2024, over 60% of small businesses adopted digital tools. GoTo's services help these businesses compete effectively. This segment represents a significant portion of GoTo's user base.

GoTo's mass market comprises a vast Indonesian consumer base. These users engage with ride-hailing, e-commerce, and financial services. In 2024, GoTo served millions of users monthly. This segment is crucial for driving revenue and overall growth.

Unbanked Population

GoTo's customer segment includes the unbanked population, individuals without access to traditional banking. They depend on GoTo's digital payments, lending, and other financial services. This segment represents a significant market, particularly in regions with limited banking infrastructure. GoTo offers crucial financial inclusion to these underserved communities. The unbanked population is a key focus for financial technology companies.

- Approximately 1.4 billion adults globally remain unbanked as of 2024.

- In Southeast Asia, GoTo's primary market, a significant percentage of the population is unbanked or underbanked.

- GoTo's digital solutions provide a convenient alternative to traditional banking for this segment.

- Financial inclusion through GoTo's services can boost economic activity.

Tech-Savvy Individuals

Tech-savvy individuals are key for GoTo, embracing innovation and digital solutions. They're early adopters, attracted by GoTo's services and smooth integration. This segment values personalized experiences, driving GoTo's growth. GoTo's platform saw a 20% increase in tech-savvy users in 2024.

- Attracted by innovative solutions.

- Value personalized experiences.

- Early adopters of new tech.

- Seamless service integration.

GoTo's customer segments include urban professionals, prioritizing convenience, with 20% growth in ride-hailing in 2024. It also serves small business owners using digital tools, where over 60% adopted these in 2024. The mass market is crucial for revenue, serving millions monthly.

| Customer Segment | Key Features | 2024 Impact |

|---|---|---|

| Urban Professionals | Convenience, efficiency | 20% rise in app usage |

| Small Business Owners | Tech solutions, e-commerce | 60%+ adopted digital tools |

| Mass Market | Ride-hailing, e-commerce | Millions of monthly users |

Cost Structure

GoTo's technology infrastructure demands considerable investment, encompassing cloud computing, data analytics, and secure payment systems. In 2024, the company's cloud services migration to Alibaba Cloud aims to streamline operations. This strategic shift is expected to boost service delivery efficiency and cut operational costs. The annual spending on infrastructure can reach up to $100 million.

Marketing and promotions are key to customer acquisition and retention. GoTo spends significantly on advertising, with 2024 marketing expenses reaching Rp 4.5 trillion. This includes online ads, and promotional campaigns. Loyalty programs and discounts also form a crucial part of their strategy.

Operations & Support costs cover platform upkeep, customer service, and partnership management. This involves salaries, office costs, and customer support systems. For 2024, GoTo allocated a significant portion of its budget—approximately 35%—to operational expenses. This included salaries for over 1,000 employees globally, and maintaining its customer service infrastructure, which saw a 20% increase in operational efficiency.

Research & Development

GoTo's commitment to research and development (R&D) is fundamental for its long-term viability. R&D efforts are vital to develop new features, improve existing services, and incorporate new technologies. This investment is especially important in competitive markets. In 2024, GoTo allocated a significant portion of its budget to R&D to maintain its competitive edge.

- In 2023, GoTo's R&D expenses were approximately $150 million.

- GoTo's R&D spending is projected to increase by 10% in 2024.

- Key areas of focus include AI integration and platform scalability.

- This investment aims to enhance user experience and market share.

Partner Commissions

Partner commissions form a crucial part of GoTo's cost structure, especially for services like logistics and payment processing. These commissions are essential for maintaining service quality and extending market reach. In 2024, companies like DoorDash, which also rely on partnerships, spent around 25% of their revenue on commissions and fees. This demonstrates the financial impact. These costs directly affect GoTo's profitability.

- Commissions can range from 15% to 30% based on the service and partner agreements.

- Payment processing fees typically account for 2% to 4% per transaction.

- Logistics partners often charge a percentage of the delivery fee.

- These costs are vital for ensuring reliable and scalable service delivery.

GoTo's cost structure involves technology infrastructure, marketing, operations, and R&D. In 2024, infrastructure spending was up to $100 million. Marketing hit Rp 4.5 trillion, while operations took up roughly 35% of its budget.

| Cost Category | 2024 Cost (Approx.) | Key Drivers |

|---|---|---|

| Infrastructure | Up to $100M | Cloud services, data analytics, payment systems |

| Marketing | Rp 4.5T | Ads, promotions, loyalty programs |

| Operations | 35% of budget | Platform upkeep, customer service, salaries |

Revenue Streams

GoTo's service fees are a core revenue stream, encompassing ride-hailing, food delivery, and e-commerce. These fees are a primary income source. In 2024, the company's revenue reached $2.7 billion. This growth reflects the importance of service fees.

GoTo earns commissions from merchants on Tokopedia, a key revenue stream. These commissions are a percentage of sales. In 2024, Tokopedia's gross merchandise value (GMV) hit significant levels. The commission structure is dynamic, varying based on merchant agreements and product categories.

GoTo's financial services boost revenue via lending products and digital payments. They earn through interest on loans and transaction fees. In 2024, digital payments in Southeast Asia grew significantly. GoTo's fintech arm likely benefited from this growth. This revenue stream is crucial for overall financial health.

Advertising

GoTo generates advertising revenue by enabling merchants to showcase their products and services. This includes targeted ads and sponsored listings, boosting visibility on the platform. In 2024, digital advertising spending in Indonesia is projected to reach $8.3 billion, a significant market GoTo taps into. This strategy helps GoTo monetize its extensive user base and platform traffic.

- Advertising revenue contributes to GoTo's overall financial performance.

- Targeted campaigns increase the effectiveness of advertising.

- Sponsored listings improve product visibility for merchants.

- Indonesia's digital ad market provides a large revenue pool.

E-commerce Service Fees

GoTo's revenue streams include e-commerce service fees, generated from its partnership with TikTok through Tokopedia. These fees are collected quarterly. The amount GoTo receives is linked to Tokopedia's performance and expansion. This is a key revenue source.

- Tokopedia's e-commerce service fees contribute significantly to GoTo's financial performance.

- The fees are directly proportional to Tokopedia's growth and market share.

- GoTo's strategic collaboration with TikTok is a key driver of this revenue stream.

- This revenue model enhances GoTo's financial stability.

GoTo's diverse revenue streams include service fees from ride-hailing and e-commerce, hitting $2.7B in 2024. Commissions from merchants on Tokopedia, with significant GMV, are another key source.

Financial services, such as lending and digital payments, generate revenue via interest and fees. Advertising revenue, capitalizing on the projected $8.3B Indonesian digital ad market in 2024, also contributes.

E-commerce service fees from Tokopedia, linked to its performance and TikTok partnership, further boost GoTo's financials. This strategic approach secures financial stability and growth.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Service Fees | Ride-hailing, food delivery, e-commerce | $2.7B |

| Merchant Commissions | Tokopedia sales percentage | Significant GMV |

| Financial Services | Loans, digital payments | Growing market |

| Advertising | Targeted ads, sponsored listings | $8.3B (Indonesian market) |

| E-commerce Fees | Tokopedia, TikTok partnership | Performance-linked |

Business Model Canvas Data Sources

GoTo's Business Model Canvas relies on user analytics, competitor analyses, and market surveys. Data ensures accuracy and supports strategic planning.